Investment Themes to Watch Heading Into 2022

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / December 27, 2021

The turn of the New Year is approaching and, coincidentally, several market-impacting shifts are underway. These shifts are creating headwinds for consumers and the market. In this abbreviated Weekly, we look at the investment themes to watch as we head into 2022.

Headwind 1: How will the consumer react to the failure of Build Back Better?

After President Biden was elected, Democrats moved quickly on two fronts. First, they proposed a $1 trillion infrastructure package to invest and upgrade physical infrastructure in the U.S. Then, a $3.5 trillion “social” infrastructure bill cobbled together, which addressed key political goals for the Democrats, such as investment in climate and social initiatives. This latter bill is called “Build Back Better.”

Early on, Democrats hoped to package these two bills together and pass them quickly. But opposition to the social infrastructure plan emerged from centrist Democrats in the Senate. This led to a change in strategy of trying to pass the two bills separately. The $1 trillion physical infrastructure bill (finally) passed in November. But the Build Back Better (“BBB”) plan was recently declared DOA for 2021 as Senator Manchin of West Virginia objected.

I’m very surprised that even a scaled-back version of BBB failed to get passed. While a $3.5 trillion spending plan was obviously ambitious and included every wish list item for the caucus, even cutting this in half didn’t get it done.

The key negative for consumers is that the expanded Child Tax Credit – paid monthly and fully refundable to low-income families – will expire at the end of 2021. Families will still benefit from this as they file their tax returns for 2021, as they get the other half of the tax credit. So refunds and spending may still be strong into the first half of 2022.

But this is the last “stimmy” the consumer is going to get. How will that impact spending and consumer confidence as we get into the second half of 2022? It’s a clear negative, in our view.

Headwind 2: Eviction moratorium expired

Another COVID-related initiative halted apartment evictions for anyone who didn’t pay their rent. The government did everything they could to extend this, but ultimately failed this past fall.

Rents have been increasing at a very rapid rate in 2021. Many attributed these increases to extremely tight apartment rental markets, as many consumers could stay in their home despite not paying rent.

We see two headwinds emerging from the expiration of the eviction moratorium. First, consumers who got by NOT paying their rent will now have to pay rent again, whether it’s in their current apartment or elsewhere. This will act as a drag on consumer spending.

Second, we believe the landscape for rentals has shifted against consumers in recent years, exacerbated by the eviction moratorium. Hedge Funds and Private Equity have been quietly buying up homes in order to rent them. These are sophisticated investors and will certainly look to push through annual rent increases to “make the numbers work.”

It’s terrible the government has allowed this to happen. These funds have been bailed out by the Fed time and time again and have a massive funding advantage relative to the average consumer looking to take out a mortgage. It’s yet another despicable example of our government enabling well-connected cronies to profit off the backs of the masses.

Net-net, we think higher rents are here to stay for consumers who rent (about 1/3 of Americans) which creates another headwind for 2022.

Headwind 3: Expiration of student loan payment moratorium

One of the first things the government did to help consumers early in the COVID pandemic was to allow Federal student loan borrowers to defer making payments. They also set interest rates to 0% for all borrowers to keep loan balances from increasing while the payment moratorium was in place.

After being extended a few times, the payment moratorium will expire at the end of January 2021. According to data we’ve seen, 42.9 million Federal student loan borrowers have “saved” over $100 billion from not having to make payments.

If payments do in fact resume (there’s talk of extending this again given the current Omicron wave) then that’s a big headwind for consumer spending. Not to mention the fact we still have a Federal student loan system that’s completely broken burdening young graduates.

Headwind 4: Federal Reserve is firmly in tightening mode

After initiating the most aggressive monetary policy easing our country has ever seen at the onset of the COVID pandemic, the Fed is now taking the punchbowl away. Last week, they announced they would double the pace of “tapering.” Which means they will no longer be buying government bonds and mortgage-backed securities as soon as March 2022. Further, they clarified that short-term hikes in interest rates are on the table for 2022 and 2023.

I’ve written many times about how the Fed has completely bastardized the economy with their constant “rescues” whenever the economy isn’t just exactly perfect. They’ve inflicted financial repression (low rates) on our Seniors while fanning the flames of bubbles in housing and other parts of the economy.

Every time the Fed has determined to “get tough” in the last 20 years has ended in tears. They went after the Tech Bubble (which they caused) in 1999 and everything crashed a year later.

They tightened aggressively in 2005-2006 to combat a housing bubble (again, which they caused) and we know what happened in 2007-2009.

Post financial crisis, they tried to back off aggressive easing in 2010 and 2011 only to see a crisis erupt in Europe. They tried again in 2013 only to see a “taper tantrum.” And again in 2018, until stocks revolted by selling off 20% in the fourth quarter that year.

At the risk of sounding like a broken record, we continue to believe this hawkish turn by the Fed will eventually mean more volatility for stocks, and possibly a correction.

A Rare Confluence of Multiple Headwinds at Once for 2022

In normal times, there are always headwinds and tailwinds for the economy. But as we head into 2022, we’re struck by the number of headwinds the economy faces. Lower fiscal spending, less money in consumer pockets, and higher spending drags from rents and student loans present a unique challenge for consumers.

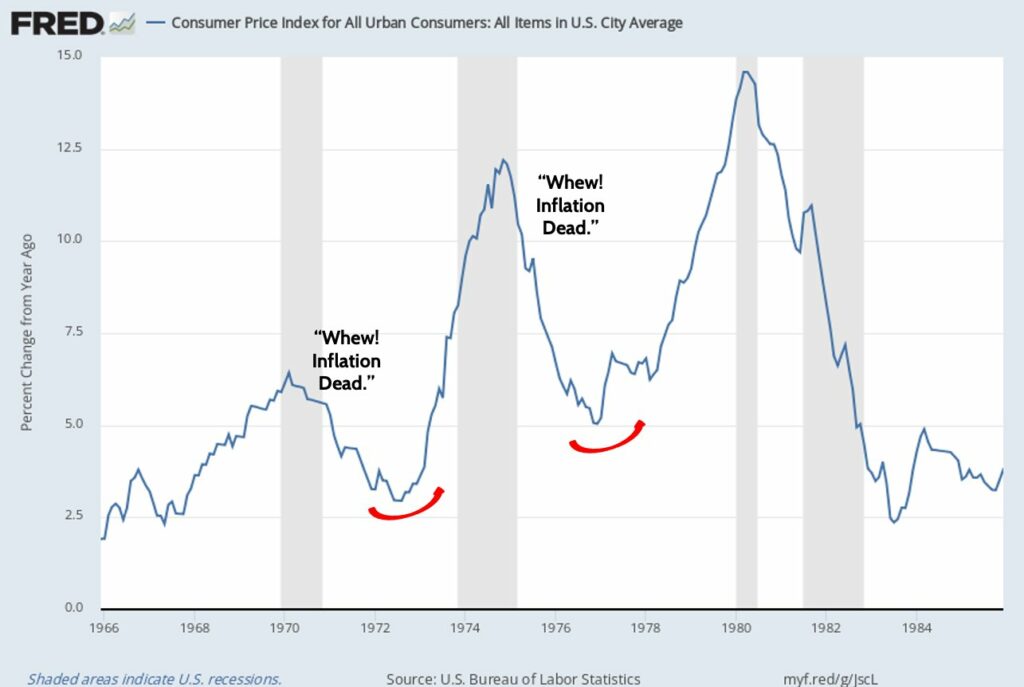

The one potential benefit from all of this is that reduced consumer and fiscal demand should help inflation level off. Many economists are already excitedly declaring that the inflation story is dead. I don’t buy that.

Here’s the pattern we saw in the 1970s. Inflation took off. It hurt the economy. Spending slowed, dragging the economy into recession. Inflation came down as a result. But the second the economy recovered, inflation surged to a fresh high.

The on-again, off-again inflation cycle happened in ’68-’72. Again from ’72-’76. And once more from ’78-’82, until Fed Chair Paul Volcker made clear he’d keep monetary policy tight until inflation was indeed dead.

I believe the seeds of inflation are still very much in place. Tight labor markets aren’t due solely to COVID. They were emerging in the years before COVID washed ashore.

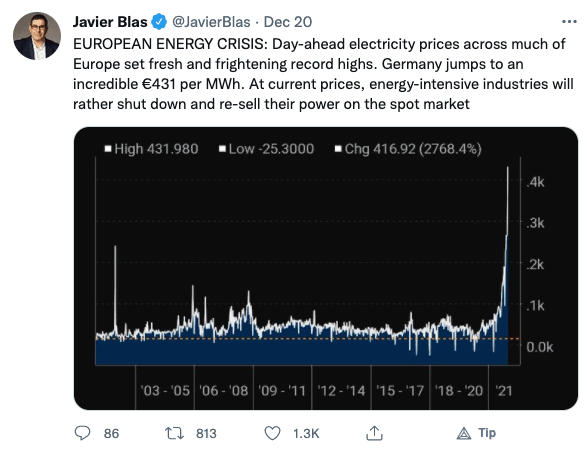

Global elites are also attacking any investment in fossil fuels. Starving a capital-intensive industry with long investment cycles from being able to invest – without having reliable energy sources to replace fossil fuels – is laying the ground work for YEARS of high energy prices. Europe is getting a first-hand view of what happens when you cut “dirty” energy usage too quickly.

The energy issue is a huge factor in my belief that inflation is going to be a problem for years to come. For example, it takes a lot of energy to make fertilizers for food. Fertilizer prices are surging. And if the cost of fertilizer surges, that cost either gets passed on to the consumer via higher food prices or farmers don’t use as much, which means lower harvests (supply) and higher prices.

Net-net, 2022 is shaping up to be a major year of transition for the economy. How it all plays out is anyone’s guess. But we’re prepared to deal with it and change client portfolios as markets move one way or the other.

Ready to take the next step?

Schedule a quick call with our financial advisors.