2021 Advanced Child Tax Credit: What It Means For Your Family

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / June 10, 2021

In response to the coronavirus pandemic, the government shoveled a lot of money towards consumers through three rounds of stimulus checks. You’d think the “stimmy check” parade was over, but there’s yet another round of cash coming for families with young children! Here’s what the 2021 Advanced Child Tax Credit might mean for your family.

Child Tax Credit Becomes more Valuable

The Child Tax Credit was first introduced in the Taxpayer Relief Act of 1997. This offered a tax credit of up to $500 for each child in a family. They doubled this amount to $1,000 as part of the 2001 Bush tax cuts. Then it doubled again to $2,000 in 2017 with the Tax Cuts & Jobs Act.

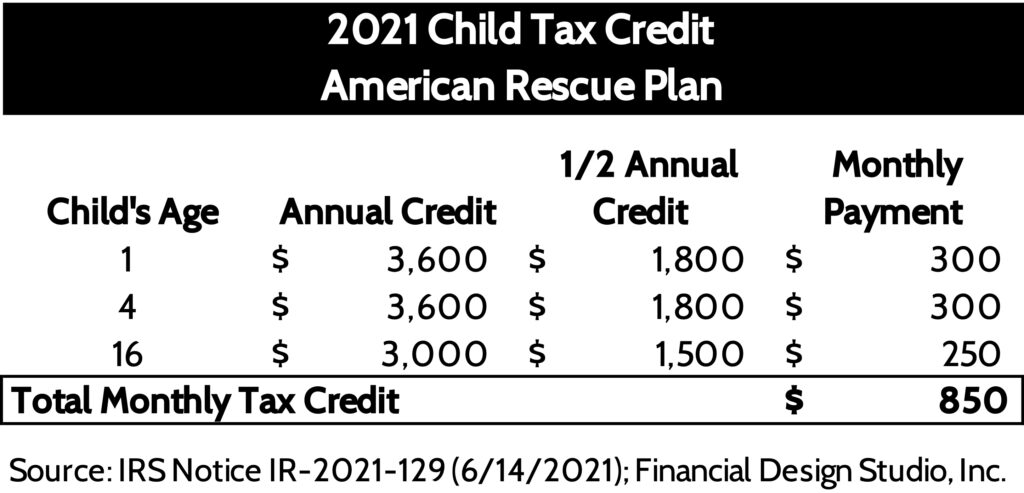

The American Rescue Plan that was passed by Congress and signed by President Biden in March 2021 increases this tax credit again. Now, a family can receive up to $3,600 for each child age 0-5 and $3,000 for each child age 6-17.

As the law is written, the increased child tax credit under the American Rescue Plan will expire at the end of 2021. So it’s a one-shot, increased tax credit to help families this year alone. However, Congress is currently debating a new, multi-trillion dollar “infrastructure” bill and one provision is to extend the higher Child Tax Credit through 2025.

We believe there’s bipartisan support to extend this tax credit. It’s seen as a good way to tackle child poverty in the U.S. We place high odds that this is extended, if not made permanent at some point.

What’s Different About This Child Tax Credit? Refundability.

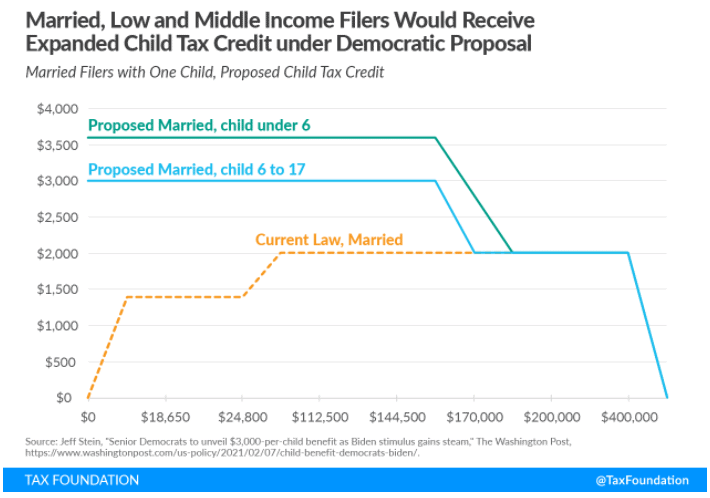

Child Tax Credits have always been subject to income phase-outs. Meaning that if you made too much money, you don’t get the tax credit. That still applies with the new Child Tax Credit.

Married couples will see the increased tax credit phased out starting at $150,000 of income, and then fully phased out at incomes over $400,000.

What’s different about the 2021 version of the Child Tax Credit is that it’s going to be fully refundable. That means you don’t have to have any income in order to receive the tax credit. Prior law only gave you the tax credit if you were working and paying taxes. No more. This is going to be a tremendous boon for low-income families, as it’s intended.

Wait, It Gets Better… Getting Your Child Tax Credit Paid Monthly Starting July 2021

This week, many taxpayers are receiving letters from the IRS explaining that they can receive this new tax credit as a monthly payment starting in July. We see here a copy of the letter my wife and I received.

An additional feature of the Child Tax Credit for 2021 is that families can start receiving the tax credit as a monthly payment starting in July! We spoke about this briefly in a blog post a few weeks ago talking about the labor shortage we’re seeing in the U.S.

How will this monthly payment work? Let’s use the example of a married couple making $100,000 per year. They have three children, two under the age of 6 and one that’s in high school and under the age of 18.

Under the American Rescue Plan, the IRS may give families up to 50% of their Child Tax Credit as a monthly payment starting in July and running through December. For our family above, they’d get $850/month deposited directly into their bank account for the last six months of 2021.

That might not sound like a lot of money, but it is. The family making $100,000 in gross income has after-tax, take-home pay of around $5,800/month. The extra $850/month is an effective 15% increase in their monthly cash flow! At lower income levels, this monthly tax credit becomes even more valuable.

What happens to the other 50% of the credit that isn’t paid out each month? That’s given to families when they file their taxes for 2021. This will probably lead to nice refunds for many low and middle-income families next spring.

Should You Receive the Advanced Child Tax Credit?

By default, the IRS is going to send you the Advance Child Tax Credit starting in July. You don’t have to do anything to receive it. But you can opt-out of receiving it. As of today (mid-June 2021) the IRS has yet to open the portal where you can opt-out, but they will shortly.

Should you? One benefit of what we do at Financial Design Studio is that we have a partner, Steve Smalenberger, that prepares taxes for clients. This gives us good visibility on how many clients normally receive refunds – or have to pay.

We find that tax credits like the Child Tax Credit can often move a taxpayer from a position of cutting Uncle Sam a check or getting a refund. And surprise, surprise, we’ve yet to find a client that was happy they weren’t getting a tax refund!

This should caution people about taking up the IRS’s offer to receive the Child Tax Credit early. By doing so, you may risk having to write a check to Uncle Sam when you file your 2021 taxes.

To be clear, your tax liability will be the same whether you decide to receive the tax credit early or not. It simply becomes a game of whether it’s worth it to you to have more cash flow today and risk cutting a check later, or vice versa.

What Will the 2021 Advanced Child Tax Credit Mean to You?

Finally, whether to take the 2021 Advanced Child Tax Credit as a monthly payment depends on a lot of factors. One benefit of working with Financial Design Studio on an ongoing basis is that we run tax planning scenarios for you throughout the year. The goal in doing tax planning is to reduce surprises when you file your taxes.

For many clients, getting an extra $250-300/month will not move the needle much. So it might make sense to avoid the monthly payment and get the tax credit as a refund next Spring.

However, if the monthly payment is interesting to your family, it’s worth doing some tax projections to make sure that you won’t owe taxes later. We can look at your current tax withholdings and make projections about what your 2021 taxes might look like.

Regardless of what your family decides, the benefit of getting tax planning as part of your ongoing relationship with FDS is just one piece of advice that we offer. Real value is created when we combine tax planning with your investments and more complex planning strategies, such as Roth Conversions.

Ready to take the next step?

Schedule a quick call with our financial advisors.