Testing Our Thesis: Will Higher Inflation Eventually Hurt Stock Prices?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / November 18, 2021

Last Fall we started talking about the prospect for higher inflation and what that would mean for the stock market. Our thesis was: if inflation moves higher, then stocks would suffer. Over the last year, we’ve certainly gotten a heavy dose of inflation, more than we would’ve thought. Yet stocks are sitting at all-time highs and are up over 20% this year. Is the link between (higher) inflation and (lower) stocks broken? We don’t think so. In this month’s letter, we lay out why we believe: 1) inflation will continue to surprise to the upside, and b) why stocks will eventually have to reckon with this inflationary reality.

How Has Inflation Increased Since 2020?

We’ve experienced a significant pickup in inflation in 2021. Back in the Spring, higher inflation readings were being driven by “base effects,” which means we were lapping abnormally low prices from the immediate months of the COVID outbreak in early 2020. But since May, inflation has continued to rise, surprising investors and government officials.

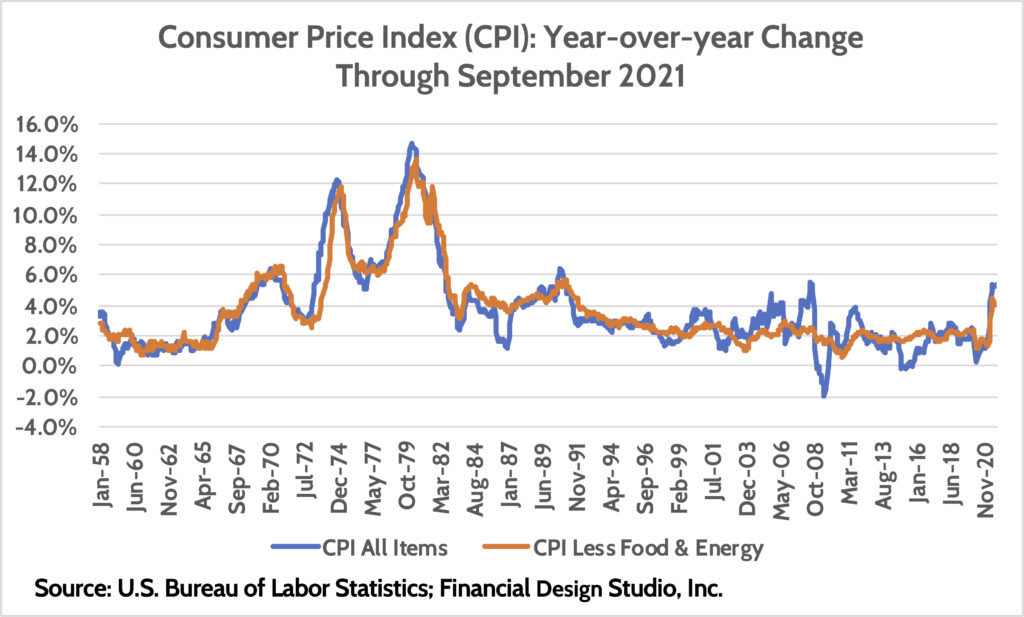

There are two major inflation readings that people watch. The first is the Consumer Price Index – All Items. This tallies up price increases for everything. The second is the Consumer Price Index – Less Food & Energy. This latter index smooths out volatile food and energy prices.

The graph below compares these two indexes going back to the 1950s. Current inflation readings are well-below the worst period for inflation in the 1970s. But if you look at the orange line, which is the “core” CPI less Food & Energy, we haven’t seen inflation this high since December 1991, nearly 30 years ago.

Any way you slice it – and believe me, the Federal Reserve and Government try to “slice” as much bad inflation out of the numbers as possible – inflation is a problem. Most economists expected the spike in inflation to be “transitory,” which we addressed recently. Now, most everyone is admitting that inflation is here to stay for a while.

Inflation is Up, but Stocks are Also Up??

With inflation rising faster and proving stickier than what investors and economists expected, one would naturally expect that stocks would suffer? Why do stocks dislike higher inflation? Because to combat inflation, the Federal Reserve would need to increase interest rates. And higher rates mean slower economic growth and more competition for stocks, as investors get better yields from their bonds and savings.

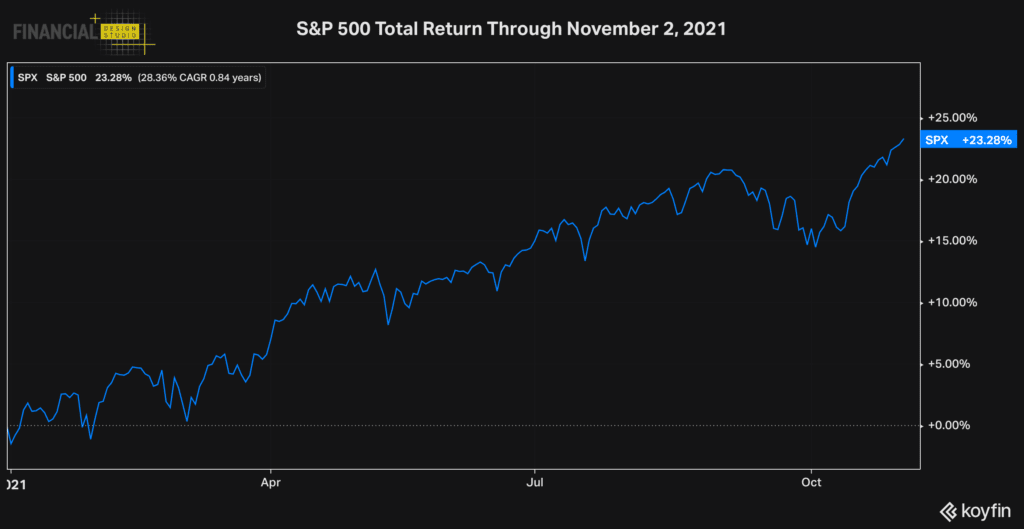

Yet here we are, in the midst of a major spike in inflation, and stocks are sitting at all-time highs. I’ll be the first to admit that I never expected that to occur. Yet another example of how Mr. Market humbles investors all the time. So is the thesis that stocks will struggle in the face of higher inflation wrong?

There’s an old saying that, “…the market can stay irrational longer than you remain solvent.” Meaning, an investor might have a well-thought out thesis that stocks should drop, but they keep going up in the face of mounting evidence that they shouldn’t!

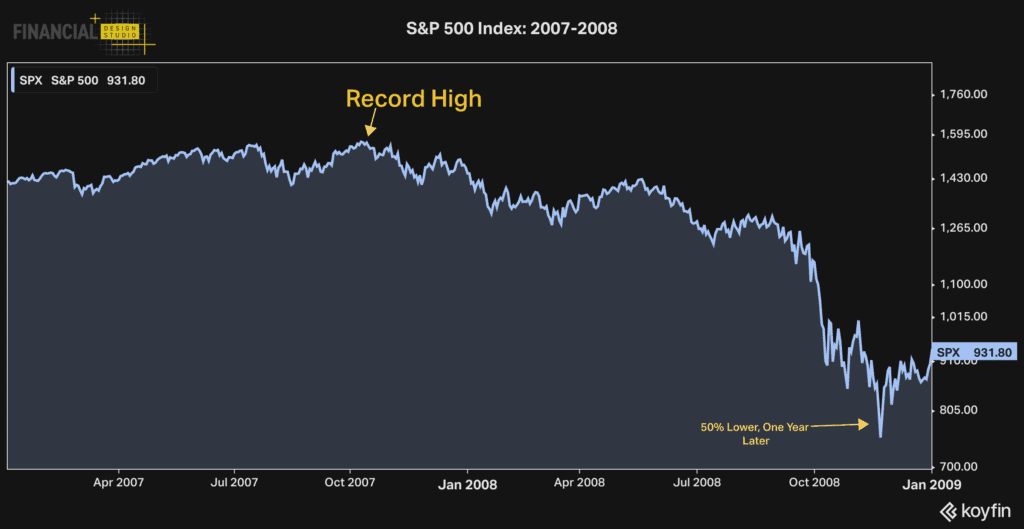

A great example of this happened before the Great Financial Crisis of 2008-2009. I was an investment analyst in charge of our investments in global banks. And during 2004-2006 I was appalled at the mortgage underwriting that was happening. Yet home prices and stocks continued to march higher.

The mortgage problems started coming home to roost in late 2006, and became glaringly apparent by mid-2007 as some mortgage funds and banks raised red flags about losses on their balance sheet. Yet the S&P 500 continued higher, hitting a record high in October 2007.

To be clear, I’m not forecasting a huge drop in the stock market. It may happen, but it might not. The point of this history lesson is to show that the stock market *can* be wrong sometimes.

Will Inflation Continue to Be a Problem in 2022?

Whenever the stock market is acting in a way that’s contrary to one’s investment thesis, it’s good to go back to the drawing board and test your thesis again. The worst thing you can do as an investor is to get dogmatic about your views.

Since stocks have rallied in the face of higher inflation, we’ve re-tested our hypothesis that we’re entering a new era of higher inflation. Briefly, we’ve written over the last 12 months our view that the 40-year regime of progressively lower inflation is over. The Fed slayed the inflation beast in the 1980s and we’ve enjoyed disinflation ever since. We believe that era is over, and the implications for stocks are profound, as stock valuations have reached historical heights on the back of lower and lower interest rates.

You can look back to our post in July asking, “Is inflation transitory or not?” In that piece, we lay out reasons we believe inflation is NOT transitory. But I want to dig in on a few of those reasons here.

Issue #1: Labor Shortages Will Persist and Drive Wages & Prices Higher

First, there has been a fundamental shift in the labor market. We’ve all seen “help wanted” signs plastered on every store front. There’s a clear shortage of help.

Those who believe that inflation is ‘transitory’ (i.e. it will settle down and isn’t a problem) assert that current labor shortages result from the pandemic and abnormally high unemployment benefits. I completely disagree with this view.

My view is that the current labor shortages are a continuation of the shortages that were emerging well before the pandemic started. If labor conditions remain tight – as I believe they will – then that means wages will continue to go up. Higher wages mean higher prices as businesses eventually pass those costs on to consumers. What’s the evidence for this view?

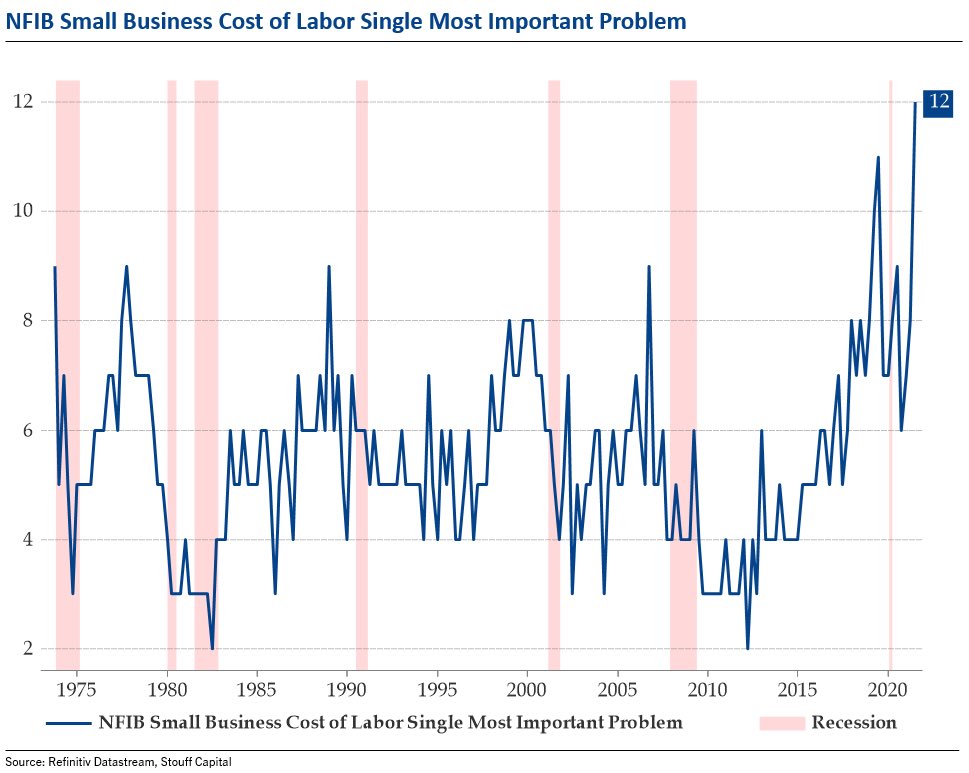

One way to look at this is the National Federation of Independent Businesses (NFIB) survey of Small Business Labor Costs. The September 2021 release showed a record high number of businesses pointing towards higher labor costs as their #1 problem. Mind you, this survey started in 1974 during the early stages of the last bout of inflation experienced by the U.S.

Look closely at the chart and you can see that labor problems started emerging in 2017-2018. By 2019 – a year before the pandemic – this index hit a record high. Translation: labor was a big problem before the pandemic.

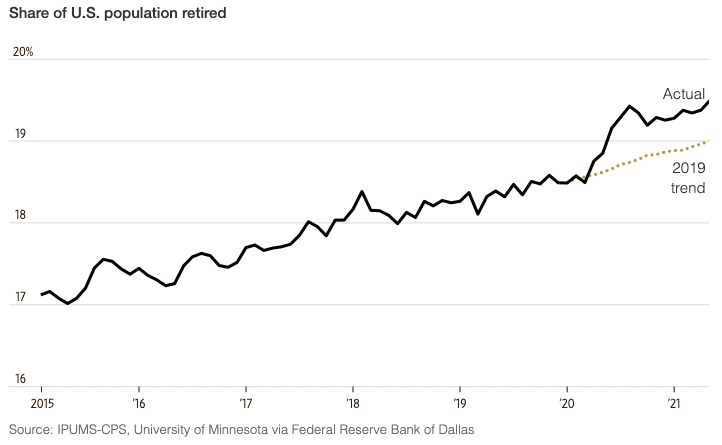

COVID had a big impact on the pool of available labor. Many people who were close to retirement with flush retirement savings accounts have called it a career. The Wall Street Journal estimates that 1.5 million more people retired from the labor force than would’ve had the pandemic not happened.

Fewer workers means more competition for those who remain, pushing wages (and prices) higher. And demographically, as Baby Boomers retire, there simply aren’t enough new workers to take their place in the labor market.

Issue #2: Home Price Surge to Make Way Into Inflation Numbers

Home prices have been on fire during the pandemic. Mortgage rates dropped to all-time lows, and many people bought homes to reflect today’s new Work From Home environment.

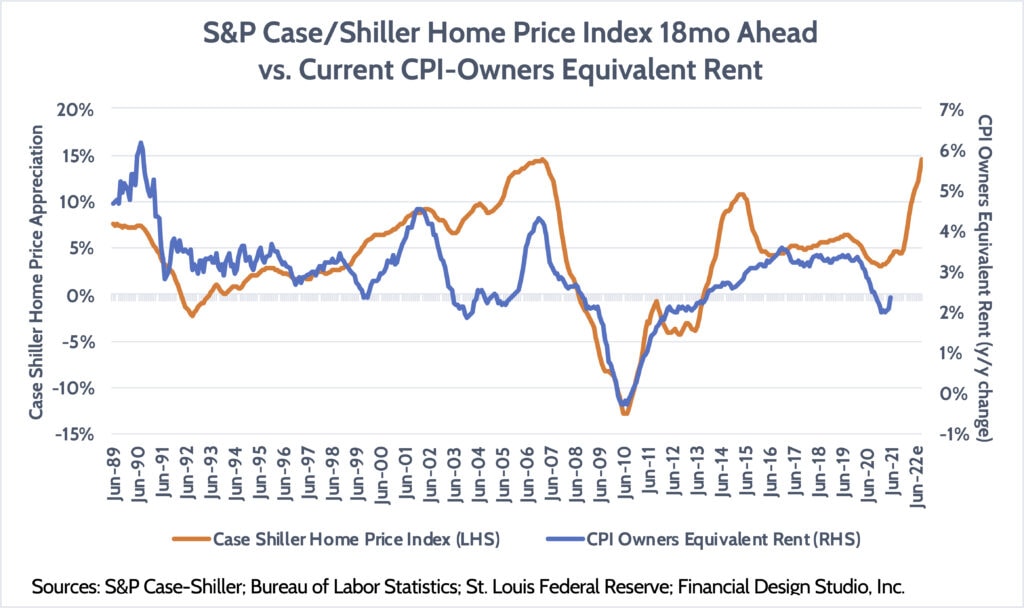

There’s not a 1-1 correlation between home price changes and changes in the cost of housing within the Consumer Price Index. But there’s clearly a relationship. Historically, home prices have “led” changes in housing costs by about 18 months.

We’ve just experienced a record surge in home prices, which were +20% y/y in August. This is going to feed into future inflation numbers over the next 12-18 months, keeping reported inflation levels high and sticky.

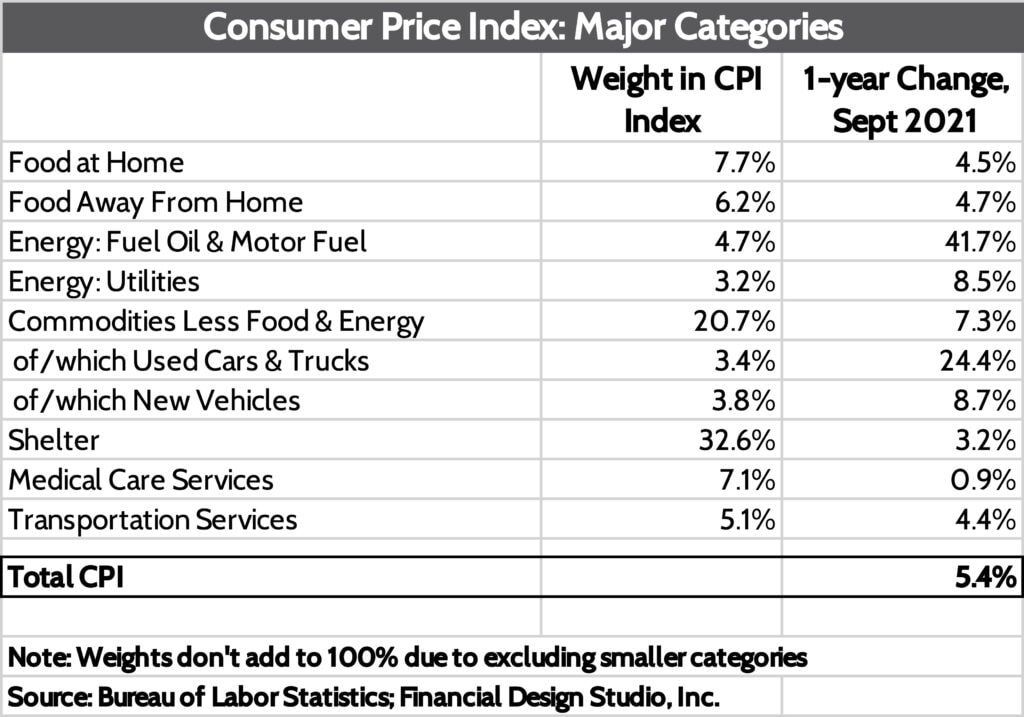

How significant is the cost of housing in official inflation statistics? “Shelter” is the largest component of inflation, making up 32% of the total index calculation. Even if other categories see lower inflation over the next year, the surge in housing costs will offset a good part of those benefits.

Those who believe in “transitory” inflation point to big increases in car prices (used and new) and argue that as those issues are corrected, prices will come down and bring the overall inflation rate down. They’re not wrong. But those are much smaller components of the official numbers. Housing and shelter are the big hogs, and that’s certainly going up.

Issue #3: Energy Costs are Likely to Stay High

Economists like to exclude energy price inflation or deflation from official statistics because it’s volatile. In normal times, that’s appropriate as changes in energy prices don’t mean immediate changes in the prices of products that depend on petroleum.

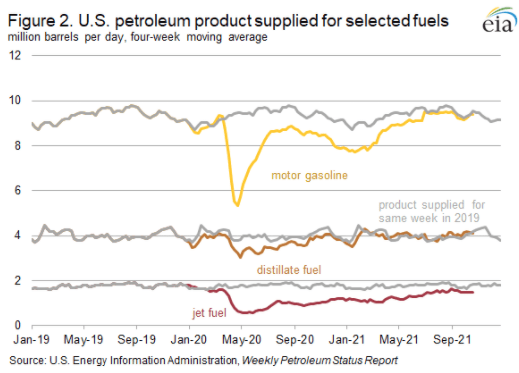

However, we believe energy prices will remain an issue for years to come. First, we note that demand for oil products is almost completely back to normal after falling dramatically during the pandemic.

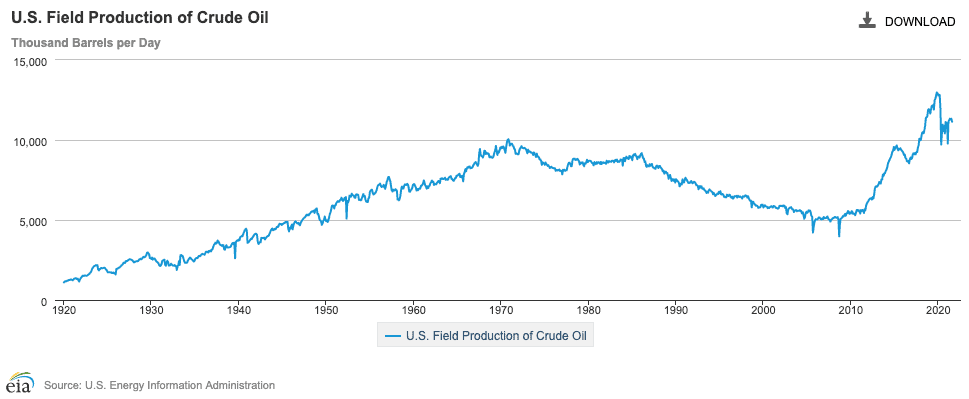

Yet despite the snap-back in demand for oil, supplies of oil haven’t recovered. New shale discoveries and fracking technology drove a big surge in U.S. oil production during the 2010s, which sent prices lower.

Prices collapsed further after the pandemic hit, and in response, producers cut production back dramatically. And yet, even with demand back to normal, production is still 15% lower than what it was pre-pandemic. Econ 101 says that less supply and higher demand = higher prices, which is exactly what we’ve gotten this year.

Won’t producers simply ramp up production again in response to these higher prices, which will tame future increases in energy costs? I don’t think so.

The new kid on the investment block is ESG – Environmental, Social & Governance investing. Climate change is a major component of ESG investing. World governments and business elites are pushing hard on ESG, demanding that we cut production of fossil fuels to forestall future climate change.

Believe what you will about whether or not man-made climate change is real. The point is that there’s a massive effort underway to cut investments into the oil & gas sector. Pumping oil is a capital intensive business, and if capital isn’t constantly spent to maintain production and discover new wells, then production suffers. And it’s really hard to “make up” for underinvestment. Just ask Venezuela.

Now think: demand is back to normal and continuing to grow. Even the most aggressive de-carbonization estimates assume fossil fuel usage will grow through 2050. If demand is growing, but efforts to fight climate change limit fossil fuel investments, then it’s only logical to conclude that future supplies will be constrained. Higher demand + constrained supply = higher prices.

Rising energy prices affect the cost of goods everywhere. Higher fuel prices mean higher transportation costs, which means higher costs for the goods we buy at the store. Fertilizers are energy intensive, so higher energy costs equal higher fertilizer prices, which means food costs will be under upward pressure. The environment is plenty ripe for higher inflation based on higher energy costs.

Issue #4: Modern Monetary Theory & Stimulus Checks to Consumers

The one piece of the inflation thesis we wrote a year ago that might not play out as badly as we thought is Modern Monetary Theory (MMT). You can read more about what MMT is in our September 2020 Newsletter.

Essentially, MMT believes that the Federal Government can spend whatever it wants with no concern towards budget deficits. “Hey, we print the money we use to repay our debts, so why not spend as much as we can!?”

The one fatal flaw of MMT, which even their proponents admit to, is that MMT fails if it generates inflation. Inflation is an ugly tax on the public, so if government spending is too high and causes inflation, it leads to bad outcomes for everyone.

Well, we’re not even a year into this MMT experiment and inflation has become a big problem. But does that mean MMT is tucking tail and going away? I don’t think so.

While President Biden’s Build Back Better agenda is stalled in Congress and getting whittled down, the one piece that keeps broad support is Advance Child Tax Credits. This gives families with children direct check deposits each month. For low-income families, it’s a tremendous boost to monthly cash flow.

Many forget that it was Republican Senator Mitt Romney that first proposed an expansion of the Child Tax Credit back in February 2021. Biden adopted this in the American Rescue Plan Act of 2021. It’s set to expire at the end of 2021, but current bills propose to extend it to 2025.

Our belief is that Biden and Democrats will get some bill passed this year, even if it’s scaled way down from what they wanted. If this monthly tax credit gets extended, you can bet it’ll become a permanent fixture. Low-income households spend close to 100% of their income, so child tax credit paid monthly represents a (likely) permanent step-function higher in consumer spending. Higher consumer spending leads to higher inflation until supplies can catch up.

Will Higher Inflation Lead to Higher Interest Rates?

Circling back to the major question at hand: will higher inflation eventually hurt stock prices? We believe it will. Or it will at least be a major headwind to stock prices in the future.

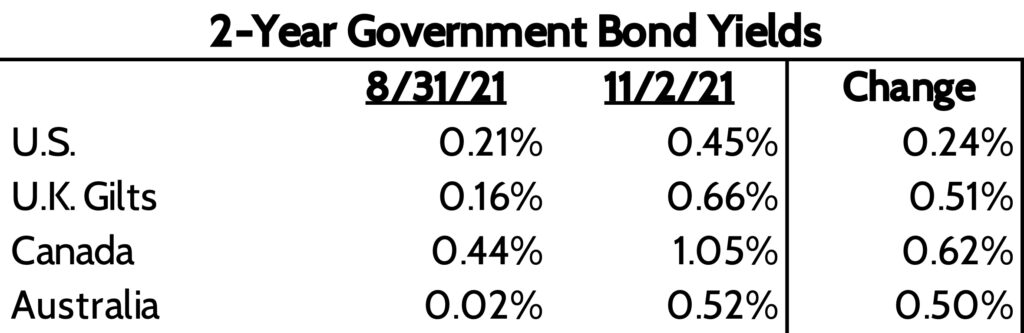

Stocks don’t like higher interest rates. Yet the last couple of weeks have seen significant moves in the 2-year yields of global government bonds.

Inflation is increasingly seen as a global problem. Already, the Bank of Canada announced it had fully stopped easing policy by buying Canadian government bonds. Australia abandoned its control over interest rates, pointing to higher inflation. Just in the last two weeks.

Our view is the market is going to continue to force interest rates higher as inflation proves to be sticky. The Federal Reserve and other central banks are going to have to react to that. But they’re boxed in. If they push rates higher, they’re going to cause a recession and higher unemployment. How’s that going to work in our current political environment, particularly with a big election coming up in 2022?

I just finished reading an interesting book on President Nixon’s abandonment of the gold standard in August 1971. “Three Days at Camp David” by Jeffrey Garten provides an excellent look at the events that led to that decision. My biggest takeaway was that the same problem Nixon faced – a decision between higher inflation or higher unemployment – is the same problem we face today.

Nixon faced reelection in 1972. Higher unemployment was simply not an (political) option for him. He put enormous pressure on Congress to increase spending. Even more pressure was put on the Federal Reserve to keep interest rates low. The parallels between then and now are amazingly similar.

My view is that politicians will continue to push ‘stimulus’ and low interest rates as long as they can. Heck, it took until 1980 for voters to view inflation as a bigger problem for their lives relative to being unemployed! In other words, I don’t think the government will tackle the inflation problem until their political lives depend on it.

The Longer Inflation Stays High, the More Risk to Stock Prices

To summarize our thoughts:

1) Current inflation is the worst we’ve seen in decades;

2) Investors are increasingly convinced that higher inflation will persist;

3) Labor shortages, surging home prices, and higher energy costs are likely to keep inflation higher for longer than many expect;

4) Bond investors are pricing in higher interest rates by the Federal Reserve and other central banks;

5) Stocks – particularly expensive growth stocks – hate higher interest rates.

Our concern is that the seeds are very much in place for a sustained period of higher inflation. The only way to deal with inflation is to create demand destruction. That means consciously pushing the economy into recession, as was done in the early 1980s. The only way the government can do that is to raise short-term interest rates.

You don’t have to be an economist to know that higher interest rates and recessions are bad for stocks. History bears that out clearly. Yet the chances of that happening are going up as we head into 2022.

One final thought about the markets right now: the frenzy we’re seeing in stocks like Tesla and in the crypto world is at such an insane level that it makes the Dot-com bubble of the late 90s blush. Tesla is a fine company and crypto will probably have its place in the world, but the speculative frenzy in those areas is shocking. Tesla’s stock added $400 billion of market value in the span of two weeks on rumors that Hertz would buy 100,000 cars. $4 billion of market value for each car sold? Nuts.

Paul Volcker was Undersecretary of Monetary Affairs at the Treasury Department in Nixon’s administration and eventually head of the Federal Reserve charged with defeating inflation once and for all. He warned:

“Price stability belongs to the social contract. We give governments the right to print money because we trust elected officials not to abuse that right, not to debase that currency by inflating.”

The government has pumped so much money into the financial system that it’s leading to rank speculation in stocks, housing, and other markets. This is a two-party debasement of our currency. Neither Republicans nor Democrats have any moral ground to stand on when it comes to the spending that’s occurred. They’ve broken the social contract.

This sounds dire, but remember that we’ve gone through this rodeo before. The 70s stunk for investors, as did the 10 years after the Dot-com bubble burst. You just want to make sure you’re prepared for what may come, if the worst comes to pass. That’s what we’re here to do for you as your financial advisor.

Ready to take the next step?

Schedule a quick call with our financial advisors.