2021 Investment Returns Review

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / December 9, 2021

We always like to take the last newsletter of the year to look back and see which asset classes performed and which ones did not. In reality, we do this all throughout the year, as it’s part of our process to rebalance client portfolios. But this review is always helpful as it reminds us and our clients that there’s a lot going on under the big tent of “Stocks” and “Bonds.” With that, let’s do a review of investment returns for 2021.

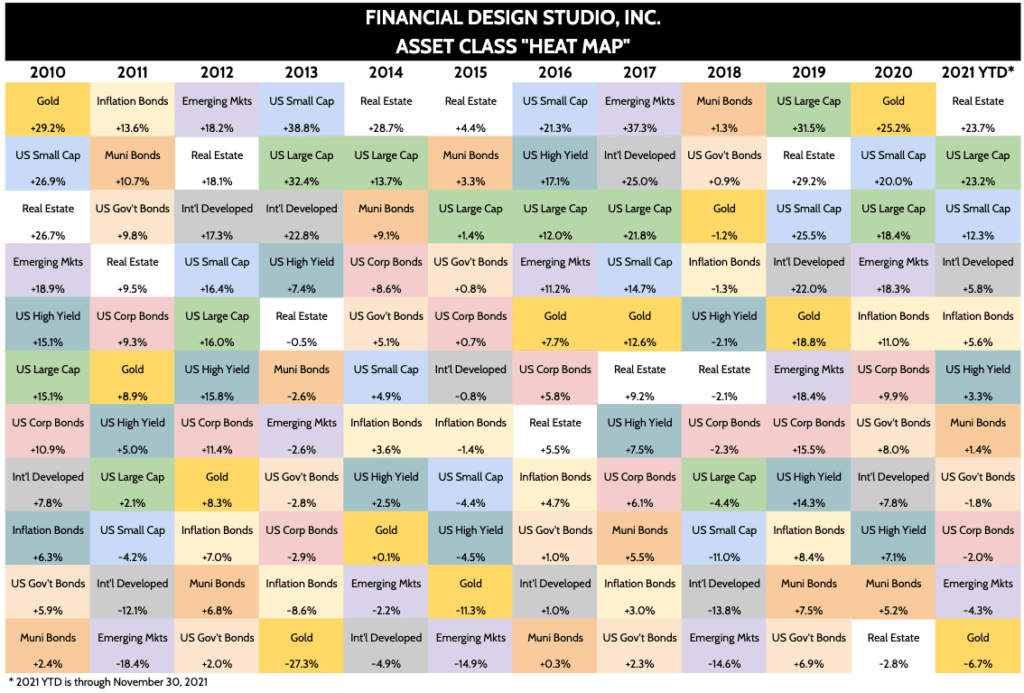

FDS Asset Class “Heat Map”

The busy chart you see below tracks 11 of the key asset classes we follow. There are five stock indexes, five bond indexes, and Gold. We invest almost all FDS client portfolios in these asset classes. Why invest in different asset classes? Because each year, there are winners and there are losers. Having a well-diversified portfolio helps reduce overall portfolio volatility.

I’ll run through some key asset class performance highlights in a moment. But let’s take a moment to consider the goal of investing your long-term savings. Why are you socking away money each month in a 401(k)?

As many of our clients already know, at some point in your life, you’re going to stop working. We call this ‘retirement.’ At that point, you’ll no longer have paychecks being deposited into your account every two weeks. But you’ll still have to pay the mortgage, buy food, maintain your cars, and (*gasp*) get out and enjoy life by going on vacations!

Your long-term savings is what you’ll use to pay for these things. And as our retired clients can attest, it’s a very different set of emotions when you’re using your savings versus “saving for the future.” There’s always a fear of running out of cash.

It’s for this reason that we invest in a well-diversified portfolio. Each year, some asset classes do well, others do not. We don’t want to put all your “eggs in one basket” because it’s impossible to predict which basket will do best from year to year. Diversification can hurt your returns in concentrated markets like we’ve had the last few years. But when we go through tough markets like we did in 2000-2003 and 2007-2010, being well diversified was extremely important, especially if you retired during those periods.

US Large Cap Growth Stocks Continue to Perform

It’s almost like a broken record at this point – US Large Cap stocks once again were one of the best asset classes of 2021. The only time this asset class wasn’t in the Top 3 over the last nine years was 2018.

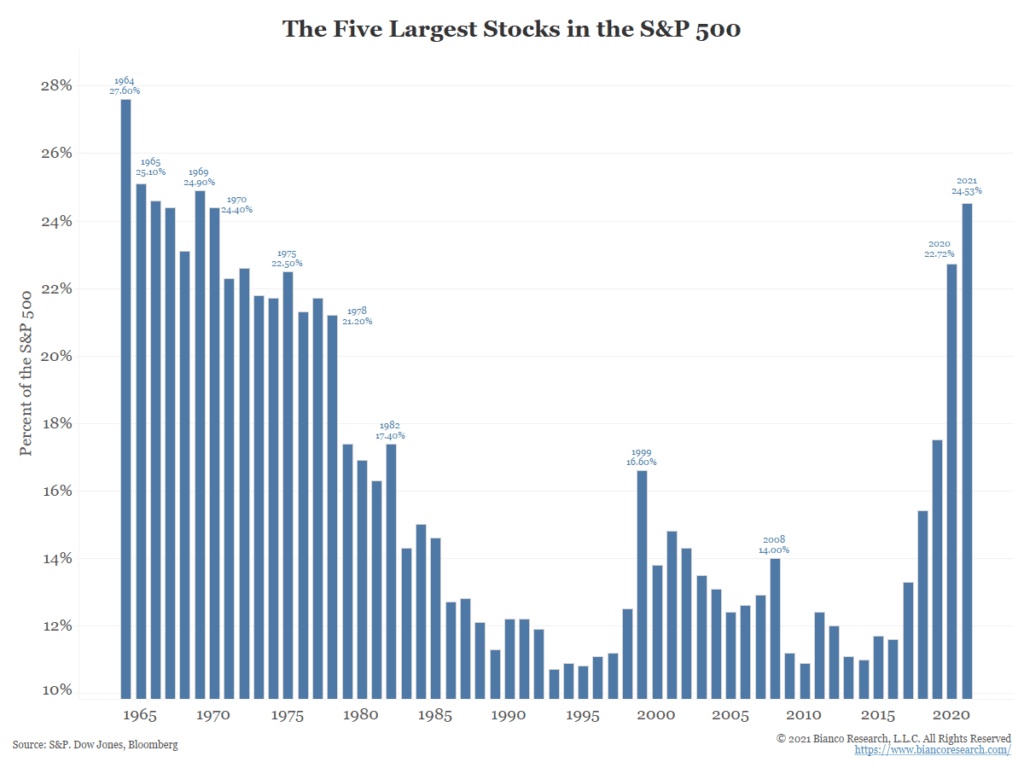

We’ve written many times about how concentrated the stock market has become. This dynamic continues to get worse, with fewer and fewer stocks powering the market to all-time highs. The chart below from Bianco Research highlights how concentrated the large-cap S&P 500 index has become. Five stocks account for 25% of the value of the overall index, a level not seen since 1970.

Here’s another way to put this into context. The S&P 500 is up +23% through the end of November. If you took out just seven stocks – Microsoft, Apple, Google, Facebook, Tesla, Amazon and NVIDIA – the index would be up half that amount.

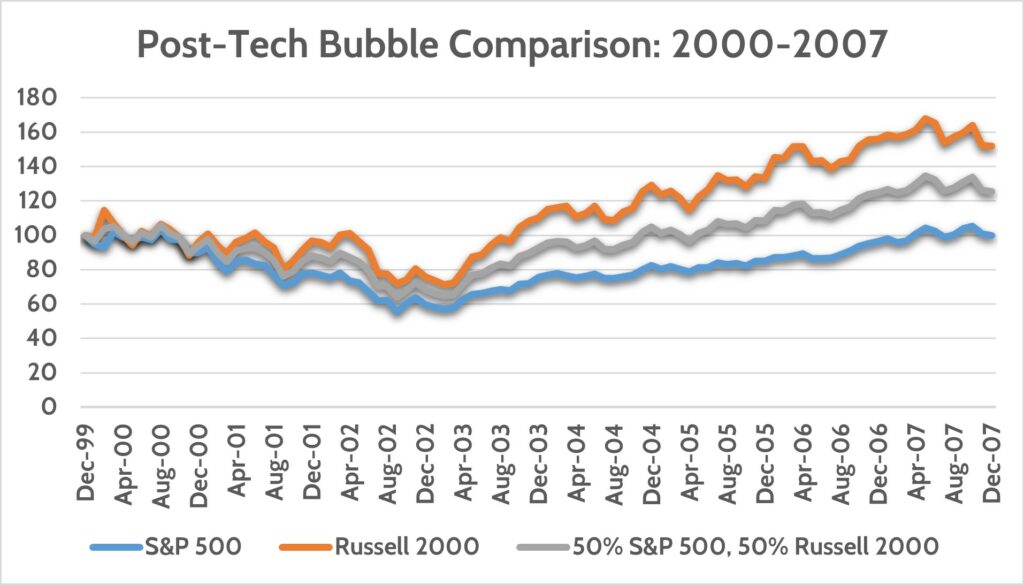

Is it time to throw in the towel and put all of our Stocks “eggs” in the large cap basket? That’s the temptation that most investors and professional money managers are facing, with many following that path. But we’re reminded of what happened the last time the market went through this sort of cycle in the late 90s.

An investor who put all their eggs in the S&P 500 basket at the end of 1999 made no money for the next 7 years before the Great Financial Crisis hit in 2008. A diversified investor who also owned small cap stocks (Russell 2000) performed much better. This is my constant reminder that while it’s tempting to say “large caps win forever,” history tells us that’s not the case.

Gold & Real Estate Flip-flop Best and Worst Performance

The performance of Gold and real estate stocks the last two years is a great example of how feast-or-famine investing can be. In 2020, as the world grappled with COVID-19, Gold was the clear standout performer. Real estate stocks, by contrast, fell in 2020 because of concerns about whether office workers would ever go back to the office again.

Turn the page to 2021 and the script has been flipped. Gold has lagged as fears around COVID-19 faded. As that happened, investors snapped up real estate stocks, causing that asset class to be the best performer this year!

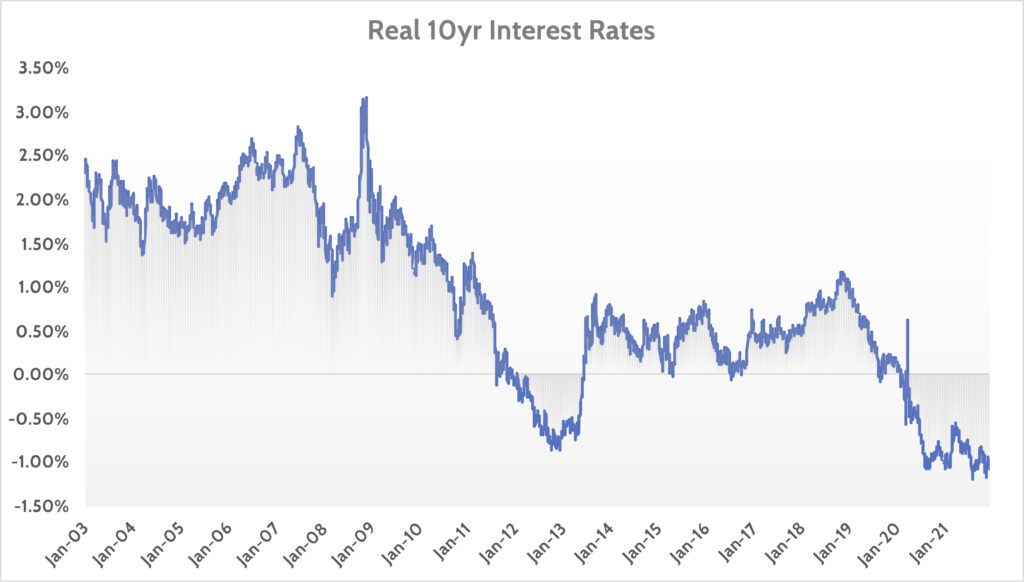

Gold’s performance is about as unpredictable as any asset class can be. I would’ve thought it would do better in 2021 as the inflation story took off. But it hasn’t. Does that mean it won’t eventually respond to higher inflation? I think it will. The fact remains that “cash” investors are losing money, and are expected to keep losing money for the next 10 years.

The knock on Gold is that it doesn’t earn interest and that it costs money to store it. But investors in 10 year U.S. government bonds will LOSE -1.0% per year for the next 10 years, after inflation. This was a dynamic investors faced throughout the 1970s. And it was a good time to be in Gold. Maybe 2022 will be the year?

Historically Tough Year for Bonds in 2021

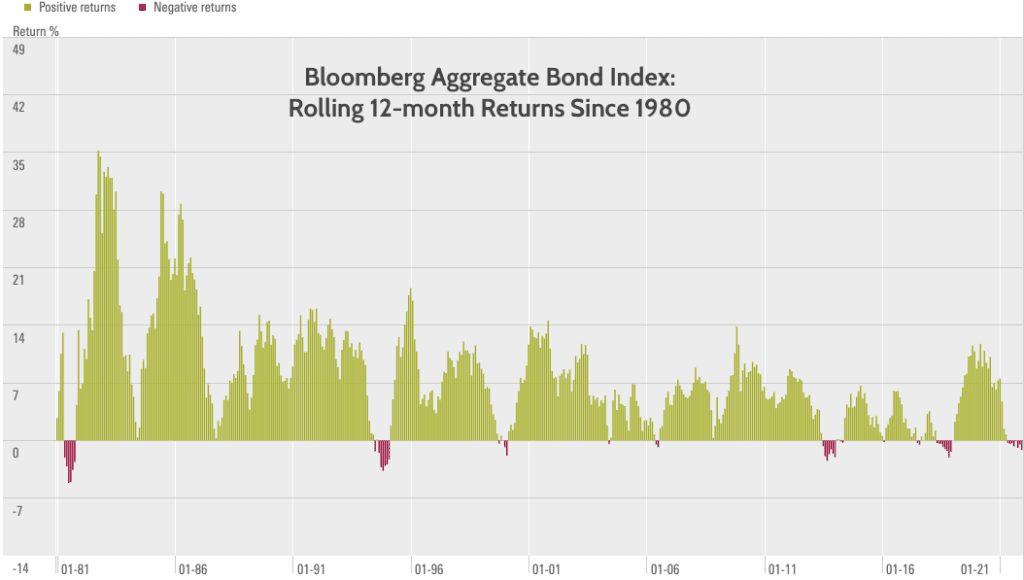

Since the late 1970s, bonds have been one of the most consistent asset classes. If you’re old enough, you might remember when mortgage rates were over 15% and you could get over 10% interest on your bank deposits. Yes, that actually happened.

But after Fed Chairman Paul Volcker committed to defeating the scourge of inflation once and for all, bond yields have consistently gone lower over the last 40 years. Lower bond yields mean higher bond prices, which have benefitted investors a lot!

Other than a short period in 1994, 2013 and again in 2018, investors have consistently made money in bonds. 2021 will be one of those rare “down” years for bond investors.

We made some moves in client portfolios to protect against this trend by shortening the “duration” of their bonds [see linked article above]. Just like stocks, we aim to put clients in a well-diversified portfolio of bonds, which has helped in 2021.

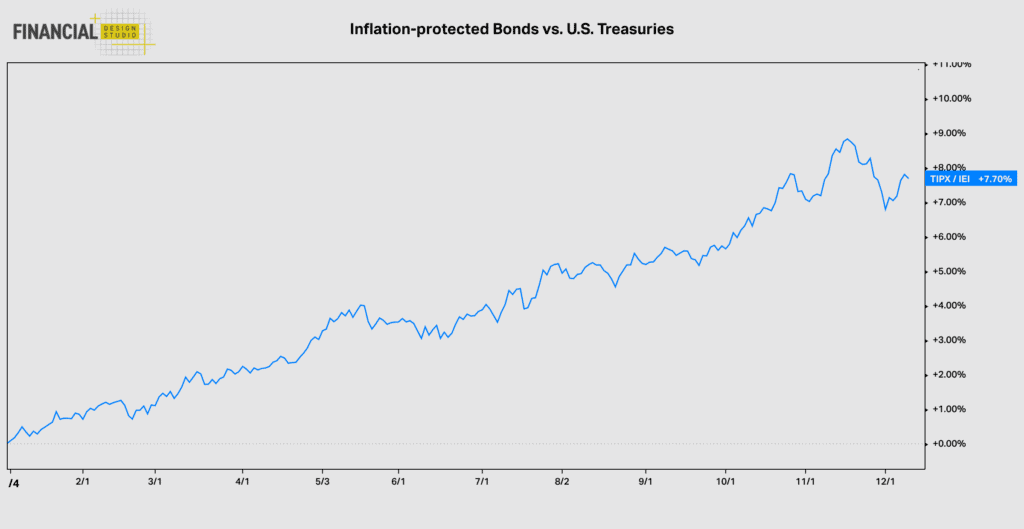

One of those better areas has been Inflation-protected Bonds. Of the five major categories of bonds that we track in the Heat Map, inflation-protected bonds performed the best in 2020 and again in 2021.

We’ve written a lot about inflation over the last 12+ months. In short, we believe that we’re entering a new investment regime where inflation will be higher and prove stickier than anything we’ve seen in 4 decades. This means the easy money days for bond investors are likely over.

Does that make bonds a poor investment going forward? No. You just have to be careful with how you invest. Investing in shorter-maturity bonds not only protects against higher interest rates (lower prices) but means the interest you make on your bonds will increase more quickly.

We also put emphasis on higher quality “junk” bonds. This may sound like a misnomer, but there are ways to invest in junk bonds of otherwise good and steady companies that have too much debt at the moment. Those kinds of bonds are also less sensitive to higher interest rates.

Market Return Expectations for 2022

That’s a trick headline. We do not know what the market is going to do in 2022. And neither does any highly paid prognosticator at big Wall Street banks.

What we know is that what worked and didn’t work in 2021 is likely to look different in 2022. Maybe this is the year Gold shines again. Maybe inflation bonds take a “breather” after two great years. It’s anyone’s guess.

Since we can’t control market returns, we focus on what we can control. And that’s the way we manage money for clients. Building well-diversified portfolios and backing those up with a process that allows us to rebalance and take advantage when asset classes get “out of whack” vs. others.

Nothing keeps the FDS Team up at night more than knowing we have clients who depend on their portfolios to fund daily living expenses. There’s a constant tug-of-war between the reality of today’s living expense needs and the likelihood that those clients will be retired for a long time and need to earn high enough returns on their investments to out-pace inflation.

As we wrap up 2021, please know that we’re grateful for your trust. We work hard to earn it and we work very hard to add value to your financial life! Have a great Christmas and Holiday Season!

Ready to take the next step?

Schedule a quick call with our financial advisors.