Surging Home Prices a Warning to Consumers

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / September 2, 2021

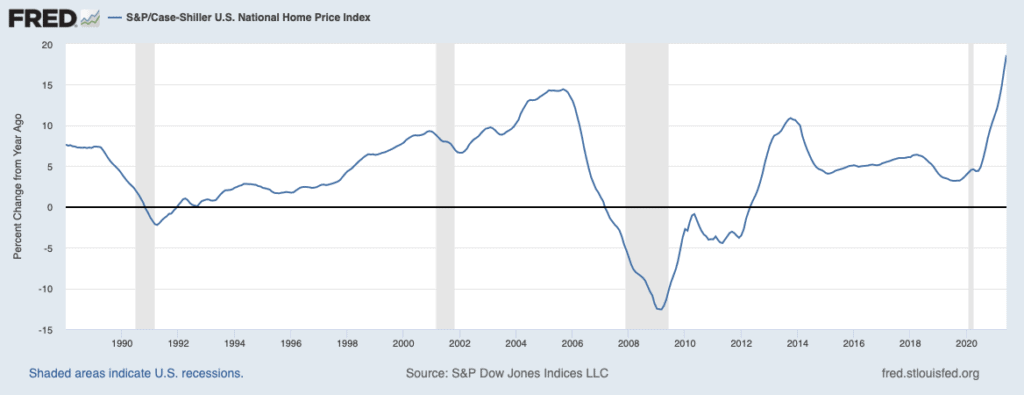

This week, the monthly Case-Shiller index of home prices in the United States logged its biggest year-over-year increase in the index’s history, dating back to the late 80s. Home prices were up an astounding +18.6% June vs. prices in June 2020. The increase was higher than what we saw during the housing bubble of 2004-2006. In our view, these surging home prices are a warning to consumers.

Biggest Increase in History for Home Prices

The Case-Shiller index is an index that measures the value of existing single-family homes of similar quality. The index we’re talking about in this week’s blog post is the nationwide home price index. There are sub-indices of home prices by region, which can vary depending on local economic conditions.

The index extends back to 1988. Since its creation, the median home price increase since 1998 has been +4.6%. This is reasonable. Inflation has averaged 2-3% for the last three decades and mortgage rates have dropped, which also pushes home prices higher.

There have only been two periods where home price increases deviated significantly from the median. From 2000 to 2006, home prices generated strong year-over-year price increases as the Federal Reserve unleashed new, unconventional monetary policy. They drove short-term interest rates down to 1.00% in the wake of the Tech Bubble bursting in 2000, which fueled home prices.

The other time home prices deviated from the norm was from 2007 to 2012. Here, home prices collapsed because of the housing bubble the Federal Reserve blew earlier in the 2000s.

As COVID-19 washed ashore in 2020, home prices barely budged. Home sales slowed as realtors and buyers/seller were trying to figure out how to execute sales in a pandemic. But again, the Federal Reserve unleashed even more unconventional monetary policy, driving short-term interest rates towards 0% and buying mortgage bonds like a drunken sailor, which pushed mortgage rates to all-time lows. One year later, we’re seeing the consequence of this policy show up in record-high home prices.

Home Buyer Beware

As mortgage rates collapsed, home buyers in late 2020 and early 2021 got busy. The pace of home sales rose and the inventory of homes available for sale dropped. Homes that had been sitting on the market for years were suddenly snatched up as buyers tried to get ahead of rising home prices.

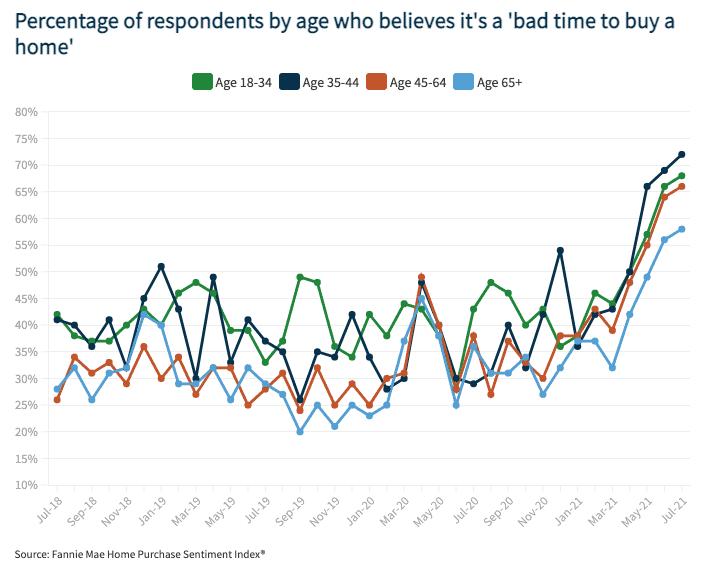

But as often happens in buyer frenzies, prices get pushed up so high that buyers pull back. We’ve seen some of this price discipline enter the housing market the last few months, as buyers go on strike.

Once again, we’re seeing an example of the unintended consequences of unconventional monetary policy from the Federal Reserve (“Fed”). Its policies drive a wedge between the “haves” and “have nots,” creating wealth inequality.

With housing, the surge in home prices is having a negative impact on young home buyers. They’re at the age of getting married and having kids – and hence, needing bigger homes – but the Fed’s kowtowing to Wall Street is killing their home ownership opportunity.

The lesson for potential home buyers is this: be careful that you don’t get caught up trying to chase the market. As recently as 15 years ago, the nation was caught up in a similar home buying frenzy. And we know how that ended.

Home Owners Beware

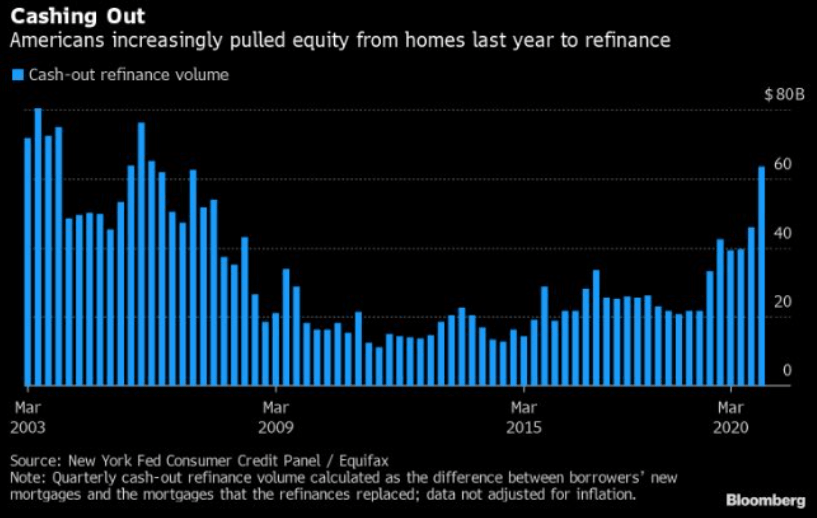

Surging home prices might seem like a panacea for those who already own homes, but they should be cautious as well. The temptation to “cash out” home equity becomes a lot harder to resist when home prices are rising and banks are encouraging you to do so.

We haven’t seen updated data on the volume of cash-out refinances, but wrote about this topic a few months ago. The point we want to make here is that history appears to be repeating itself. Back in the housing bubble, people started using their homes as quasi-ATMs, cashing out home equity every time mortgage rates dropped.

This funded consumer spending for a while. But when home prices rolled over, many consumers owed more than their house was worth! In fact, over 25% of homeowners in 2009 owed more on their mortgage than their home was worth.

The caution here for homeowners: be careful using equity in your home to fund lifestyle expenses. Sometimes a cash-out refi can make sense, such as when you’re funding specific home improvement projects. Just be careful that you’re not becoming over-reliant on cash-out refis to sustain basic living expenses. The party WILL end at some point!

Parting Shot: Beware of Surging Home Prices!

Over the last 18+ months living with COVID, Americans have been increasingly exposed to buying frenzies. It started with toilet paper and Clorox wipes, but has extended to other areas of the consumer market as well.

Financial manias can quickly suck you into something you never intended to get into. There’s something about seeing prices surge that causes us to want a piece of the action.

Make sure your family’s home ownership decision is being driven by your family dynamics. Is your family growing or will you be empty nesters soon? What school districts make sense for your kids? What do real estate taxes look like, and are they sustainable for you? Decide these factors first, and then make your move.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Set Financial Goals (According to a Coach) [Video]

Many aren't sure how to set financial goals. In this video, ICF coach Sarah Fincher shares how she works with her clients on their goals.

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.