Donating Appreciated Stock: Save On Taxes & Help Those In Need

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / December 7, 2022

Americans give more than $450 billion a year to charity, with the vast majority made up of individual donations. When people think of giving a donation, they usually think about giving in cash, checks, or credit cards. But as stock ownership has increased in the United States – particularly for corporate executives who receive restricted stock options as part of their compensation – the opportunity to donate stock has also increased.

If you own a stock that has gone up in value, you have a great opportunity to save on taxes and help those in need at the same time. How? By donating appreciated stock to your favorite charity. In this post, we’ll cover:

- The Double Tax Benefit of Donating Appreciated Stock

- Rules for Gifting Appreciated Stock

- The Charitable Deduction Limitations for Donating Appreciated Stock

- Gifting Appreciated Company Stock for Corporate Executives

- How to Donate Appreciated Stock to a Charity

The Double Tax Benefit of Donating Appreciated Stock

There are two ways to minimize your tax bill. You can avoid creating a taxable event that causes you to owe taxes. Or you can strategically lower your taxable income by taking advantage of tax deductions.

When you donate appreciated stock, you’re avoiding paying capital gains taxes you’d otherwise have to pay in the future. But you’re also lowering your taxable income today, which can save you taxes, particularly if you’re in a high tax bracket.

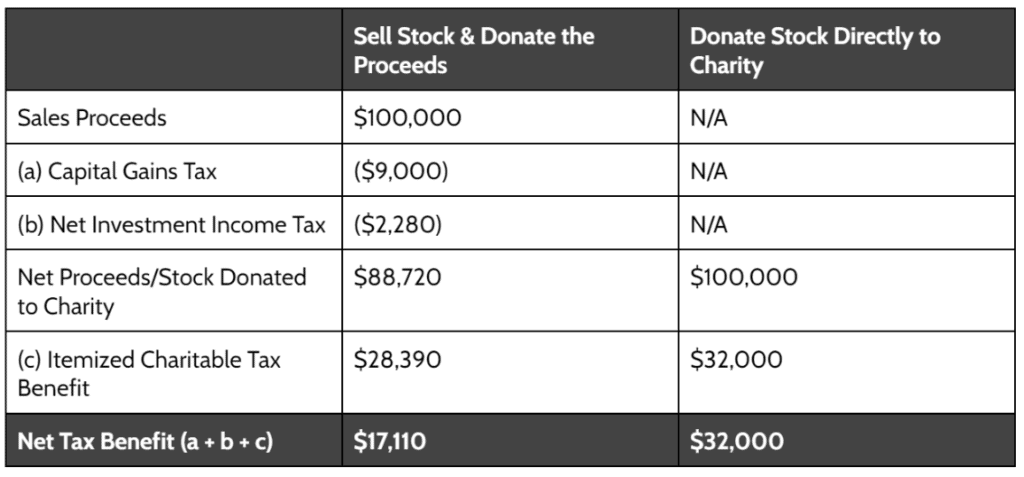

To see how this works, let’s use a hypothetical example of a married couple looking to donate to their favorite charity this year.

This couple has accumulated a stock holding currently worth $100,000, which they’ll use to donate to charity. They paid $40,000 for the stock several years ago, leaving them with a $60,000 unrealized taxable gain.

There are two ways they can donate this stock to charity.

- Sell the stock and donate the net proceeds (cash) to charity.

- Donate the stock directly to charity.

Notice what happens here.

If they sell the stock and donate the proceeds, they’ll have to pay $11,280 of taxes on the sale of the stock. These taxes would be offset by $28,390 of tax benefits from their itemized charitable deduction. That’s not a bad outcome, but they can do better.

If instead they donated the stock directly to charity, they’d avoid having to pay capital gains and net investment income taxes. Even better, they’d be able to deduct the full and fair market value of the stock when they itemize the charitable contribution on their tax return.

By donating appreciated stock, you effectively get a “double” tax bonus.

> Don’t pay taxes on the sale of the stock

> Get a larger itemized charitable deduction

Not only that, but in this example, the charity would receive over $11,000 more! That’s how donating appreciated stock can save on taxes and help those in need at the same time.

Rules for Gifting Appreciated Stock

There are some rules and limitations to be aware of for gifting appreciated stock. And there are limitations to the deductibility of charitable donations to be aware of covering all types of donations, not just stock.

First, you must have held the stock for at least one full year in order to get the benefit of deducting the full market value of the stock you donate. In tax terms, the stock must be in a “long-term capital gain position.”

Second, the donation must be made to a 501(c)3 charitable organization. Notably, a Donor Advised Fund (“DAF”) qualifies as a 501(c)3 organization, so you’d be able to donate appreciated stock to your DAF.

Third, to get the full “double tax bonus” from donating appreciated stock, you must itemize your deductions. If the value of your gifted stock isn’t higher than your standard deduction ($12,550 for Single; $25,100 for Married Filing Joint) then you won’t be able to deduct the value of your gift, but at least you’ll avoid the capital gains on the stock you donated.

What are the Charitable Deduction Limitations for Donating Appreciated Stock?

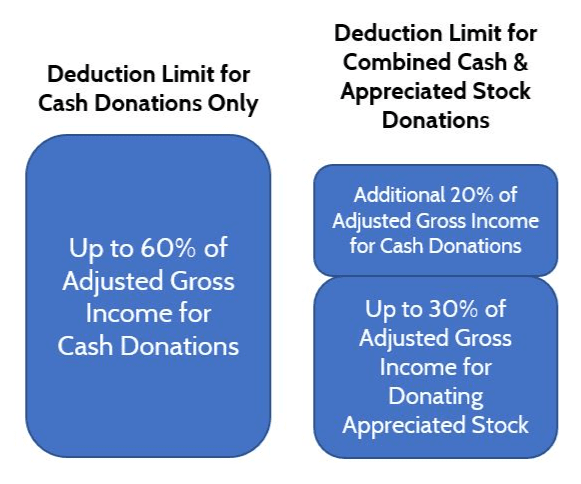

Current tax law limits the amount of charitable contributions you can deduct from your taxes to a certain percentage of your Adjusted Gross Income (“AGI”). However, if you’ve given more than you’re allowed to deduct this tax year, you can still carry forward the unused portion of your deduction for up to 5 years.

As with tax law, the rules aren’t 100% straightforward. The IRS places different deduction limits depending on whether you give cash or an asset, such as appreciated stock. For the sake of simplicity, we’ll only look at the rules for cash and donated stock to qualified charities.

The IRS will allow you to claim a charitable deduction of up to 60% of your AGI if all of your donations are in cash. However, if you donate appreciated stock, they limit the total deduction for appreciated stock to 30% of your AGI.

While this might seem unfair at first, remember that you’re not having to pay capital gains and net investment income tax on the stock you’re donating. And you can always carry forward any unused portion of your appreciated stock donation.

Let’s go back to the example of our married couple above with $400,000 of AGI.

Example A: They give $200,000 cash to a charitable organization. Since they only gave cash, they’ll be able to deduct the full $200,000 since that amount is below their $240,000 limit, which we get to by multiplying $400,000 of AGI by 60%.

Example B: They give appreciated stock valued at $200,000 to a charitable organization. Because they’re giving a non-cash gift, they’ll only be able to deduct $120,000 this year [$400,000 AGI x 30%]. The remaining $80,000 that they can’t claim this tax year is carried forward and claimed in the next five years.

Gifting Appreciated Company Stock for Corporate Executives

One type of investor may find the idea of gifting appreciated stock attractive: Corporate Executives. In today’s world, many companies offer employee stock purchase plans (ESPP), stock options, and restricted stock units to their executives. This can mean that a substantial part of an executive’s net worth becomes tied to their employer.

Reason #1 for Executives to Donate Appreciated Stock: Diversification. We often find that executives have a lot of exposure to their employers. Not only is their income dependent on their continued employment at the firm, but they may have a lot of investment exposure to their company’s stock. If an executive has accumulated stock because of stock options exercises, RSU vesting, or stock purchase plans, it may be prudent to reduce exposure through charitable gifting of your company’s stock.

Reason #2 for Executives to Donate Appreciated Stock: Rebalancing of investments. Besides reducing investment exposure to one’s employer, donating company stock can also help keep your stocks and bonds allocation in-line with your age and financial goals. This is especially true if you’re late in your career and have accumulated wealth in company stock.

How to Donate Appreciated Stock to a Charity?

Many charities will accept donations of appreciated stock. Once donated, it would be up to them to sell the stock to get cash, which can be used for the organization’s mission.

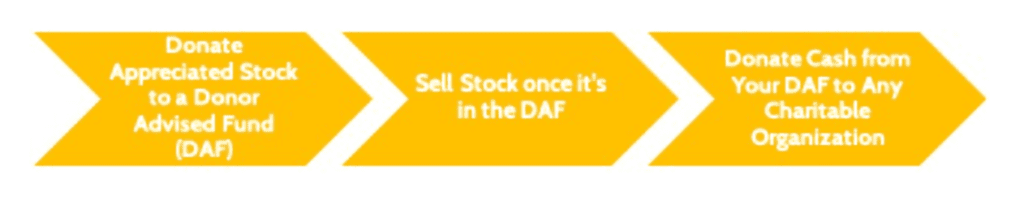

Sometimes small charities or ministries aren’t set up to accept stock donations. What can you do in that case?

The answer is to open a Donor Advised Fund, or DAF for short. DAFs are like 501(c)3 charities, just like any church or other nonprofit you might give to. Most custodians, such as Schwab or Fidelity, offer Donor Advised Fund accounts on their platform.

The benefit of donating appreciated stock to a donor advised fund is that it’s easy to sell the stock to generate cash. And once your DAF has cash, you’re free to give to any qualifying charitable organization you’d like to.

One important note: Just like donating to a charity, you can’t reverse a donation you make to a Donor Advised Fund. So make sure you’re prepared to part ways with your stock before you move it to a DAF.

Donating Appreciated Stock: Save on Taxes & Help Those in Need

You’ve seen how donating appreciated stock can give you “double” bonus tax savings. But more important is the fact that the charity you’re donating to might receive more help than if you were selling the stock and donating cash. And that’s really the point, isn’t it?

As you consider whether gifting appreciated stock is right for you, we advise you to work with a tax professional or financial advisor before pulling the trigger. Since gifts to charities are irreversible, you want to make sure you’re doing everything correctly.

At Financial Design Studio, we help clients achieve their charitable desires within their financial plan. We can help open up and manage a Donor Advised Fund. And since we have in-house tax planning, we’re able to make sure you get the full tax benefit of your generosity. If you have questions about this topic or your finances in general, schedule a call with us to see how we can help!

Ready to take the next step?

Schedule a quick call with our financial advisors.