Alphabet Soup of the Economic Recovery

by Financial Design Studio, Inc. / October 8, 2020Talking heads on TV love to latch on to catchphrases as a way of communicating their point. Economists are no different. Watch CNBC or Fox Business for any length of time and you’ll eventually hear someone talk about a “V-shaped” or “L-shaped” recovery. It’s an alphabet soup describing the economic recovery! But what does these letter-shaped recoveries mean for you?

Differences in Economic Cycles

Economic cycles are a fact of life. Some are caused when the economy grows too fast and cause inflation. Others are caused by external shocks, such as oil embargoes, 9/11, or COVID-19.

The nature of recoveries from these periods of recession has changed over the last 60 years. In the past when America was more of a manufacturing hub, economic downturns tended to be quick and painful. But the recoveries from these downturns were similarly quick and powerful to the upside.

But since the late 80’s, economic recoveries have been slower. If you’re old enough, you might recall the “jobless recovery” of the early 1990’s that caused George Bush to lose the 1992 election. Economists coined this term to describe a situation where the economy was too slow to recover the losses it suffered in the recession. The reason recoveries have slowed is because we’re a more knowledge-based economy, where people work in corporate middle management vs the assembly lines.

Today’s COVID-19 recession is unique in terms of its severity and the policy response from Washington. We pointed this out a month ago when talking about the recovery that’s currently underway. But there’s a lot of debate as to what this recovery will look like, so let’s look at what the economists are saying.

What’s a V-Shaped Recovery?

The optimists argue that the U.S. economy will experience a “V-shaped” recovery. What this means is that it will recover very quickly from the downturn, bringing economic activity back to normal within a short period of time (less than 2 years.)

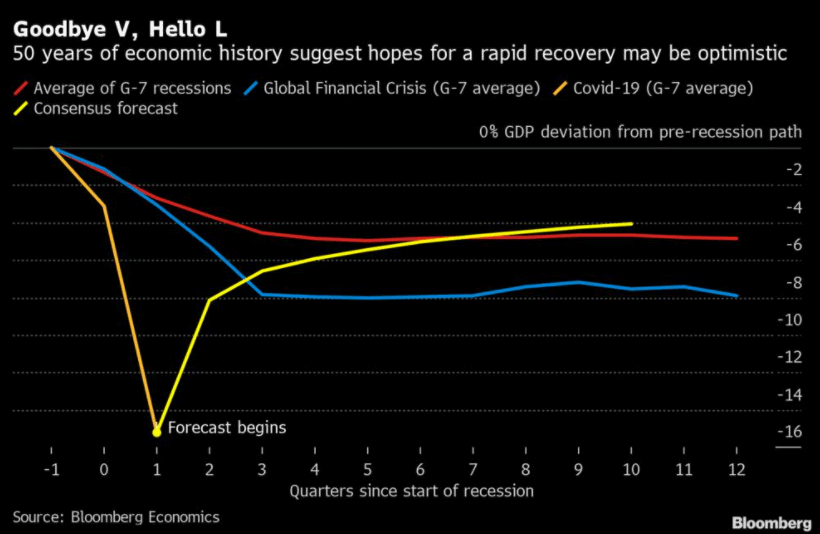

In the chart above, you can see that this is what consensus economists are expecting. We’ve experienced a very sharp downturn, but they expect the recovery will be just as swift.

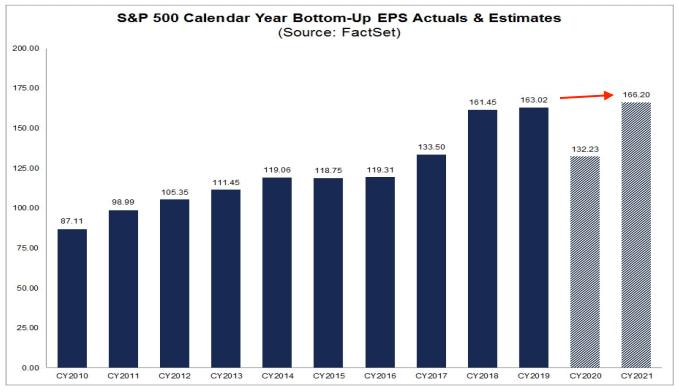

Stock market analysts are also very optimistic. Despite the severe downturn we’ve just experienced, these analysts expect company earnings in 2021 to surpass the 2019 high. Talk about V-shaped!

What’s an L-shaped Recovery?

Pessimistic economists are talking about an “L-shaped” recovery from the COVID-19 downturn. What they mean by this is that economic activity is likely to remain low for an extended period given the economic shock we’ve just experienced.

If you look at the blue line in the first chart above, the recovery from the Great Financial Crisis of 2008 was more of an “L-shaped” recovery. Economic activity dropped significantly as the housing bubble burst. But there was little recovery in economic activity after the worst of the crisis was over.

If we have an L-shaped recovery, then what you see today in terms of business activity is what you’d see in the next 2-3 years. Small businesses struggling. State and local budgets in deficit. And a slow recovery in employment. We hope these pessimists are wrong, of course!

Is a K-shaped Recovery Bad?

The new kid on the block of economic lexicon is the “K-shaped” recovery. This describes a situation where one part of society experiences a V-shaped recovery while the other part experiences an L-shaped recovery.

Proponents of the K-shaped recovery story argue that the economy is indeed recovering quickly, but only for white collar, upper middle-class America. We see evidence of this in housing data, where home buying activity is very strong even in the face of high unemployment levels.

For the lower middle-class, a K-shaped recovery means that times remain very difficult. Employment in the hospitality and food service sector factors heavily for the lower middle-class, and clearly these businesses are struggling under the weight of COVID shutdowns.

From our viewpoint, the K-shaped recovery seems to be a more accurate description of what’s going on right now. Interventions in bond markets by the Federal Reserve has caused stock prices to reach record highs again. Meaning, the well-off investor is no worse off than they were before this crisis started.

For the lower middle-class, the expiration of extra unemployment benefits in July is showing itself in slowing economic growth data, such as restaurant spending. Given that the government is imposing lockdowns on business that employ many of these fine people, another round of stimulus and extension of jobless benefits is important to help them get by until these lockdowns are lifted.

Your Economic Recovery Experience Can Be Different

One thing that gets lost as economists and talking heads try to generalize the situation is that everyone’s experience will be different. A consensus “V-shaped” recovery doesn’t mean a hill of beans to someone who works in the airline or hotel sector. Whereas an executive that was able to rapidly shift to working from home won’t necessarily feel the “L-shaped” recovery that small business owners are feeling. Whatever your recovery looks like, please know that we here at Financial Design Studio are here to support you.

Wondering how this affects your investments? Schedule a call with Financial Design Studio to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Impactful Giving: Tax Strategies and Vetting Charities [Video]

We all want to make a difference with impactful giving. In this video, find out how to evaluate charities and employ tax-efficient strategies.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.