Is Inflation Transitory or Not?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / July 22, 2021

The biggest investment debate of 2021 is about the future of inflation. One side of the debate believes we’re entering a new period of sustained, higher inflation after 40 years of low and declining inflation. The other side of the debate believes that the high inflation readings we’ve seen in 2021 will prove fleeting, and that we’re destined to return to the low-growth, low-inflation environment we were in pre-pandemic. This isn’t a trivial debate, as the investment implications of either outcome are diametrically opposed. The question to ask is, “Is Inflation Transitory or Not?”

How High Was June 2021 Inflation Compared to History?

June 2021 inflation readings were reported last week. Consensus expected inflation to remain high due to “base effects” as the economy lapped a drop in prices a year ago, because of COVID-19. But the actual inflation numbers were well-ahead of expectations.

Many observers like to look at the Consumer Price Index excluding food and energy costs, which can be volatile. Looking at this index, we find that the June 2021 reading was the highest since November 1991.

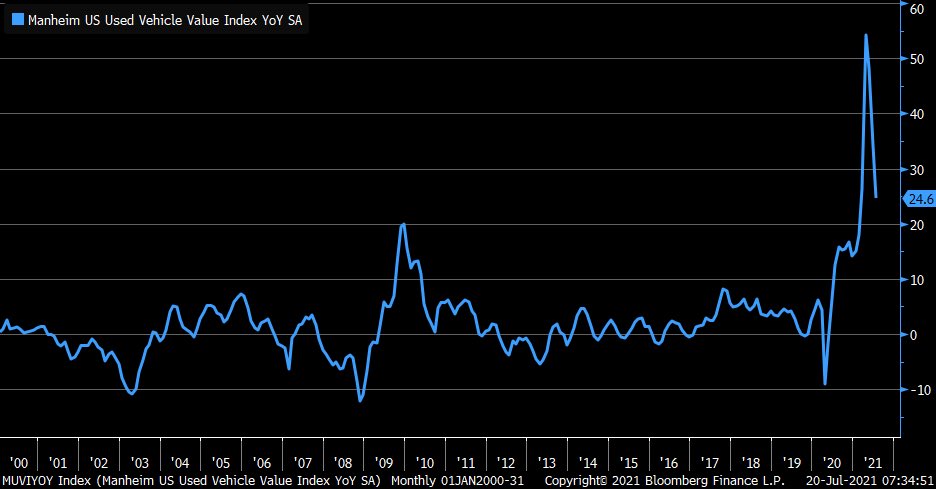

What drove inflation in June? There were many culprits, but one of the biggest ones was the continued jump in used car prices. These prices have been pushed higher because of a shortage of new car inventory, which is being affected by the global computer chip shortage.

Regardless of what drove inflation in June 2021, it’s clear that the inflation trend is broad. The chart below by commentator John Authers from Bloomberg shows that “core” inflation was the highest in decades, even excluding food, energy, AND used car prices.

I like to call this inflation index, “Consumer Price Index, excluding all the bad stuff.” Okay, it’s the highest in 30 years, but is inflation going to be transitory or not?

Arguments in Favor of Transitory Inflation

There are some good arguments that the current lift in inflation will work itself out. First, we noted the “base effects” of current (higher) inflation numbers lapping unusually low readings a year ago during the COVID panic. We included a chart in a February post arguing these base effects would peak in May. In fact, they continued to rise in June. But in the future, this base effect will diminish, putting downward pressure on inflation readings.

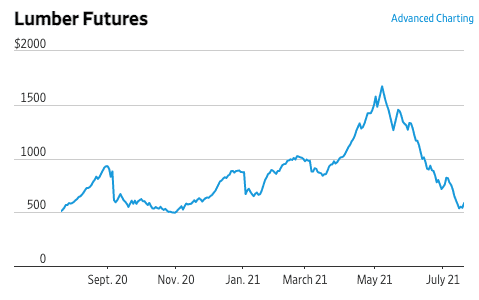

Second, we’re seeing signs that supply issues are working themselves out. When supply is tight, people and businesses bid up prices in order to secure the good. This was most clear in lumber for homebuilding, where prices surged early in 2021.

Lumber prices tripled from November 2020 into early May 2021. Since then, however, prices have crashed -65% as supply/demand dynamics corrected themselves. There’s an old saying, “The cure for high prices is high prices.” And that’s clearly the case with lumber as homebuilders balked at early 2021 prices.

We’re also seeing used car prices return to normal. The global chip shortage continues, but car manufactures are receiving new chips and shipping new vehicles.

Used car prices were up over 50% y/y as recently as April. But that pace is slowing.

What lumber and used car prices show is that there are pieces of the inflation story that are truly transitory. In fact, a year from now we might talk about the “base effect” going the other way. Meaning, inflation a year from now might be held back as used car prices lap the unusually high levels of 2021.

Arguments in Favor of Sticky Inflation

We’ve been in the camp that inflation is going to prove sticky and dominate the investment landscape in coming years. Our view is unchanged. There are a couple of reasons for this.

First, is the impact of much higher home prices. Home prices are not a direct input in the government’s inflation readings. Instead, the government uses a concept of “owners equivalent rent” to measure changes in how much it costs to own a home. There’s some controversy about how this is calculated, but we’ve noticed that home prices lead moves in this component of inflation by about 18 months.

The recent surge in home prices is going to lead to a rise in the Consumer Price Index’s Owners Equivalent Rent (OER) reading. If history is any guide, this will put upward pressure on inflation a year from now, at the time that “transitory” components fade. But remember, OER is a much bigger component of inflation than used car prices!

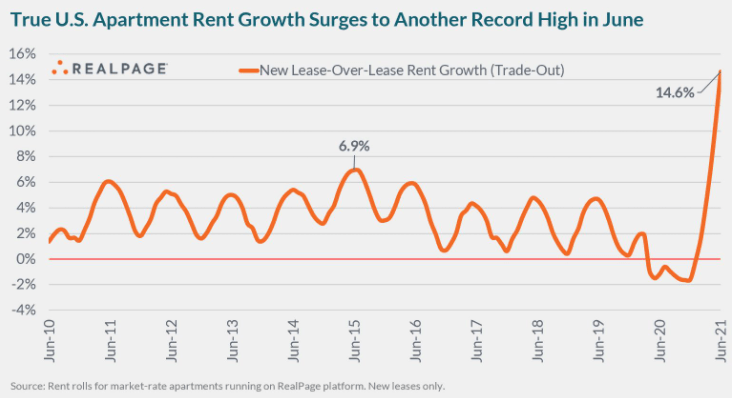

What about rents? Well, anyone that’s recently rented a home or apartment has likely experienced sticker shock. Last year, COVID held rents back. But now, they’re surging.

Here’s a real life example of apartment rents going up. Our daughter and son-in-law recently purchased their first home. The landlord of the apartment they were renting advertised – and got a new renter – at a monthly lease cost 20% higher than they were paying!

Finally, we remain convinced that what’s new with the future (higher) inflation dynamic is politics. Americans once sneered at the idea of the government sending checks directly to people. But COVID stimulus checks and Advance Child Tax Credits paid monthly change that.

Consumers outside the top 10% of income spend most of their income. So if their “income” is going up, so is their spending. And if their spending is going up, so will prices. These support payments are also causing acute labor shortages that we firmly believe will continue.

Is Inflation Transitory or Not?

The answer to this week’s topic is “Yes.” Yes, there are aspects of current inflation readings that will prove transitory and roll off over the next 12 months. But Yes, there are major pockets of higher inflation that have yet to feed through official inflation statistics.

The actual issue here is not which side “wins” the debate. It’s the fact we even have a debate. If inflation stays low, like it was pre-COVID, then that suggests one kind of investment environment. If inflation keeps rising and proves sticky, then that suggests a very different type of investment environment.

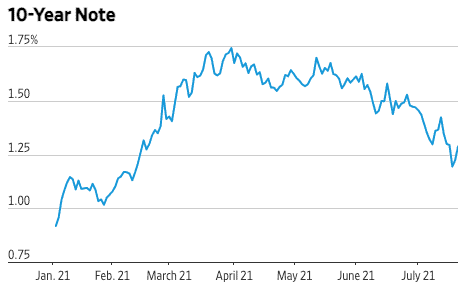

Big debates like this lead to volatility, which is exactly what we’ve seen in bond markets during 2021. Early on, it looked like inflation would take off, and interest rates rose sharply as a result. More recently, the “transitory” side starting claiming some wins, and interest rates have dropped.

It’s important to emphasize that we at FDS don’t take directional views of stock and bond markets. We have our views and opinions, yes, but we’re cognizant that no one can time every single move the market will make.

That’s why we invest much time and energy in creating well-diversified portfolios for clients, and then rebalancing them regularly. Our goal is to take advantage of periodic volatility as these debates swing from one side to the other. Trimming asset classes benefitting from one side’s debate “wins” while adding to classes that are “losing” the debate.

The structure of your portfolio and the process in place to keep your investments in-line with your goals makes FDS investment management unique. Would you like to learn more about how we manage your hard-earned savings?

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.