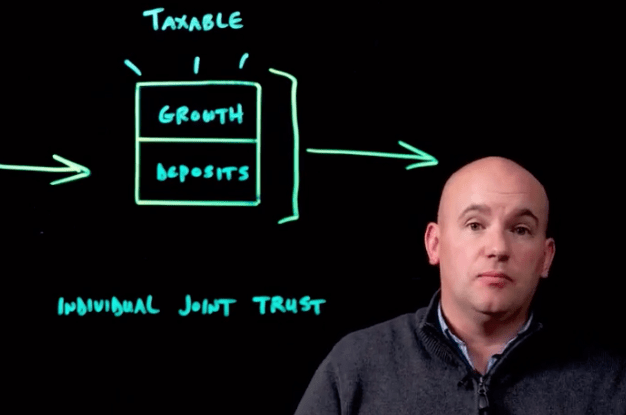

How Taxable Accounts Work [Video]

by Stephen Smalenberger, EA / March 2, 2021There are three different types of accounts; taxable, tax deferred, and tax-free accounts. Let’s look at that very first one. I want to show you how taxable accounts work in a visual format.

What are taxable accounts?

First, I want you to think about your checking account, savings, individual accounts, joint accounts, maybe even a trust account.

How do taxable accounts work?

These are primarily focused on your lifestyle or your living expenses. They could be used for retirement, however they don’t have to be. Because they are not for retirement and are not focused on retirement there are some different rules.

What are the rules?

There is no limit on what you can put in. Let’s use a box for example of an account. It is made up of your deposits, what you put into it as well as the investment growth.

When I am looking at this account visually, the growth on these accounts would be interest, dividends, and capital gains or losses for the stocks that you own. Those are taxed in the calendar year that they happen. First I put money into the account. Then the account grows and it pays interest, dividends, and capital gains. These are all taxed in that year.

So again, there is no limit on how much you can put in and therefore there is no limit on how much you can take out. For instance, if you wanted to you could take everything out and liquidate it tomorrow.

In summary, what kind of accounts are they? Individual accounts, joint, and trust accounts. There is no limit on how much you can put in. Also, it is taxed in the year that it happens. Finally, there is no limit on what you can take out and those distributions are not taxable. There are not any other rules. Also, there is no age rule, these accounts could be for a child, someone in their working career, or even for retirees. These accounts are perfect for any person; they fit into many financial situations.

If you don’t have a taxable account or maybe are not utilizing it correctly. Reach out to us. We would love to walk you through it and share how you could be using it better for your financial situation.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Strategies for Restricted Stock Unit Taxes [Video]

In this video, we breakdown the types of RSU vesting schedules and different strategies for handling Restricted Stock Unit taxes.

Strategies for Early Retirement Healthcare [Video]

Early retirement healthcare can be tricky. This video explains your health insurance options before age 65 and Medicare.

Stephen Smalenberger, EA

Steve enjoys getting to know clients and hear their unique stories and the lessons learned which has brought them where they are today. One of the reasons he enjoys what he does is the ability to show the outcome that can be achieved with different choices. He also enjoys continually learning.