Monthly Employment Statistics: It’s Time For The Payroll Report!

by Financial Design Studio, Inc. / September 5, 2019On the first Friday of every month, the government releases employment statistics for the previous month. The financial press always seems to build these releases as “the biggest release of the year.” Indeed, this month‘s release of August payrolls will answer a lot of questions about how aggressive the Federal Reserve will cut rates at its next meeting.

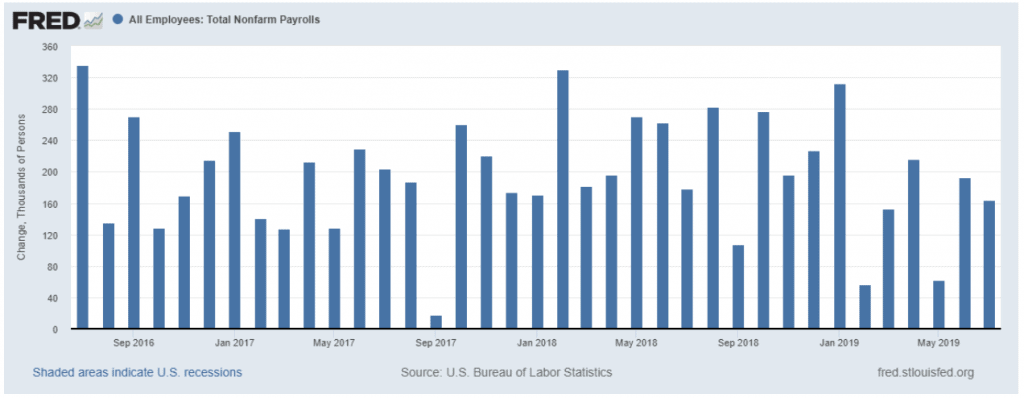

Monthly Change in Nonfarm Payrolls

What Are The Expected Payroll Numbers?

Employment data over the last few months has been soft. Economists are expecting 160,000 new jobs in August with the unemployment rate holding at 3.7%, according to Bloomberg News.

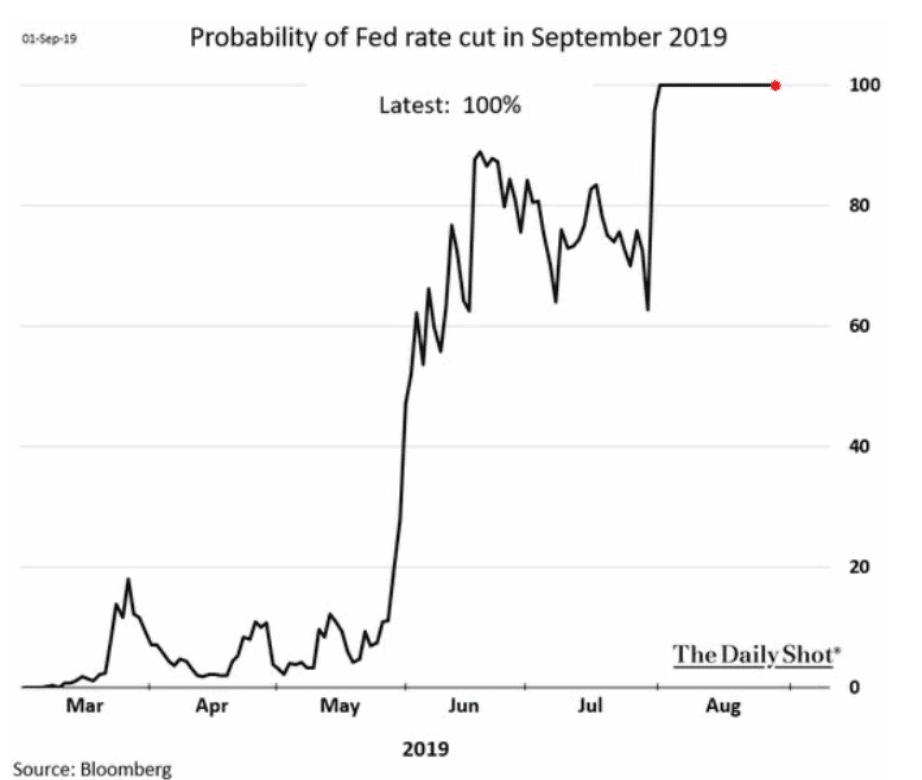

In terms of market reaction, if employment numbers come in stronger than expectations, then that’s likely to lead investors to speculate that the Fed might not cut rates as much as the market currently expects. Currently, the market is placing 100% odds on a rate cut at the September 18 meeting.

Odds of Rate Cut at September Meeting

What If The Report Is Strong?

As mentioned in previous Weekly Updates, the stock market has remained strong on hopes that aggressive rate cuts by the Fed can stave off a potential recession next year. So if the numbers come in too strong, the market might not like that news, perverse as it sounds. We’re in a classic “good news is bad news” type of market right now.

Regardless of what happens with Friday’s employment report, we here at FDS continue to focus on managing client portfolios for the long term. It’s critical for successful investors to “look through” the up and down cycles of the market. Make sure you’re always focused on the bigger picture of your long-term goals.

Wondering how this affects your investments? Schedule a call with Michelle and Steve to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.