Alternatives Are Not Just

Miscellaneous Investments

by Michelle Smalenberger, CFP® / June 16, 2017MICHELLE SMALENBERGER, CFP®

With this week’s events we are reminded again that it is important to pay attention to every investment in our portfolio, not just the current winners that are outperforming.

The market just absorbed the 4th Fed rate hike announced on Wednesday. We got another quarter point increase in interest rates by the Fed, which was expected. The Fed will also begin to unwind its balance sheet by selling some of the bonds they bought to help the economy since the financial crisis. These are positive signs that show an economy getting healthier. The Fed needs to start removing the training wheels so the economy can continue getting stronger without these stimulative measures.

This week also continued a pullback in technology stocks that have seen fast growth this year. Since the pullback has been spotty with a day of losses and the next a day of gains this appears to be a “trading event”. This causes overweight growth investors to pare back their risk and sell a portion of their technology stocks. The companies in technology are producing the numbers to support their stock prices, leading us to believe this is not a longer term investing event. But, this past week serves as a healthy reminder that there is risk in investing. A diversified portfolio is important to stay on course.

To keep a diversified portfolio you need a variety of asset types. Then keeping various percentages in these different asset types your portfolio can withstand market events. One of these asset classes we hear of often is referred to as “alternatives”. Alternatives are not simply miscellaneous investments that serve as a buffer in a down market. They are not just a filler that provide you with investments in a different category other than the stocks and bonds you own. They may outperform growth stocks in a down market, but you want alternatives in your portfolio that ALSO perform well in good markets.

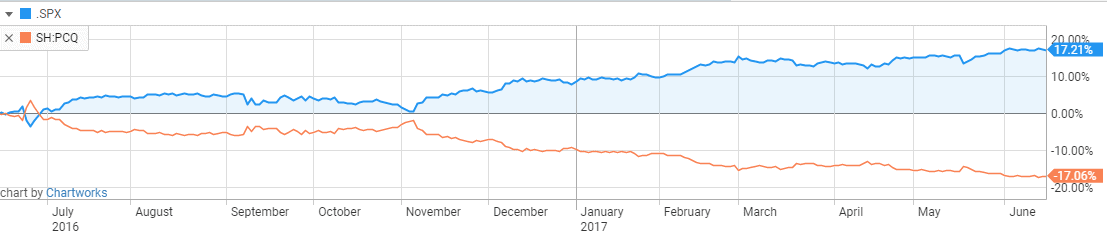

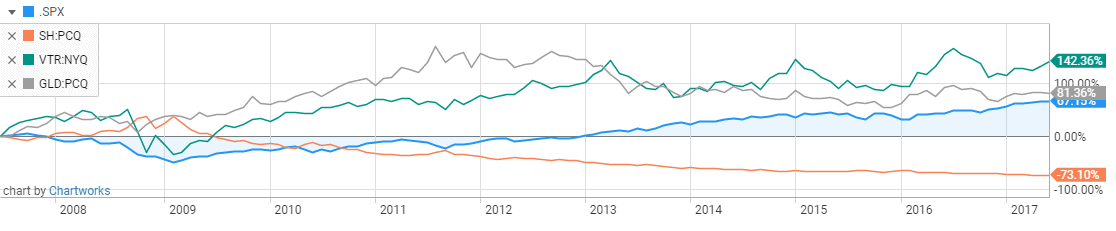

Alternatives can be a variety of different investments. See the following chart using investments to illustrate this. Here you see the S&P500 performance over the past year in blue and an alternative ETF that does the opposite of the S&P500, in orange. This type of investment would be something you might use if you expect the market to be negative for an extended period of time. Since we don’t believe this is where the market is headed we need a different strategy.

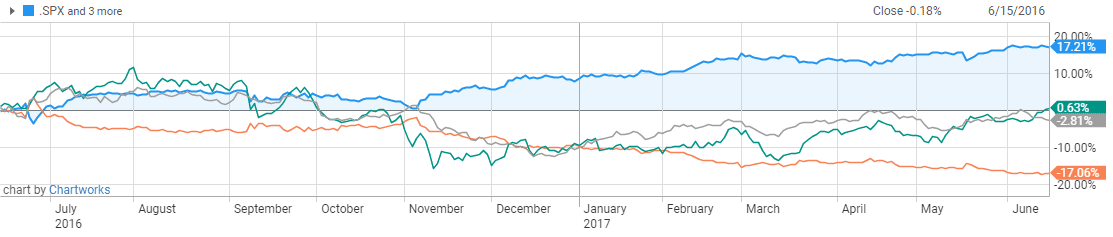

Now consider your diversified portfolio that you want to hold for the long term, expecting the market to perform positively. Instead of alternative investments that perform exactly opposite of the S&P500, let’s add some common alternatives like Gold (GLD) or a real estate investment trust Ventas (VTR). You can see these do not always mirror the S&P500, providing diversification to your portfolio. But they also can provide a positive return along with diversification.

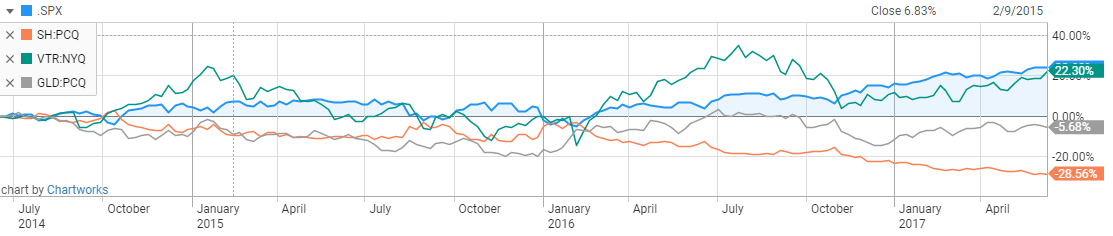

As you can see it is just as important to choose the alternatives in your portfolio wisely when deciding how to diversify for performance over a longer period of time. Both of the charts above are for a one year time period. Let’s expand this to see longer periods of time.

Last 3 years (July 2014 – July 2017)

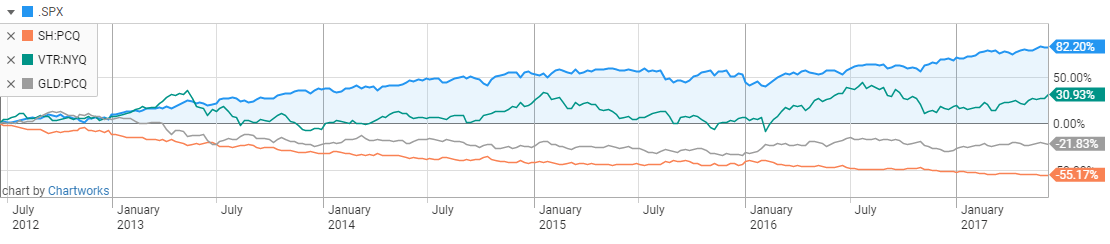

Last 5 years (July 2012 – July 2017)

Last 10 years (July 2008 – July 2017)

We invest for the long term and believe that a diversified portfolio will reward investors. Looking back can provide insight for how we should think about the future. If you are looking back and wishing you had help with your finances please don’t hesitate to reach out to us today!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.