Central Banks Signal Higher Interest Rates are Coming

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / February 3, 2022

The last two weeks have confirmed what we’ve been talking about in recent months: central banks are signaling that higher interest rates are coming. The inflation boogeyman they roundly ignored in 2021 as being “transitory” isn’t going away and now they’re being forced to play catch-up. This change in monetary policy has brought – and will continue to bring – volatility to stock and bond markets. In this week’s post we review what’s happened and what this means for markets as we move through 2022.

Hawkish Federal Reserve Meeting

The Federal Reserve held their first meeting of 2022 on January 25-26, with Fed Chair Jerome Powell giving a press conference afterwards. Stock markets had a string of down days before the meeting, causing some expectation that Powell would soften his interest rate hike rhetoric at the press conference to calm markets down. That didn’t happen.

Having listened to (way too many) of these press conferences, it surprised me how hawkish the tone was. When I say hawkish, I mean Powell didn’t give any ground on taking it easy on future rate hikes. Further, he made it very clear that the pace of monetary tightening would likely be more aggressive than the market had been expecting.

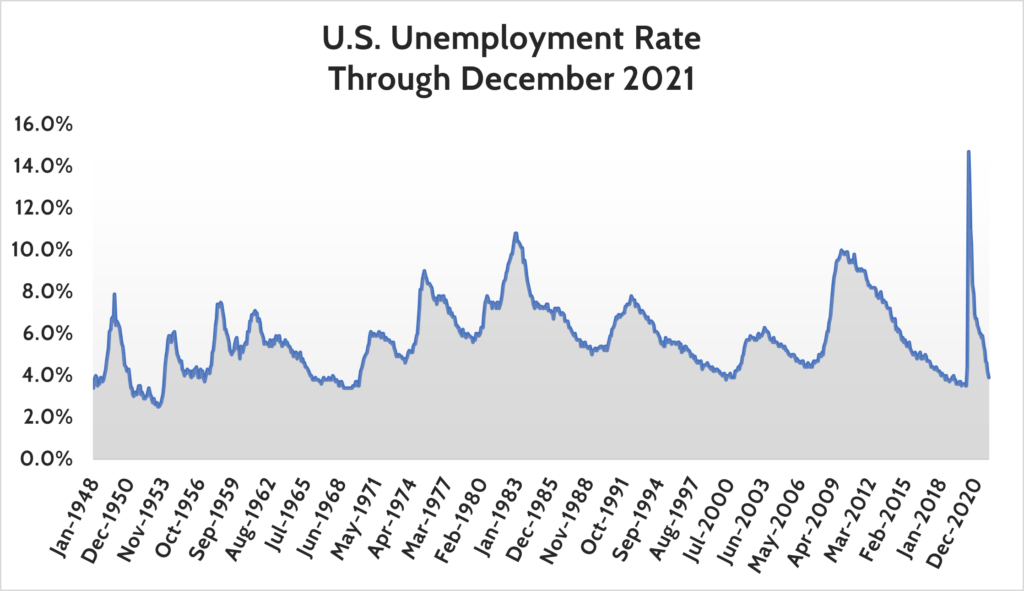

Why is the Fed reacting so quickly? The reason is that they have two key mandates from Congress. First, they have a mandate to maximize full employment. They’ve never defined what “full employment” means. But the December 2021 unemployment rate fell to 3.9%, very low by anyone’s definition.

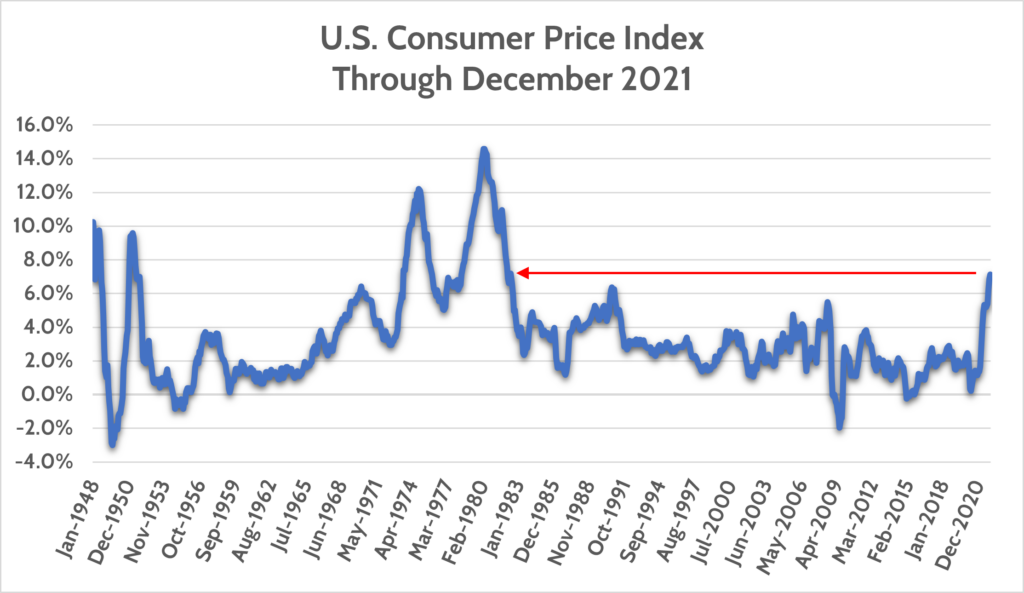

Second, they have a mandate to keep prices stable. Inflation is currently running at 7.0%, the highest reading since June 1982. To put that into context, the number #1 song in America that month was “Ebony & Ivory” by Paul McCartney and Stevie Wonder.

The strong labor market is giving the Fed a lot of room to raise interest rates in order to combat inflation. Chair Powell admitted as much during his press conference, which makes it clear to me that the market hadn’t been pricing in enough tightening.

Bank of England Hikes Interest Rates Back-to-Back for Second Time Since 2004

On February 3, the Bank of England (“BOE”) announced that it was going to hike interest rates by 0.25% for the second consecutive time. While the markets expected the rate hike, what surprised people was how hawkish the vote was. Four of the nine members on the board voted to increase rates by 0.50%.

In addition, they clarified that they were going to reduce the pile of bonds they had bought during the Coronavirus pandemic. Like all major central banks, they had been buying government bonds in order to keep interest rates low. By reversing course, the cost of getting a loan will go up in the U.K.

Much like the Federal Reserve meeting last week, the forward guidance they gave was more hawkish than the market was expecting. More hikes to short-term interest rates and faster run-down of their government and corporate bond portfolio.

European Central Bank is Falling Behind the Curve

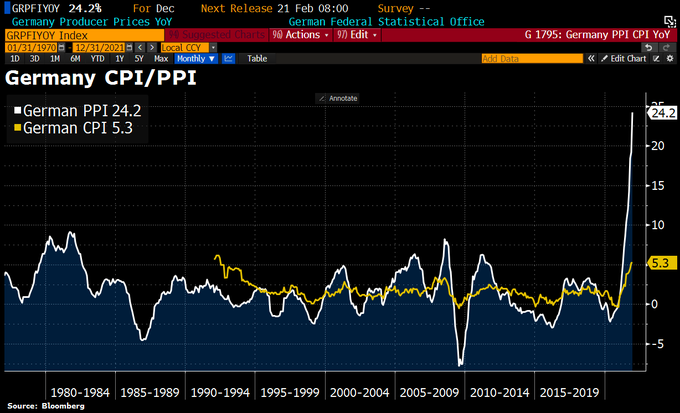

Also on February 3, the European Central Bank (“ECB”) had their own meeting and press conference. Unlike the Fed and BOE, they’re sticking to their guns that they won’t hike interest rates in 2022. But how realistic is this? Consumer prices in Germany just posted its highest reading since the mid-1990s, while a measure of producer prices (what companies charge each other for manufacturing inputs) posted its largest gain in history – going all the way back to 1949!

We’ve talked about how the Fed was painting itself into a corner by keeping monetary policy too easy for too long. The ECB is in the same predicament, and worse.

The problem for the Europeans is that they’re trying to coordinate monetary policy for 19 countries. If they tighten policy by hiking interest rates, they help German inflation but then find that government bond interest costs in Italy explode higher. If they try to save Italy, inflation will cause political problems in Germany.

The ECB hasn’t hiked rates in over a decade. They’ve gotten away with it because inflation was so low. But as we’ve noted, inflation is changing the game for all major central banks. Runaway prices quickly turn into political problems – and political pressure – on these central banks.

Why Should Investors Care About Other Central Banks?

A rational question for any U.S.-based investor is, “Why should we care about what the Bank of England or European Central Bank are doing?” It’s a great question because it’s easy to ignore what’s happening overseas.

The issue I see with the Fed, BOE, and ECB all tightening monetary policy or at least talking about doing it is that tighter money = more volatility. We’re seeing this play out already. The S&P 500 has dropped over 1% on 25 occasions in the last 12 months. Seven of those drops have occurred so far in 2022.

Another issue is that these three central banks are all moving towards tighter monetary policy at the same time. Over the last 25 years, there have only been two occasions where all three central banks were tightening monetary policy at the same time. The first was in 1999-2000, while the second occasion was 2006-2007.

Coordinated hikes in the early 2000s battled an emerging bubble in technology stocks. They were successful in popping that bubble, but global stock markets struggled for three years until bottoming out in early 2003. The second instance of coordinated monetary tightening in 2006-2007 fought against a global housing bubble. We know how that turned out, both for home prices and stock prices. It wasn’t pretty!

The point to understand with all this is that coordinated monetary tightening usually leads to market volatility. As the price of money goes up (i.e. interest rates rise), asset prices that are supported by low rates struggle. House prices and “new economy” technology stocks are sensitive to this. Or, as Warren Buffett is famous for saying, “When the tide goes out, you find out who’s been swimming naked.”

Know What You Own in Your Investment Portfolios

What’s an investor to do in this environment? I’ll admit this is the most challenging backdrop I’ve seen in my career. There’s been a running joke in the market the last several years that we’re in an “everything bubble.” Stocks have surged to one high after another. Bond prices have been pushed so high that there’s $7 trillion of bonds worldwide that have NEGATIVE yields. And let’s not even start with the cryptocurrency craze.

And that’s the challenge investors face. There are precious few places to “hide.” Even owning cash, as the current inflation rate guarantees you lose 7% of your purchasing power this year.

The biggest issue I see with investor portfolios is they’re unaware of what they own. Too often, they’re way too concentrated in large cap growth stocks, even in plain vanilla index funds like the S&P 500. Lack of investment diversification was very painful for investors in 2000 and 2008. Diversification doesn’t insulate you from short-term drops in stock markets. But it cushions the blow and reduces the chance that you get stuck in the wrong asset class that stays down while the rest of the market recovers.

We at FDS started positioning client portfolios for the environment we’re in today all the way back in Fall 2020. The first moves hedged against inflation by adding inflation-protected bonds. The second wave of moves came in Spring 2021 as we reduced interest rate sensitivity in bond portfolios and moved out of stock index funds we felt were too concentrated in “Big Tech.”

Thus, when a client asks, “What should we be doing?” our answer is, “We’ve already done what we need to do to prepare you for this more volatile environment.” If your financial advisor waits until a new, challenging investment regime smacks them in the face, it’s too late to act. You have to anticipate where things are going and move ahead of what you think is going to happen.

Dealing With Market Volatility

The strategy from here is to stick to the plan and stand ready to make changes as the market environment changes. As markets get more volatile, there’s going to be more opportunity to take advantage of strength in one asset class and put those gains in asset classes that are struggling. We’re prepared to do that.

For anyone reading this that isn’t a client and is approaching retirement in the next 10 years, I implore you to reach out. Let’s look at your current investments and make sure you’re not over-exposed to asset classes that may imperil your ability to retire. The transition from retirement saving to retirement spending is difficult in any environment, let alone one like we saw in the early 2000s and late 2000s.

For my younger high-income earners out there – I know it’s been fun to invest in Tesla and crypto over the last decade. But the times are a’ changin’ and we could be headed for a long, cold winter in those parts of the market. Counting your blessings and moving some of those gains into a well-diversified investment portfolio can set you up for early retirement down the road.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.