Now Is the Time to be Looking for a New Job

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / August 26, 2021

We are in a unique moment in time for employees. Ever since the “Jobless Recovery” of 1990-1991 cost President George H. W. Bush the ’92 election, Corporate America has had the upper hand on their employees. But times are changing. Your income can be your greatest financial “asset,” creating opportunities to save, spend, and give towards your family’s financial goals. With that in mind, our view is that now is the time to be looking for a new job!

Why Have Companies Had the Upper Hand since 1990?

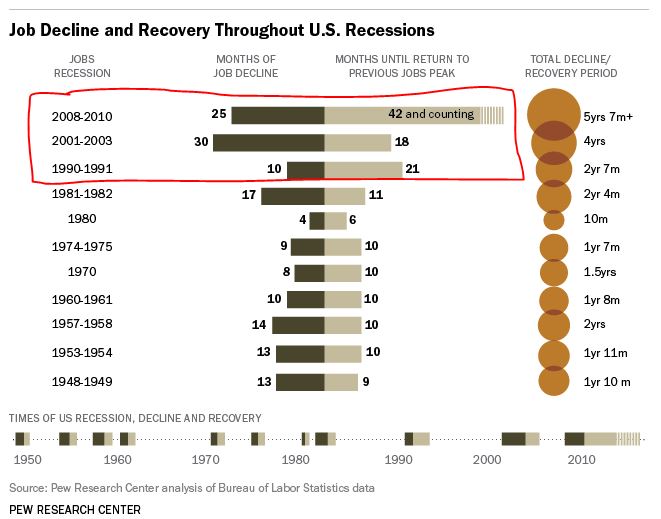

The term “jobless recovery” was coined after the 1990-1991 recession. While economic numbers improved, the rate of job growth after that recession significantly lagged the job recoveries from previous recession. The recession of 2001-2003 and 2008-2010 exhibited the same “jobless recovery” pattern seen in the early 1990s.

Pew Research Center published a report in 2013 comparing job recoveries after recessions. As seen here, the most recent recessions have seen significantly slower job recoveries vs. those recessions before 1990.

Why has this been happening? Economists have been debating this topic for years. Some of it is because of companies becoming more sophisticated with staffing, such as moving labor offshore. But from our point of view, we think it’s been a simple case of labor supply out-stripping the demand for labor.

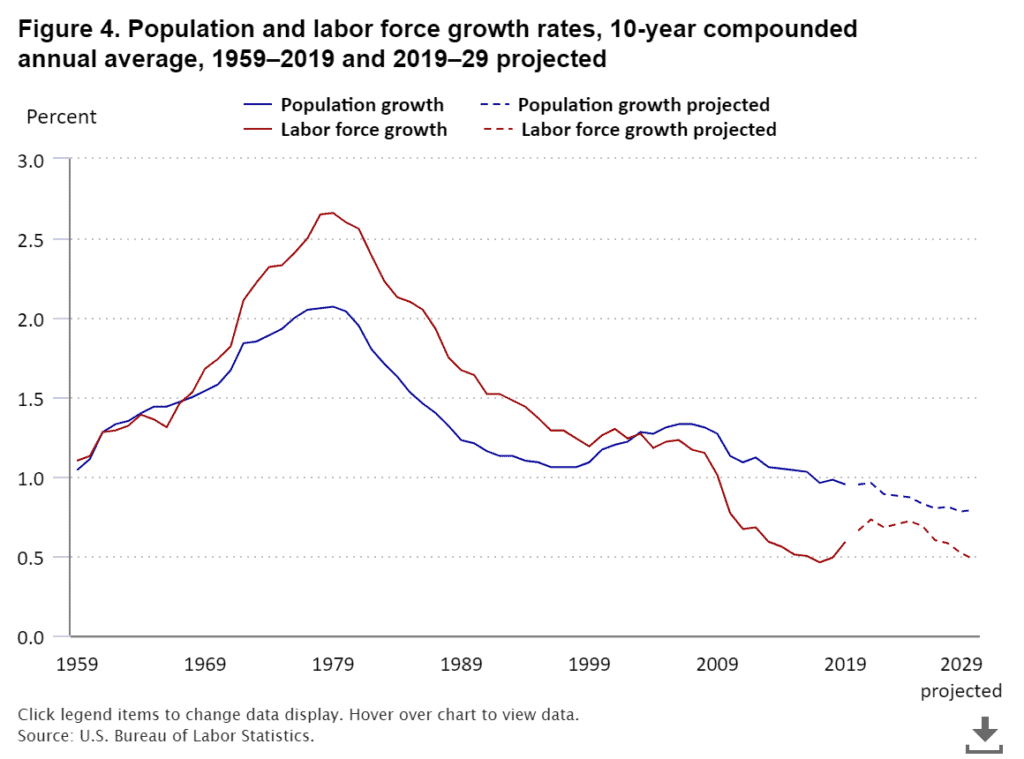

This chart from the Bureau of Labor Statistics (“BLS”) compares U.S. population growth vs. the growth in our country’s labor force. As women started entering the workforce in the early 1970s, labor force growth surged well-above the rate of population growth. To us, this is one of the key reasons companies have had the upper hand against their employees.

What’s notable in this chart is how this dynamic has changed in the last 10 years. As Baby Boomers retire, the pool of available labor is shrinking. In 2019, the BLS projected this dynamic to continue through the end of the decade. However, COVID has clearly exacerbated this labor “shortage.”

Labor Getting the Upper Hand on Companies

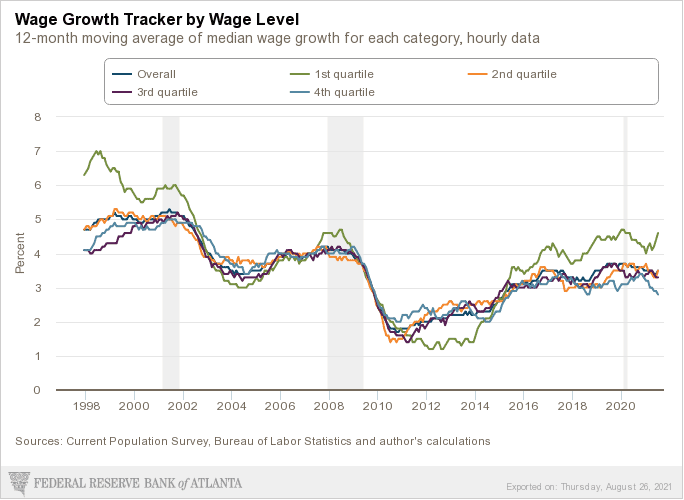

Even before COVID, evidence emerged that labor supply was running short of the demand for labor. Wage growth rose from an average of 2.0% from 2010 to 2015 to 3.0-4.0% from 2016 thorough the onset of COVID in early 2020. Lower-wage workers were particularly benefitting from this dynamic, seeing wage growth north of 4.0% for the past several years (green line, below).

Since the onset of the COVID crisis and subsequent jobs recovery, evidence is building that labor continues to have the upper hand over companies. We’ve all seen this as we visit restaurants and businesses. Help wanted signs are everywhere. On my recent trip to Best Buy, they didn’t even have their checkout lines open as they only had two people “checkers” working, both of whom were staffed to the customer service desk.

The labor shortage is so bad that job openings have surged to all-time highs.

We’ve addressed reasons for this labor shortage in previous posts. Many economists believe this labor shortage will ease with the expiration of extra COVID unemployment help. We aren’t so sure. The fact of the matter is that the pool of labor (first chart above) is lower than population growth suggests to us that labor will continue to have the upper hand for the foreseeable future.

Job Switchers Have Higher Wage Growth than Job Stayers

Let’s get to the good news. This labor shortage is finally giving the upper hand to employees for the first time in decades. The chart above shows this – the percentage of small businesses intending to raise wages is at an all-time high (bottom of the chart).

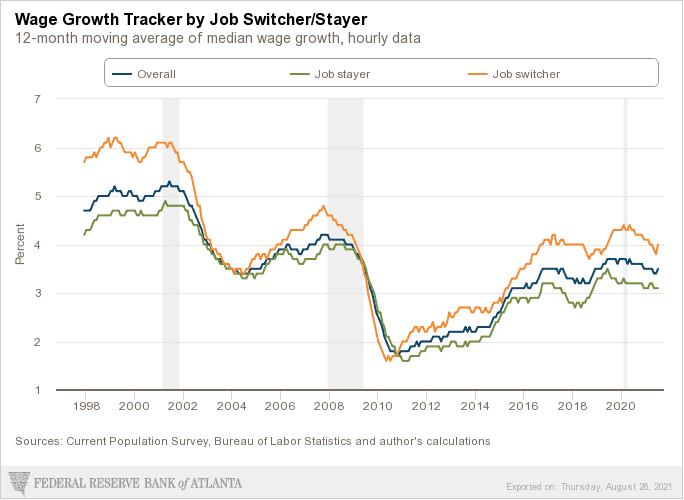

Historically, there’s evidence that those who switch jobs regularly end up getting higher wage growth. The Atlanta Federal Reserve had data that compares wage growth between Job Switchers and Job Stayers. On average, Job Switchers have experienced wage growth about 1.0% higher than those who stay at their jobs.

Anecdotal evidence from clients and other acquaintances bears this out. We’ve heard example after example of a client/friend getting a substantial boost to their income and benefits from switching jobs. Sometimes as high as a 50% increase! Of course, that’s an exceptional increase. But it’s clear that companies are getting increasingly desperate to fill job openings.

Now Is the Time to be Looking for a New Job!

Let’s summarize the situation:

- The pool of available labor is now growing LESS than overall population.

- Job openings are at an all-time high.

- Job switchers have better wage growth than those who stay at their companies.

If you’ve ever thought about changing jobs, now is the time to do it! The environment for winning a job that pays you more than what you’re getting now is as good as it’s been in a long time.

This goes for everyone, from executive-level employees at big companies to front-line workers. There are intangible benefits to changing jobs, as well.

Advancing your career. Have you been stuck at your company waiting for your boss to give you a promotion? Maybe it’s time to force the issue and see if you can get that promotion somewhere else.

Getting better benefits. COVID has changed everything. Working from home is now an acceptable means of employment. Companies are offering better paternity benefits to both Mom and Dad. Childcare benefits are increasing. Some companies are even offering to pay off a portion of your student loans. In short, companies are trying to entice people with better benefits.

Moving to a new state. If you’ve wanted to move to a new state, the current job market makes that possible. If you own a home, there’s been no better time to sell your house if you need to move.

And of course, more money! You’d be surprised by how much you’re worth to another company. Check it out!

Executive Job Changers: Make Sure You Negotiate Your Equity Compensation!

For executives at large companies and many workers at tech companies, equity compensation is a major piece of the compensation puzzle. Don’t let this go to waste if you’re looking at a new job.

If you’re sitting on a substantial amount of vested or unvested equity compensation, mention that to the company you’re applying to. Same thing with deferred compensation or even pension benefits.

Companies that are recruiting new workers are more willing to “match” any equity-based compensation you’d lose if you quit your current job. So don’t be afraid to put that on the table during negotiations. Remember, you have the upper hand.

Conclusion

Companies have had the upper hand over workers for so long that they have conditioned us to believe that we can’t negotiate with our current employer or find something better elsewhere. Hogwash. The supply/demand for labor has shifted in workers’ favor and is expected to remain that way for years to come.

Even in poor job markets, job switchers have earned higher wage growth than those who stay at their old jobs. But now, many job switchers are being rewarded with step-function increases in pay and benefits, even for doing the same job as they were before.

Being happy with your job is extremely important. Work is necessary, so you might as well enjoy what you do. You have a chance right now to find that ideal job. Take a chance. From a financial standpoint, a new, higher-paying job may open up new opportunities to save for the future or do things that have been sitting on your bucket list for years.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Choose Open Enrollment Benefits

Open enrollment season is almost here! It's time to get familiar with all the benefits your company offers you this year. Our guide will help you understand the most common open enrollment benefit options, and how best to choose open enrollment benefits.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.