[Video] What are the Sources of Life Insurance?

Insurance Part 3

by Michelle Smalenberger, CFP® / June 23, 2017MICHELLE SMALENBERGER, CFP®

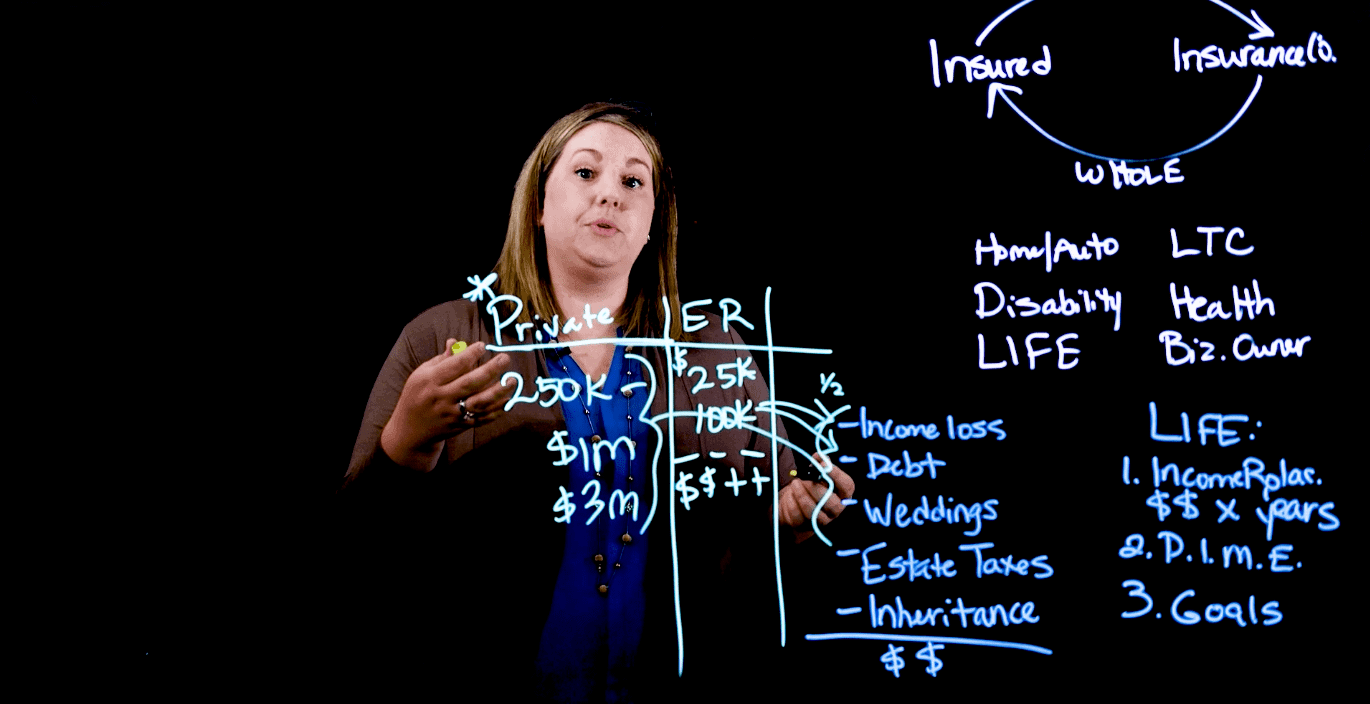

So now that we know the amount of life insurance that we agree that we need, we really want to look to where the sources of that insurance are going to be. It’s very common that someone who works for an employer or for a company may get a benefit that’s just standard. you may get 25 or 50 thousand, maybe a 100 thousand of life insurance. and so now you at least have some base benefit that maybe you’re paying something for, or you may also have the ability to buy more. So, the nice thing about getting insurance through your employer is typically you can get it at a discounted rate. It’s a larger group policy so maybe there’s some type of discount so it’s a little cheaper than otherwise.

But what I also want to suggest to you is to consider getting a private insurance policy. And really what this means is that you’re going to go out and get a life insurance policy for yourself. And the reason that you would want to do this is because when you are working for your employer, you have this insurance. But if you leave that employer, now you have nothing if you don’t have any private insurance. Or you’re dependent on the next company when you get that job to have insurance and the amount that you need that we’ve already decided we need.

So, with a private insurance policy, we may be looking at getting more like 250 thousand in insurance, maybe up to a million, maybe even 3 million. This is really dependent on what we’ve said are our goals, and what we want to cover. The difference between these two is if I only have my employer provided insurance, maybe now I can only cover a portion of that income loss, maybe I can only cover one of those debts that I have. So, by adding this additional layer of private insurance, we’re really saying that between all of this, now I can cover a variety, or a larger amount of these needs and the goals that I am trying to reach.

So, with a private insurance policy, we may be looking at getting more like 250 thousand in insurance, maybe up to a million, maybe even 3 million. This is really dependent on what we’ve said are our goals, and what we want to cover. The difference between these two is if I only have my employer provided insurance, maybe now I can only cover a portion of that income loss, maybe I can only cover one of those debts that I have. So, by adding this additional layer of private insurance, we’re really saying that between all of this, now I can cover a variety, or a larger amount of these needs and the goals that I am trying to reach.

So, I want to encourage you to go back and look at the amount of life insurance that you currently have, and where you have that insurance. If it’s through your employer, can you get more? Do you have a private insurance policy? Maybe consider adding this in case you do think that you may switch jobs in the next 5-10 years, or you may be doing more than what you are currently doing at your employer. This just gives you flexibility, but also you won’t be without insurance in case something happens, and that’s really what we’re trying to make sure we have in place.

Watch the Rest of the Series:

- What is the Purpose of Insurance?

- How Much Life Insurance Do I Need?

- What are the Sources of Life Insurance?

- When Do I Need To Have Life Insurance?

Or, Watch it All at Once:

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Insurance Webinar

Our insurance webinar walks you through the basic insurance policies, what you may be missing, and an audience Q&A session.

Endorsements for Your Insurance Coverage [Video]

In this excerpt, Ryan Delp, insurance agent with Bradish Associates, breaks down insurance endorsements he looks to add for extra coverage.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.