Will Company Earnings Recover in 2021?

by Financial Design Studio, Inc. / May 7, 2020 One of the puzzling things we’ve seen the last two months since the COVID crisis washed ashore in the U.S. is the dichotomy between the real economy and the stock market. On one side, the real economy is posting its worst performance since the Great Depression. Yet on the other side, the stock market is “only” down 11% year to date. What’s going on?

One of the puzzling things we’ve seen the last two months since the COVID crisis washed ashore in the U.S. is the dichotomy between the real economy and the stock market. On one side, the real economy is posting its worst performance since the Great Depression. Yet on the other side, the stock market is “only” down 11% year to date. What’s going on?

Last week we talked about recent economic data showing the economy going into recession. And we noted that the data in coming weeks and months would also look quite negative.

Yet the stock market, while down, is not down nearly as much as one might think given the poor economic data we’re seeing.

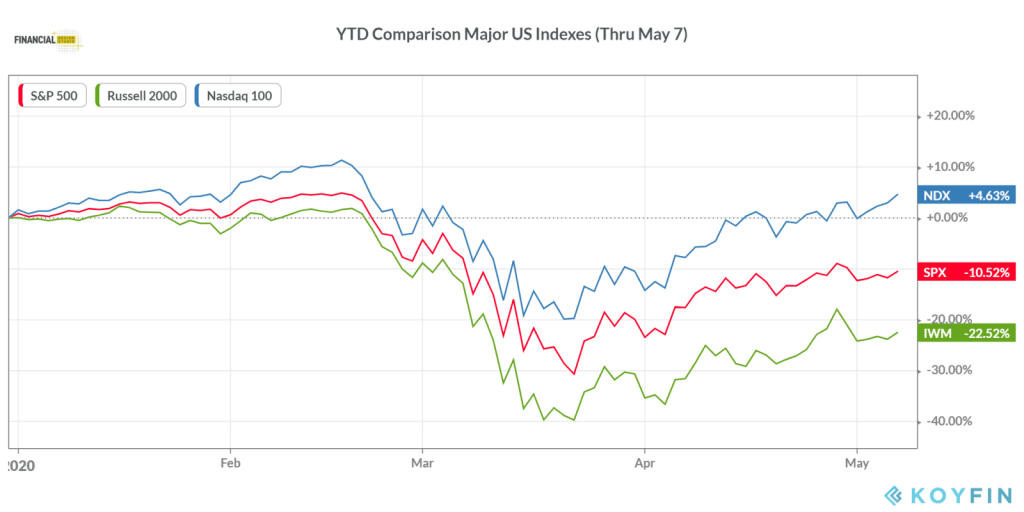

So far in 2020, the broad index of large companies is down -10.5% as represented by the S&P 500 (see above). Small cap stocks, by contrast, have done much worse down -22.5%, while the tech-heavy Nasdaq 100 index is actually +4.6% HIGHER than where we started the year.

This odd dynamic between real-world economic data and the stock market has people wondering what’s going on. We think a big reason for the divergence is because the stock market tends to “look through” near-term data.

What I mean is this: In February and March the stock market dropped -35% even though reported economic data was still good. It did this because the market was “baking in” bad economic numbers to come as a result of COVID shut-downs.

Since then, we’ve gotten the bad data that the market expected, but the market has risen as investors are now looking at economic and earnings data AFTER COVID.

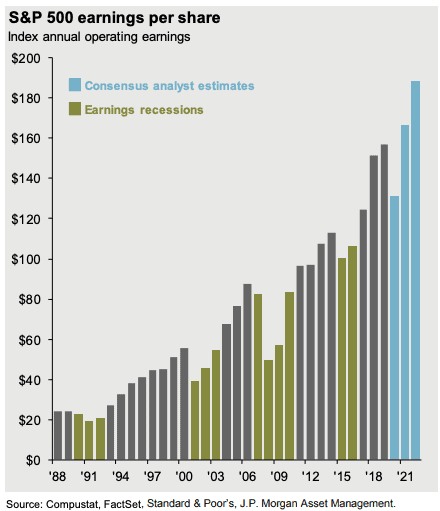

Total earnings for companies in the S&P 500 are expected to drop by about 15% in 2020.

But looking at consensus expectations for 2021 and 2022 shows that investors expect earnings resume the rising trend we saw before COVID, reaching a fresh high as soon as 2021.

In essence, the market has “moved on” from COVID and is now focused on what things will look like after this pandemic. And in our view, that poses some risk to the market.

How the economy and company earnings look like in 2021 and 2022 is what’s going to matter for the stock market from here. The risk, we believe, is that the post-COVID recovery will be slower than what the market’s currently expecting.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.