What’s the Impact of Higher Interest Rates

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / January 20, 2022

Interest rates are rising from generational lows. We’re seeing stock and bond markets react to this shift in monetary policy. Higher rates are a relief to some, but for others, higher rates present their own risks. What’s the impact of higher interest rates?

Federal Reserve to Hike Rates in 2022

We’ve seen a massive shift in posture at the Federal Reserve since last fall. As recently as October, it was “all systems go” on monetary easing. This meant keeping short-term interest rates near 0% and buying $120 billion of government bonds and mortgages each month.

Starting last spring, inflation surged above expectations. This continued into the summer and fall, causing the Fed to change its course in November. It started by the Fed announcing that it would “taper” its bond purchases (i.e. reduce how much they buy each month.) In December, they sped up the pace of tapering. And here in January they’ve made it clear that interest rate hikes are on the table.

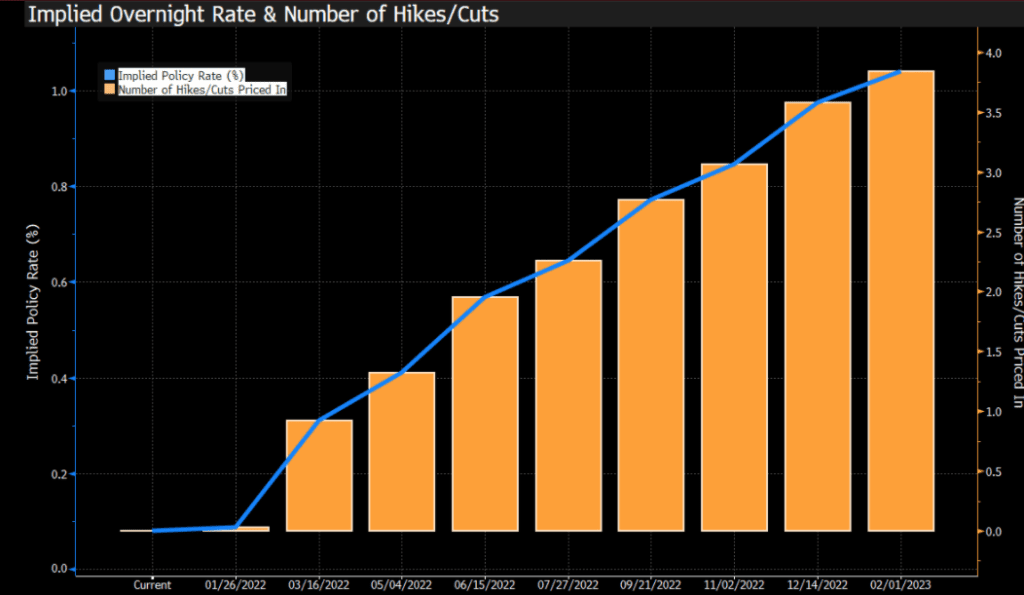

The bond market has quickly priced in this new regime. As the chart below shows, bond market participants now expect four interest rate hikes of 0.25% each between now and January 2023.

The orange bar shows the number of implied interest rate hikes at each date. Surprisingly, the market has priced in a near-100% chance of a rate hike at the March meeting of the Federal Reserve! By next January, investors expect the Fed to increase short-term interest rates to 1.00%.

How Have Bonds Reacted to Fed Interest Rate Hike Expectations?

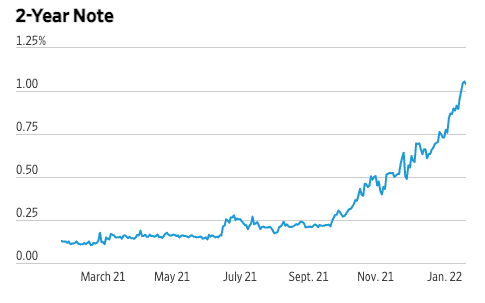

Stock and bonds markets have noted the shift in the Fed’s monetary policy posture. We have seen the biggest change in the bond market with the steep rise in 2 year Government bond yields. This makes sense, as investors have had to price in several interest rate hikes in the coming year.

Likewise, 10-year Government bond yields have also “surged” to their highest level since January 2020 – before the pandemic. I use the word “surge” despite the fact that 10-year interest rates are only up to 1.85%, which in the historical context is ridiculously low.

How Have Stocks Reacted to Fed Interest Rate Hike Expectations?

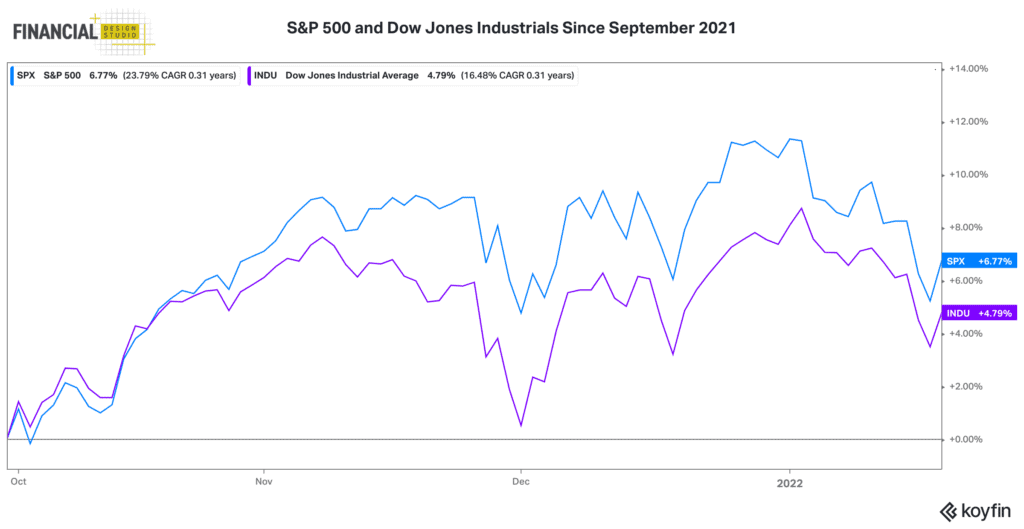

In the stock market, it’s been interesting to watch how this regime shift has played out. If you look at major indexes like the S&P 500 or Dow Jones Industrial Average, they’ve hardly skipped a beat. While they’re down about 3-4% off their all-time highs, stocks are still higher now than where they were before this change at the Fed!

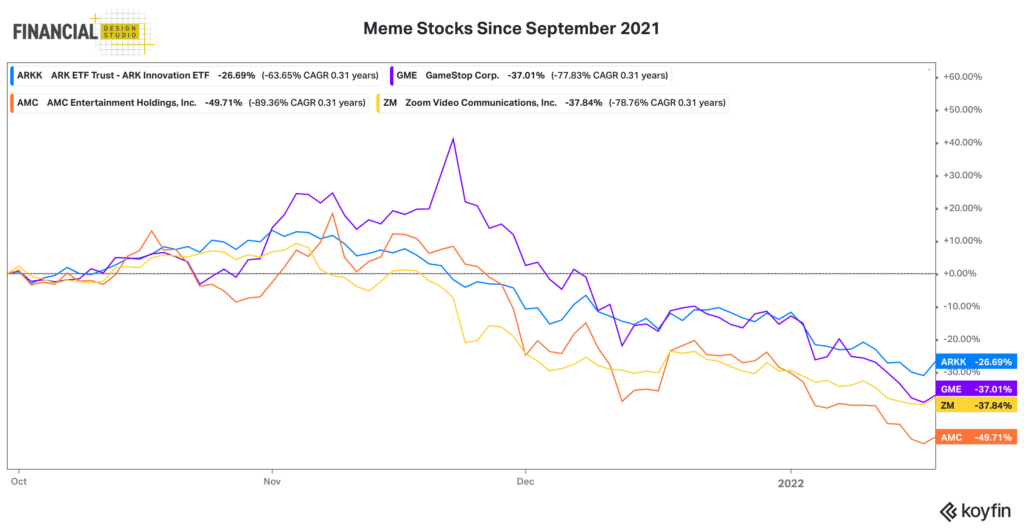

However, underneath the surface of the market, there’s been a lot of bloodshed. As happened in the early days of the Tech Bubble bursting in 2000, the first stocks to get whacked are the ones where retail investors were speculating the most. Back then, it was DotCom penny stocks. This time around, it’s “meme” stocks.

Reality has set in for many meme stocks, many of which are down anywhere from 40 to 70% in the last few months. Are they bargains at these levels? Possibly. But if we’re following the 1999-2000 script, the rallies will be few. Mind you, companies like GameStop and AMC were hurtling towards bankruptcy pre-pandemic. Now, they’re worth a combined $20 billion. Makes little sense.

Major indexes have held up because investors are hiding out in mega-cap technology stocks such as Apple, Tesla, and NVIDIA. But how long can this last with an increasingly aggressive Federal Reserve?

Good News for Savers: Interest on Deposits Will Rise!

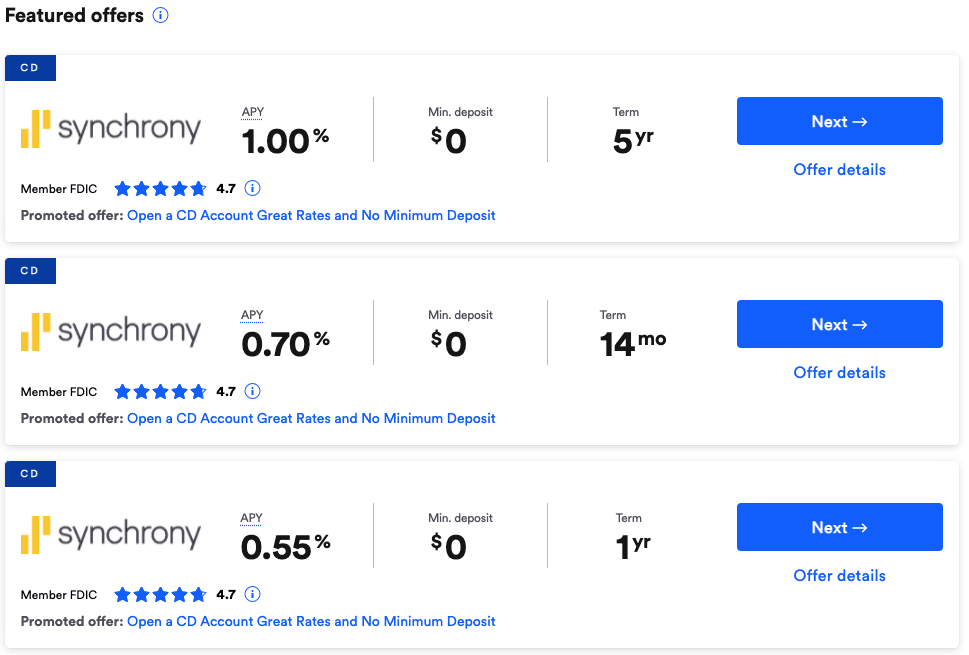

The good news is that if the Federal Reserve follows through on its pledge to hike rates, deposit interest rates will start heading higher, depending on where you keep your cash. Money market funds and online banks will probably be the first to see higher interest rates paid on your cash. Savings and checking at big, national banks will probably stay near 0% for a long time.

CD rates haven’t yet gone up with this recent move higher in government bond yields. But they will. No reason to “lock in” a low rate today when they’re going to go up in the next few months.

Bad News for Home Sellers: Higher Rates Hurt Home Prices

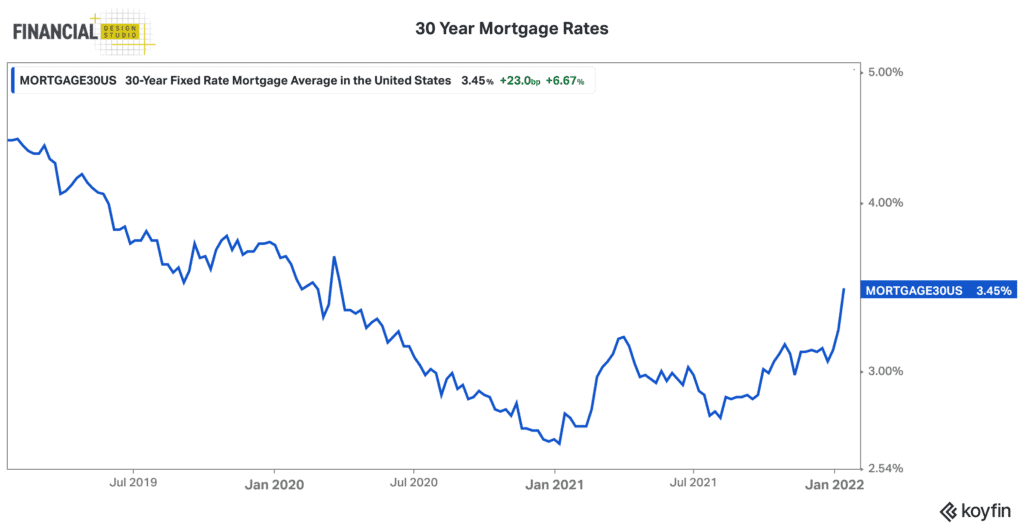

On the flip side, home sellers have likely seen the peak in the house price frenzy seen over the last 18 months. 30-year mortgage rates are close to 3.50% now, up from the all-time low of 2.65% a year ago.

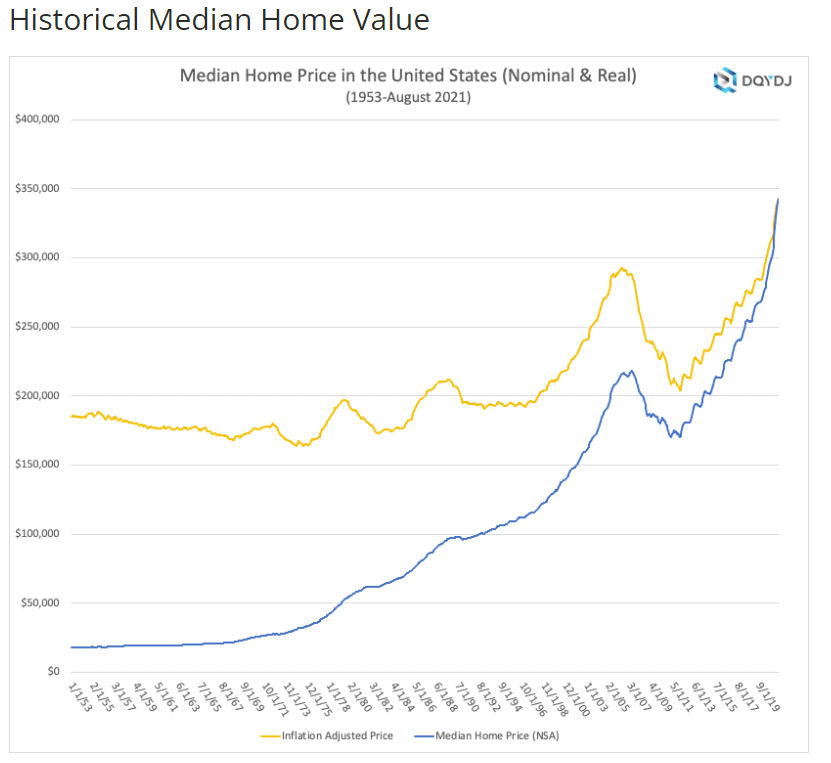

Cheap, plentiful debt always pushes prices higher, whether it’s homes (mortgages) or stocks (margin loans). The housing market has arguably seen a boom even more crazy than what we saw in the mid-2000s. To put this into context, this chart shows real home prices (i.e. prices adjusted for inflation) since 1953. You can see that from 1953 through the late 1990s, real home prices were consistently around $175,000-$200,000.

The mid-2000s housing bubble pushed the median real house price to $300,000 before collapsing during the Great Recession. Today, real home prices are knocking on the door of $350,000, which is extremely high.

That doesn’t mean home prices are going to collapse. There aren’t the crazy no-income, no-job, no-asset mortgages (“NINJA Mortgages”) like we saw in the mid-2000s. And home building has been slow to keep up with household formation.

What this might mean is that home prices drop a bit and then stagnate for a long period. The good ol’ days of using home equity to fund spending desires and buying other properties is likely ending.

Tighter Monetary Policy Means More Volatile Markets

Other than meme stocks, it doesn’t feel like the Fed’s shift has meant much to investors and consumers. But as we’ve warned in the past, stocks move toward monetary policy. If the Fed is easing, they’re underwriting stocks, which means stocks do well. If they’re tightening, the opposite is true; liquidity is being pulled away, which eventually hits stocks.

The million dollar question is whether the Fed will once again turn tail and ease if stocks start acting badly, much as they did in 2019. I’m not so sure. With inflation running at 7%, it’s not as easy for them to go back to a zero interest rate policy. They’ve painted themselves in a corner and it will be hard to tame inflation without either killing stocks or killing jobs.

Professionally managed investments at FDS are built to trade around volatility. As stocks and bonds start moving around quickly, it’s important you have someone watching your investments continuously, looking for opportunities to “buy low” and “sell high.” We don’t take directional views on markets. But we do take advantage of opportunities to add value to your investments as markets move around.

Ready to take the next step?

Schedule a quick call with our financial advisors.