How Will Your Pension Choices Impact Your Retirement? [Video]

by Trevore Meyer, CFP® / December 19, 2022I’m excited to be walking you through pension choices. We will be figuring out what little variables we need to be mindful of as we think through what will be best for you and your financial plan.

If I were to ask you whether you would be better off receiving $50,000 per year, for the next 30 years, or $800,000 today, do you know what you would choose? The right answer for you may depend on a number of different factors. There is a financial best answer, which even then it depends and then there is a family or behavioral best answer. Because we all know that if some of us had $800,000 we may not make the best and highest use of those funds. So it might be better to actually spread this out over a longer time period.

Now let’s assume that we are making wise financial decisions with our money. We need to determine what’s going to be the most economical or best financial answer for our pension choices. That is what we are trying to troubleshoot to find today.

What is the Pension Value?

The way to determine what option is going to be better for us comes down to a term called “Net Present Value” (NPV). Essentially this formula looks at the two different options. Once it looks at the annuity payment method and the lump sum, based on a specific discount rate, it will bring all these values to its end value. All we have to do is pick the highest one. So we know with option two, the $800,000, we know that we will receive all of it.

If we look at the $50,000 option over 30 years, that’s a little more challenging because we can’t simply multiply $50,000 by 30 years; that would work out to $600,000. In reality, some of those $50,000 is getting invested, because we are being wise with our funds and are preparing for the future. So, if we apply a discount rate to this value of roughly 5%, that actually works out to a number very close to $800,000 from a Net Present Value perspective.

How Will It Be Paid To You?

Let’s say we don’t need to go through the math, and that we know the lump sum won’t be the financial best answer for us. We are now left with the $50,000 option. This is your Single Life Annuity amount (SLA). Generally, these don’t just pay for 30 years, but the rest of your lifetime. We need to take into account how long you anticipate living, but also if you are married.

If you are married, we need to think through what will happen to the money. When we take the Single Life Annuity, it is based solely on your lifetime. If, unfortunately, something happens to you just a couple years into your retirement as you are taking this pension, that money goes away. We don’t want that to happen to you and your spouse. That’s really bad news for your entire plan.

If you are married, one of the options you have available is to convert your Single Life Annuity into what’s called a Joint & Survivor option. It’s worth mentioning that generally speaking, this payment will be less than your single life annuity. The annuity company, whoever picks up this annuity or your employer, is generally expected to pay out over a longer time period. These are all grounded on actual figures for how long humans are expected to live.

When insuring two people, it’s going to be a longer period than just a single person. If it’s a longer time period, our benefiting amount is going to be less. Instead of $50,000 we might be looking at $45,000. These are just examples and every case is going to be different. Every insurance company will have their own specific numbers to apply specifically to your pension amount. So let’s talk about how to calculate the best pension choices available to you.

What About My 401(k) Plan?

One of the questions we often get is how do pensions interact with your 401(k) plan? This is a more common retirement benefit that we are seeing from employers. Over the last 20 or 30 years, these have really surged in popularity. Why? Frankly speaking, 401(k) are generally cheaper for an employer to administer and manage than a pension would be.

The math is pretty simple here. A lot of times, employers will be expected to front out a pension for an employee for 30 or 40 years of retirement. Sometimes, this can be even longer than when they actually worked for the company. As opposed to a 401(k), where the employer just pays a set percentage of your pay. This is oftentimes as a match or safe harbor contribution directly into an account for your benefit. Then when you retire, the employer is not required to pay anything additional to you. That risk is back on you.

Let’s say when retirement comes, we have both a 401(k) and a pension amount. What do you need to do? What are the things you need to do to make the most of both of these benefits? It’s not uncommon for us to see clients with both a pension amount and a 401(k). We can look at the pension and see if we want to convert that into a monthly income stream. Or if we want to change that income to $50,000 or $45,000 a year?

Conversely, we can take the 401(k) and move that into an IRA. This is so that we don’t have to keep that at our employers anymore. We can put that into an IRA and self manage it. We can pick up investments that are most applicable for you, so that you have the most flexibility amiable to you. You are living off that $45,000 a year from your pension and whatever distributions you need to take out of your IRA.

How Do Taxes Impact Pensions Choices?

Let’s take another step back. What taxes are associated with all these pension choices? Generally speaking, if we move the pension into an IRA, which is one of your options, it won’t be a taxable distribution. This is called a rollover contribution into an IRA.

Now, what if we take this pension as a $45,000 distribution as a Joint & Survivor payment for as long as you and your spouse are living? You would receive these $45,000. But as you look at your tax return, normally we have to include those $45,000 as taxable income. Depending on your state, it may or may not be taxable. But, it often will be included for your federally taxable income, or be reported on your 1040, your federal tax return.

That’s one of the things to keep in mind as we are looking at different planning scenarios. If we want to maintain a tax planning window to reduce taxable income in certain years, we might want to look at the IRA approach at rolling it over there rather than converting it into income. This is another one of the little variables and planning considerations that we think about as we evaluate pension choices, as we work with each of our clients.

How Do You Read a Pension Table?

Thus far, we’ve talked a little about the financial implications associated with pension decisions. We’ve also talked about some of the coordination aspects with a 401(k). Additionally, we’ve covered the taxability aspect of what’s going to happen when you retire and take distributions.

One of the final things I want to talk about today is, how do you go about getting this information? As you get closer to retirement, you have to make an intentional decision of what you want to do with any pension that might be available to you. As a reminder, it is completely on you to get this information ahead of time because there may be a default option through your employer that you may or may not like.

Annuity Choices

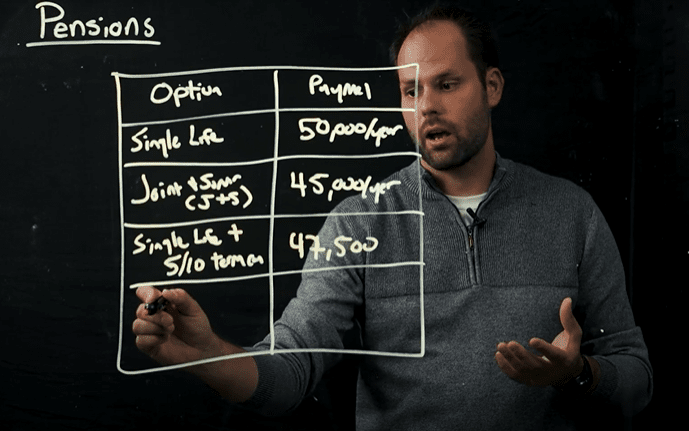

As you are looking for this information, one of the things you need to do is request a quote for the Single Life Annuity, Joint & Survivor Annuity, and the Lump Sum. Oftentimes, this will take the form of a table. I’ll draw out an option table like this.

They usually have a few kinds of things on this. They say what the pension choices and payment are. So this will take the form of a table like this. Often we will see a single life option. If we are married, we can see some other options. Let’s say from the prior example, $50,000 a year but instead of 30 years, they will actually call this the rest of your life. The other option will be the Joint & Survivor (J&S). This is where we are looking at that reduced benefit to claim, for example, $45,000.

So, understanding how that coordinates with our financial plan will be important to know as well. There might be many other options available to you. It’s important to look at this whole table and evaluate all the options in unison to see what will make the most sense for you and your family.

The 10 Year Certain Plan

Another option that you might see is a 10 year certain. Let’s say you take a Single Life Annuity option, you can also choose to say “hey I want the single life, but I want to make sure even if I were to die within the second policy year, that payments would continue for the next X number of years.” So this is oftentimes referred to as the single life plus a 5 or 10 year term certainty. This is because the insurance company or your employer have to make sure they can pay out more. Again, this will likely be smaller than the $50,000. Let’s say for example this is $47,500.

One of the common recommendations we make, if you are married, is to not look at the Single Life Annuity. Again, If something happens to you, your spouse would not likely receive any of the funds. It would be a wasted benefit. We might recommend that you take a look at the Joint & Survivor annuity or the Lump Sum.

Next Steps For Pension Choices

A lot of detail is associated with pensions. They have a lot of information and a lot of decision making involved. You can read more about creating your retirement plans here. If you have a pension or aren’t sure how to make the most out of it, please reach out!

Ready to take the next step?

Schedule a quick call with our financial advisors.