How Investment Diversification Can Benefit You

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / March 25, 2021

The last 12 months have witnessed one of the strongest rises in stock market history. Despite a first wave and then a second wave of COVID-19, stocks have powered through all the noise and are very close to all-time highs. We can learn two big lessons from this. First, it’s important not to panic when markets go down. Second, we’ve seen that having a diversified investment portfolio works, especially when you have a process in place to trim winners and buy laggards. Let’s look at a real life example of how investment diversification can benefit you.

Stocks Stage One of the Biggest Comebacks on Record

At the open of trading on March 23, 2020, the S&P 500 dropped 5%. Stocks recovered a bit the rest of the day, but still closed down a whopping -3%. This marked the bottom of the stock market drop that started February 20 of that year, bringing the cumulative loss in the S&P 500 to -34%!

At that point, the Federal Reserve had seen enough and launched a series of programs to protect financial stability. This immediately calmed markets as stocks jumped +9.4% on March 24 (yes, that’s nine point four percent in one day!). Stocks haven’t looked back since.

According to data compiled by Deutsche Bank, the last 12 months have seen the biggest increase in the S&P 500 since the mid-1930s. That was coming out of the depths of the Great Depression.

What’s remarkable to me in this chart is that the 1930s comeback came after stocks had suffered horrible losses, declining almost 75%. The 2008-2009 comeback happened after stocks fell -48%. The current comeback has happened against a much more modest drop in stocks compared to those periods.

Performance Laggards Turn Into Leaders

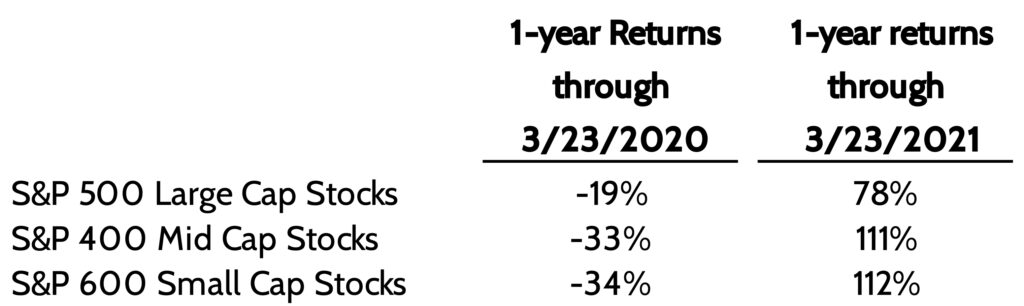

Heading into the Coronavirus pandemic in early 2020, small cap and mid-cap stocks were trailing their large cap peers by a wide margin. As we wrote at the time , the market was increasingly being driven by a smaller and smaller number of very large tech stocks.

Many investors were asking whether it was wise to be diversified. Large cap stocks had dominated for years. It didn’t look like there was anything on the horizon to change that narrative. Then COVID-19 happened.

Given how badly small and mid-cap stocks did through the pandemic, it’s not a surprise to see that they’ve rebounded. But the scale of the rebound has surprised us, as these same small and mid-cap stocks have outperformed large cap stocks by a whopping 33% in the last 12 months.

One reason we think small and mid-cap stocks rebounded so strongly was because of the scale of stimulus passed by Congress and signed by the White House. Three separate stimulus bills sent large amounts of money to consumers via checks and unemployment benefits, while small businesses were given “free” money through the Paycheck Protection Program.

The takeaway here is that the performance laggards of today often turn into the performance leaders of the future.

A quick word of caution. Don’t look at these performance figures and expect the party to continue. According to Credit Suisse and the London School of Economics, annual returns in U.S. Stocks since the year 1900 have averaged about +10%. But that average includes terrible markets (Great Depression, Tech Bubble, 2008-2009, March 2020) and very good ones. Investing in stocks is NEVER a smooth ride.

Is Your Investment Portfolio Too Simple?

One thing we always preach here at Financial Design Studio is, “Keep it simple.” Don’t get your finances tied up in esoteric assets that are hard to get out of. Wall Street will always try to convince you you’re “missing out” by not investing in their latest illiquid investment opportunity, promising juicy returns. But those products almost always fail at the worst possible moments.

With investing, we follow the same mantra by investing client funds in highly liquid, easy-to-understand investments. Yet there’s keeping things simple, and there’s keeping things too simple.

Diversification Example

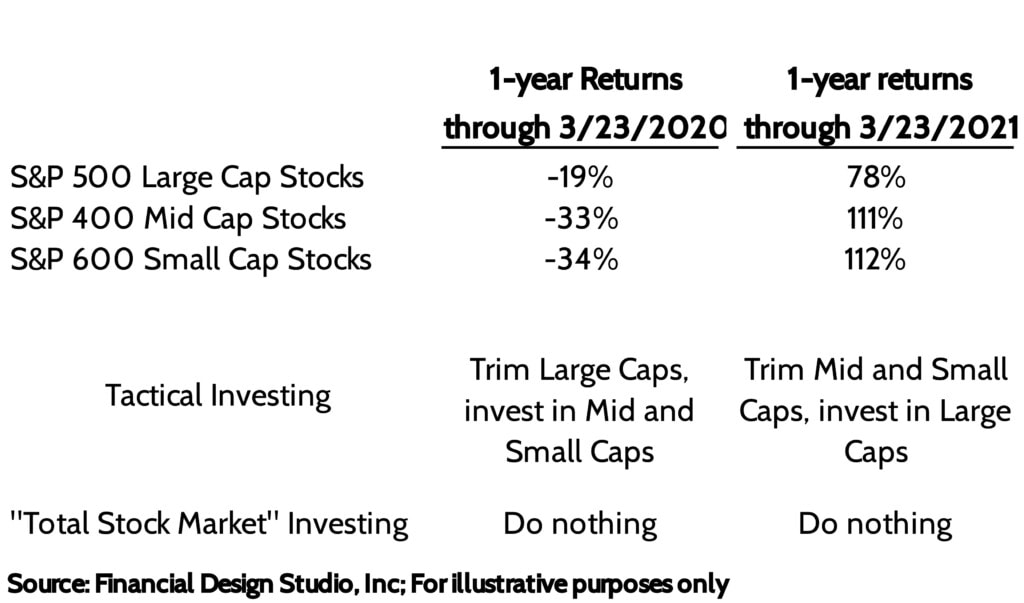

Let take the example of U.S. Stocks. You can invest in a fund that bills itself as a “Total Stock Market” fund. That means they own large cap, mid-cap, and small cap stocks all in one fund. Essentially, you can get exposure to the entire U.S. stock market by buying just one fund.

There’s nothing wrong with that approach. The issue is that by investing in that one very simple fund, you lose the ability to tactically rebalance your investments in U.S. stocks.

As we just saw with the divergence between large/mid/small-cap stocks over the last two years (above table), certain segments of U.S. stocks can perform very differently. A passive ‘total stock market’ fund will not decide that small stocks have been too strong and need to be trimmed and put into large cap stocks, or vice versa. They simply invest in all U.S. stocks and let it ride.

If you have more granularity in your investment portfolio (another word for “diversification”) then you can be tactical with your investments as they perform differently. When small caps are weak and large cap stocks are strong, you rotate some money from large caps to small caps. Then when things go the other way, you rotate from small/mid caps back to large caps.

This example looks at what “tactical” investing in U.S. stocks might look like. We can extrapolate this example to international stocks as well: Developed markets vs. emerging markets. Or to bonds, where you can invest in government bonds, high-quality corporate bonds, or riskier high yield bonds. There are dozens of “granular” asset classes underneath the big headings of Stocks and Bonds.

Making a Diversified Portfolio Work

With thousands of stocks, mutual funds, and exchange traded funds out there, it can feel overwhelming trying to figure out where to invest and how to best diversify your portfolio. That’s why clients hire us. We evaluate all parts of the stock and bonds markets all the time and create what we believe are well-diversified investment portfolios.

We then layer on top a process that allows us to react quickly to changing market conditions. This allows us to rebalance portfolios when a client’s stocks/bonds allocation gets too out of whack versus their target investment allocation. But we can even be “tactical” and rebalance within certain parts of the market, such as U.S. large/mid/small-cap stocks.

It’s Springtime in Chicago and my wife and I are currently sending out checks for our annual landscape work. I don’t have the time, skill, nor the patience to keep our yard looking nice like they can. It’s not inexpensive, but for us it’s worth the cost in terms of time and aggravation I’d save having to take care of our lawn myself.

We can say the same about your long-term investments. It costs something to hire an advisor like us to manage your investments. But the goal is the same as why we pay a landscaper: to get a better outcome for less time, effort, and aggravation on my part. Is it time to move “investments” off your mile-long list of things to do and hire someone to do that for you?

Ready to take the next step?

Schedule a quick call with our financial advisors.