Incredible Performance Divergences in First Quarter 2022

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / March 24, 2022

This year’s first quarter is one of the craziest quarters we’ve seen in terms of market performance. We noted at the beginning of the year that 2022 was shaping up to be a more volatile year because of inflation. But frankly, we didn’t expect the eruption of conflict between Russia & Ukraine, which created even more uncertainty. Now that we’re nearing the end of March, it’s a good time to do a “tale of the tape” on the incredible performance divergences we’ve seen in the First Quarter of 2022.

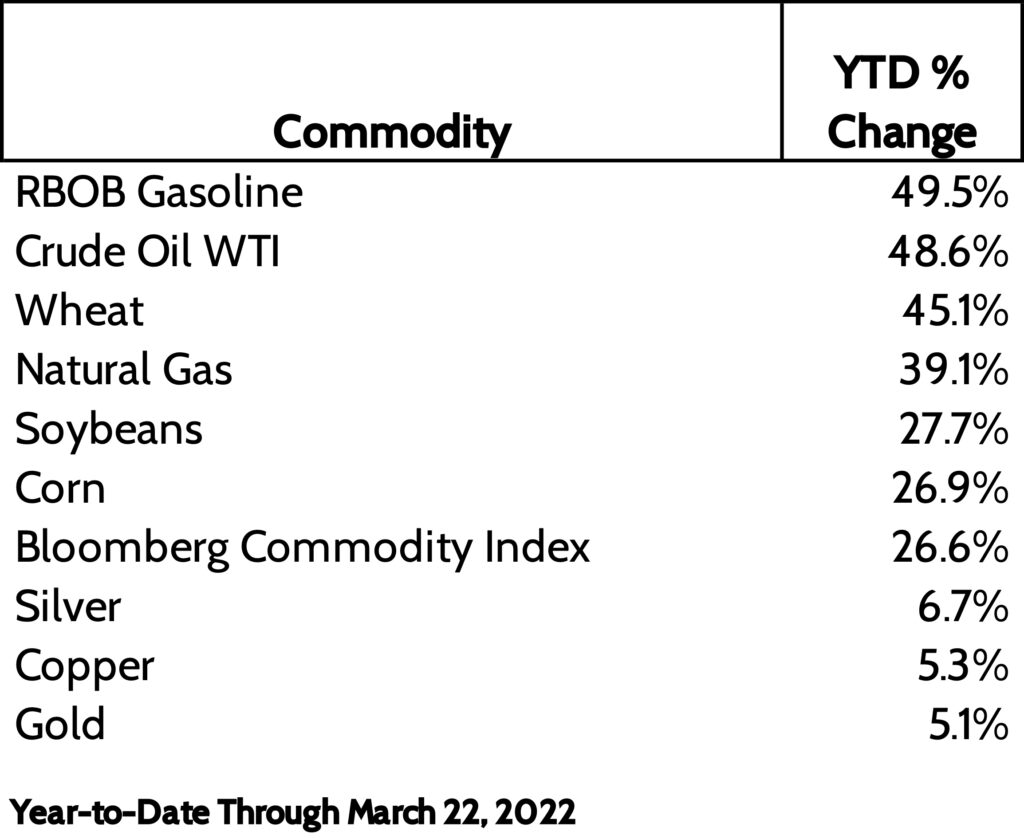

Commodities, Commodities, Commodities

The commodities asset class is one that investors have struggled with for a long time. It’s not correlated with moves in stocks or bonds. And over the last decade, many investors wrote commodities off as a waste of time.

We at FDS have always included an allocation towards commodities in client portfolios because it’s uncorrelated with stocks and bonds. If you’re building a well-diversified portfolio, you need to have asset classes that aren’t correlated with each other. That way, you can take advantage of relative moves between them, trimming “winners” and buying “losers”.

Commodities have been the only area of the market to generate positive investment returns in 2022. This is good and bad. It’s good if you own commodities in your portfolio. But it’s bad to pay higher gas prices and watching food inflation take off. The Russia/Ukraine conflict has created even more tightness in the commodities space.

Given how volatile commodities are, it wouldn’t surprise us to see prices come down a lot in coming months. But there’s a “floor” sitting underneath all these commodities as underinvestment in energy exploration will lead to higher sustained energy prices than what we saw pre-pandemic.

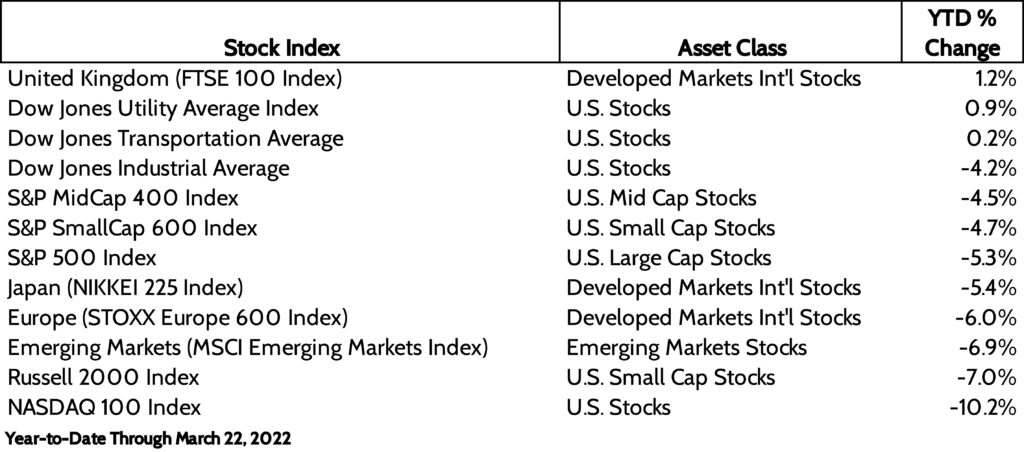

Poor Start to 2022 for Stocks

“I don’t want to see what the market is doing!” We’ve heard that comment from more than one client in the early part of this year. And it’s a good thing because there has been little positive news to see in recent weeks.

Other than the United Kingdom, global equity investors have struggled regardless of where they invested. U.S. stocks are down 5% so far this year, while international stocks are down 6-7%.

Notable in the early part of 2022 is how the technology-heavy S&P 500 and NASDAQ 100 indexes have lagged. Higher sustained inflation is a headwind to growth stocks, as we note below.

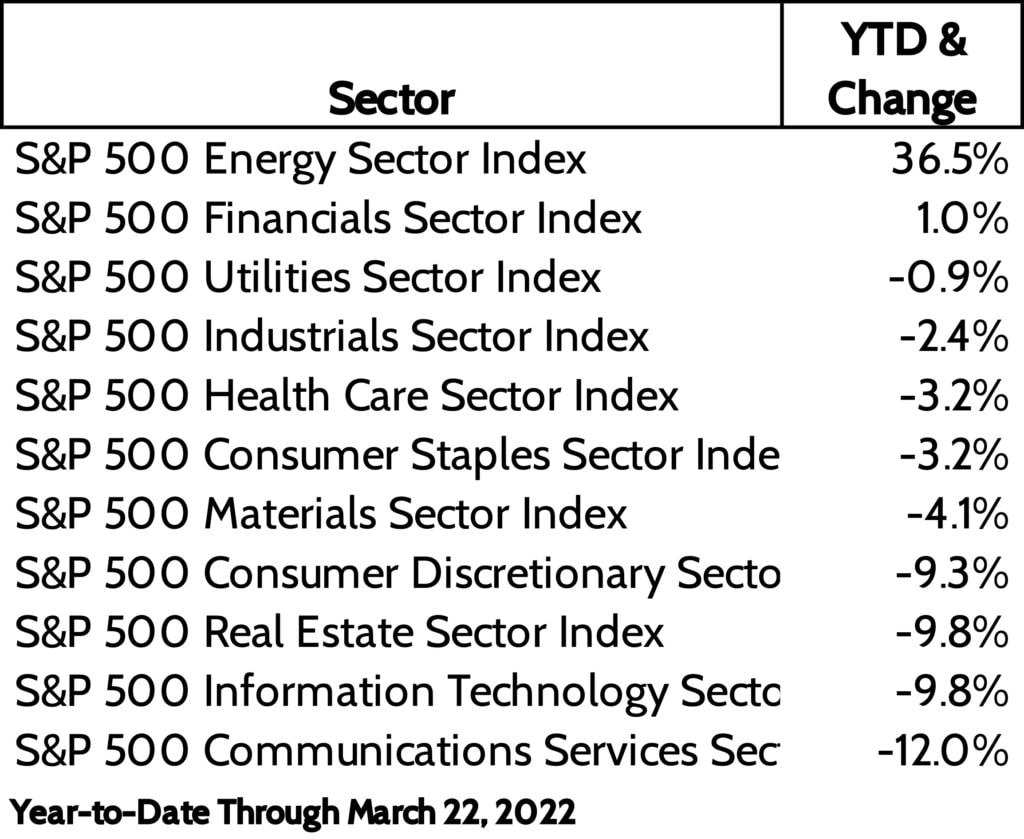

Value Sectors Turning Around?

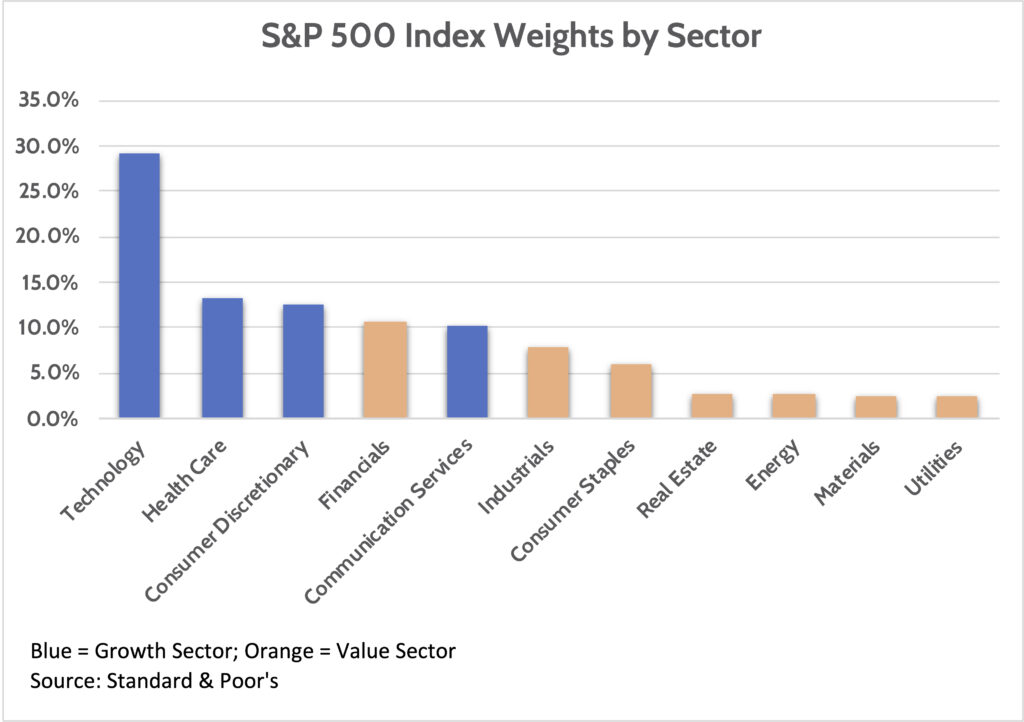

Several weeks ago, we theorized that value stocks may finally turn into the market’s leaders after a decade of getting crushed by growth stocks. We noted that value vs. growth performance moves in multi-year cycles. Are we seeing this turn now?

Looking at this list from top to bottom, you definitely see value sectors doing much better than growth sectors. Energy is the obvious winner given how high oil & gas prices have risen. But Financials and Utilities have also done pretty well.

At the time we wrote the piece noted above, we noted how small many “value” sectors had become in recent years. Even with the performance divergence in the first quarter of 2022, these sectors remain small. For example, the Energy sector is still just 3.9% of the overall S&P 500 Index despite being up 36%!

An Historic Downturn in Bonds

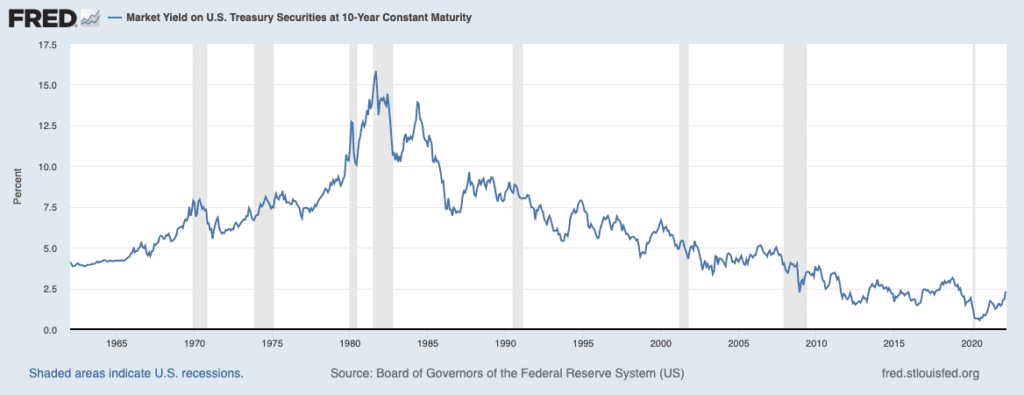

The real investment story of 2022 has been in bonds. A relentless rise in inflation over the last year has brought a normally cautious Federal Reserve to heel. Bond yields are rising from near all-time lows.

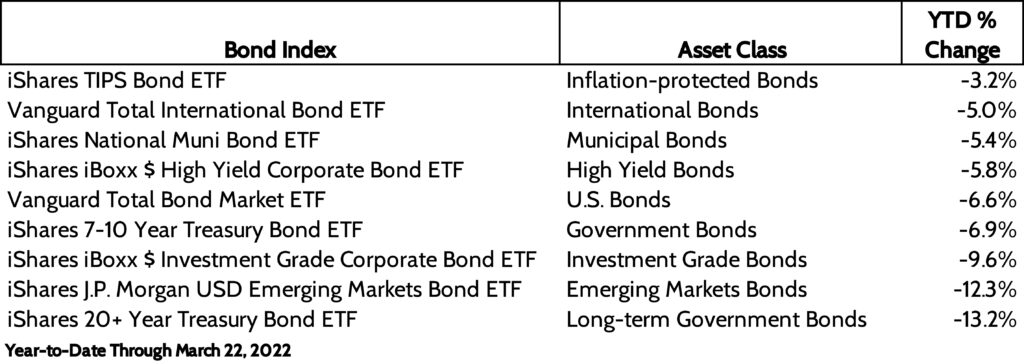

There has been nowhere to “hide” in bonds this year. But there have been parts of the market that have done relatively better. Namely, those areas that offer inflation protection and/or less interest rate risk.

Regarding interest rate risk, you can see how “duration” is a critical factor to think about when you invest in bonds. Intermediate-term U.S. Treasury bonds depicted by the iShares 7-10 Year Treasury Bond ETF have done significantly better than Treasury bonds that mature in 20+ years.

There’s also the interesting dynamic of what’s happening with corporate bonds. Look at High Yield bonds, which are -5.8% so far this year. Compare that to investment grade corporate bonds, which are -9.6%. Why the difference?

Again, it boils down to interest rate risk. The duration of high yield bonds is around 4.0 years, while investment grade corporate bonds have a duration of 9.1 years. In plain English, that means investment grade corporate bonds are going to suffer more as interest rates go up.

But there’s another part of this story that we believe has yet to play out: credit risk. As we continue to navigate a higher inflation, higher interest rate environment, we believe lower-quality corporate bonds will be at risk. It’s one reason we recently changed client bond portfolios, increasing the credit quality of the corporate bonds they own.

Will These Incredible Performance Divergences Continue?

How things play out from here is anyone’s guess. One thing I’ve learned in my career is that nothing moves in a straight line. Yes, I have a view that we’re in a radically new investment regime of higher inflation and interest rates. But that doesn’t mean there won’t be significant moves against that thesis from time to time.

Given how strong commodities have been and how awful bonds have performed, it wouldn’t surprise me to see these trends reverse somewhat in the second quarter. Stocks may even catch a bid before we enter the “Sell in May and go away” doldrums of Summer and Fall.

It’s important to keep this in mind when investing. Too often, when markets change course, people are quick to conclude that something has changed. Sometimes there is an important change. But other times, the change of direction is because of nothing more than investors repositioning themselves.

We track and monitor client portfolios granularly. If an asset class within a client portfolio drifts too far away from our target – because it’s gone up a lot or because it’s underperformed – we make adjustments to bring their portfolio back in-line. Sometimes the subtle changes in portfolios are the ones that add the most value.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.