Tax Filing Deadline & Stimulus Payments – BE CAREFUL!

by Michelle Smalenberger, CFP® / March 18, 2021

The tax filing deadline for your 2020 Federal tax return has been extended to May 17, 2020. This gives you a little breathing room to make sense of the recently passed legislation, which provided for another stimulus payment. More money is always great, right? Before you say yes too quickly, be very careful of the dollar amounts that are on your tax return!

Tax Filing Deadline Extended

On Wednesday of this week the IRS pushed back the Federal tax filing deadline to May 17th. Please read this carefully! The IRS pushed back the Federal tax filing deadline but not necessarily your State tax filing deadline. Some states have adopted the new deadline and it’s likely that all will; but it is not certain. In addition, people who live in Texas had already received a disaster declaration tax filing deadline of July 15th after the February freezing temperatures caused so much damage and loss. You need to be careful to know your own tax filing deadline(s)! These affect when you need to pay any remaining balances and how late you can make IRA contributions.

Why you need to be careful

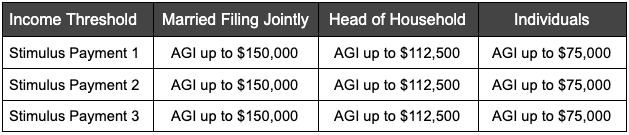

You probably remember that in 2020 and 2021 individuals have been eligible to receive up to three separate tax stimulus payments. The qualification for who and how much you receive is based on your adjusted gross income of your most recently filed tax return.

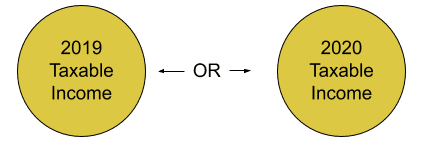

Initially, people were receiving stimulus payments based on their 2019 tax return. If you have filed your 2020 tax return you could qualify if you didn’t before. You could now receive these payments if you weren’t able to last year. You now need to be careful that you don’t disqualify yourself from the third stimulus payment though. Let’s dig in to clarify the details.

Here are the income thresholds that have been used to qualify for the three stimulus payments:

Stimulus Payment 1 – Issued March 2020

When individuals initially received stimulus payments, the eligibility was based on 2019 taxable income. That was the most recently filed tax return. If you didn’t qualify for this payment based on your 2019 income you could become eligible. If your 2020 taxable income was below the income threshold, you would now receive the funds when you file your 2020 tax return. However, if you already received a stimulus payment but your income increased with your 2020 tax filing your stimulus payment will not be taken away or “clawed-back”.

Stimulus Payment 2 – Issued December 2020

Just like the first stimulus payment, this second payment is based on the very same Adjusted Gross Income (AGI). This decides whether or not you receive the stimulus payment. If you already received a stimulus payment but your income increased with your 2020 tax filing your stimulus payment will not be taken away or “clawed-back”.

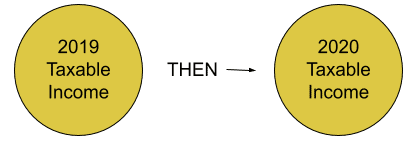

Stimulus Payment 3 – Issued March 2021

This third stimulus payment is very similar to the previous payments. If you qualified and already received the stimulus funds they will not be taken away. BUT THIS IS WHERE YOU NEED TO BE CAREFUL!

Do you need to wait to file your 2020 Tax Return?

Some people have already filed their tax returns for 2020. If your taxable income was below the thresholds for both 2019 and 2020 tax filings then you are fine. But if your taxable income increased in 2020 so that you are now above the thresholds for receiving stimulus payments you need to WAIT TO FILE. Wait until you have received all three stimulus payments.

What I mean by waiting to file your tax return is waiting to hit the “Submit” button to file your return. I recommend that you work with a tax preparer. If you are close to the income threshold that could affect your stimulus payments received.

Even if you are preparing your own return you can enter all of the information into your software. Then see what the outcome will be. Once you see the result you can consider whether there is any tax planning after year-end that you can do. For example, if you had taxable income of $156,000 is there anything you can do now to get that down under the $150,000 (Married Filing Jointly) eligibility threshold? But if you just go ahead and hit “Submit” without paying attention to that small difference you could miss a BIG planning opportunity.

A Big Planning Opportunity

Even if you already received your three stimulus payments there is still one more thing affected by your taxable income going forward. If you have children and had higher income on your 2020 tax return this is where you need to pay attention. In this recent legislation there was an increase in the child tax credit to $3,600 per child under the age of 6 and $3,000 for those older from $2,000. If your income was significantly over the thresholds you may not be able to do enough to change your eligibility. But if you are close you need to consider any planning options available to you.

The reason it matters to pay attention to this when filing your 2020 tax return is that you could begin receiving these child tax credit payments as early as this summer. It has been discussed in Congress to send monthly payments for eligible children starting this summer and then receiving the remainder when you file your 2021 tax return. The idea here is that the money can further help those who need it sooner.

So what are the most important takeaways from these most recent changes?

- Provide your tax preparer with all of your documents so they can have your return entered to see of the planning opportunities that exist.

- Pay attention to your taxable income on your 2020 tax return. You want to know what this amount is BEFORE you or your accountant submit your return. This way you know if there’s any potential for savings first.

- Be aware of the stimulus payments you have received so far as well as any you might still benefit from. If you’re unsure, you can look it up by using this tool here: https://www.irs.gov/individuals/get-transcript, creating a profile and downloading your 2020 Account Transcript.

- Get help if you don’t know the details and how they affect you. If you file your 2020 return and don’t take advantage of planning then you will need to amend your return to do so later.

- Pay attention to your tax filing deadline so you know when you are required to file your tax return, have any payments due, and how late you can make IRA contributions by.

As always, this is the planning that we are thrilled to help your family with. It’s these important details in this new legislation that can literally mean a difference of thousands of dollars to your family. We want to help you!

Ready to take the next step?

Schedule a quick call with our financial advisors.