Mid Year Review of the Investment Landscape

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / June 24, 2021

It’s hard to believe but we’re nearing the half-way point in 2021. Six months ago the economy was completely locked down because of COVID. Now, airplanes are full as people rush out to vacation for the first time since 2019. With all that’s happened, it’s a good time to do a mid-year review of the investment landscape.

Investors Seek Inflation Safety

As we’ve written about in recent months [Will We Finally See Higher Inflation in 2021? and Investing in an Inflationary Environment], inflation is becoming a hot topic in the investment world. Prices for almost everything consumers buy have gone up, from gas at the pump to food to used cars.

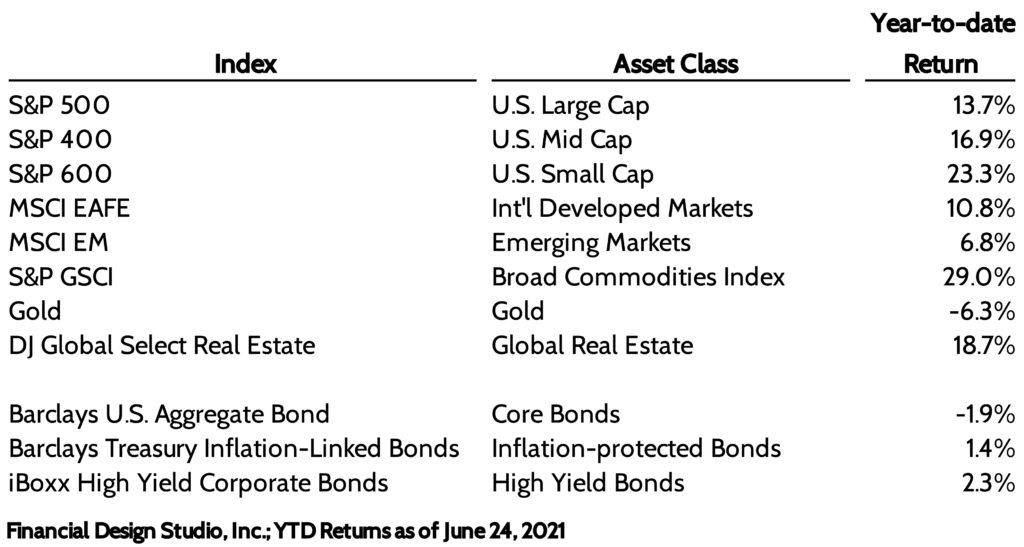

Investors have reacted to these price pressures by moving into inflation-friendly asset classes during 2021. Inflation-protected bonds have done better than bonds without such protection. Real estate stocks have done well. Gold is the inflation laggard so far in 2021, but it’s important to remember that gold was up +18% in 2019 and +25% in 2020.

Small U.S. Stocks Continue to Do Better

Looking at a breakdown of U.S. stocks, we can see a definite performance difference looking at large company stocks (“large caps”) vs. small company stocks (“small caps”). This continues a trend that first emerged after the bottom of the stock market in late March 2020.

We believe small caps have gotten a boost from a couple of factors. First, the various COVID stimulus bills that have passed helped consumers and small/medium-sized businesses a lot.

Smaller companies focus on domestic U.S. markets, so support for the U.S. economy has been good for them.

Another reason small stocks have done well is the surging investment activity of retail investors. We noted back in January that penny stocks, in particular, were seeing a lot of interest from small investors. This dynamic has faded somewhat as we’ve moved through 2021, but remains a factor in small cap outperformance.

The performance diversification between large caps, mid caps, and small caps is a reminder that there’s a lot going on under the big umbrella of “U.S. Stocks.” Investment diversification is critical to make sure you’re not over-exposed to one part of the stock market. It’s a big reason we’re not a fan of “total stock market” index funds, which are heavily tilted towards large cap stocks.

International Lags, But for How Long?

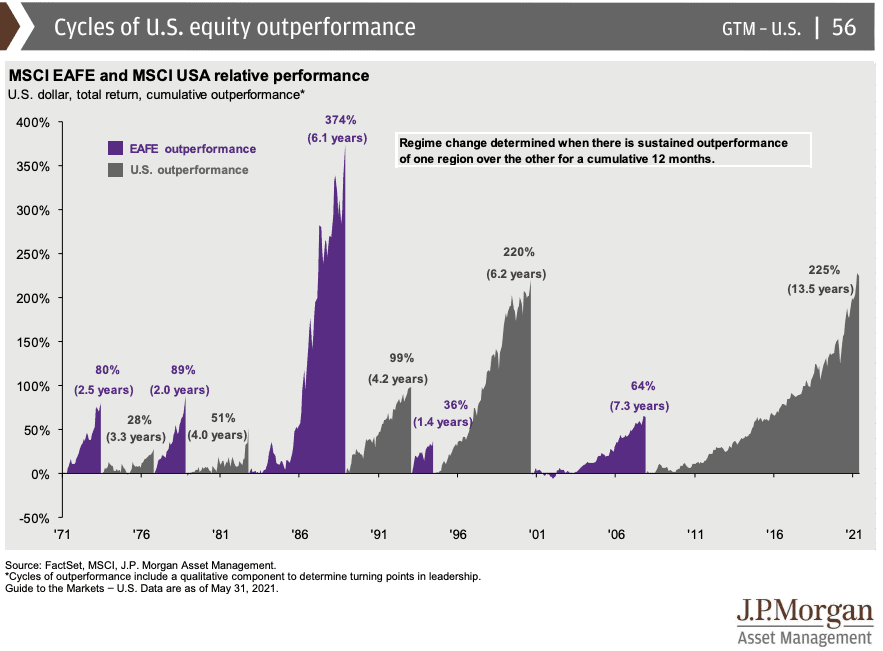

International stocks continue to lag their U.S. peers. This dynamic has been pretty consistent in recent years and reflects long cycles that U.S. vs. international stocks go through. This chart from J.P. Morgan Asset Management shows us how long these cycles are.

The chart above is looking at international stocks in developed markets, such as Europe and Japan. Emerging markets also have their own cycles doing very well or poorly, as we’ve noted in the past.

Most of our clients have investment time horizons measured in decades. It’s why we include allocations to international stocks in client portfolios.

Bonds Down, But Still the Key to a Diversified Portfolio!

There’s an old adage amongst advisors that if your clients have well-diversified portfolios, you’ll always be apologizing for something. Leading this year’s “apology tour” are core bonds. Core bonds are U.S. government bonds, mortgage bonds, and high-quality corporate bonds.

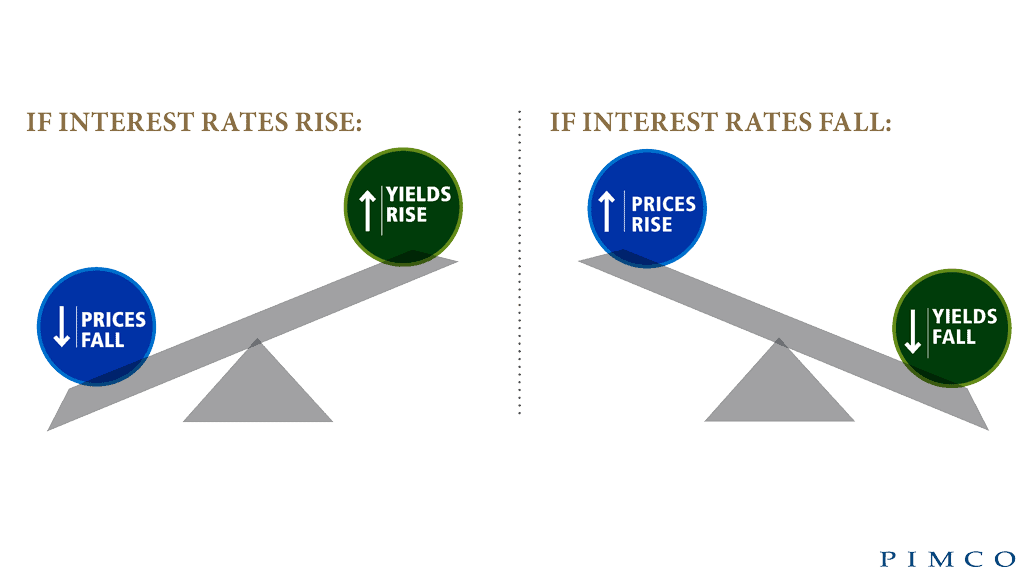

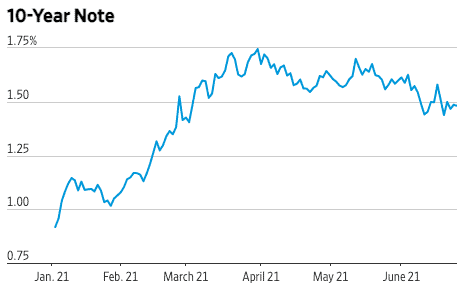

Why have bonds struggled in 2021? The answer is very simple: interest rates have gone up. We shared this chart in a post on managing interest rate risk in your bond investments. It’s very simple but very much to the point!

Interest rates are still very low from a historical standpoint, but have risen in 2021. If inflation proves to be sticky, then future rises in interest rates are likely.

No one likes to see a minus sign in front of their investment returns. But it’s important to realize that – at least for 2021 – it’s a sign that investment diversification is working. When stocks were down over 25% in March 2020, core bonds were actually UP.

Owning non-correlated assets like stocks & bonds together allows us to take advantage of relative moves in these asset classes. Trimming winners and buying losers and then waiting for the trend to reverse itself.

Seeking Inflation Protection

An interesting aspect of what we’re seeing in bonds is that inflation-protected bonds are doing much better than bonds that don’t have that protection. Inflation-protected bonds are actually up +1.4% year-to-date vs. a -1.9% decline in core bonds.

Gold has lagged after having strong years in 2019 and 2020, but Real Estate has picked up nicely as an inflation hedge. The reason real estate likes inflation is because of the leverage (debt) that’s used to buy and hold real estate. If I borrow $100 today to buy real estate and inflation is 3%, I get to pay that $100 back with future (inflated) dollars.

We’re in a period of consolidation for the “inflation trade,” as many investors call it. The Fed admitted last week that inflation might be a problem, but a lot of inflation-friendly assets sold off on the news. On Wall Street they call that, “Buy the rumor, sell the news.” We continue to believe this inflation story is in the very early innings, so keeping some inflation protection is appropriate.

Stay Diversified; Rebalance When Necessary

Well-diversified portfolios help your long-term savings grow with less volatility than if you had all your eggs in one or two baskets. This only works if you have a process to rebalance when your investments stray too far from their targets.

As we head into the summer doldrums, it’s not uncommon for markets to tread water. This will especially be the case this year after last year’s shut-downs and this year’s many summer sporting events, like the Olympics. Traders on Wall Street will be distracted.

But we stand ready to rebalance and make changes if markets start moving. It’s what we do, so you can focus on doing life, including having some summer fun!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.