Business Owners: Set Up Repeatable Monthly Bookkeeping Tasks [Video]

by Financial Design Studio, Inc. / September 28, 2020We’ve been doing videos recently for our small business owners. We understand that so much of your time and energy is spent on your business or building your business, that it’s often not in your “business”. That’s what we want to talk about here. How do you set up an accounting structure or bookkeeping tasks so everything is in place where you can get reports and know the health of your business?

Let’s talk through it right now. Here are some monthly repeated tasks you can do every month, every period, and every year.

Bookkeeping Tasks to complete:

-

Reconcile:

First take all your business accounts, your bank accounts, and credit card accounts get them entered and reconcile them. What that means is enter them into the software into your spreadsheet and true them up. Tie them or reconcile them to a bank statement or a credit card statement. Every month do this, make sure everything is golden, everything is in there, nothing is doubled, and nothing is missed. This would be bank accounts, credit cards, and anything that has an account or a statement that you can tie to, do this every month.

-

Timely Payments:

These are vendor payments, these are people that you owe money to. Do this in a timely manner so you don’t have late payment penalties or you don’t have vendors upset with you. There are easy ways to do this, you can do bill pay, ACH, or put it on a credit card so it’s automatic. Do as much of that as you can so it’s automatically paid. For those payments that fluctuate, they are large some months and small other months you really can’t automate it. Those are the ones you pay by check, so you can review it first. For utilities put those on something that can be automatically paid you don’t have to even think about it.

-

Receipts:

Here we are looking at accounts receivable and know what your customers owe you so you don’t have to go and collect. The worst thing to do is do all the work and never get paid for it. Or feeling like you’re hounding someone because you haven’t gotten paid months after it. Keep on that to know who owes you and when so you can collect it in a timely manner.

-

Scanning and Storing:

The IRS wants to see the actual receipt or it may not be deductible, so keep track of those. You can use your phone, use an App, store them, put them online, or in a google dropbox. Have the physical receipts somehow accessible should you ever be audited, you can pull it out and prove here’s how and why I bought it and here’s proof that I did.

In Summary, these monthly tasks make it easy and make it repeatable. Just like a checklist, do it every month, every period, and every year. If you need any help setting this up we are always happy to do that. Please reach out to us and let us know!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Retirement Saving Strategies for High Income Earners [Video + Free PDF]

One of the most common questions we get from high earning business owners and corporate executives is: how can I be saving more money for retirement? Here are several options to consider, along with a video and free PDF guide.

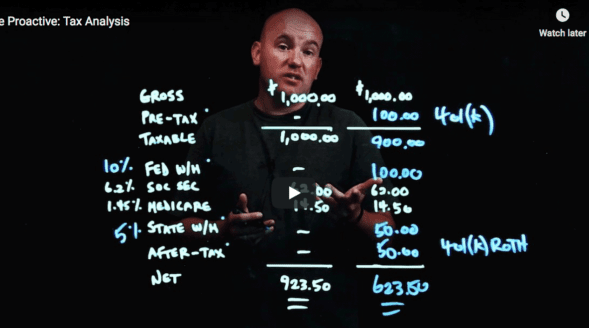

Be Proactive: Tax Analysis [Video]

One question we hear a lot from those who are self-employed and doing some type of payroll is: “How do I balance my taxes and save for the future?” For this let’s discuss your tax analysis… Let’s go through an example so I can show you some of the mechanics of how a…

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.