[Video] When Do I Need To Have Life Insurance?

Insurance Part 4

by Michelle Smalenberger, CFP® / June 28, 2017MICHELLE SMALENBERGER, CFP®

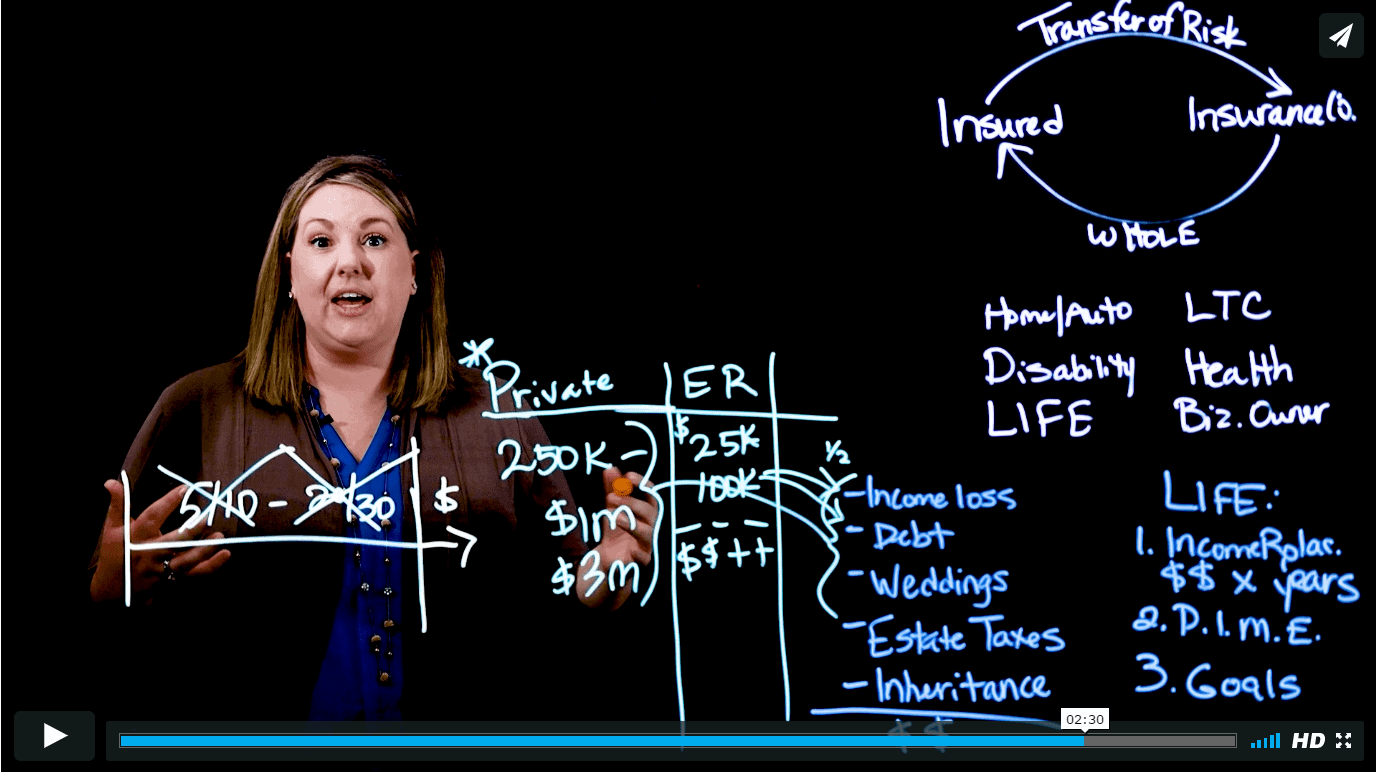

The last part I really want to talk you through is the term, or how long we typically have life insurance. When you’re buying a policy, especially maybe this private policy, it may be that you have it for 5 to 10 years, or 20 to 30 years. And really, the purpose of life insurance is to insure the income that we’re planning to earn until we retire, to be able to save money so that when we’re at retirement, really when we match it up to when we’re assuming we’re going to retire after this, we already have the money that we need.

So now when this policy expires, this can go away. We don’t really need it anymore, because now I have the money I need to be able to fulfill all of those needs or goals in retirement. Maybe your mortgage is paid off, your student loans, your auto loans that you may have had 20-30 years ago are done. Your children are grown, maybe they’ve already had weddings, maybe not. But these are some of the things that now you’re saying I’m able to self-insure for the cost, or other things that may come up.

I really want you to think about some of the times that life insurance becomes important, is really before something happens. So, if you’re having a child, if you know you’re going to be having a child coming up, it’s really important to think through. Okay, now that I have someone else I need to support in my family, I need to be adding more insurance to what I have now for myself and my spouse. So, it’s things like that. Am I buying a house? Am I going to be buying a business, or starting a business? These are times, changes in our lives, where we need to be changing or adjusting this amount of life insurance, or at least reviewing to see if we need to be changing it.

I really want you to think about some of the times that life insurance becomes important, is really before something happens. So, if you’re having a child, if you know you’re going to be having a child coming up, it’s really important to think through. Okay, now that I have someone else I need to support in my family, I need to be adding more insurance to what I have now for myself and my spouse. So, it’s things like that. Am I buying a house? Am I going to be buying a business, or starting a business? These are times, changes in our lives, where we need to be changing or adjusting this amount of life insurance, or at least reviewing to see if we need to be changing it.

So, I really want you to be thoughtful of the life insurance that you have, go back and review, see if changes need made. But I also want to just explain one of the ways that when you have these things in place, it really allows you to live life in a different way. When you have life insurance set in place, when you have the proper amount, it allows you to live in such a way that you don’t have to worry if something happened to you. You don’t have to worry that your family wouldn’t be taken care of, that anyone surviving you wouldn’t be supported. So, I really want you to understand that having things in place, it allows you to live life differently. This is really the goal of planning ahead and really having these conversions now. Even though we don’t enjoy them, or if it’s a topic you may not want to talk about, this is the goal of really talking through and planning these things ahead of time.

Watch the Rest of the Series:

- What is the Purpose of Insurance?

- How Much Life Insurance Do I Need?

- What are the Sources of Life Insurance?

- When Do I Need To Have Life Insurance?

Or, Watch it All at Once:

Ready to take the next step?

Schedule a quick call with our financial advisors.