[Video] How Much Life Insurance Do I Need?

Insurance Part 2

by Michelle Smalenberger, CFP® / June 20, 2017MICHELLE SMALENBERGER, CFP®

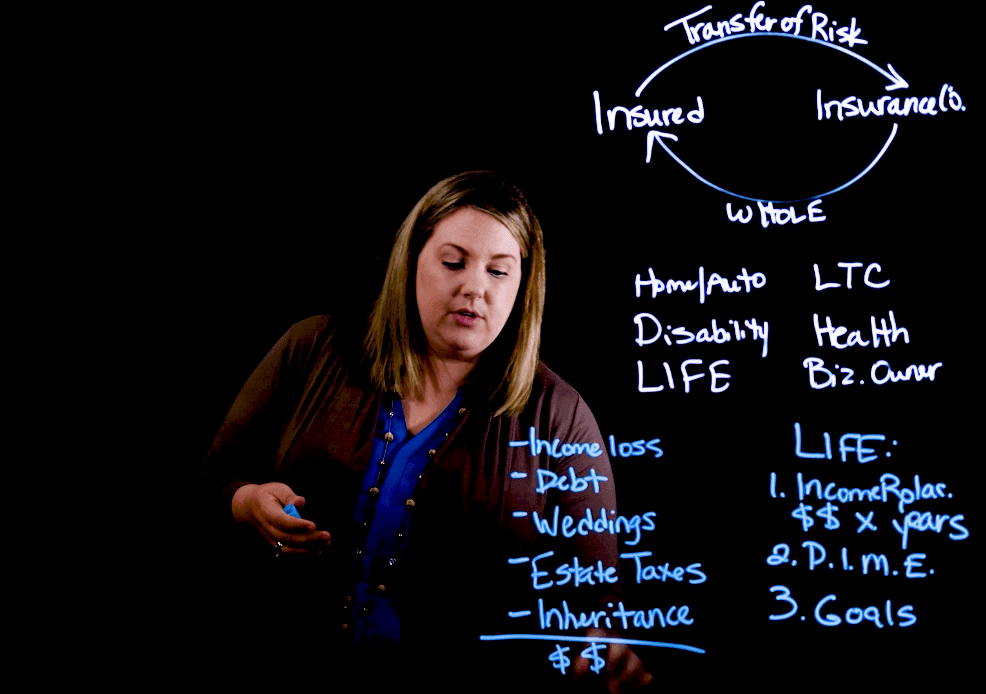

One area of insurance that I think is hard to define a value for is life insurance. So, I really want to dig into that a little bit to help you come up with or to make a little simpler that process of what is the amount of life insurance that I need? When we contrast this with a home or an auto insurance, it’s really easy to find a willing buyer who wants to buy those things, and so there’s a price that they’re willing to pay you. That really sets a value of what we need to be insuring that property for.

The life insurance is very different because this is really dependent on you, on someone else, on who is surviving you, so it’s really looking forward and saying what do I want to make sure is taken care of? When we just look at life insurance in general, there are some common ways that people typically look at this, and these are just really simple calculations.

For example, one may just be income replacement. Where we’re really just looking at your salary, today, times the number of years that we know you need to work to fill those goals, or fulfill everything you’re wanting to do for your family. Second, is an acronym D.I.M.E. So really wanting to make sure we’re covering our debt, our income, a mortgage, or education if you have children. These are some simple ways we could start with.

One third way that I want to suggest to you, is really looking at what are your goals. We’re going to dig into this a little more. And the nice thing about this is this really becomes a discussion between you and your financial advisor, or an insurance agent so you feel like you’re a part of coming up with how much insurance you need instead of someone else saying this is the amount you need and now having this shock of not knowing where that number came from, or feeling like it’s unreasonable.

So, let’s talk through what some of these goals might be to get us to the value of life insurance we both feel like we might need. For example, we’re of course going to need some of the things that are used in some of these other equations. So basically, income loss. It is really important that if there is a loss of income from one of the spouses that we’re replacing that. And one note on this that I really want to stress is even if there’s a spouse who stays home with your children, or really helps to keep the household in order, it’s really important to have life insurance for that individual. Because the cost of replacing that person, the childcare, cleaning, things like this, that person is really supporting the ability for the other people in the household to go to school and work. So, it’s really important to consider both people who are supporting the household and the income that is coming in. We don’t want to forget about that.

Of course, the next is debt, whether that’s a mortgage, auto, or maybe a student loan. And then we start to get into some goals that may not have been defined in some of these others formulas, like maybe a wedding. You want to be sure to support your kids if you know or think there’s going to be a wedding in the future.

Some others that we may typically not think of, are if your estate is large enough, you may actually have estate taxes, whether that’s federal or state. And you want your beneficiaries to actually receive those assets, you don’t necessarily want them to have to pay taxes first and then get what is left.

And then lastly is inheritance. For example, if you don’t want to worry about spending all your assets down, but you want to ensure that your beneficiaries are going to receive a set amount after you pass away, you can use life insurance to make sure that that happens.

I hope this is helpful to really just come up with another way to look at and solve for the amount of life insurance that you need, but also to include you in that conversation so you feel like you’re a part of coming up with the value you need, instead of just getting a number from someone and you don’t know how it’s made up.

Watch the Rest of the Series:

- What is the Purpose of Insurance?

- How Much Life Insurance Do I Need?

- What are the Sources of Life Insurance?

- When Do I Need To Have Life Insurance?

Or, Watch it All at Once:

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Insurance Webinar

Our insurance webinar walks you through the basic insurance policies, what you may be missing, and an audience Q&A session.

Endorsements for Your Insurance Coverage [Video]

In this excerpt, Ryan Delp, insurance agent with Bradish Associates, breaks down insurance endorsements he looks to add for extra coverage.

Michelle Smalenberger, CFP®

I have a passion for helping others develop a path to financial success! Through different lenses on your financial picture, I want to help create solutions with you that are thoughtful of today and the future. I have seen in my life the power of having a financial plan while making slight changes of direction from time to time. I believe you can experience freedom from anxiety and even excitement when you know your finances are on track.