Investment Impact of Ukraine Invasion

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / March 10, 2022

[Note: This was an email originally sent to FDS clients on February 28, 2022. Additional comments below.]

No doubt you’ve been watching the escalating situation with Russia and Ukraine.

Let’s first be clear about something: what matters most now is not “the markets” but the wonton attack on a non-aggressor. Ukraine is a nation of 45 million people sitting on the edge of Eastern Europe. It’s unbelievable that this is happening in 2022, but here we are. Keep everyone in your prayers.

While the situation is still playing out, these are our early thoughts on the investment impact of the Ukraine invasion.

Digesting all the news over the last week I can make two observations:

1) No one – and I mean no one outside of Russian and Western intelligence – has any clue what’s really going on in Ukraine. I’ve seen very convincing arguments that Ukraine was fighting back and that Putin was/is on his last legs. I’ve seen equally convincing arguments that Putin is stronger than ever and that news of Ukraine’s resistance is nothing more than propaganda. Thus, it’s impossible to predict how this is all going to work out.

2) Financial markets reflect this ‘unknowable’ situation. Stocks are up and down in trading sessions despite a huge escalation by Putin. Makes zero sense. Markets are likely to be locked into schizophrenic up/down moves until there’s clarity on how this conflict resolves itself.

Uncertain environments like this is where investors lose a lot of money. Everyone tries to anticipate what’s going to happen, they trade on that, and before the ink is dry, the thesis has gone the other way. Rinse and repeat. The temptation to “do something” is hard to resist, but my experience is that reacting to unknowable situations like we’re in most often leads to regret.

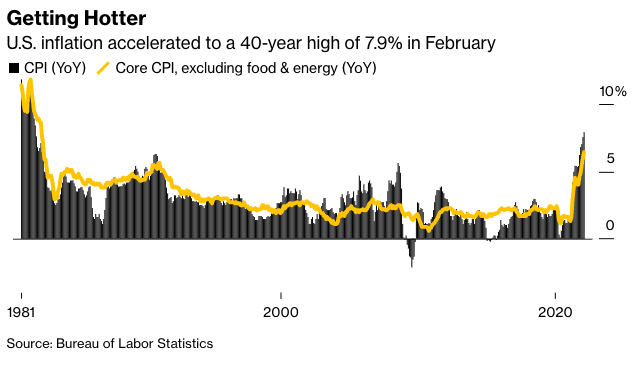

Instead, it’s important to stay focused on the big picture and the thesis we’ve had for the last 18 months. We’ve been of the view that inflation would become a problem due to a number of factors: Pandemic-related supply chain disruptions, labor market tightness, and underinvestment in energy infrastructure. Inflation is a big deal because we’ve been in an environment of low/stable inflation for 40 years. That’s changing, which has investment implications.

So how does the Russia/Ukraine conflict impact our thesis?

1) We expect the inflation problem to worsen regardless of how the conflict works itself out. While we have likely seen a near-term peak in inflation, disruption in Ukraine is a big deal because they’re one of the largest exporters of grains in the world. Grains = food which means consumers will continue to face headwinds at the cash register.

Even if Russia magically withdraws tomorrow, the world now realizes how much it relies on Russia for key inputs such as oil and palladium. High oil prices and disruptions in car production (where palladium is a key input) are likely in a world where Russia can ‘turn off the gas’ at any moment.

2) Economic uncertainty has increased, which means higher financial risks. We’ve noted in previous newsletters and blogs how the Federal Reserve has boxed itself into a corner. Inflation is raging. If they raise rates, they run the risk of pushing the economy into a recession. If they don’t raise rates, inflation rages on. They’re in a lose-lose situation.

Importantly, I don’t think Russia “bails” the Fed out of its predicament. If the economy slows because of this conflict, what’s the Fed to do? Rates are already at 0% and they’re still buying bonds. If they go off the deep end and try buying Apple’s bonds again or worse, stocks, then politicians are going to go berserk about how they enable inequality.

Increasing credit quality of bond holdings

Before the Russia/Ukraine situation came to a head we already had some portfolio changes in the works to hedge against a more uncertain economic environment. 12 years of Fed easing has compressed credit risk in corporate bond markets. Corporate debt has risen significantly as a result. We’ve been worried that a sustained period of higher interest rates by the Fed would negatively impact parts of the corporate bond market. The Russia/Ukraine situation only exacerbates these concerns. Thus, shifting a portion of bond holdings from lower-quality corporate bonds to U.S. Treasury bonds and high-quality corporate bonds seems appropriate.

A Reminder about investing in uncertain times

As a reminder, there’s always a trade-off between risk and reward. You get paid less for owning the safest assets, while you’re paid more for owning riskier assets. Now seems like a good time to tilt towards safer assets.

The entire team at FDS is here for you. We’re watching everything very closely. Please reach out to us if you have any questions!

[End of February 28, 2022 email]

Additional Observations as of March 11, 2022

The last two weeks have yielded little new clarity on the forward path in Ukraine. However, there have been some notable events that are worth highlighting.

First, U.S. inflation readings surged to a new 40-year high of 7.9% in February. The remarkable thing about this additional rise in inflation is that it doesn’t even factor in ANY of the price increases since the Ukraine invasion. So the next few months are going to see inflation rise to over 8.0% and possibly over 9.0%.

Second, the European Central Bank made it clear on March 10 that the uncertainty in Ukraine will not derail their plans for tightening monetary policy. As I noted in our original email, I don’t think the invasion “bails out” the Fed or any central bank from dealing with inflation. They are failing miserably at their #1 mandate: price stability. The Fed officially ended its Quantitative Easing program of buying U.S. government bonds this week. Next, we’ll likely get a 0.50% rate hike at their March meeting, with further hikes to come.

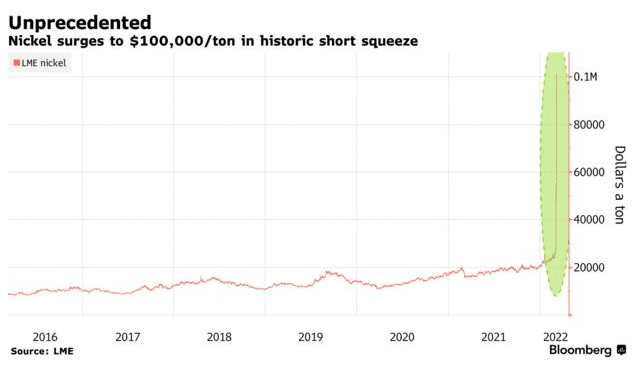

Third, there have been dislocations in parts of the commodity markets. Anyone who’s filled up their car in the last two weeks has seen pump prices go up by nearly $0.70/gallon. But the invasion has also caused commodity traders and producers to get caught on the wrong side of a position. The most prominent dislocation has been seen in the market for nickel, a base metal that’s used in a wide variety of goods. Prices surged more than 3-fold this week and the market had to suspend trading in nickel in order to protect certain investors and banks from getting wiped out.

Markets to Remain Volatile

These three examples demonstrate that we are living in a much different world than we’ve lived in for a long time. The age of Just in Time manufacturing and offshoring manufacturing overseas is going to come to a halt as countries reassess their supply chains. Add in higher labor costs and commodity prices and we have a recipe for a sustained period of inflation.

Investors have to be well-diversified to deal with this new environment. Gone are the days where you can invest in 2-3 simple index funds and call it a day. That strategy might still work for folks in their 20s who have very long time horizons. But if you’re nearing retirement, that’s not likely to cut it. Twelve years of ultra-loose monetary policy has created a lot of concentration risk in many “diversified index funds.”

Markets are also likely to remain volatile. There will be big rallies in coming weeks, in our opinion. But these may not last, and it’s quite possible we retest recent lows in the stock market. We deal with this by sticking to a well-diversified investment strategy and being nimble in navigating these volatile markets.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.