Iran: Geopolitical Risk Creates Market Volatility

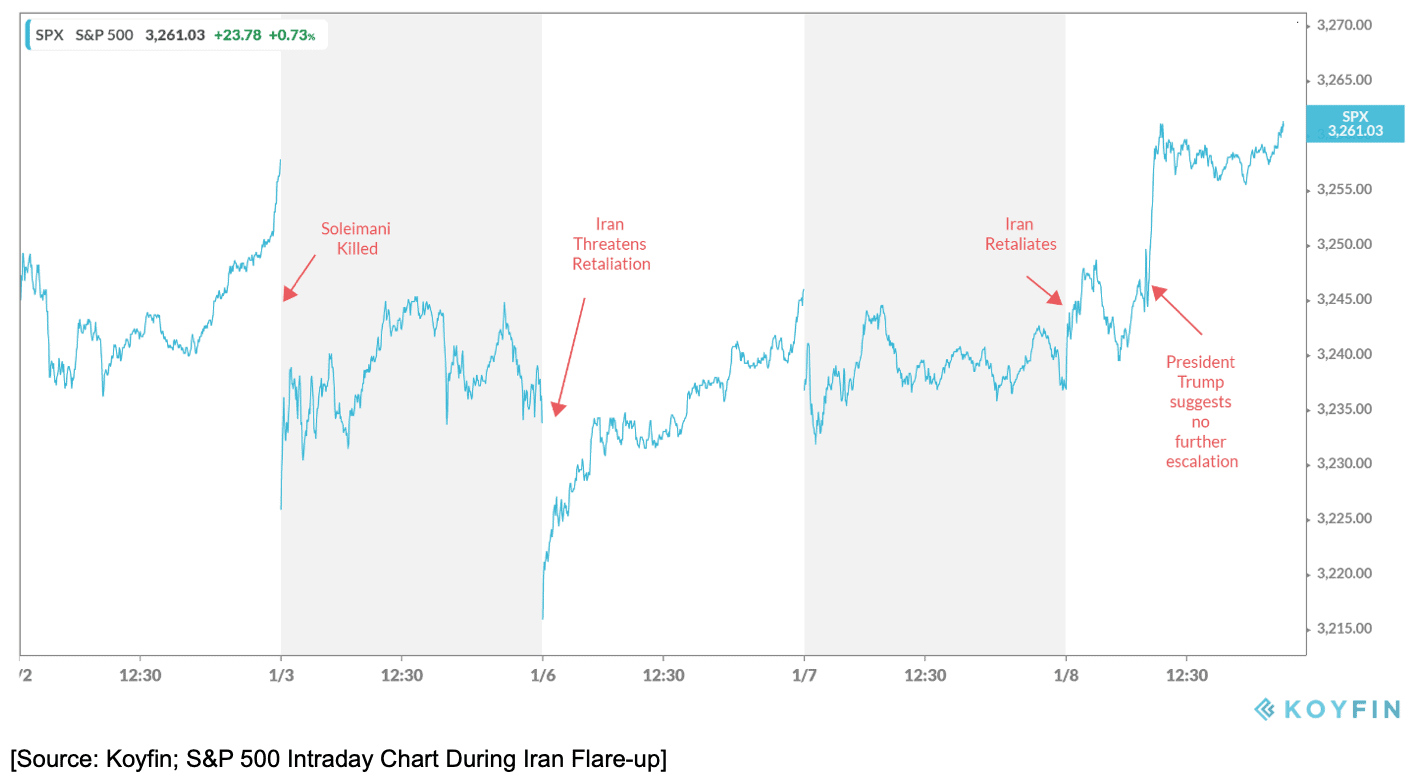

by Financial Design Studio, Inc. / January 8, 2020On January 3 the U.S. attacked and killed Quasem Soleimani, Major General from Iran that the U.S. accused of plotting terror.

This surprising bout of uncertainty caused the stock market to pull back, while the price of oil and gold (a safe haven) rose strongly.

The biggest cause of volatility in the stock market is uncertainty. When market participants don’t know what’s going to happen, many rush to the sidelines to “wait out” whatever crisis is happening. That’s why stocks tend to go down when we see geopolitical uncertainty.

But things can change quickly. And we’ve seen that this week with the tensions with Iran.

The stock market opened considerably lower on January 3 on news of Soleimani’s killing. Stocks moved even lower as Iran threatened to retaliate.

But by Wednesday, January 8, the stock market was surging to all-time highs as President Trump suggested that the escalation cycle with Iran was ending.

Keeping your investment “cool” while the market experiences bouts of volatility like this isn’t easy, especially with geopolitical events. It’s not hard to come up with worst case scenarios of how such an event can play out, as we saw on social media with the hashtag #WWIII “trending” this week.

Sometimes the best thing you can do with your investments when the market is volatile is to do nothing.

“Doing nothing” doesn’t mean you’re not a sophisticated investor. Quite the opposite.

It means you have the emotional discipline to gather the facts before deciding to make a move.

In this case, by the time most of the financial media started to argue that investors should be selling into the Iranian uncertainty, the problem resolved itself and the market surged back to all-time highs.

At Financial Design Studio, we keep constant tabs on what’s moving the market and being talked about in financial media. Our goal is to educate our clients of what’s going on and encourage them to stick with their investment plan even when it doesn’t feel like the right thing to do.

Wondering how this affects your future finances? Schedule a call with Financial Design Studio, financial advisors in Deer Park, to discuss your portfolio today.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Time Horizons for Your Investment Goals [Video]

In this video, Rob breaks down what time horizons are, why diversification matters too, and how this strategy works in action.

Understanding Stock Market & Economic Cycles

Do you remember what an economic cycle looks like? In this week's post we help you understand stock market & economic cycles and what they mean for investors.

Financial Design Studio, Inc.

We are financial advisors in Deer Park and Barrington, IL. A team with a passion for helping others design a path to financial success — whatever success means for you. Each of our unique insights fit together to create broad expertise, complete roadmaps, and creative solutions. We have seen the power of having a financial plan, and adjusting that plan to life. The result? Freedom from worrying about the future so you can enjoy today.