Tax

Asset Location [Video]

[Video]Asset Location| Today we are going to talk about one of the silent killers of investment performance, taxes. Taxes are a fact of life and we can’t avoid them forever. However, we can be strategic about when incurred so that it doesn’t negatively affect our finances any more than necessary.

High-Income Earner’s 401(k) Mistake [Video]

[Video]High-Income Earners 401(k) Mistake. We all know that each year in our 401(k) we have a maximum amount we can save. But what if you earn too much to contribute your full amount? Be sure and know the options you have before missing out on these savings.

When to Incorporate? Credit Protection [Video]

[Video] When to Incorporate? Credit Protection| When lots of people think about incorporating their business they tend to think of the tax advantages they may get instead of the liability protections. That’s actually what I want to encourage you to think about today.

Custodial Accounts: Non Tax Advantaged Savings Account[Video]

[Video] Custodial Accounts: Non Tax Advantaged Savings Account | Maybe you’re trying to plan for your child’s future and all the options you look at help you cover college expenses but you just want to save for their future, not only college. You understand that there are tax benefits to saving in college savings accounts, but you want flexibility for how the funds will be used.

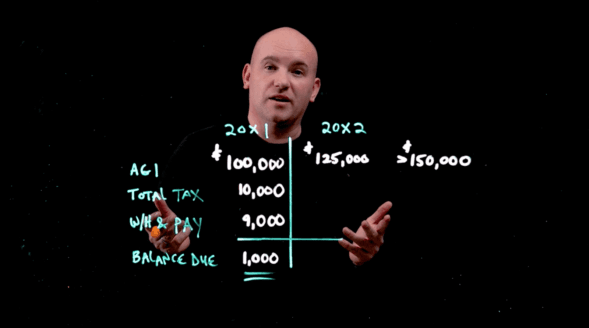

Tax Underpayment Penalties Aren’t Worth Paying [Video]

No one enjoys paying money to the state or the IRS. On top of that, adding insult to injury, there are underpayment penalties and interest!

Tax Extension To July 15

Tax Extension To July 15 Are you expecting a refund? Depending on how tight money is right now, you might want to file as soon as possible to get that refund check! Or maybe you want to wait as long as possible before filing to hold onto your finances longer. Depending on which…