[Video] What is the Purpose of Insurance?

Insurance Part 1

by Michelle Smalenberger, CFP® / June 13, 2017MICHELLE SMALENBERGER, CFP®

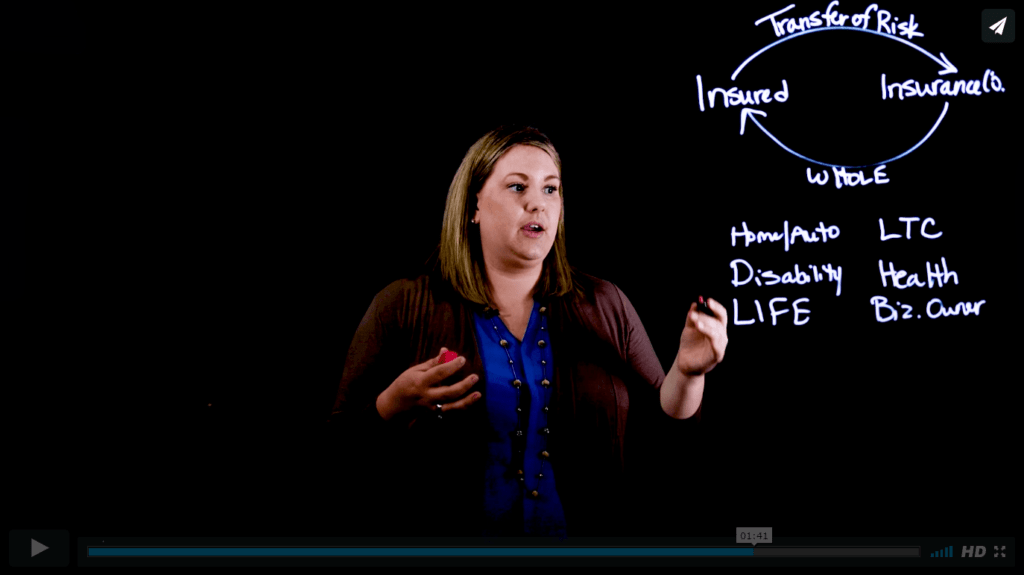

I’d like to talk about one area of financial planning that seems to be misunderstood. Or maybe there’s just a lack of knowledge about this topic, and that’s insurance. When you’re considering getting any type of insurance, you the insured are looking to transfer the risk to someone else. So really what’s happening here is that there is a transfer of risk that you’re saying you don’t want to take on, but when something happens you want to be sure that you are going to be made whole.

With different types of insurance, and in most cases, you are made whole. Let’s just talk about a few. For home and auto, we have a home and we have a car, and we need to be able to function. So, the goal of this is to be able to continue using those things.

With different types of insurance, and in most cases, you are made whole. Let’s just talk about a few. For home and auto, we have a home and we have a car, and we need to be able to function. So, the goal of this is to be able to continue using those things.

Disability is one type of insurance that actually doesn’t make you whole. Typically, you can get insurance up to 60% of your income, which is going to fill most of your needs. However, it’s not 100% so it’s not making you completely whole.

Another is life insurance, and we’ll talk through that. Some others might be long term care. When you can’t do two activities of daily living that you normally do, now you need help. You need some type of insurance to help supplement that. But again, it’s not meant to completely cover you. Others that we think of commonly are health insurance, or maybe a business owner insurance.

So, these are just the types of insurance. Typically when you think of getting them you’re really trying to transfer the risk from yourself so that if you have a loss, you’re going to be made whole and you’re going to be able to function, because you have insurance to cover these times where you do have a loss.

Watch the Rest of the Series:

- What is the Purpose of Insurance?

- How Much Life Insurance Do I Need?

- What are the Sources of Life Insurance?

- When Do I Need To Have Life Insurance?

Or, Watch it All at Once:

Ready to take the next step?

Schedule a quick call with our financial advisors.