Tax

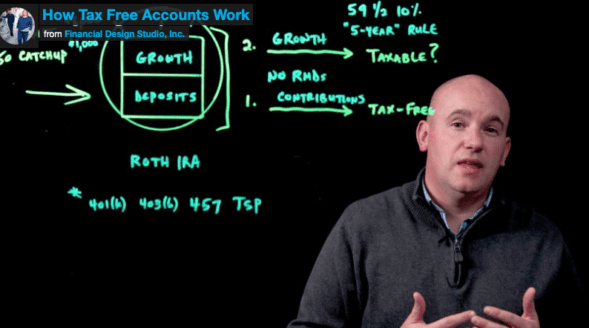

How Tax Free Accounts Work [Video]

[Video] How Tax Free Accounts Work| Let’s look at how tax free accounts work. Who are they for and what rules do they have? Maybe this is an account that’s beneficial for you.

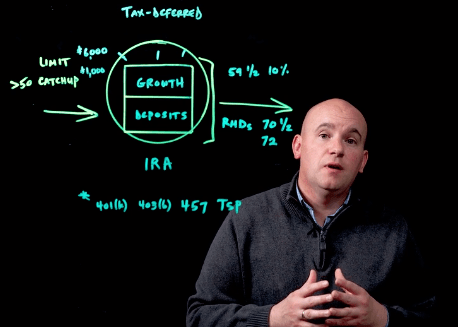

How Tax Deferred Accounts Work [Video]

[Video] How Tax Deferred Accounts Work| How tax deferred accounts work. There are different types of tax deferred accounts and rules to follow. So which accounts are best for you?

Financially Lucky [Video]

I want to share two recent stories that have shaped some new thinking and understanding for how I think people view financial planning.

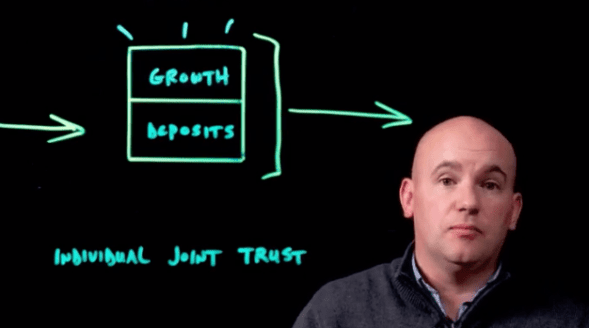

How Taxable Accounts Work [Video]

[Video] How Taxable Accounts Work| Let’s look at how taxable accounts work. We can see how they work, what the rules are, what the limits are, and who they are for.

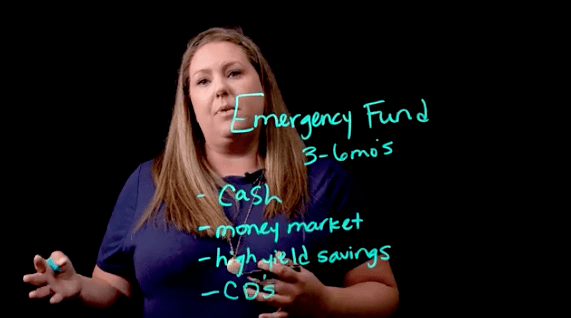

Where Do I Park My Emergency Fund Cash? [Video]

[Video] Where Do I Park My Emergency Fund Cash?|Maybe you are someone who has built up an emergency fund or you are currently working on it. Let’s talk through some common places where you can park these emergency funds.

Business Owners and the Balance Sheet [Video]

[Video] Business Owners and the Balance Sheet| What is the balance sheet and what do business owners need to know about it? A balance sheet shows what you own and what you owe.