What is Net Unrealized Appreciation?

by Financial Design Studio, Inc. / March 2, 2023

The Net Unrealized Appreciation Rule (“NUA” for short) is a tax-savings strategy for high income earners who own company stock in their 401(k). It allows employees to pay capital gains taxes on the gains in their 401(k) company stock, sometimes avoiding much higher income tax rates. Getting this favorable tax treatment isn’t easy, as the law requires you to follow specific rules. And it isn’t for everyone. We tackle the question “What is Net Unrealized Appreciation” and talk about some advantages and disadvantages of the strategy.

How Taxes Work When Withdrawing Money from Your 401(k)

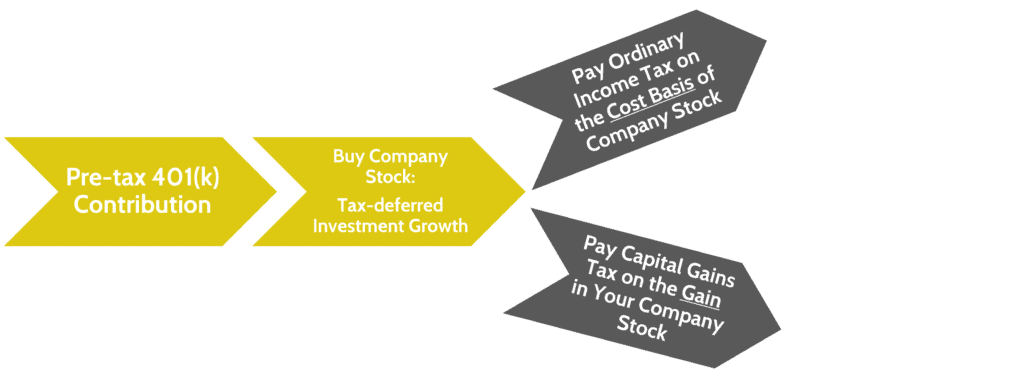

To fully understand the NUA strategy, it’s important to understand how taxes work when you withdraw money from your 401(k). For this, we’ll assume that the employee put money into a pre-tax Traditional 401(k). This means they received a tax benefit this year from making contributions to their 401(k). Here’s how a Traditional 401(k) works:

When you make a pre-tax contribution to a 401(k), you’re lowering your taxable income for the current year. This lowers the tax you have to pay in the current tax year. You can then invest these savings so they grow. But you don’t get taxed on that growth as long as you leave money in the 401(k).

However, Uncle Sam will want his cut of your income. Since you didn’t pay taxes when you put the money in, you’ll have to pay tax when you take money out of the 401(k). When you take money out, it’s taxed at Ordinary income tax rates. It’s just the same as if you had earned it at a job. And if you withdraw a lot in a future year, the withdrawals can push you into higher income tax brackets.

What is Net Unrealized Appreciation?

Now we’ll look at how the tax treatment differs with a Net Unrealized Appreciation (“NUA”) strategy. The most important piece to understand is that NUA only applies to your holdings of company stock in your 401(k). So if you work for Costco and own Costco’s stock in your 401(k), then you can do an NUA strategy.

The major difference with NUA happens when you’re taking money out of your 401(k). Instead of paying Ordinary income tax on all your withdrawals, the NUA strategy allows you to pay a combination of Ordinary income taxes and capital gains taxes. Since capital gains tax rates are lower than ordinary tax rates for many people, they end up saving money on taxes.

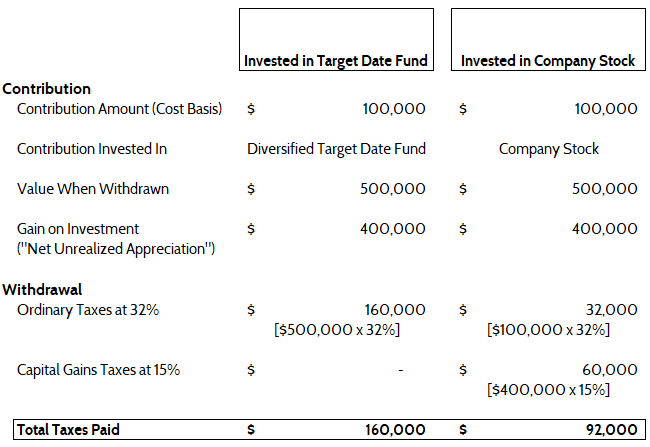

To better see these potential savings, let’s look at a simple example using the following assumptions:

- $100,000 contributed to a pre-tax 401(k)

- Employee is in the 32% tax bracket

- Capital gains tax rate is 15%

In both examples, you’re paying taxes on the total value of what you withdraw; $500,000 in this case. However, the NUA strategy allows you to pay Ordinary income taxes ONLY on the cost of the company stock you purchased. The government taxes the rest of the value – the investment gain – at your capital gains tax rate. The tax savings in this example is $68,000, which is substantial.

To summarize the NUA Strategy:

- Pay ordinary income taxes on the cost of company stock (its “cost basis”)

- Pay capital gains taxes on the GAIN in value on the company stock. “Net Unrealized Appreciation” is the name for the gains.

How to Qualify for Net Unrealized Appreciation Strategy?

Saving taxes using an NUA strategy seems like a “win.” But of course, there are specific rules that you need to follow to get this favorable treatment.

Rule #1: You must experience one of these qualifying events:

- At least Age 59-½ or older

- Separated from your company, either voluntarily (i.e. retirement) or involuntarily

- Disabled, but only if you’re self-employed

- Death

Rule #2: You must distribute the company stock “in-kind” to a taxable brokerage account. Meaning, if you’re a Costco employee and have 100 shares of Costco in your 401(k), you must directly transfer those 100 shares to a taxable brokerage account. You can’t sell the shares and transfer the cash to the brokerage.

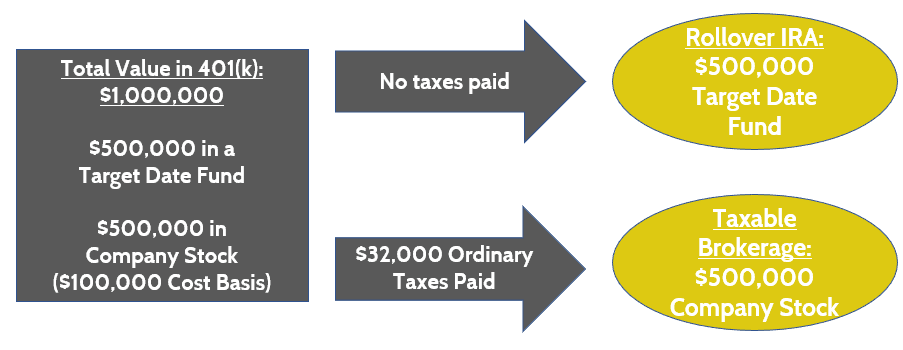

Rule #3: You must distribute the entire value of the 401(k) within the same year as doing the NUA strategy. This is often the most confusing part of the NUA strategy. It’s where you need to take great care to make sure you’re doing it right.

Continuing with the example used above, here is how to meet Rule #3 in an NUA strategy:

Pursuing the NUA strategy means you take your one 401(k) account and move ALL the investments in it to two new accounts: A Rollover IRA and a Taxable Brokerage account. Remember, this has to take place within the same calendar year.

One of the biggest challenges with this strategy is making sure the 401(k) plan administrator does it right for you. We’ve seen examples with our own clients of plan administrators potentially messing this up.

The most common “hiccups” we see are:

- The plan administrator liquidates the company stock before transfer. Remember Rule #2 – they must transfer the stock “in-kind,” not sell it for cash.

- The plan administrator doesn’t transfer the company stock to a taxable brokerage account, but sends it to the Rollover IRA. There are no do-overs with the NUA strategy, so if the company stock ends up in the wrong account, you’ve likely lost the benefits from NUA.

Once you’ve navigated the complex rules of the NUA strategy, you’re free to sell your company stock that’s now sitting in a taxable brokerage account. Because the stock is no longer in a 401(k), you’re no longer penalized for using the money as you would be if you took money out of a 401(k) before Age 59-1/2. Of course, you’ll owe capital gains tax on the difference between the sales value of the stock and its original cost basis.

What are the Advantages of the NUA Strategy?

Here are some scenarios for when pursuing the NUA strategy might make sense.

Advantage #1: The company stock has a large gain over its cost basis. The value of NUA is the taxes you save on the gain in company stock. The larger the value of that gain, the larger the potential tax benefits.

Advantage #2: NUA can free up cash to fund early retirement. We work with many executives who retire early (i.e. in their 50s). One of the key challenges with early retirement is having enough money on hand to fund spending needs and healthcare costs until you’re able to pull money from 401(k)s and IRAs penalty free after Age 59-½. If the value of the company stock in your 401(k) is high, pursuing an NUA strategy helps move this value from your 401(k) to a taxable brokerage account, which you can access, penalty free.

Advantage #3: Company stock can fund charitable causes through a Donor Advised Fund. Donating highly appreciated stock is a great way to fund your charitable desires AND save on taxes at the same time. If the value of the company stock is significantly higher than its cost basis, then this stock would be an excellent candidate to donate to a Donor Advised Fund, where it can be sold and distributed to your charities.

Advantage #4: Company stock with large unrealized investment gains can offset carryforward losses from prior tax years. Sometimes we end up losing a lot of money on a poor investment. The problem is, the IRS will only allow you to recognize $3,000 of capital losses per tax year. Suppose you lost $100,000 on an investment last year; do you really have to wait 34 years to fully recognize that loss? Not necessarily. If you pursue NUA and have company stock with large unrealized gains, you can use those gains to offset losses from prior tax years, allowing you to “recoup” those losses faster.

What are the Disadvantages of the NUA Strategy?

Disadvantage #1: Lack of investment diversification. Buying company stock in your 401(k) might seem like a great way to show pride in your employer. But it’s a risky strategy that can blow up on you if the company’s fortunes turn south. The key question you need to ask yourself is, “Are the potential tax benefits of pursuing NUA more than the cost of not being well-diversified in my portfolio?” Selling company stock after doing an NUA strategy means you’re recognizing capital gains and paying taxes on those gains. But you can always sell that stock tax-free in the 401(k), investing the proceeds in a well-diversified portfolio.

Disadvantage #2: No more tax-deferred growth on company stock. The NUA strategy moves your company stock from a tax-deferred vehicle (the 401(k)) to a taxable brokerage account. If your company stock pays high dividends, then doing an NUA strategy will mean recognizing taxes on the dividends you’re paid each year, since those dividends are no longer shielded in a 401(k) or IRA.

Is Net Unrealized Appreciation Strategy Right for Me?

The potential tax-savings of pursuing an NUA strategy make it a powerful tax-planning tool when planning for retirement. However, the rules are complex and you need to weigh both the advantages and disadvantages of the strategy.

There are key questions to ask yourself before doing anything:

- Are the potential tax savings high enough to make NUA worth it?

- Do I need the money tied up in company stock to fund my early retirement?

- How does keeping my company stock affect the diversification of my overall investment portfolio?

Next Steps for Net Unrealized Appreciation

We help high-income executives balance these questions to arrive at a retirement and investment strategy. It is important to maximize the lifetime value of their investments. Everyone’s plan is unique and there are no cookie cutter answers to planning strategies as complex as NUA.

If you have a large amount of company stock in your 401(k) and a low cost basis in it, we highly recommend you reach out to us to discuss your options. We have in-house tax expertise to help you see how different scenarios affect your future. And we can show you how pursuing – or not pursuing – an NUA strategy affects other parts of your retirement plan. Don’t wait to find answers to your questions, reach out to schedule a meeting with our team!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.