Will Labor Shortage Push Inflation Higher?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / May 13, 2021

The government reported disappointing employment numbers for April, leading many to question what’s going on. Anyone who’s been out and about at restaurants and stores has likely seen plenty of Help Wanted signs. Yet jobs growth continues to fall short of expectations. This is causing employers to raise wages, so costs to end-consumers move higher. More and more, inflation is in the news, as we noted last week regarding the global computer chip shortage. The key issue now is whether this emerging labor shortage will push inflation even higher?

Jobs Data in April Was Disappointing

The government released jobs growth data for the month of April last week. With many states reopening from Coronavirus lockdowns, expectations for jobs growth were high. Some analysts were even expecting 1 million new jobs!

Actual job growth in April came in at “just” 266,000 new jobs. While that’s a good number in normal times, it was very disappointing to many economy watchers. The unemployment rate actually rose to 6.1%.

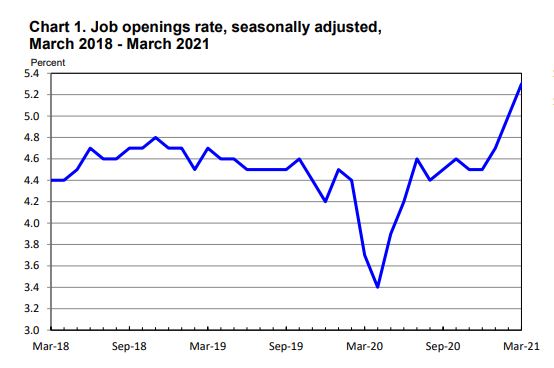

There isn’t a lack of jobs out there. According to JOLTS, job openings haven’t been higher in several years. Small business surveys say the same thing. There are LOTS of jobs out there for anyone who wants one.

Are Higher Unemployment Benefits Holding Jobs Growth Back?

The government responded to the loss of jobs from COVID by enacting extra unemployment benefits. In 2020, this amounted to $600/week of extra unemployment payments. Those extra benefits are now $300/week through the end of September.

Three hundred dollars might not seem like a lot, but if you divide that amount by a 40-hour workweek, that’s $7.50/hour. For low-income workers, that’s a big boost to their normal unemployment benefit.

This explains why many restaurants, small business, and even big box stores are having trouble finding workers. The days of offering $11/hour starting wages aren’t enough to overcome what workers can get on unemployment.

For example, the Chipotle near our FDS office is offering daily, walk-in interviews for anyone that wants a job. They’re not only offering $15/hr on Day 1 but also tuition reimbursement, 401(k), paid sick time, and yes, free burritos.

This is a welcome development for many low-income workers who’ve been left behind over the last 20 years. But there is a cost.

Will Labor Shortage Push Inflation Higher?

Rising wages is a big issue for businesses that run on thin profit markets, as is the case for many big boxes and service-oriented businesses. If they’re paying more for labor, someone has to make up the difference. That means higher prices.

Inflation numbers reported this week came in higher than expected. We warned that inflation in April and May were likely to look bad due to “base effects” from the onset of the pandemic a year ago. Economists were quick this week to note these base effects, arguing that bad inflation numbers today are transitory. But are they?

If a real labor shortage emerges, as it appears to have, then that’s going to mean higher, stickier inflation. If you’re a business having to boost your starting wages from $11/hour to $15/hour, you aren’t likely to cut their wage back to $11/hour when the labor shortage ends. That’s a permanent increase in wages and prices.

I believe economists are way too sanguine about this labor dynamic. Yes, extra pandemic unemployment benefits will end in September, which would presumably push people back into the job market. But there’s a new, monthly cash benefit coming in July for families with children.

How Big of a Boost to Incomes Will the Advance Child Tax Credit Be?

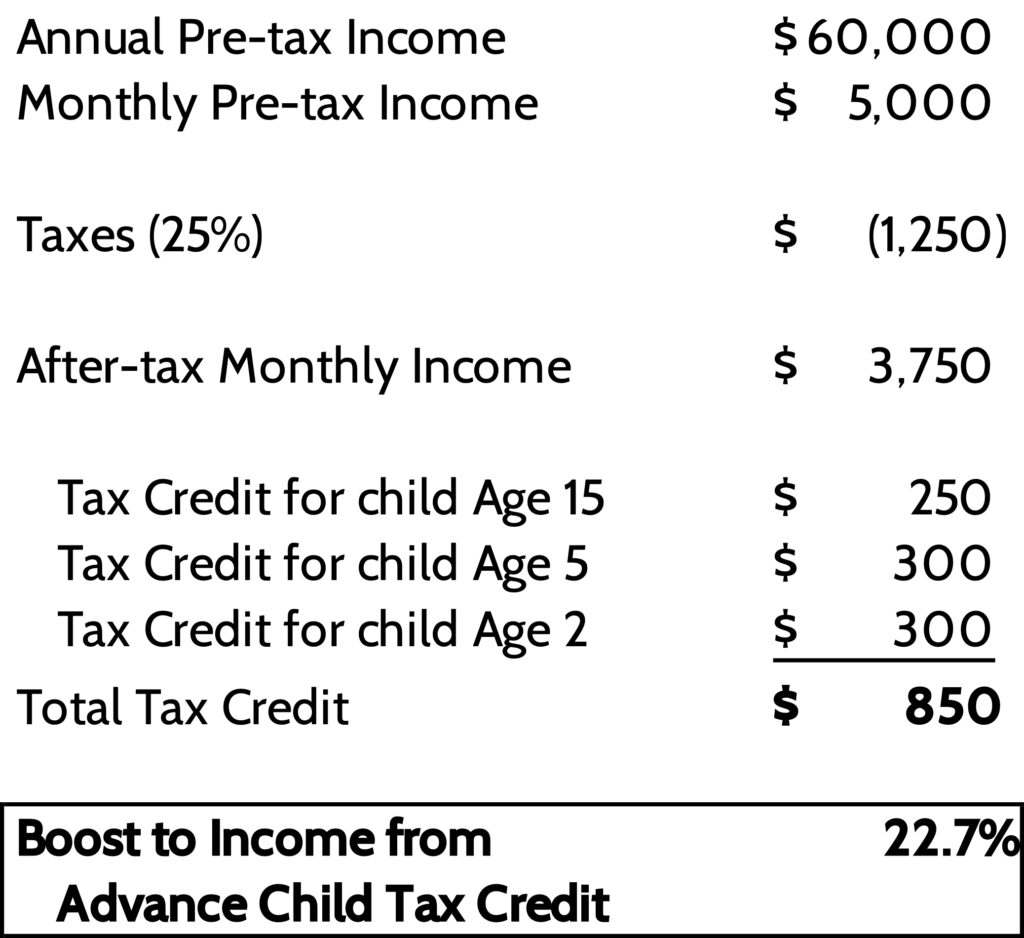

The stimulus signed into law in March, which gave us another round of “stimmy” checks, increased the Child Tax Credit for 2021. The increased child tax credit amounts to $3,000 for children ages 6-17 and $3,600 for children under the age of 6.

A little-noticed wrinkle to this tax credit is that the bill allows people to collect the tax credit ahead of the April 2022 deadline to file 2021 taxes. Starting July, families can receive 50% of this credit as a monthly cash payment.

How significant is this? Let’s look at an example of a family of 5 with one child age 15 and two children under the age of 6. This family makes a median wage, which amounts to $60,000 pre-tax.

This tax credit would boost monthly cash flow for this family by over 22%. That’s nothing to sneeze at. Since this starts in July, anyone receiving unemployment can receive the $300/week extra unemployment benefit AND get this tax credit (if they have children, of course!)

While the extra unemployment benefits go away after September, this tax credit will continue into December. Congress is currently negotiating extending this tax credit benefit through 2025 as part of the next round of stimulus.

The takeaway with this is that pressure on wages will continue. And as wage pressure continues, so will the pressure on prices at restaurants and stores. And that means durable inflation for consumers.

Investment Implications if Inflation Isn’t “Transitory”

Unlike most commentators, we believe the emerging inflation dynamic in the U.S. will prove stickier and longer-lasting than many expect. We are seeing behavioral changes we haven’t seen in a long time. It started with toilet paper hoarding, and continues today with gas shortages in the Southeast because of a pipeline being hacked.

It’s easy to write these events off as “one-time” and transitory, but they’re happening. And they’re happening at the same time these labor shortages are creating permanent inflation in the economy.

The investment implications of a sustained increase in inflation cannot be exaggerated. It turns the investment environment we’ve been used to over the last dozen years on its head.

Large, expensive growth stocks are at risk to higher inflation, much like the Nifty Fifty experienced in the 1970s. Since these stocks have powered the stock market’s rally, any pressure here is going to mean investors need to have a well-diversified portfolio to withstand a correction in this part of the market.

Bonds are also at risk. Persistently low interest rates have caused governments and companies alike to lock in low interest rate debt for the long-term. This means that many passively managed bond index funds have more interest rate risk than they’ve ever had. Higher inflation means higher interest rates down the road.

We at FDS started making moves in Fall 2020 to protect client investments against this emerging inflation risk. We’ve made further moves in 2021 as well.

As the investment environment changes, it’s important to make sure your investments are keeping up with the changing times. Many investors have a set-it-and-forget-it attitude towards their savings. That mindset isn’t wrong, but it can lead to missed opportunities. Our job is to make sure we’re keeping client investments up to date with the times and reacting quickly when the market gives us opportunities.

Ready to take the next step?

Schedule a quick call with our financial advisors.