Is the Bear Market Over?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / August 10, 2022

2022 has been a challenging year for investors and economists alike. As inflation emerged from its 40 year hibernation, stocks dropped into bear market territory in the first half of the year. Fears of a recession arose. However, in the last few weeks, recession fears have eased and stocks have rebounded. Are investors out of the woods now? In this week’s post we examine where the economy and stock markets are and how bear markets play out. Is the bear market over?

Disclaimer:

All written content on this site is for information purposes only. Opinions expressed herein are solely those of FDS, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

Are We Really in a Recession?

There’s been a lot of debate about whether the U.S. is in a recession or not. As with most dialogue these days, they split the debate around political tribes. One side insists we’re in a recession while the other side says we’re not.

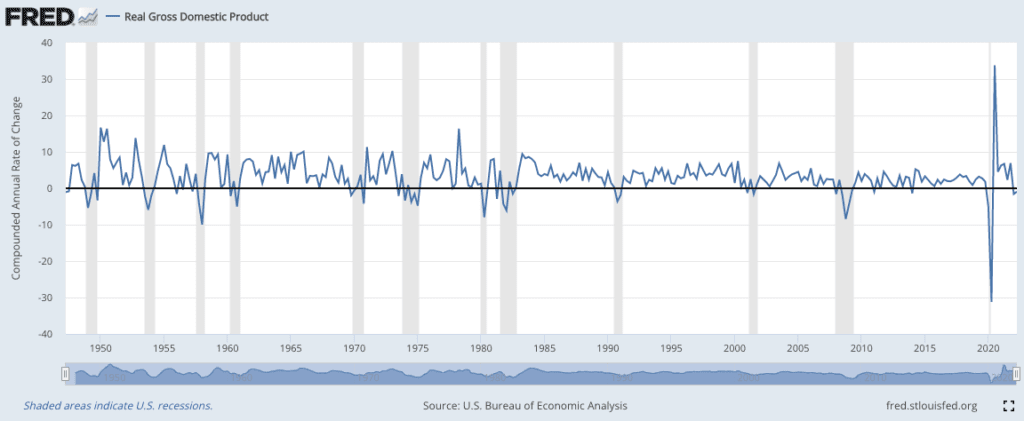

Here’s what we know. The economy has contracted for two consecutive quarters. In the first quarter, economic output fell -1.6%. And last week, the Bureau of Economic Analysis released their early estimate of the second quarter’s economic growth and estimates that it fell -0.9%.

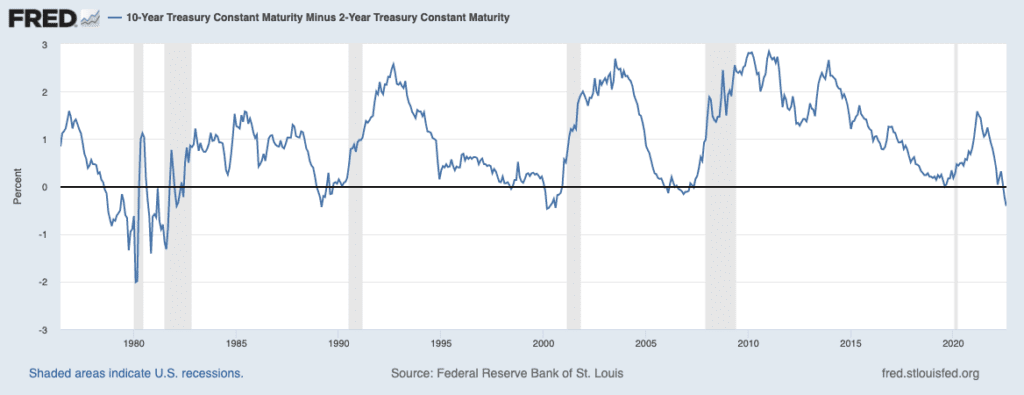

The shaded areas in the graph above are economic recessions. Any time the line has dropped below zero and stayed there for at least two quarters, we’ve been in recession. But you can see the scale of the current “recession” is quite modest compared to past downturns.

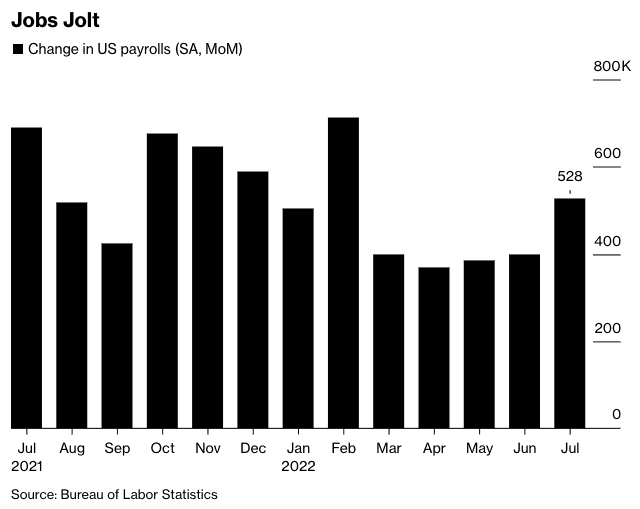

Making the recession argument more difficult is the jobs report we got last week. Jobs growth came in much stronger than expected during the month of July. And if we look at jobs growth over the last 12 months it’s hard to argue we’re in recession. The economy doesn’t GAIN jobs in a recession!

So are we in recession right now? I don’t think so. Two quarters of slightly negative growth aren’t positive, but people still have jobs and are spending. Let’s call it a slowdown.

What Does the Yield Curve Say About a Recession?

For investors, the argument about whether we’re in a recession today is irrelevant. We’re more interested in what’s going to happen versus what’s currently happening. Almost exactly 3 years ago I wrote a blog post about how the yield curve had inverted that month. The question that was posed was, “Is a Recession Coming?”

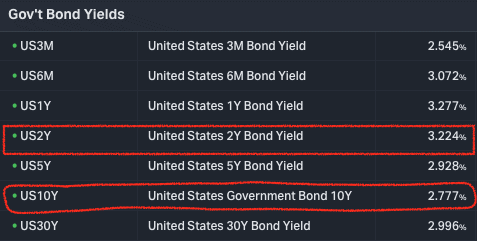

First, what is the “yield curve” and why does it matter? The yield curve plots current U.S. government bond yields across different maturities. To fund day-to-day operations, the government is constantly issuing new debt. Sometimes they’re issuing short-term debt which matures in as little as 3 months. Other times they issue debt that doesn’t mature until 30 years from now. Below, you’ll see the yield on government bonds ranging from 3 months to 30 years.

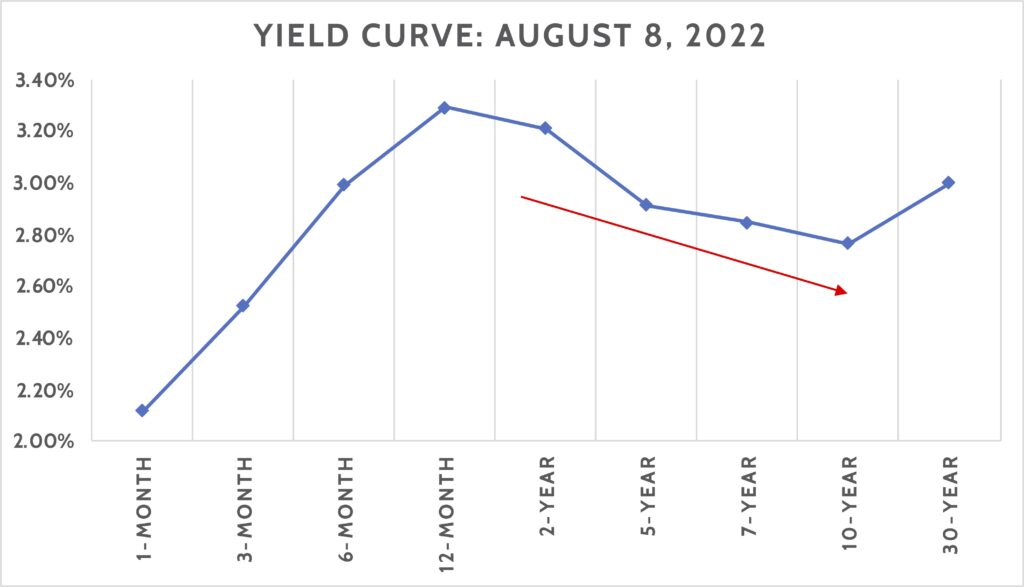

When we plot these yields on a graph, we get what’s called a “yield curve.

I highlight two key U.S. government bond yields: those with maturity of 2-years and the other with maturity of 10-years. These are two of the most important yields to focus on and understand. Why?

2-year yields are the best indicator of what bond investors expect the Federal Reserve to do with their interest rate policy. Two years is close enough in time to put some confidence in, but long enough to allow the Fed to change its policy. We can see that investors expect the Fed to continue hiking interest rates well into the 3% range from 2.50% today.

The 10-year yield is important because it’s an indicator of what bond investors believe “normal” interest rates should be. Meaning, it’s less concerned with what’s happening today, but what the market expects the world to look like after the current economic cycle runs its course.

What Yield Curve Inversions Signal

When we compare these two yields, we call this the “10/2 Year Yield Curve.” In normal times (i.e. 99% of the time) 10-year yields are higher than 2-year yields. The reason for this is simple: there’s more uncertainty about what’s going to happen 10 years from now versus what will happen 2 years from now. Investors demand extra yield for that uncertainty.

Rarely, the yield curve will “invert” where 2-year yields will be higher than 10-year yields. This normally only happens at important turning points in the economy.

Over the last 40+ years, any time the yield curve inverted, a recession was around the corner. Notably, each yield curve inversion happened at the tail-end of a cycle where the Federal Reserve was increasing interest rates.

The logic for yield curve inversions is this:

- Market sees the Fed is serious about hiking rates and slowing the economy down…

- So the market builds in higher interest rates (i.e. 2-year yields go up)…

- Market believes the Fed will be successful in slowing the economy down…

- So investors factor in lower long-term growth, which leads to a decline in 10-year yields…

- Which causes the yield curve to invert.

The current yield curve inversion matters because it suggests we’re not out of the woods yet. If a recession is a possibility in the next 12-18 months, then that’s going to matter a lot to investors. While investors waste time debating whether or not we’re in a recession today, we’re keeping our eyes peeled for what’s on the horizon.

What Kind of Bear Market Are We In?

That brings us to the stock market. The S&P 500 hit an all-time high of 4,793 on January 4 of this year. From there, it was all downhill. By June 16, the index had declined -23.5%. Any decline greater than 20% is classified as a “bear market.”

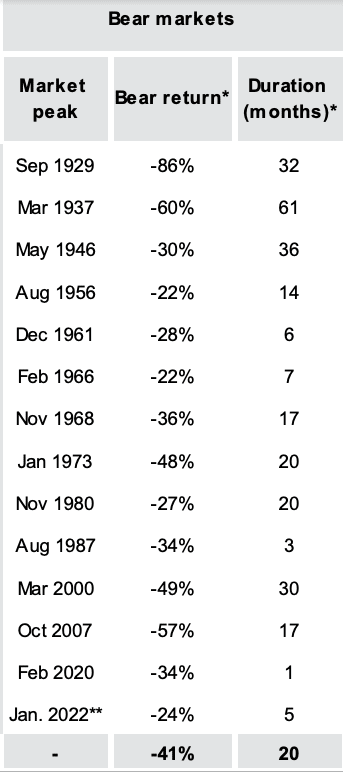

Bear markets are not uncommon. There have been 12 bear markets since the end of WWII. In four instances, the economy never went into recession. So bear markets and recessions don’t always go hand-in-hand.

Putting aside the 1930s Great Depression, the average bear market saw stocks decline -34% over about 15 months. Most of them saw declines from the mid-20% range to the mid-30% range. Many of those bear markets were driven by recessions or specific events, such as the COVID-19 bear market in March 2020. I’d call these “normal” bear markets.

However, there have been 3 “nasty” bear markets in the last 50 years. These three bear markets happened amid major structural issues:

- 1973-74: Inflation driven by oil embargos

- 2000-2002: Technology bubble burst; 9/11

- 2007-2009: Housing bubble burst; banking crisis

In each case, there were deep-seated economic issues and imbalances that took time to work out. Looking at the average length of those bear markets we can see they took almost two years to run their course.

What kind of bear market are we in? I think odds are higher than normal that we may be in a structural bear market. We’re dealing with a lot of issues right now:

- Inflation of 9%

- Federal Reserve increasing rates aggressively

- High levels of government and corporate debt

- Speculative frenzy in large cap growth stocks and “meme” stocks during 2020-2021

This isn’t a prediction that the market is doomed to drop significantly from here. Each of the nasty bear markets cited above had distinct events that turned an economic cycle into a crisis. What it may mean, however, is that investment returns are subdued for several years as we work these issues out.

Navigating Bear Markets

It’s important at this point to remind everyone that bear markets are normal. When we build financial plans for people, we make long-term investment returns. Those assumptions come from 100 years of historical stock returns. From booming bull markets to nasty bear markets and every market in between.

“Recency bias” is a well-known behavioral finance issue. That means that investors anchor their expectations based on what’s happening now, losing sight of the big picture.

We’re in a bear market in 2022. But did you know that over the last 3 years the S&P 500 is up 47%? That averages out to +13.7% returns per year over the last 3 years. And that includes the March 2020 bear market AND the current bear market.

Over any longer time period you can see that the returns on the S&P 500 have been solid and very much in-line with what we build into financial plans. And they include an array of bull and bear markets.

So that’s it? We just accept that bear markets happen and do nothing? “Invest for the long-term,” they say. Frankly, I see a lot of financial advisors talk like this and it really bothers me because it’s intellectually lazy.

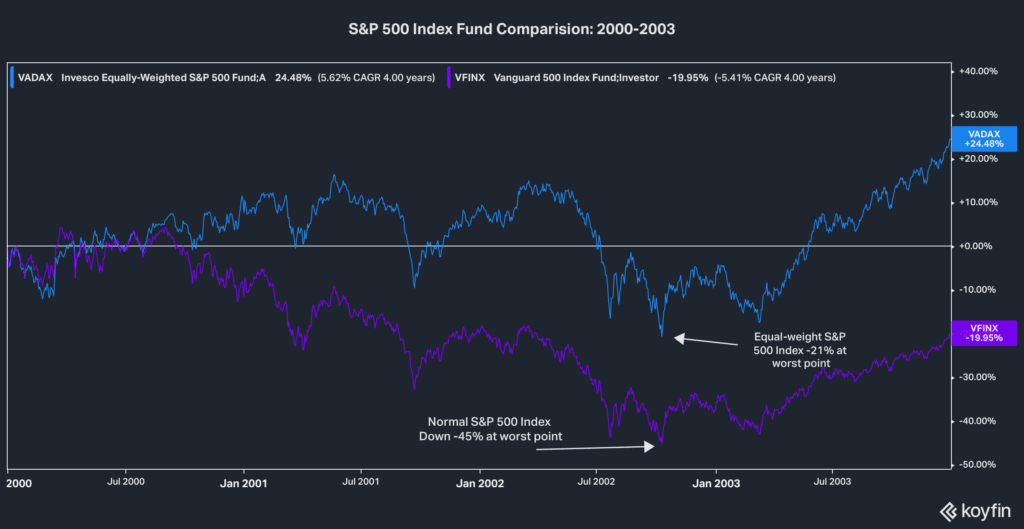

We can’t and won’t try to time markets. But we can position client portfolios for the environment we believe we’re heading into. A very simple example that I’ve highlighted before is switching to an S&P 500 index fund that weights each company equally versus a conventional index fund that weighs each stock in the index based on its market value.

No two periods are the same, but if our thesis is right about inflation becoming sticky, then the expensive growth stocks that dominate the conventional S&P 500 index will get hurt. It’s very similar to 2000-2003, when the tech bubble burst.

The blue line is an equal-weight S&P 500 index fund while the purple line is the conventional S&P 500 index fund. An investor who wisely switched to the equal-weight fund at the end of 1999 DID NOT avoid the coming bear market. But their max draw-down was -21% versus -45% for the conventional S&P fund. And after 3 years, the equal-weight investor was back in positive territory while the conventional investor was still down 20%.

We made this switch for clients just over a year ago. And earlier this year we de-risked client bond portfolios as inflation went way higher than even we thought it would.

Currently, we’re in a bear market rally that has taken the S&P 500 +14% off its June lows. There’s a good possibility that we reposition client portfolios further to protect them against the risk of a structural bear market. That may include further de-risking of bond portfolios, adding commodity exposure, or even raising cash levels. Fortunately, the cost of holding cash is going down as the Fed raises interest rates!

Is The 2022 Bear Market Over?

With the current bear market rally underway, we’re already seeing people call the end of the bear market. “A new bull market is getting underway!” I’m skeptical that’s happening – yet.

Inflation remains very high by anything we’ve seen in 40 years. And that’s forcing the Fed to raise rates aggressively. They have conditioned investors to expect the Fed to turn tail and cut rates at the first sign of trouble but my view is that the bar for easing rates is way, way higher than anything we’ve seen since the early 80s. Inflation is a political problem above all, and the pressure on the Fed to get inflation down is enormous.

Bear markets are notoriously difficult to navigate because emotions are high. They have many bear market rallies that convince people that the worst is over. And then they’re hit with another leg lower.

We will continue to fine-tune portfolios and make changes as opportunities present themselves. It’s been tough to do that so far this year because both stocks and bonds have declined. But we’re now seeing some differentiation in performance between asset classes that will make opportunistic trades more likely.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.