Hawkish Turn by the Federal Reserve

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / December 2, 2021

The normally quiet Thanksgiving trading period has been anything but this year. Stocks got whacked in a holiday-shortened trading session Friday as word of a new COVID variant hit the wires. We got a respite on Monday, only to be hit Tuesday with hawkish comments from Federal Reserve Chairman Jerome Powell. In his words, it’s time to retire the word “transitory” when describing inflation. What does this hawkish turn by the Federal Reserve mean for investors?

Inflation Moves from Transitory to Sustained

In previous missives we’ve talked about the big market debate about inflation. Will it be a temporary blip (“transitory”) in price increases or turn into sustained increases in prices? The monetary policy implications of this debate were big. If inflation proved transitory, that meant that the Fed could keep rates at 0%, sustaining speculation in everything from stocks to housing. If inflation proved sticky, then that would mean it would force the Fed to tighten policy sooner than investors expected.

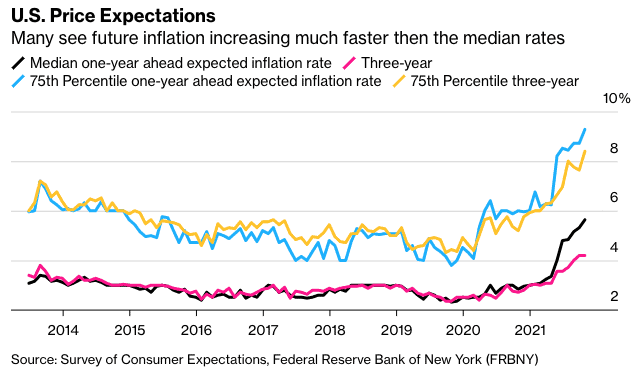

When does an inflation problem move from transitory to sustained? When consumer and business expectations for higher prices increase. And this is exactly what’s happening, as seen in the chart above. For the first time in a very long time, people are expecting price increases to accelerate. And that can quickly turn into a self-fulfilling prophecy as people pull-forward buying decisions trying to “lock in” lower prices today.

Inflation Becomes a Political Problem

The Fed resisted recognizing this dynamic as long as they could, but as happened in the 1970s, inflation moved from a monetary problem to a political problem. Just ask President Biden, who’s seen his job approval plunge in the last 6 months as inflation surged to multi-decade highs.

Coincident with this was the curious holdup of Fed Chairman Powell’s reappointment to a new 4-year term. Usually these reappointments are done quickly, but Powell wasn’t officially reappointed until just before Thanksgiving, and it was after weeks of speculation that he’d be booted.

It’s very important to keep politics in mind when talking about the Federal Reserve. Officially, the Fed is “independent” from the three main branches of government. Independence is important because history is littered with failed monetary systems that were run by politicians, often resulting in uncontrolled inflation.

Despite the Fed’s independence, we can’t be fooled to believe that it works out that way in real life DC politics. President Nixon famously leaned on then-Chairman Arthur Burns NOT to raise rates ahead of the 1972 election because he (rightly) feared that the resulting job losses would hurt his reelection. And in the last decade, central banks across the globe have had to carry the load to stimulate the economy because of dysfunctional parliaments and Congresses.

Powell’s U-Turn on Inflation This Week

With this as a backdrop we had Powell testifying before Congress this week, where he drops the bombshell that “transitory” inflation is dead. Translation: “inflation is going to be around longer than we (the Fed) expected.” Given his reappointment last week and President Biden’s plunging approval, one has to wonder whether Powell was told to “get tough” on inflation in order to keep his job.

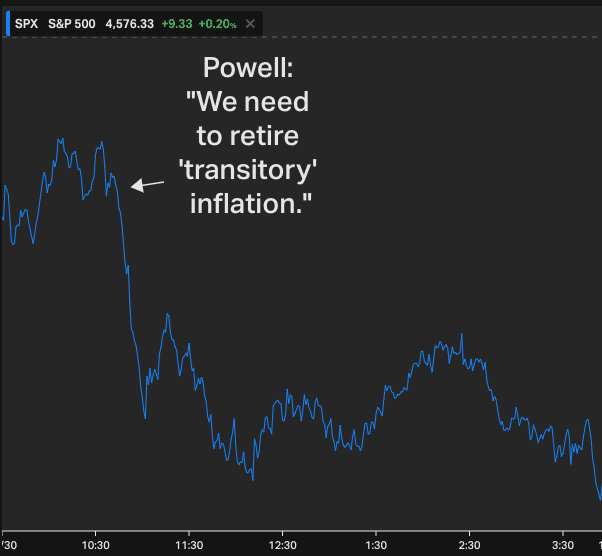

Either way, the stock market has merrily danced its way to one record high after another despite these rising inflation concerns. These gains have confounded many investors, including yours truly. But Powell’s testimony on November 30 seemed to wake many investors up.

Powell provided two new pieces of information for the market to digest.

First, he announced that a faster “tapering” of bond purchases is in the cards. Mind you, the Fed announced this tightening less than a month ago, and now he’s saying they may do it faster than what they thought a few short weeks ago.

Second, he implied that interest rate hikes are coming into view. As seen above, stocks didn’t enjoy getting that message!

Why Don’t Stocks Like Higher Interest Rates

A question we often get from clients and investors is, “Why are stocks so sensitive to what the Fed is doing?” The issue boils down to whether money is “loose” or it’s “tight.” If you’ve ever been to Vegas, you’ll understand the analogy I’m going to use.

When the Fed is pumping money into the economy, there are more dollars sloshing around. Idle dollars get bored and go look for something to do. So they end up in houses, stocks, and crypto. It’s like walking up to a blackjack table with a garbage bag full of chips. It’s really easy to “play” the most marginal of hands because, hey, you got plenty of chips to spare. “Maybe I’ll get lucky and make some money on this.”

When Fed policy is “tight,” those dollars become scarce and people become a lot more discerning where those dollars go. Put another way, if you’re down to your last 20 chips at the Vegas blackjack table, you’re going to be a lot more careful with how much you play on the next hand.

The stock market is no different. The chart below looks at the large cap S&P 500 Index and Federal Reserve Policy rates going back to 1998. Each time the Fed has tightened, stocks eventually revolted. It happened in 2000-2003 and again in 2007-2009. And more recently, in late 2018.

What Should Investors Do About a Hawkish Federal Reserve?

Thanksgiving week is always one of my favorite times of year because I get to visit with friends and family that I normally don’t see regularly. As a financial advisor, I’ve always found it informative to hear what Joe and Jane Sixpack have on their minds as it relates to finances and investing.

This Thanksgiving was remarkable. Conversations moved from talk around crypto assets to call options to potentially buying rental properties half-way across the country. This isn’t just speculation – this is rank speculation in the most speculative assets available. There’s A LOT of money sloshing around and everyone is looking to do something with it.

The most important piece of advice we can give as financial advisors in speculative environments like this is to not let this speculation get to your head. The concerning thing to me is that it’s no longer enough to make money in stocks. People want to make MORE money in stocks so they’re doing it by buying options instead. It’s classic gamblers’ behavior of doubling your bet with each win.

But we all know how the story ends: the house eventually wins all their chips back and more. That doesn’t mean you should cash in all your chips ahead of a potential stock market correction. A correction may or may not happen. Most likely, it will happen so quickly that your exit and entry points won’t make you any money.

So our advice as the Federal Reserve turns hawkish is simple: Sit tight. Manage your chips well (or better yet, let us do that for you!). And when Greed eventually turns to Fear and everyone else starts losing their heads, be ready to get greedy.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.