Will We Get Relief From Inflation

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / July 21, 2022

We’ve been quite vocal over the last 18 months about our views on inflation. Namely, that we are shifting away from a 40-year period of low inflation to a new regime of higher and stickier inflation. We still firmly believe this to be the case. But economies move in cycles. And to steal a phrase from theater, we may be in the closing chapter of Act 1, “Inflation Makes a Comeback,” thanks to the Russia invasion. This month’s newsletter looks at how we think the inflation story may play out over the rest of 2022, trying to answer the question, “Will we get relief from inflation?”

Federal Reserve Finally Fighting Inflation

If you’re on social media at all, you’ve probably seen memes poking fun at someone who’s failing by saying, “You had one job!” Well, everyone – from consumers to politicians to economists – is yelling this exact phrase at the Federal Reserve. Their job is to control inflation and they’re failing miserably at it.

The Fed is finally taking notice. “Doves” have dominated the committee that decides our monetary policy for two decades. Doves believe that monetary policy should be as accommodative as possible in keeping the economy humming along. Conversely, “hawks” are in perpetual worry about inflation and want to take the punch bowl away quickly at the first sign of price pressures.

One of the more dovish doves on the Fed, Leal Brainard, gave a speech this week that signifies a meaningful change in the Fed’s attitude. She advocated for aggressive interest rate hikes and faster run-off of the Fed’s balance sheet. When doves become hawks, you know they’re taking their job seriously!

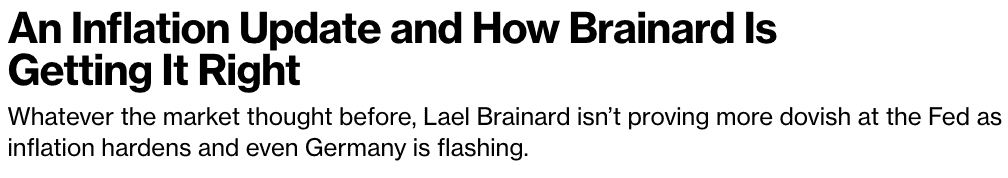

Current Inflation is Out of Control

There’s no sugar coating the current inflation story. Prices of everything are out of control. As I had the unfortunate experience of learning recently, there’s a new thing called “market adjustment” pricing when you buy a new car, where you’re forced to pay a premium to MSRP. Absolutely unheard of.

As if prices for cars, gas at the pump, and food weren’t high enough to begin with, the Russian invasion of Ukraine dumped gas on the inflation fire. This sent food and energy prices even higher.

Instead of using the “uncertainty” of the invasion as an excuse to turn dovish again, the Fed has made it very clear they’re intent on fighting inflation. And they have to. It’s their job, they’re failing miserably, and politicians are facing 2022 midterm elections with a lot of unhappy constituents. The time to act is now, and the Fed is going to follow through.

How Will the Fed Beat Inflation?

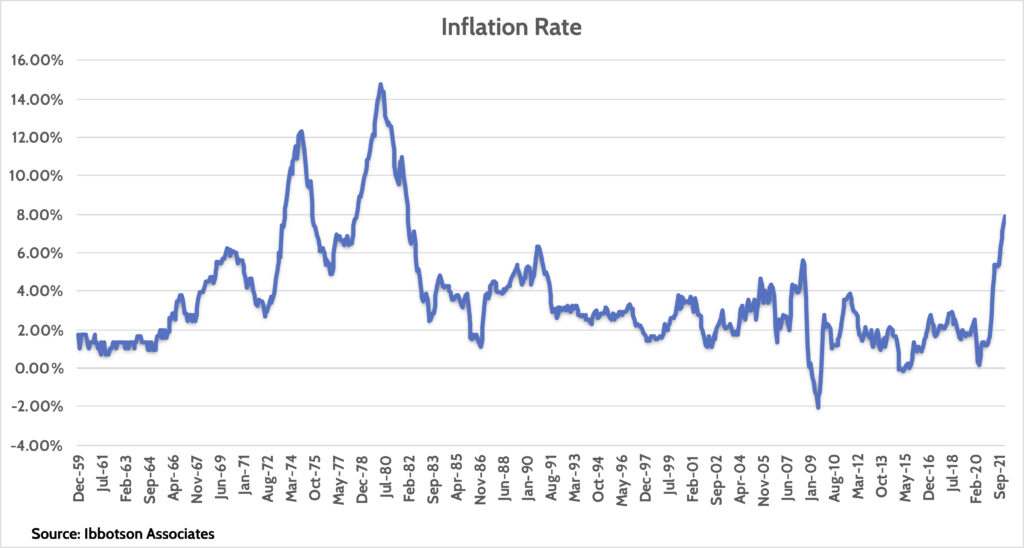

Reading the tea leaves of Fed speeches and the minutes from their meetings, we believe the Fed has two key goals in tackling inflation. The first is to hike interest rates to a level that causes demand for goods and services to fall. This is the classic Fed response to any inflation problem. Slow down the economy until demand falls. As demand falls, pricing pressures will ease. This is simple Economics 101, as seen in the chart below, where a fall in demand causes prices to fall from P1 to P2.

The second way we see the Fed controlling inflation is to target asset prices. For much of the last 25 years, the Fed has enamored itself with the idea of the “wealth effect.” This means that consumer spending ebbs and flows with changes in how “wealthy” they feel. As home prices and stocks go up, consumers spend more and stimulate the economy.

While this theory is true, there’s been recognition in Washington that this policy has had a profound effect on wealth inequality. The Fed has routinely bailed out banks and hedge funds under the guise that an economic downturn would hurt the consumer. But this policy has caused its own problems.

The shift towards targeting asset prices is a new tool for investors to grapple with. If our view is correct, the days of blindly “buying the dip” are over. The hurdle for the Fed to rescue markets is way higher than what it was before. Not only because of inequality, but their excessive monetary easing in early 2020 is the reason inflation is out-of-control today.

We’ll see how this shift affects the near-term narrative on inflation.

Inflation Tamer: Home Prices Likely to Cool Down

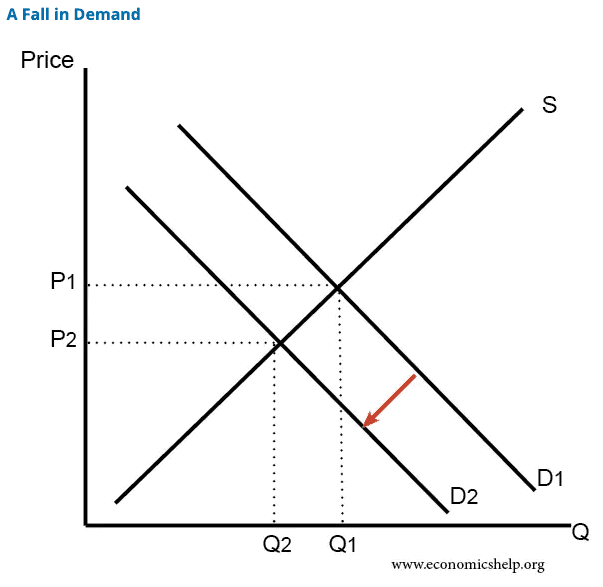

Since the pandemic, we’ve seen a feeding frenzy in housing. There are a few factors that drove this. Consumers living in locked-down cities decided that the ‘burbs weren’t so boring after all and moved to them. Housing inventory has been tight as the homebuilding market never fully recovered from the housing crash of 2008. And then you had a historic drop in mortgage rates, dropping from over 4.00% to all-time lows around 2.50%.

Over the last 20+ years, the average mortgage payment for consumers has been remarkably steady around $1,100 a month. As home prices rose, mortgage rates fell, keeping the payment low. However, tight supplies have caused home prices to rise even more than the drop in mortgage rates, sending the average monthly mortgage payment much, much higher.

This is all reversing. Mortgage rates have staged one of their biggest two-month increases in history, rising from 3.25% to about 5.00%. Did you know mortgage rates are close to 5% now? Happened in a flash!

While consumer wages are higher, they certainly haven’t risen enough to deal with a mortgage payment 25% higher than normal. It’s our belief that the recent surge in mortgage rates will prove sticky. If that’s the case, then it’s a matter of time until home prices cool as well.

Putting this into perspective, if we assume that a $1,350 monthly payment is the “right” average and a prevailing mortgage rate of 4.75%, then that suggests median home sales prices of $325,000. The current average sales price is over $400,000, so the “right” home price implied by this model is well below that.

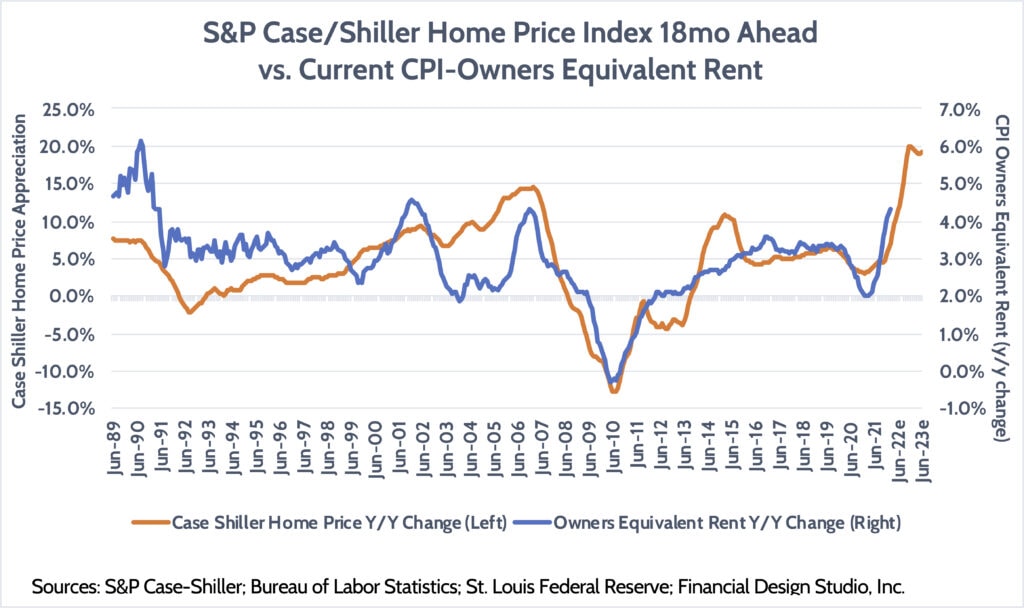

Why does housing matter to the inflation conversation? Because changes in the cost of owning a home make up 30% of the consumer price index measure of inflation. You can read about how this factors into inflation from our piece last year on the topic. But the point is this: If home prices are peaking – as they should because of the surge in mortgage rates – then the measure of housing inflation will also peak by early 2023.

This dynamic alone is likely to cause headline inflation to march downward by the end of the year.

Inflation Tamer: “Base Effects”

Inflation has been on a rampage for 12 months. Stimulus checks met head-on with supply chain issues causing shortages everywhere, driving prices higher. Inflation growth in 2021 was driven by abnormally low inflation in the early days of the pandemic in 2020. These “base effects” have made inflation look bad.

You can read the referenced piece for more information on how base effects work. But basically what’s going to happen from now on is that current inflation is going to be compared with already-high inflation rates of late 2021. An example. Suppose the price of a widget went up 10% in June 2021 but then stayed there for over a year. The inflation readings for the 12 months after that price increase would show inflation of 10%. But after June 2022, reported inflation would be 0% since the price of the widget didn’t go up further.

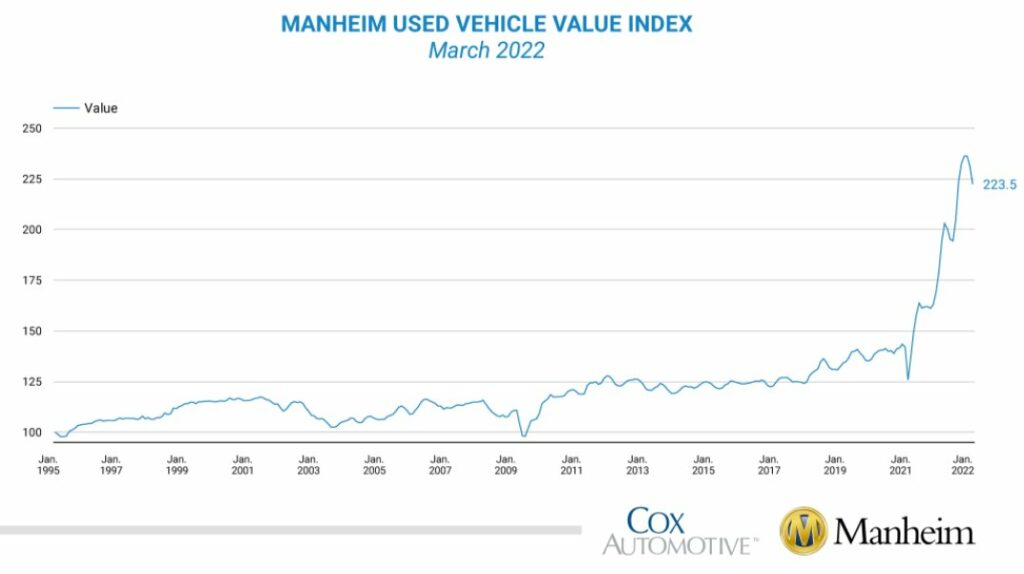

That’s what I expect to happen to many components of inflation in the coming months. A very simple example is used car prices. They exploded higher in 2021 as chip shortages caused new car inventory to collapse. But they’ve leveled off and are easing somewhat, as seen here.

Of course, the impact of higher prices is long lasting. Just because the price of that widget didn’t go up after the initial 10% surge doesn’t mean it doesn’t permanently cost 10% more than before. Put another way, the cost of living has been driven to a higher plateau, but reported inflation figures will still give the illusion that price pressures are easing.

As they say in Washington, “Perception is everything.” And if the perception is that the inflation dragon has been slayed, then that has implications for the near-term investment outlook.

How Will Lower Reported Inflation Affect the Investment Outlook?

The market has had to absorb one of the fastest monetary policy changes we can recall. As recently as October 2021, no one was thinking the Fed would hike rates until 2023. Inflation threw a wrench into those plans, and the market is now pricing in a whopping 8 rate hikes by year-end.

We already got one 0.25% rate hike in March. Essentially, the market is predicting that by the end of this year, short-term interest rates will be 2.00%. Savers, rejoice!

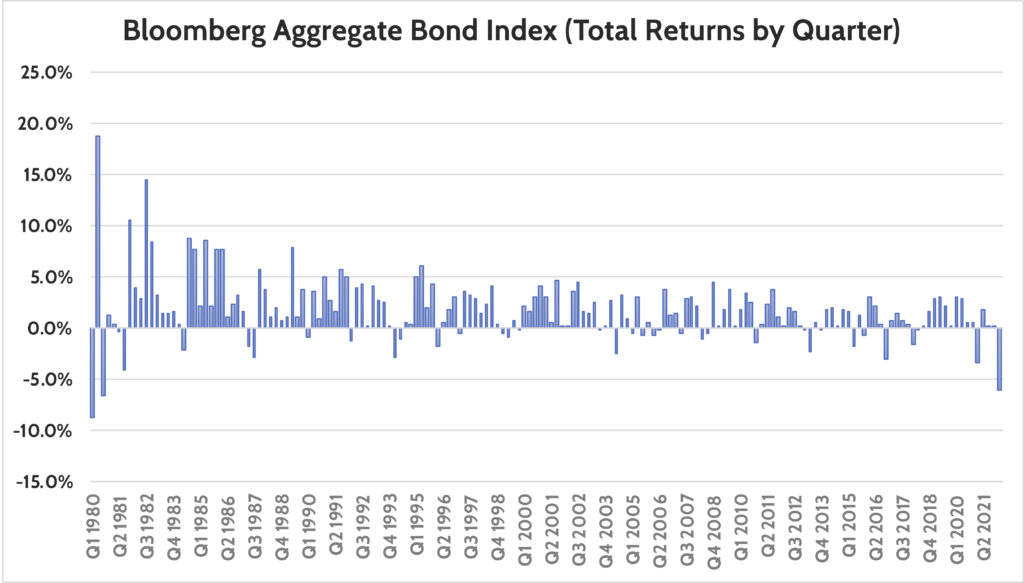

But this has had a dramatic and negative effect on the bond market. The recent quarter ending in March 2022 saw the worst performance by the Bloomberg Aggregate Bond index (-5.9%) since the third quarter of 1980!

This is the reason we’re so attentive to future “narratives.” If the reported inflation rate slows down later this year and into 2023, as we expect, then the pressure to tighten monetary policy will lessen.

Bonds may experience a relief rally if this happens. We still expect longer-term rates to remain elevated. But short and medium-term bonds may see some buying as the market is currently banking on a massive rate hike cycle.

How stocks do in this environment is uncertain, but I don’t think this would be a “green light” to buy big, expensive growth stocks again. I’d be shocked if we ever went back to 0% interest rates with the inflation genie out of the bottle. High-growth stocks need low long-term interest rates. We may be in an environment where stocks chop along sideways for an extended period.

Inflation is Dead! Or is it?

One of the most important things I’ve learned in my career is that no “theme” plays out in a straight line. Whether you’re bullish or bearish, markets never take the straight and narrow road to where you think they’re going. There will be fits and starts and many turns along the way that challenge your thesis.

My belief is that we have decisively shifted into a high-inflation environment for an extended period. The reasons for this are many, but boil down to:

- Tight labor market supply. Fewer workers = higher wages = higher inflation.

- Underinvestment in energy infrastructure. Energy inputs affect almost everything we buy, so sustained higher energy prices will = higher sustained inflation.

- De-globalization. The pandemic-induced supply chain issues and invasion of Ukraine have focused attention on making stuff “at home” versus overseas.

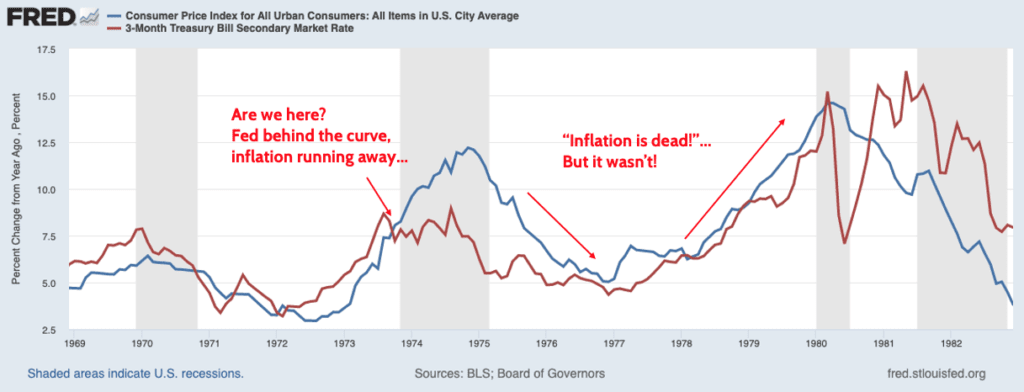

It’s instructive to look at the 1970s inflation experience for what we may expect. After the initial surge of inflation in 1973-1974, the Fed woke up and tried to tackle it. Raised rates a few times but eventually gave up because the economy ran into a recession. Inflation dropped from over 12% back down to 5% in 1976, but proved a temporary respite.

Once the economy grew again in the mid-70s, inflation came right back and surged to new highs. It wasn’t until 1979 and 1980 that the Fed got ahead of the curve by raising rates dramatically.

As noted at the outset, I think we’re in the closing moments of Act 1. In other words, we might be in 1974, thinking the inflation beast has been slain. Only to see it roar back as soon as the Fed takes its foot off the gas.

The political reaction to the Russian invasion of Ukraine has been extremely telling. Faced with surging food prices, famine in Africa, skyrocketing home heating costs and gas prices, the political elite in Europe and the US have framed this as a “necessary price to pay” to transition away from fossil fuels. In other words, they are okay with inflation because they and their well-connected business elites have fully invested themselves in climate change.

I’m not in any way diminishing the noble goal of reducing fossil fuel usage. But it’s extremely clear we’re not ready for that shift without major, major price pain. And unless something changes politically, high energy prices are here to stay, which means high prices everywhere as oil & gas are key inputs for almost anything we consume.

Will We Get Relief from Inflation?

As laid out in this month’s piece, I do think we may have a temporary respite from inflation over the next 12 months. That doesn’t mean prices are going to go down. It just means they will not go up as much for a period.

Further, we continue to believe we’re in a new, higher inflation regime, despite the temporary respite we might get. We’d expect any respite to be short-lived.

We remain focused on the bigger picture and view these ebbs and flows in the narrative as opportunities for investors. Intermediate-term bonds might do better as the market has already priced in a lot of rate increases. And there may be scope to take some money off the table in inflation-protected bonds, with the view of re-upping those investments if investors prematurely believe the inflation coast is clear.

Regardless of how this plays out, we continue to believe the easy money days of 2010-2021 are likely over. Investors will have to be nimble and well-diversified in order to succeed in the coming decade.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.