NQSOs versus ISOs: What’s the Difference?

by Financial Design Studio, Inc. / June 8, 2023

Stock options can be one of the most valuable forms of executive compensation. They can also be the trickiest to manage when it comes to taxes. There are two flavors of stock options. These are offered to executives at private and public companies: Non-qualified Stock Options (“NQSOs”) and Incentive Stock Options (“ISOs”). Each has their own tax rules to follow, and careful planning is imperative, especially if you’re a high-income earner. In this post we’ll explore the topic, NQSOs and ISOs, What’s the Difference?

Stock Option Basics

Before discovering the differences between NQSOs and ISOs, let’s first look at what they have in common with each other. The concept of how stock options work is like that of another form of compensation, Restricted Stock Units (“RSUs”). There are three key stages for both types of options and for RSUs.

Stage 1: Granting of stock options

Regardless of which type of option you’ve been granted – NQSOs or ISOs – the granting stage is the same. The company wants to reward you to work hard and stay with the company for a long time. Giving you stock options is a way to do that. As the value of an option increases as the value of the company increases.

There’s nothing for you to do when you’re granted stock options, as they won’t have value until you earn them. But keeping track of the options they have granted you helps you plan for the future.

Stage 2: Vesting of stock options

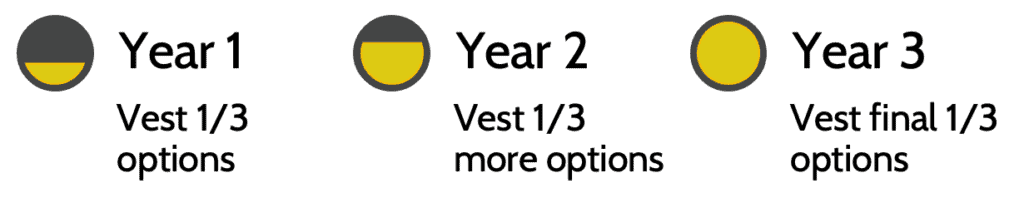

The value of stock options won’t become real for you until the options “vest.” This is a fancy way of saying you have to do certain things to earn the options.

The most common way to vest stock options is time-based. For example, your company might say that you have to work for them for at least 3 years in order to fully earn your stock option grant. Each year, you earn a portion of the options that were granted to you, as shown below.

Make sure you understand how your company’s option vesting schedule works, as it may differ from the example above.

Stage 3: Exercise & Invest stock options

The final stage that’s common between both types of stock options is the “invest” stage. This is where you make a conscious decision to exercise your options and start owning stock in your company.

The most important consideration when exercising stock options is to realize that you need to pay cash for the shares you exercise! For example, if you are exercising 1,000 options with an exercise price of $10/share, you need to come up with $10,000 cash to pay for the purchase of those shares.

That can be a big hurdle for many employees. Fortunately, if you work for a publicly traded company, you can likely sell some shares to cover the cost of the exercise and any taxes you may owe. This is called a “cashless exercise” or “sell to cover” strategy. Many brokers will take care of this for you when you exercise shares. You’ll receive a “net” amount of shares less the cost of exercise and taxes.

However, if you work for a privately held company, exercising stock options is more complicated. In most cases, you’re not allowed to sell shares you exercise because the company is not publicly traded. Hence, you’ll need to consider the cash flow needed to exercise shares in a privately held company before you do it.

What are Nonqualified Stock Options?

Nonqualified stock options (“NQSOs”) are the most common form of stock options given to employees. You can learn more about them in our video on NQSOs. They’re most popular with publicly traded companies and offered to many executives at these companies.

Why are these options called ‘nonqualified’? It’s a tax term meaning that the IRS doesn’t give these types of options any special tax treatment. We’ll get into how taxes work with NQSOs below.

Finally, there’s no limit to how many NQSOs your company can grant to you. They can grant you as much – or as little – as they want.

What are Incentive Stock Options?

Incentive stock options (“ISOs”) are a special type of stock option that enjoys special tax advantages if done correctly. You can watch our video on ISOs to learn more! ISOs are a popular form of compensation for early stage, non-public companies. They offer employees a turbo-charged way to get tax-favored exposure to their company’s future growth. Which can become quite valuable if the company goes public in an Initial Public Offering (“IPO”).

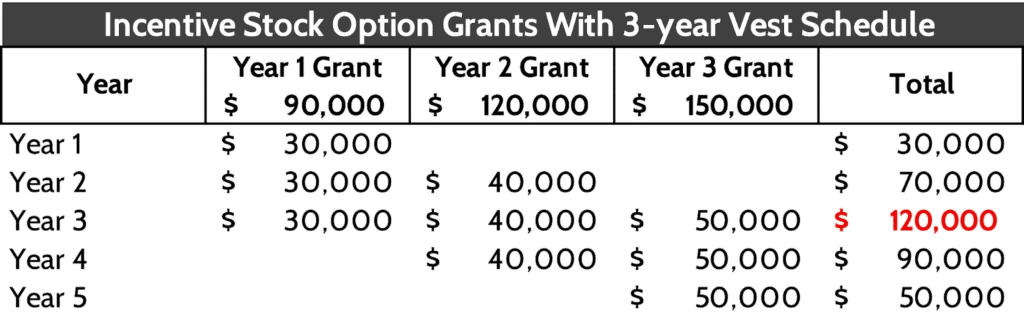

Unlike NQSOs, the IRS applies a $100,000 limit to the value of ISOs that qualify for favorable tax treatment. The limit applies to each calendar year and is based on the value of ISO grants that vest that year. Here’s an example of how this limit works.

This employee received an increasing amount of grants for three years. It’s okay that in Year 2 and Year 3 they received grants worth more than $100,000. This is because the grants vest equally over three years, so the entire amount doesn’t vest at once.

However, in the third year, we can see that the total value of vesting grants from Year 1, 2, and 3 equals $120,000, more than the IRS limit. What happens? The first $100,000 of vesting ISOs will get favorable ISO tax treatment, but the IRS will treat the remaining $20,000 as NQSOs, which are less tax favorable.

Both ISOs and NQSOs offer the potential to build substantial wealth in your employer stock. They’re granted similarly and vest similarly. But the tax treatment is different.

Tax Treatment of Nonqualified Stock Options (NQSOs)

The mechanics of NQSO taxation is like that of Restricted Stock Units (“RSUs”). The major difference between NQSO and RSU tax recognition is that you have more control over when you realize taxes with NQSOs.

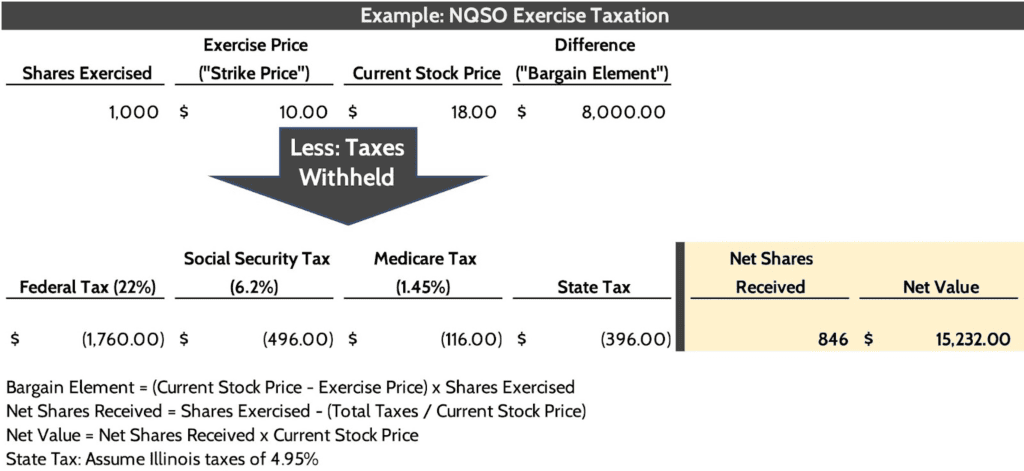

You realize taxes on NQSOs when you exercise the options. You get to choose when you exercise NQSOs, as long as it’s before they expire. These are the key things to know about NQSOs and taxes.

- What kind of tax? Ordinary Income taxes; similar to taxes on wages.

- When? When you exercise NQSOs.

- What’s taxed? The difference between the current value of the stock and the exercise price of the options, called the “bargain element.”

- Are taxes withheld? Yes, taxes are withheld for Federal, State (if applicable), Social Security, and Medicare. This is done by automatically selling enough shares to cover the required tax withholdings (called “sell to cover”).

Here’s an example of how an NQSO exercise would be taxed.

NQSO Tax Strategy

The tax strategy for when to exercise NQSOs comes down to your current and future tax brackets. This is very important if you’re a high income earner already in a high tax bracket, or someone whose income is close to pushing you into a higher tax bracket.

In the example above, the “bargain element” is what drives your taxable income higher. $8,000 will not make a huge difference for most people. But we’ve seen lots of examples where executives are exercising options with a bargain element in the hundreds of thousands of dollars. That can cause an unwanted tax bill when you file your taxes.

What are the key considerations to think about when exercising NQSOs?

- How long do you have before the options expire? If you have options that are “in the money” and expiring soon, you’d want to prioritize those as you’ll lose the opportunity once they expire.

- How much room do you have in your current tax bracket before getting pushed into a higher bracket? This is often called “filling up the bracket,” where you exercise just enough shares to keep you in the bracket you’re in.

- Rank your vested stock options from highest to the lowest bargain element. If you know how much room you have to “fill” your current bracket, then you can choose the options that will generate just enough bargain element (i.e. income) to fill that bracket.

At Financial Design Studio, we help executives with their current year, and future year tax planning. This helps us strategize which option exercises are best for your situation, with the goal of minimizing taxes that you have to pay.

Tax Treatment of Incentive Stock Options (ISOs)

If you’ve been granted Incentive Stock Options (“ISOs”) it’s highly recommended to engage with a financial advisor and tax planner before exercising your options. That’s not a self-serving statement on our part. Taxation for ISOs is complicated and can cause large tax bills and can even put you into the Alternative Minimum Tax (“AMT”). This is especially true for employees at high-growth private companies.

ISOs are special because you can pay capital gains tax rather than ordinary income taxes, as with NQSOs. For high-income earners, the capital gains tax rate is almost always lower than their ordinary income tax rate. This difference in tax rates can save you a lot of cash when you exercise ISOs.

Getting that favorable capital gains tax treatment is tricky. It not only raises the prospect of having to pay AMT taxes, but it requires you to hold the stock for more than a year. This holding requirement can create a mismatch between the cash needed to exercise the options (i.e. buy the stock) and receiving cash proceeds from the sale of the stock.

There are two ISO tax treatments to be aware of. The IRS refers to each as a type of “disposition,” which means nothing more than selling the stock you receive from exercising options.

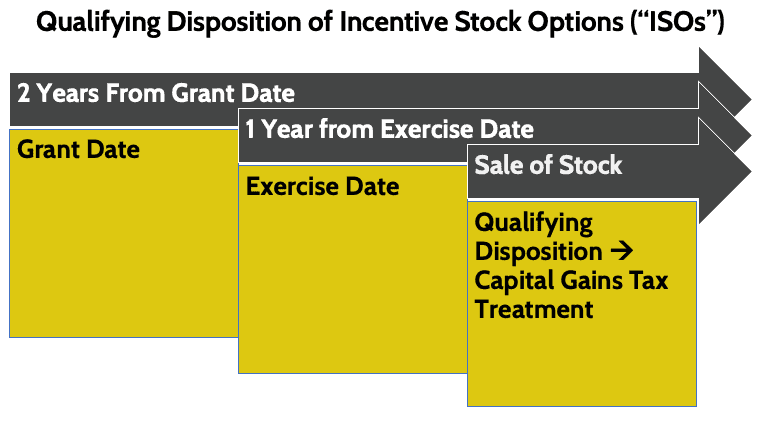

Qualifying Disposition Rules for ISOs

“Qualifying disposition” is unique to ISOs and is why they can be tax helpful. By fulfilling both requirements, you’re allowed to pay capital gains tax on the difference between the option’s exercise price and the price that you eventually sell the stock at. You must meet BOTH of the following rules to meet a Qualifying Disposition.

- Hold the stock for at least two years after the Grant Date of the options, and

- Hold for at least one year after the Exercise Date

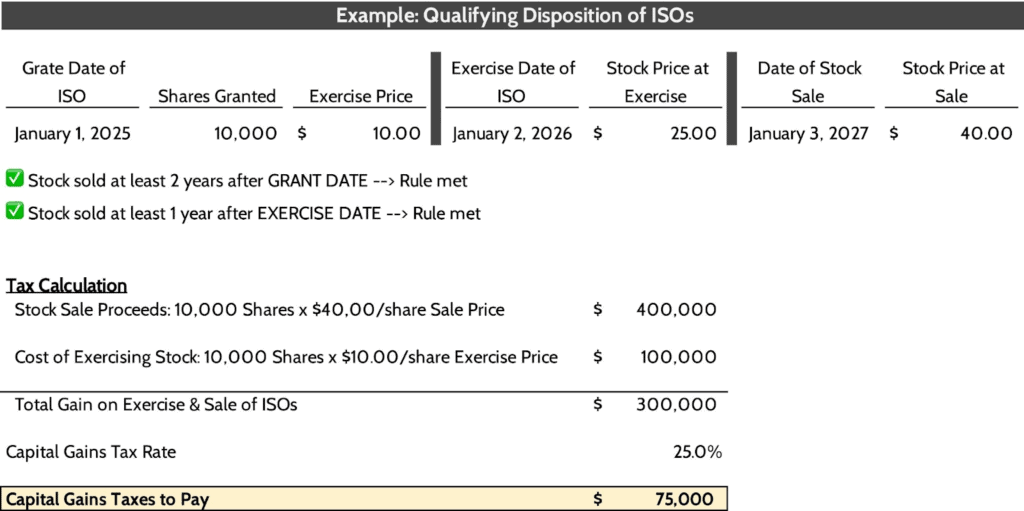

Here is a numerical example of how a Qualifying Disposition of ISOs works.

A $75,000 tax bill is nothing to sneeze at. But remember, if these were NQSOs, the employee would owe ORDINARY income taxes, with Federal tax brackets topping out at 37%.

Risk of Pursuing a Qualifying Disposition of ISOs: Alternative Minimum Taxes

Saving taxes is great. But there’s one key risk to pursuing a Qualifying Disposition strategy to be aware of: the Alternative Minimum Tax (“AMT”). Many people don’t realize this, but when you file your taxes each year, your potential tax liability is being calculated on two parallel systems; the ordinary income tax system, and the Alternative Minimum Tax system. Whichever resulting tax liability is higher is what you pay.

For over 90% of Americans, the tax liability calculated under the ordinary income tax system is higher than what’s calculated under AMT. For that reason, few people ever have to deal with AMT. But AMT can often come into play when exercising ISOs. How?

Under the Qualifying Disposition rules for ISOs, when you exercise the options, you must report the “bargain element” on your tax return. The Bargain Element is the difference between the price of the stock on the day you exercise options less the exercise price. Then you multiplied that by the number of options.

In the example above the bargain element would = 10,000 shares x ($25 price on day of exercise – $10 exercise price) = $150,000.

That $150,000 number is then fed into the Alternative Minimum Tax system and taxed at either 26% or 28%. If the resulting tax liability under AMT is higher than your tax liability calculated under the ordinary income tax system, then you owe the higher AMT taxes.

What To Know About the AMT

This can be very problematic for the employee, as they face two “cash calls” from exercising ISOs if they intend to pursue a Qualified Disposition strategy:

1) Cash needed to buy the stock; in the above example, $100,000 (10,000 shares x $10/share exercise price).

2) Cash needed to cover AMT tax liability when they file taxes the following year.

Remember, when you pursue a Qualifying Disposition strategy, you cannot sell the stock before you meet both holding period requirements! That means you aren’t able to sell stock to help pay any AMT tax you may owe.

Pro Tip: If you’re going to exercise ISOs and pursue a Qualifying Disposition strategy, calculate your potential Bargain Element first (Current price of stock – Exercise price x # of shares exercised). If that amount is greater than $80,000 for Single tax filers or $125,000 for Married tax filers, it’s highly recommended you speak to a tax professional before you exercise any stock.

Disqualifying Disposition Rules for ISOs

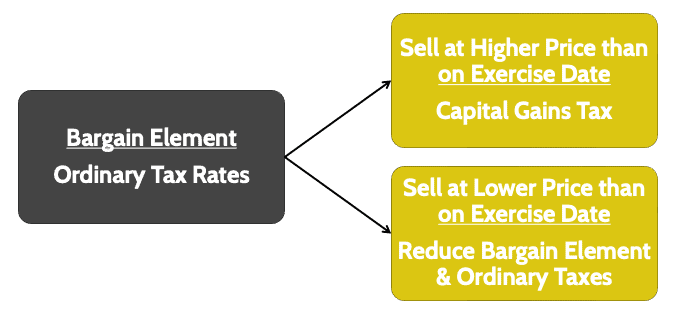

The other tax treatment of exercising and selling ISOs is a Disqualifying Disposition. This is IRS-speak for not being able to get lower capital gains treatment for your stock sale.

ISO Disqualifying Dispositions look a lot like the tax rules for NQSOs with two major differences:

- You are NOT taxed when you exercise ISOs, only when you sell the stock, whereas NQSOs are taxed when you exercise the options.

- There are no tax withholdings for ISOs, and they aren’t subject to Social Security or Medicare taxes.

Other than those two differences, the tax treatment is the same as NQSOs, as you pay Ordinary income taxes on the “bargain element” and capital gains tax on any gain above the price on the day you exercise your options.

Summarizing Differences Between NQSOs and ISOs

Bottom Line: Stock Options Require Careful Planning

We offer tax preparation services as part of what we do at Financial Design Studio. And tax preparers know! It’s that clients don’t enjoy negative surprises when they file their taxes.

If you’re an executive and high-income earner with stock options, it’s in your best interest to work with a financial planner or tax advisor before exercising options. Fortunately, you get both services when you work with FDS!

As you’ve seen in this post on stock options, they are a complicated financial planning issue. We have the experience of helping executives decide when to exercise their options in a tax-efficient way. And since we do tax planning, we can help plan future exercises as well.

Stock options have the potential to create a lot of wealth for executives and employees of early-stage companies. Taxes are obviously an important part of stock options planning. But the genuine joy is helping clients decide what to do with stock option wealth. Can you retire early? Can you donate appreciated stock to your favorite charity? Maybe you’re able to fund your children’s college education.

The possibilities are endless. If you’re looking for confidence in exercising your options and planning for the future, please reach out to us and we can help you!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

How to Choose Open Enrollment Benefits

Open enrollment season is almost here! It's time to get familiar with all the benefits your company offers you this year. Our guide will help you understand the most common open enrollment benefit options, and how best to choose open enrollment benefits.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.