It’s a Home Seller’s Market!

by Financial Design Studio, Inc. / October 15, 2020One of the more remarkable things we’ve seen over the last 7 months of the COVID pandemic is the uninterrupted strength of the housing market. After a brief dip in March and April, home sales have been on fire. The question for prospective buyers/sellers of homes is whether now is a good time to buy/sell. What we do know: it’s a home seller’s market!

Two Drivers of Hot Housing Market

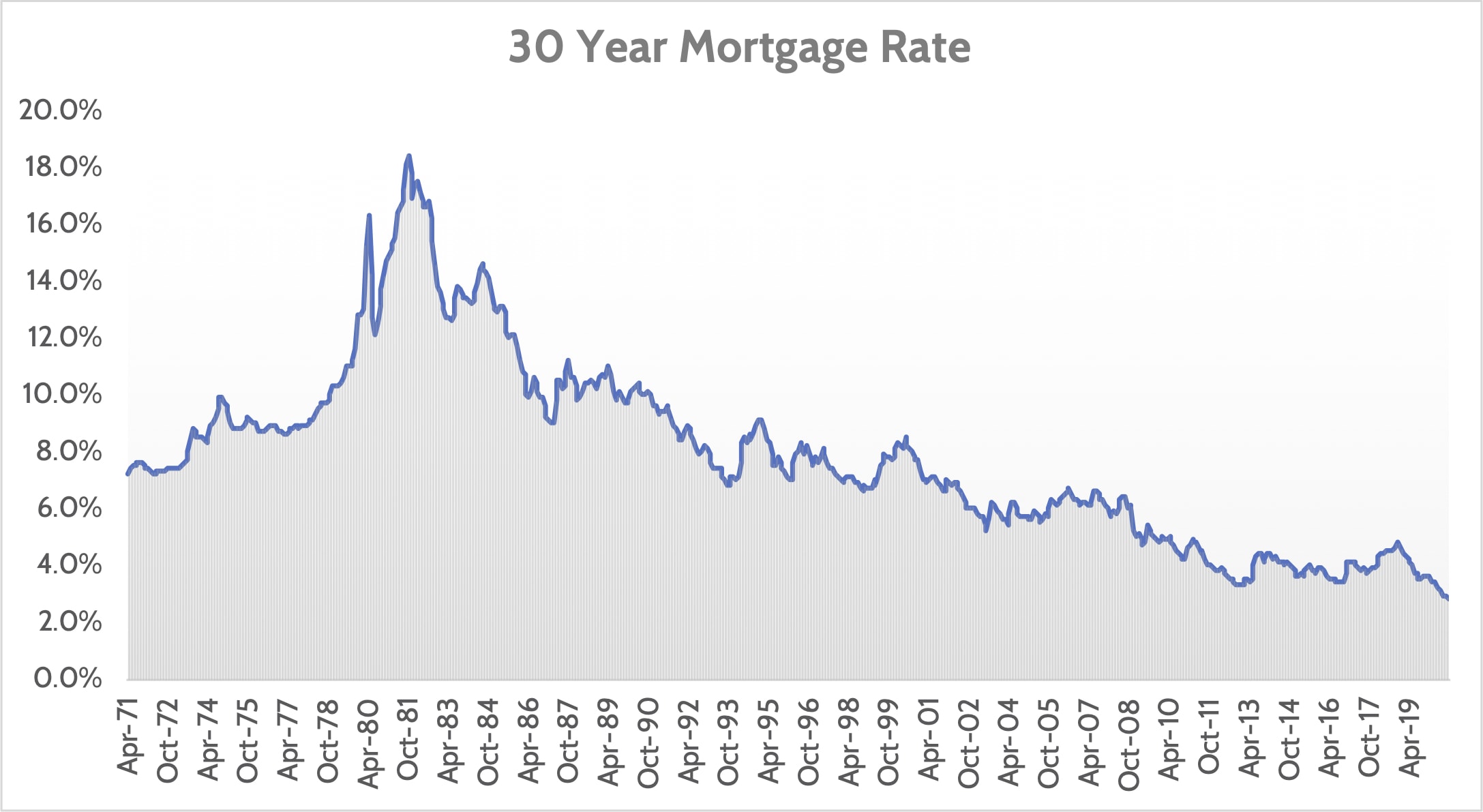

There have been two big drivers of recent housing market strength. The first is the collapse in mortgage rates to below 3.0%, by far the lowest in the last 50 years. Low mortgage rates make it easier for buyers to afford homes and “stretch” for one that’s a bit more expensive.

The second dynamic we’re seeing is people moving out of big cities into suburban areas. Cities have been more affected by COVID shutdowns than less populous areas. Also, there’s demand for more square footage at home to accommodate the increasing work-from-home trend.

Home Price Impact from Low Inventory and Mortgage Rates

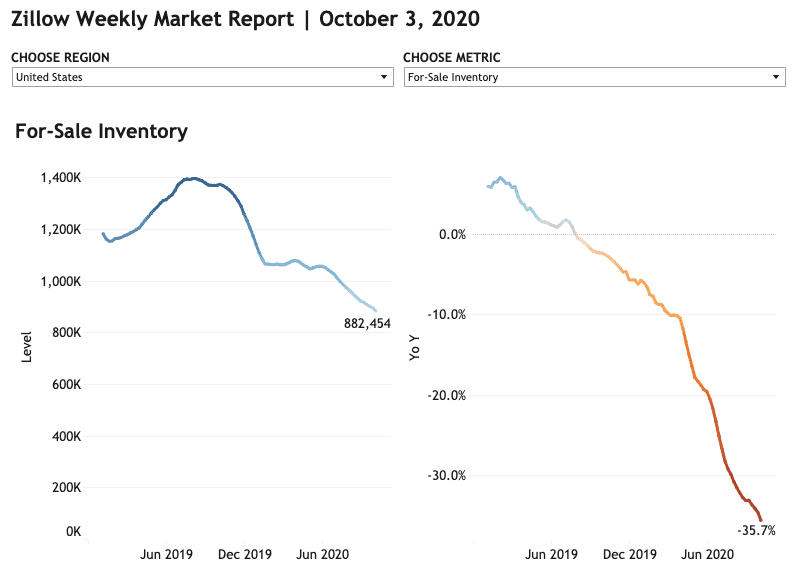

These two demand trends have caused a dramatic decline in the number of homes for sale in the U.S. The housing website, Zillow, posts a weekly temperature check of the housing market. In its most recent report, Zillow said the number of listings on its site has declined by more than 35% in the last year!

Some of this decline in inventory is due to somewhat lower inventory coming to market. But it’s also being driven by very strong demand. For families wanting to buy a home, this means that homes are moving much quicker as they hit the market and are encountering multiple offers when they go under contract.

The problem for buyers (and benefit to sellers) is that these supply/demand dynamics are leading to an increase in home prices. This is reflected in a strong upswing in median home sale prices according to Zillow.

Current Mortgage Payment for Typical Home Buyer

When mortgage rates experience a strong drop like they have in recent months, it’s tempting to think the cost of buying a home will be lower. But what we’re seeing is that the increase in median home sale price is offsetting most of the benefit from the drop in mortgage rates.

To see this, we look at what the monthly mortgage payment would be for a buyer of a home at the median sales price. We assume they put 20% down and get a 30-year mortgage.

Despite mortgage rates dropping from 4.3% in early 2019 to under 3.0% today, the monthly mortgage payment for home buyers is almost the same level that it was 18 months ago! Buyers who were able to take advantage of the steep drop in mortgage rates early in 2020 were rewarded. Since then, however, home prices have moved up and offset a lot of this benefit.

Is Now a Good Time to Buy a Home?

The question on many minds is whether it’s a good time to buy a home or not. It depends on what your family is trying to achieve. It’s almost impossible to “time” any market – whether it’s the stock market or housing market – so our advice is normally, “let your family needs drive the buying decision, not prices.”

That said, it’s always helpful to understand how hot the market is. And right now it’s pretty warm, suggesting that you pay attention to that yellow caution flag. Many buyers in 2005 and 2006 (including yours truly!) “stretched” for a home and ended up losing a pretty penny getting out of the house after the housing market crashed in 2008.

Wondering how this affects your investments? Schedule a call with Financial Design Studio to discuss your portfolio today.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.