Updates On The Market, October 2022

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / October 13, 2022

When we sent out our last investment updates on the market in mid-August the S&P 500 was in the midst of an 18% rally from the June 2022 lows. We noted that the economic weakness was becoming more clear, and that inflation was proving to be more persistent – and higher – than expected. Given that we’re in a volatile market environment, I wanted to update you on what we’ve seen since then.

The Economic Environment

The economy appears to be holding up better than expected. As I write this, the government released a strong September jobs report, with the unemployment rate falling to a very low 3.5%. Consumer spending is holding up as are corporate profits.

But there have been a couple of developments that keep us in the camp of expecting an economic downturn in 2023:

1) Inflation remains very high. The inflation report released in mid-September was unambiguously bad. Inflation is ticking higher despite a drop in gas prices. We’re seeing the seeds of a decline in inflation happening (declining home prices, for example) but it will take time for this to work through the numbers.

2) Federal Reserve to hike rates higher, for longer. At its meeting following the inflation report, the Fed increased rates by another 0.75%. It’s hard to stress how radical a shift we’ve seen in Fed policy over the last 12 months.

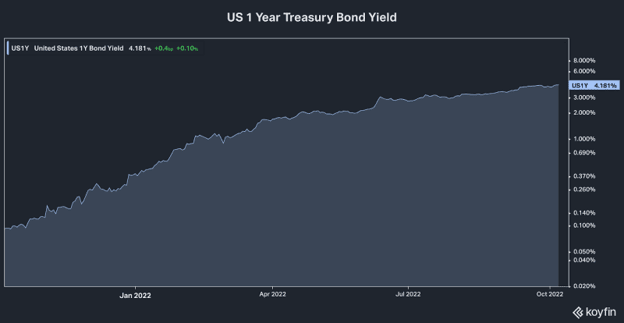

One year ago, the 12-month yield on U.S. Treasury Bills (“T-Bills”) was just 0.10%. Meaning, investors expected the Fed to keep rates at zero through October 2022. Today, 12-month T-Bills yield 4.20% and the Fed is indicating that it will take short-term rates to 4.50% by early 2023. We haven’t seen such a violent increase in Fed rates in such a short period.

3) Global energy markets remain extremely tight. Europe’s energy conflict continues with Russia. It took a turn for the worse when someone sabotaged and blew up two key natural gas pipelines running from Russia to Germany (Nord Stream 1 & 2). It’s unknown who’s responsible, but the fact is that two key energy supply lines to Europe are no longer operational.

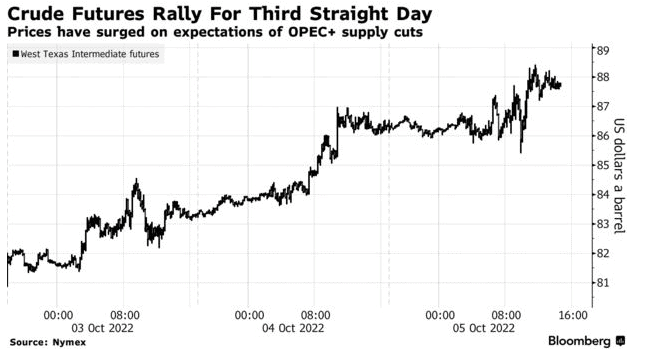

Second, OPEC held a meeting this week and agreed to cut oil supply by 2 million barrels per day. That doesn’t sound like a lot, but global oil supply/demand is already tight. This cut all but ensures a floor under energy prices. In fact, oil is up 11% over the last week.

Energy prices feed through every part of the global economy and the prices consumers pay for everything. The weaponisation of energy by Russia and other countries, coupled with European and U.S. elites believing you can replace the energy produced by a gas-fired power plant with a few windmills, means we’re following the same path we did with the 1970s OPEC Oil Embargo.

4) We’re seeing markets “break.” There have been two examples of markets “breaking” somewhat in the last two weeks. First, yields on U.K. government bonds rose so quickly that the Bank of England had to intervene in order to prevent certain pension funds from insolvency. Second, there have been rumors that the Swiss bank, Credit Suisse, is having trouble. These two events suggest that Fed policy is biting.

Taking all these developments together only increases our conviction that an economic downturn is a matter of when, not if.

Portfolio Positioning

In our August updates on the market, we said we’d be raising cash to help protect client portfolios. We did that, taking cash levels to 10% and putting that money into a money market fund that now yields 2.63%. These yields will increase to 4.00% or higher in coming months.

At the same time we also shortened bond interest rate risk and allocated more money to ultra-safe, short-term Treasury bonds, whose yield is now over 4%. When you add these holdings to the 10% cash we raised, portfolios hold anywhere from 13 to 16% in cash and ultra-safe government bonds.

We’ve made these moves to protect your capital and to stockpile “dry powder” that can be deployed if stocks continue to move lower. Getting nearly 4% on that cash is the cherry on top.

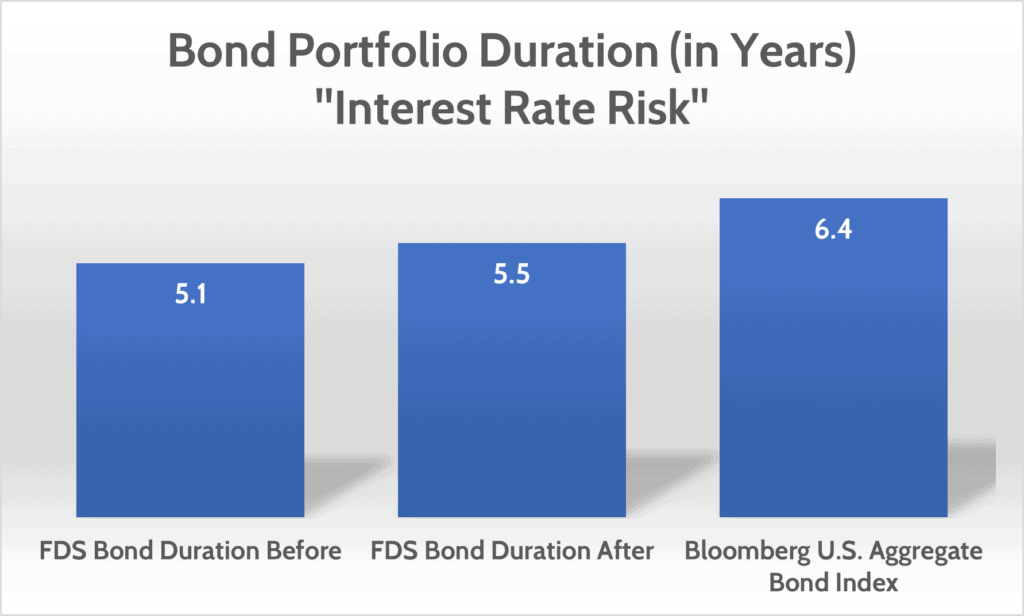

Today we made a slight change to portfolios, which is why we share our updates on the market. We are moving money from a short-term government bond fund to a long-term government bond fund. In other words, we’ve extended bond duration (interest rate risk) for the first time in 2-½ years. Why?

In short, we believe we’re nearing an inflection point in the inflation, economic, and Fed rate hike cycle. It might feel “early” given the strong jobs report we got today and the Fed continuing to jawbone rates higher. But our conviction is that an economic downturn has become certain enough such that we can see the Fed taking a breather from rate hikes in the next 6-9 months.

We also respond to what the market gives us. In August, 10-year U.S. government bonds yielded a paltry 2.75%. Today, the yield is near 4.00%. Given where we are in the cycle, we wouldn’t be surprised to see 4.00% as a medium-term ceiling on 10yr rates. There’s real value in 10-year, government-guaranteed bonds at 4.00% versus 2.75%.

To be sure, we’re still wary about the prospects for inflation staying higher for longer. Despite the modest shift higher in the duration of our bond portfolios, we’re still well below that of the overall market.

Finally, I wouldn’t be surprised if we had a very sharp rally in stocks as that Fed “turn” comes into view. We saw seeds of that on October 3 & 4 when the market was up nearly 6%. If we get appreciable strength in stocks, we may seek to raise cash levels even further in your portfolio.

Thinking Long Term, Acting Short Term

The current market environment is very challenging. We haven’t had to deal with high inflation in four decades. And in my opinion, investors have to “forget” what investing was like over the last dozen years. The days of 0% interest rates and rampant speculation in growth stocks and crypto are over.

In our next quarterly newsletter I’ll be talking about what markets may do over the next decade. We continue to look back at the 1970s experience to inform us of what the investment environment may be like in the years to come.

The experience of the 1970s demonstrated very sharp rallies and also grueling bear markets. There were long stretches where major market indexes failed to generate positive returns for investors. This suggests to us that the “buy and hold” strategy that worked so well after the 2008 Financial Crisis isn’t likely to be the winning strategy in the future.

You’re likely to see more short-term, tactical trades in your FDS-managed accounts than you’ve seen in the past. We don’t time markets. But increasing volatility will present more opportunities. We will be able to buy undervalued parts of the market and sell overvalued ones. Tactical portfolio management, as I like to call it, is the way to manage through a 1970s “lost decade” scenario.

Next Steps for Updates On the Market

We are always sharing updates on the market, what’s happening in the market and how we’re managing your portfolio. Want to receive our articles in your inbox? Sign up for our email at our blog page! As always, if you have questions on anything, please reach out to us!

Ready to take the next step?

Schedule a quick call with our financial advisors.