Is Penny Stock Investing a Sign of a Top?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / January 21, 2021

Stock market manias rarely look the same from one mania to another. But there are always a few telltale signs that froth in the markets is reaching a fevered pitch. One of those signs is investor interest in what’s called “penny stocks.” These are stocks of extremely small companies whose shares often trade (but not always) under $1 a share.

Over the last 12 months interest in penny stocks has surged, and particularly so in recent weeks. Is the rising interest in penny stock investing a sign of a top in the stock market? This post will look at what penny stocks are and some recent dynamics we’ve seen that are raising eyebrows.

Penny Stocks in Companies You’ve Never Heard Of

All investors are familiar with the publicly traded stocks of large companies. Microsoft, Apple, and Google are all names that we know and see every day. In reality, there are thousands of companies that have publicly traded stock.

Some of these companies are tiny. For reference, Apple is valued by investors at over $2 trillion dollars. But some of the smallest publicly traded stocks are worth less than $1 million. If you had $1 million, you could technically buy all the stock in some of these companies and become the owner!

The smallest of the smallest stocks trade on a special exchange called the Over the Counter Bulletin Board, or OTCBB for short.

People refer to stocks on this exchange as “penny stocks” because many of the companies that trade on it have share prices under $1.

It’s important to understand that stocks that trade on the OTCBB are lightly regulated. The government doesn’t hold them to the same stringent listing requirements that big companies have to live up to. In fact, episodes of investor fraud can be quite common with penny stocks.

Signs of Mania in Penny Stocks

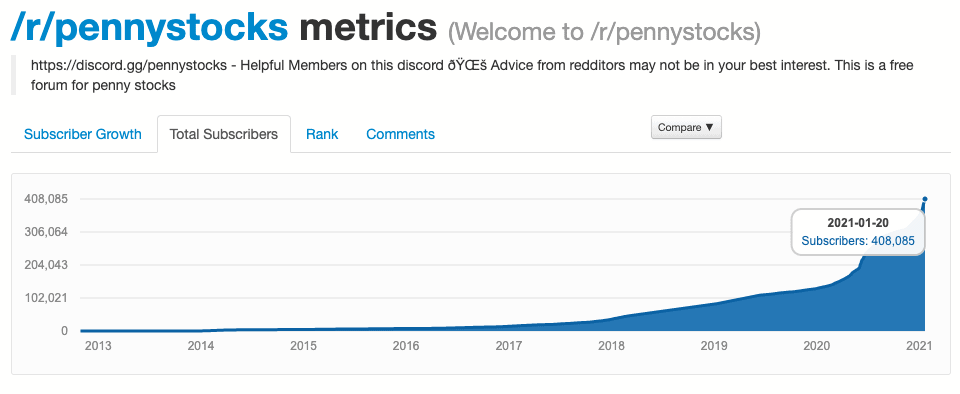

There are a couple of pieces of data that are suggesting an emerging mania in penny stocks. The first one of these is surging investor interest on stocks message boards like the Subreddit r/pennystocks on Reddit. Here, anonymous investors trade stock tips with each other, much like the old days of smoky cocktail parties on Friday night.

As recently as a year ago, there were around 100,000 subscribers on this subreddit. Those numbers have exploded to over 400,000 today, with nearly 100,000 subscribers added in just the last few months.

We can tie the surge to several things. Stocks have been going up like crazy since the depths of the Coronavirus worries last March. People are stuck at home looking for things to do, and many are getting into stock trading as a new hobby. Even bigger is the fact that many of these investors are gambling with their stimulus checks in the stock market.

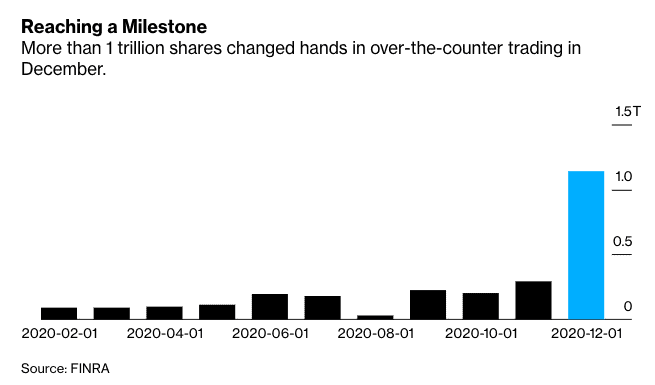

The impact of all these new penny stock investors has recently made headlines because of a surge in trading volumes in these stocks.

“Surge” is probably an understatement. Before the pandemic penny stock volumes were closer to 100 million shares per month. In December, volumes surpassed 1 TRILLION shares traded! No matter how you slice it, investor activity in these unknown, lightly regulated and risky stocks has reached crazy levels in recent weeks.

Should Low-Priced Stocks Perform Best?

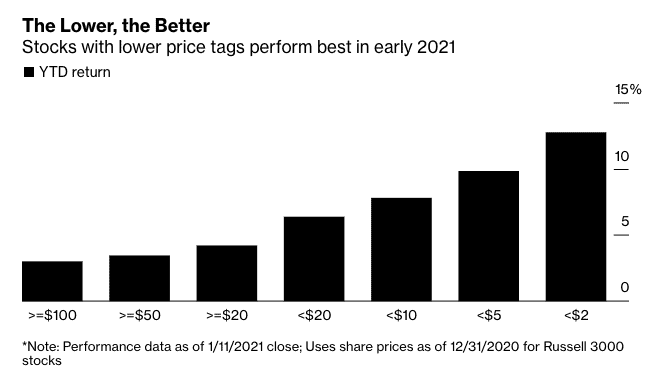

The biggest sign of indiscriminate investing in penny stocks is the performance of companies with low stock prices. Since the start of 2021, the best performing stocks in the market are the ones with the lowest stock prices.

This remarkable chart shows how stocks have performed in 2021 based solely on the price of their stock. Stocks whose shares trade over $100 are up about 3%. As you move right, you can see performance gets progressively better as the share price gets cheaper. Sub-$2 stocks are up over 12% in less than a month.

There’s no rhyme or reason for low-priced stocks to do better than stocks with high share prices. In fact, the opposite should be the case. Good companies will see their share prices rise over time as they become more valuable. While crappy, failing companies will see their share prices fall, often to zero.

What makes this even more illogical is that many brokers are rolling out fractional share trading. Apple, for instance, trades at $130 a share. But you no longer need to buy a full share to own Apple. If you have just $10 to invest, you can still buy stock in Apple by buying a fraction of one share.

My view is that investors gravitate towards stocks with low share prices because they appear easier to make money in. Everyone dreams of finding an Amazon trading at $0.10/share that’s eventually is worth $1,000 a share. An investor buying a stock for $0.10 a share is likely thinking, “All it has to do is go up a dime and I’ve doubled my money!” Psychologically, it’s a lot easier to believe a 10-cent stock going to 20-cents (i.e. a “double”) than a $100 stock going to $200 regardless of whether the $100 stock is a much better company.

Penny Stock Investing in the 1990s Tech Bubble

I know this investor mindset because this is exactly what *I* was thinking when I was investing in penny stocks in late 1999 and 2000. CNBC was littered with fantastic charts of companies like Yahoo and AOL seeing their stocks surge every day, making their investors rich. As those stocks soared, it felt like “that ship had sailed.”

Penny stock companies took notice of what was going on. Regardless of what their core business was, if they added a “.com” to their company name, their stocks ended up soaring. Didn’t matter if they had any online presence at all. They just needed to add the “.com” to get their stocks moving.

After the bubble burst, the vast majority of these hyped-up stocks crashed back to earth. Many were sued for misleading investors into thinking they were a .com when they really weren’t.

In the current cycle, the penny stock companies getting all the attention are claiming to build electric vehicles or some tangent to the clean energy theme, such as fuel cells. This type of “thematic investing” – as I call it – rarely ends well for retail investors.

Be Wary of Investing in Penny Stocks

In our July 2020 newsletter we talked about some early signs of a bubble in the stock market. Things have moved higher since then, pointing out how difficult it is to time a top or bottom in the market.

The mania we’re currently seeing in penny stocks feels a lot like the late stages of the Tech Bubble 20 years ago. It’s almost like a last, desperate act for new investors to beat the house at a casino. I was there and I know how it feels and what the mindset is. Today feels very similar to that time period. I also know the consequences when the parade eventually ends.

It’s possible that another round of $1,400 stimulus checks – as seems likely – pours even more gas onto the penny stock investing fire. But we can’t lose sight of the fact that the vast majority of these companies have been bad companies for a long time. A zebra can’t change its stripes overnight. When it comes to investing, boring is in fact beautiful!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.