The Basics of Incentive Stock Options (ISOs) [Video]

by Financial Design Studio, Inc. / March 27, 2023We’re back to talking about stock options, but specifically about Incentive Stock Options, or ISOs.

What are Incentive Stock Options?

If you clicked on this video, you may be receiving ISOs. If so, this can be a great part of your overall compensation. As we talk about Incentive Stock Options, we are going to talk about three different areas that will be helpful for you to understand.

That way, you can be sure you are using this great tool to maximize your income while minimizing taxes paid. We will talk about the structure of the incentive stock options, key terms and dates that come with it, and then finally we’re going to talk about the tax consequences.

What Is The Benefit of an ISO?

Because of how the tax consequences work, ISOs can be a huge benefit for you. Let’s think about corporate executives. If you are watching this video, you might be anywhere between the 35% to 37% tax brackets. The value of the ISO is that you are given and enabled to sell shares of your company stock in a way that takes advantage of lower capital gain treatments. Ideally, you are aiming for long term capital gains, which will be at around the 15% to 20% rate versus your ordinary income tax rate.

How do Incentive Stock Options Work?

Let’s talk about the incentive stock option. You might be given these as a part of your compensation package. If you are, they will be subject to a vesting schedule. That is, the point at which these shares are granted; when you are actually able to do something with them.

Let’s say you are given 1000 stock options. An example vesting schedule say that 250 of those shares will vest year one, another 250 shares in year two, and so on until you own all 1000 shares. Another vesting schedule involves a cliff. They might say you have a two year cliff for your 1000 shares, and you have to wait two years and then all your shares will vest.

What are the Key Terms and Dates?

What is a grant? This is the number of options given to you. The day they are given to you is called the grant date.

When you are given these options, they will have what is called a strike or exercise price. This is the discounted price the company is offering to you. For example, let’s say you are given stocks at a strike price of $5. Now you haven’t exercised these shares yet, they aren’t yours and you are waiting for them to vest.

Let’s say they have vested, and you decide you want to exercise these options. Your next step is to purchase your stocks from your employer after they have vested. In our example, let’s keep the strike price at $5. So, to buy 100 options at $5, you need $500. The date when you make the purchase is called the exercise date.

So, we’ve exercised the options and now we decide it’s time to sell. This date is called the sale date. When you sell, you are going to have to pay tax on the gain.

How are ISOs Taxed?

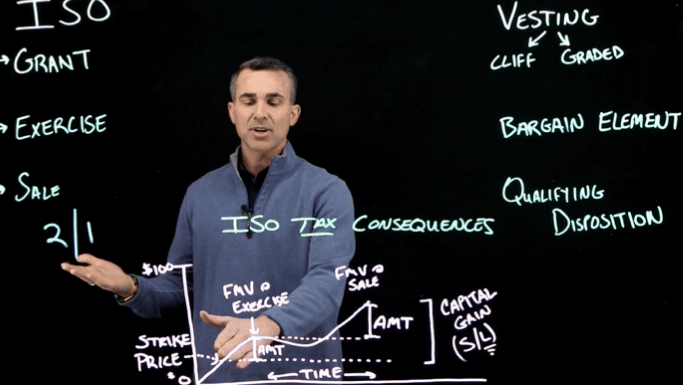

One thing I want everyone to remember is the “2/1” rule. In order to qualify for preferential tax treatment, you need to hold those options for two years from the grant date, and 1 year from the date of the exercise. You will be taxed on the gain of the sale either with the long term rate or the short term rate. If you can remember the “2/1” rule, the taxation will make a lot more sense.

ISOs Taxation Example

I’m going to use this chart which will hopefully bring this example to life. So in our fictitious example here, we’ve got our price of the stock on the y axis, and length of time on the x axis. We have a strike price of $5.

When we decide to exercise, we purchase the stock at a price much cheaper than the value of the stock trading on the market for a publicly traded company. If it’s a privately traded company, there is an evaluation that needs to go on. But you will be told if your shares are not publicly traded.

Understanding the Tax Rules at Play

So we exercise, the shares become ours. We don’t pay any tax at this point. This is one key difference between ISOs and NQSOs, or Non-Qualified Stock Options. We have a video on NQSOs that might be helpful for you too! However, there is what is called an AMT adjustment that you will need to watch out for.

A brief tax lesson here: AMT stands for Alternative Minimum Tax. AMT runs alongside or beneath your regular income tax. For some of those who are making a certain amount of money, typically highly compensated individuals, you may run into a situation where your AMT exceeds your regular tax rate. You may have to pay a little extra to meet the AMT. But if this is done as we are describing, this should not be an issue for you.

Now we wait another full year to meet the “2/1” rule. Let’s say the stock is now trading at $40 a share. Remember our strike price was $5, we exercised at $20, we can now sell at $40. When we sell this share, we want to make sure we have a negative AMT.

ISOs Qualifying Disposition

As long as we have held it two years from grant date and one year from the exercise date. We have what is called a qualifying disposition. A disqualifying distribution is when you exercised your shares before two years and sold them before holding one year.

What a disqualifying disposition means is you pay short term capital gain rates, aka your ordinary income rates. But with a qualifying disposition, if you are in the 37% margin tax bracket, you might be in the 20% capital gains bracket. That’s a 17% savings in taxes from hanging onto those options for two years after grant and one year after exercise.

One other term that we have to address is the bargain element. You may see this term around if you have researched ISOs at all. It’s the difference between market value and strike price at exercise date. That is called your bargain element.

Next Steps for Incentivized Stock Options

ISOs are not the most simple stock option out there, but be sure if you are given ISO that you use this video. We also have some other great videos on Non-Qualified Stock Options and Restricted Stock Units which seem to be more common in 2023.

In summary ISO can be a nice compensation benefit for certain employees. It’s the option to purchase company stock at a discounted price. You want to make sure you plan so that when you sell those options, you are taxed at the lowest rate possible.

When it comes to tax planning, timing is everything! If you are looking for a tax planning service or have more questions about how ISOs fit into your finances, reach out. We would love to start a conversation with you.

If you are interested in finding new ways to save on taxes, download our Tax Savings Strategies pdf!

Ready to take the next step?

Schedule a quick call with our financial advisors.