A Guide to Restricted Stock Units

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / May 24, 2023

Equity compensation is an important part of executive pay packages that can create long-term wealth. Stock options, restricted stock units, and employee share purchase plans are some of the popular forms of executive compensation. Unfortunately, the rules for each form of compensation can be confusing, and there can also be meaningful tax implications. This Guide to Restricted Stock Units will help you understand how RSUs work and how you can best plan for them.

What are Restricted Stock Units?

Restricted stock units (“RSUs”) are a promise by your employer to give you shares of stock in the company for meeting certain conditions. Your company may give you RSUs in addition to a cash bonus, or sometimes pay a portion of your bonus in RSUs instead of cash.

Why do companies offer RSUs? As one RSU plan document we’ve seen says, “…the purpose of the program is to attract and retain outstanding directors, officers, and other employees…” RSUs are a form of incentive compensation.

The good news with RSUs is that their mechanics are pretty straightforward. There aren’t many decisions for you to make. But RSUs can significantly impact your taxes and investment plan, so knowing how they work is important. We also have video on RSUs, that you can find here!

To start, there are three distinct stages in the life of RSUs, from when they’ve been granted to you to when you receive the stock.

We will go through each of these stages in more detail, but the way to think about these stages in plain English is:

- My company is giving me the right to receive stock (i.e. the “grant”)…

- If I meet certain conditions, such as working for the company for a few years (the “vest”)…

- And if I do that, they will give me shares in stock that I can keep or sell (“invest”).

With that as an overview, let’s look at each of these stages in more detail.

Granting of Restricted Stock Units

Companies that use RSUs as compensation usually grant shares to employees on a set schedule. For example, you may work for a company that does employee reviews and gives out bonuses early in the year. Granting RSUs to you would be logical, as they are a form of “incentive” pay.

To help you visualize the life cycle of RSUs, we’ll use the same example throughout this blog post.

- Grant Date: January 1, 2024

- Shares Granted: 1,000

- Vesting Schedule: 4-years, with 1-year cliff

- Stock Price on January 1, 2024: $50/share

When you are first granted RSUs from your employer, nothing really happens. The employee here would “have” 1,000 shares of RSUs. But they wouldn’t have any value as the employee has not yet met the vesting requirements. Since RSUs have no value to you on the Grant Date, there aren’t any tax consequences either.

Even though they have no value to you today, you can estimate their potential value. Here, the employee is receiving the right to receive 1,000 shares of stock that’s currently worth $50/share. So the potential value of these shares is $50,000.

Knowing the potential value is important! There are some questions to keep in the back of your mind as you think about your RSU’s potential value:

- “Is it worth sticking with the company for the next several years, or does the value of a new job opportunity outweigh the RSU value I’d lose if I left the company before vesting my shares?”

- “What can I do with this money? Can this help fund a down payment on a house or car? Pay down debt? Go on vacation?”

- “How will these RSUs affect my taxes? Am I going to get pushed into a higher tax bracket? How do I avoid surprises when I file my taxes?”

As you can see, even though there’s nothing for you to do when you’re granted RSUs, that doesn’t mean you file them away and don’t think about them. If the potential value of RSUs is large enough, then this might be the time to get yourself a financial planner and tax professional to plan for these awards.

Vesting of Restricted Stock Units

Once you’ve been granted RSUs, the clock ticks towards earning those awards. The technical term everyone uses to describe earning your RSUs is “vesting.”

Vesting schedules can vary widely from one company to another. There is no standard vesting schedule that all companies use. The reason for this is that each company has its own desire for how quickly they want to reward their employees.

One of the more popular vesting schedules is called “4-year vesting, with 1-year cliff.” Let’s dissect what that means.

First, “4-year vesting” shows how many years you have to work for your company to earn ALL the RSUs granted to you. As we’ll see, you’ll vest (earn) shares during each of those 4 years. But if you leave your company before the end of 4 years, then you’re most likely going to give up the value of the unvested shares.

Second, “1-year cliff” is how many years you have to work for the company before you’ll vest your first shares of RSUs. It’s best to understand this concept with an example.

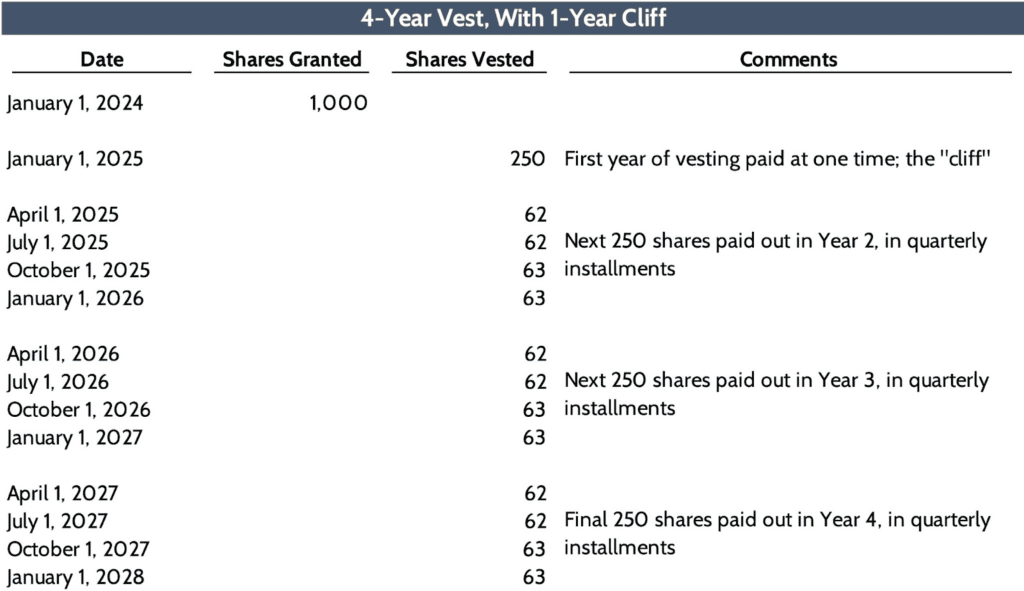

Continuing with our example above, we see the company has a 4-year, 1-year cliff vesting schedule. Digging into the details, we find more information about exactly how the vesting schedule works.

- 25% of the shares vest after 1-year (the 1-year “cliff”)

- 25% of the shares will vest in Year 2, paid out quarterly

- 25% of the shares will vest in Year 3, paid out quarterly

- 25% of the shares will vest in Year 4, paid out quarterly

Here’s how the RSU vesting schedule would pay out for the employee.

You can see in this example how the “cliff” works. Unlike Years 2-4, your RSUs don’t vest in quarterly installments. Instead, you’ll get a full year’s worth of RSUs vested at the end of Year 1. From the company’s point of view, this is an incentive not to take the RSU grant and “run.”

Taxation of Restricted Stock Units as They Vest

The vesting stage of RSUs is important not only because it’s when you receive stock but also because it’s when RSU taxation starts. If you’re a corporate executive with lots of RSU value that pushes you into higher income tax brackets, it’s especially important to understand how the taxation works.

Fortunately, there’s nothing you have to “do” when RSUs vest. Your company will take care of all the mechanics of giving you shares of stock like paying taxes.

Most often, you’ll see the value of your vested RSUs show up on your paycheck. They withhold taxes on RSUs much like the regular income you make in each pay period. But your RSU taxes and remaining value won’t be paid to you in cash; you’ll get shares instead.

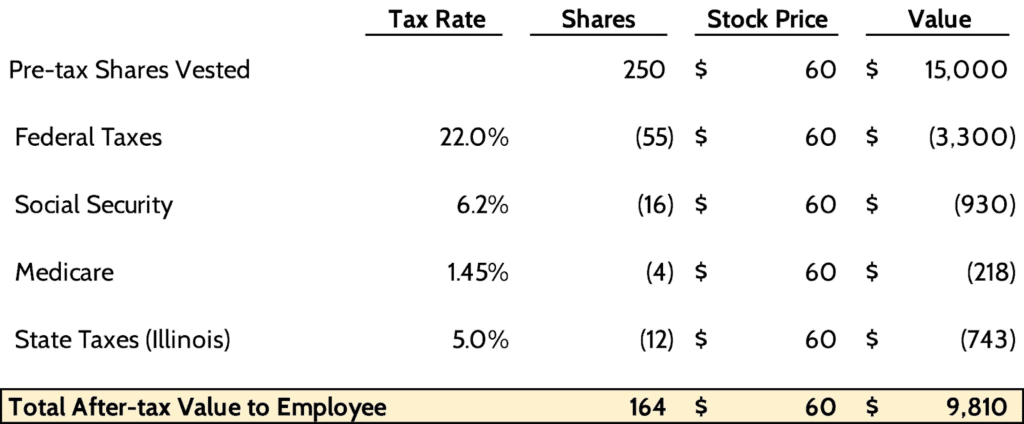

We’ll continue the example, looking at what happens to our employee on the January 1, 2025 1-year “cliff” vesting of RSUs. The share price on January 1, 2025 is $60/share.

They report $15,000 on your paystub and they tax it at your ordinary income tax rate, just like your regular earnings. Despite our employee vesting in 250 shares after the 1-year cliff, they’re only going to receive 164 shares. Why’s that? Because the company will automatically withhold taxes on the value of those shares. They’ll withhold those taxes by keeping some of your shares and selling them to raise cash to pay the taxes.

You rarely have control over the tax rates that are used for withholdings. The 22% Federal tax withholding rate is standard, and Social Security, Medicare, and State taxes are typically withheld at the exact rates they’re supposed to be withheld.

For high income earners (think, executives at larger companies), this presents a problem. The top of the 22% Federal tax bracket is around $200,000 for married people and $100,000 for single tax filers. Executives often earn much more than these levels, pushing them into higher tax brackets. This creates a tax withholding “shortfall” that they have to pay when they file their taxes.

As an example, what if your total compensation – salary, bonuses, and the value of vested RSUs – puts you in the 32% Federal income tax bracket? Remember, your company is only withholding 22% for Federal taxes on vesting RSUs.

In the example above, our executive would likely have to cut a check for $1,500 to Uncle Sam at the April 15th tax deadline the following year to compensate for under-withholding on their RSUs. [32% marginal rate – 22% withholding rate x $15,000]. There are a lot of details surrounding the taxation, but a tax professional will be able to explain them to you.

Investing of Restricted Stock Units

After your RSUs vest and shares are withheld for taxes, what’s left over is what you get in actual stock in your employer. In the example above, our employee walked away with 164 shares of stock in their company. The question is what to do with the stock after receiving it.

The way to think about this is to think of the stock like any other investment in your portfolio, because that’s what it is. Do you like the long-term prospects of the company? Is your portfolio diversified after receiving the stock, or do you have a concentrated position in it?

Strategy: Sell shares immediately for investment diversification.

A common strategy that advisors will recommend is for the employee to sell the stock immediately after receiving it. If left alone, you’ll likely build a concentrated stock position in your employer, which isn’t advisable. Why? No matter how much we might believe in our company’s growth prospects, things may not play out that way. There have been examples of executives keeping most of their net worth in their employer’s stock. But then the economy turns south, their company goes bankrupt, and they not only lose their job but their life savings as well. Stay diversified!

Strategy: Continue to hold some or all of the stock you receive.

Holding stock in your employer isn’t a bad thing, but if you choose to do that we recommend keeping the total value of your employer’s stock to 10% or less of your investment portfolio. There’s nothing magical about the 10% target. But it’s high enough for the stock to have a positive impact on your portfolio, but small enough such that you can lose it and still be okay. We see cases where a client will keep a portion of their vested RSUs and sell any amount over their target.

If you decide to sell, make sure you check with your employer’s rules about trading their stock. Many companies prevent you from selling stock outside of specified trading windows.

Taxation of Restricted Stock Units

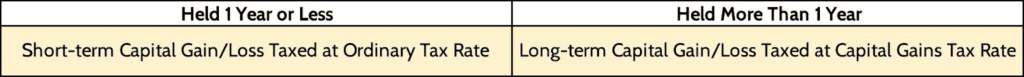

As noted above, stock that you receive from RSUs is like any other investment in your portfolio. That goes for taxes as well.

On the day you receive the shares, your tax “cost basis” in the stock is established. In the example above, that would be $60/share.

From there, the taxation of your investment depends on two things:

1) Whether the stock moves up or down in price from your cost basis;

2) How long you hold the stock.

Special Situation: RSUs at Privately Held Companies

The discussion to this point applies to employees of publicly traded companies. But what if you work at a private company that gives you RSUs? How are they treated differently?

Most everything is the same in terms of grant dates, vesting schedules, and how companies withhold taxes when you receive the stock. The important difference is with the timing of WHEN you pay taxes.

Because private companies don’t have an active market to buy and sell their stock, there are special rules that delay taxation until you actually can sell vested RSUs.

RSUs in private companies are called “double-trigger” RSUs, which means two events have to happen for you to receive value:

- Trigger #1: Time/performance-based vesting. This works just as described above in the 4-year with 1-year Cliff example.

- Trigger #2: Liquidity event. For private companies, this can be an Initial Public Offering in the company, a buyout, or some other means to monetize your vested RSUs.

For your RSUs to fully vest, BOTH triggers need to happen. Even if you’ve worked at the company for a long time and have fully “vested” based on how long you’ve worked there, the RSUs won’t have any real value to you until Trigger #2 is met.

Taxes work the same as in the example above, but the value of privately held RSUs can be much higher if the company has an Initial Public Offering (“IPO”). That’s why it’s important to work with a tax planner before a public offering, as you might incur significant taxes from vesting RSUs in the year the company has an IPO.

Conclusion

RSUs can be a valuable piece of your overall compensation package. The rules for RSUs are pretty straightforward, limiting the number of “major decisions” you need to make.

The main points to remember about RSUs is when and their taxation rules. The timing of when RSUs vest can push you into higher tax brackets and create unexpected tax liabilities for you.

Then you have to decide whether to hold the stock or sell it immediately. Hopefully, the strategies discussed above will help you in making those decisions.

Our specialty at Financial Design Studio is working with high-earning corporate executives. We have a lot of experience analyzing different corporate compensation plans and how they work. And then we take that information and create a plan for you that honors your financial goals and limits how much you end up paying in taxes. If you’re an executive and aren’t sure exactly how your compensation plan works, please reach out to FDS. We would love to answer your questions and bring confidence to your finances.

Ready to take the next step?

Schedule a quick call with our financial advisors.