Friday’s Financial Update 6-9-2017

by Michelle Smalenberger, CFP® / June 9, 2017MICHELLE SMALENBERGER, CFP®

A week of distraction can leave you questioning future direction. Let’s sum up this week for what it means to us.

Much of this week’s news regarded events that happened later in the week. Thursday we heard the testimony of Ex-FBI Director James Comey, which consumed most of the media. With much less media hype but arguably more importance Thursday also brought the House vote to pass the CHOICE Act (Financial Creating Hope and Opportunity for Investors, Consumers and Entrepreneurs Act) – a bill aimed at cutting many of the Dodd-Frank regulations.

Many critics of the Dodd-Frank reform acknowledge it goes too far and imposes costly regulatory burdens on banks, but they feel this Choice Act goes too far in the other direction of making the system less safe while reducing burdens. Most feel the Senate will make several changes to the House version and also keep some provisions the House voted to remove like the Volcker rule that prevents banks from trading for their own profit with customer money.

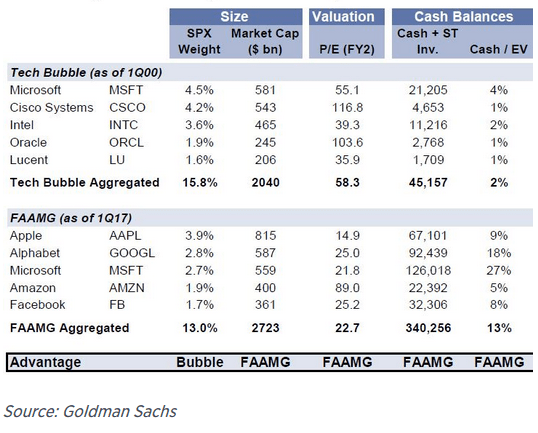

Friday brought a story about whether there is a bubble in FAAMG stocks. Here is a helpful comparison to view the fundamentals from the 2000 tech bubble to today’s stock prices in companies that are seeing rapid stock price growth. Many fear getting caught in a bubble that could burst. As you can see below, today’s numbers do not mirror those of 2000. This fear may be leading to the increase in portfolio allocation to financials this week.

Those who believe the bull market is set to continue regardless of these distracting headlines are looking for moments of pullback and downturns so they can buy at lower prices even in some of these names like FAAMG (Facebook, Apple, Amazon, Microsoft, Google). But let’s talk about what we really need to be paying attention to amidst the distractions we’ve discussed.

There is still room for this bull market to run, but we have to start hearing of meaningful changes regarding tax and healthcare reform that will push our economy forward and push these distractions aside. Without results on healthcare and taxes, we will fail to see improvement for the economy in terms of growth, jobs, and wages.

Decreasing the tax burden for tax payers and businesses and decreasing the costs of healthcare for consumers gives a large boost to a working person’s contribution to the economy. If you give people the ability to spend and save more money by decreasing unnecessary costs we can make the economy better for everyone. Companies could increase wages, hire additional people, and create further business growth.

Distraction can be dangerous. So in the midst of distraction stick to your diversified portfolio strategy. Steer clear of quick, sudden judgments that can derail long-term progress. We are here to help if you aren’t sure you have a strategy you like.

Ready to take the next step?

Schedule a quick call with our financial advisors.