Social Security Cost of Living Increase in 2022

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / September 1, 2022

There’s very little good news with runaway inflation. Price increases lead to the loss of purchasing power for each dollar spent and are destructive for people living on a fixed income. The “good” news, if there is any, is that Social Security is indexed to inflation. Benefits rose by the most in 38 years in 2021, and are on pace to eclipse last year’s increase. What do we expect for the Social Security Cost of Living Increase in 2022?

How Are Social Security Benefits Better than Pensions & Annuities?

Social Security is a uniquely beneficial retirement benefit compared to most pensions and annuities. The key benefit that Social Security has over the other retirement income streams is that the government adjusts the benefit each year for inflation.

Given that inflation has averaged 3.0% per year over the last several decades, this annual increase is important. Without it, a beneficiary would see the actual purchasing power of their Social Security erode by one-third every 10 years!

The vast majority of pensions and annuities give you a level annual payment that doesn’t adjust for inflation. Sure, some annuities allow you to buy inflation protection, but the cost of it is usually prohibitively high.

How Does Social Security Determine Annual Cost of Living Increases?

Each year in October, the Social Security Administration (SSA) reveals how much Social Security benefits will increase the following year. For example, in October 2021, the SSA announced benefits would increase by +5.9%, starting in December 2021.

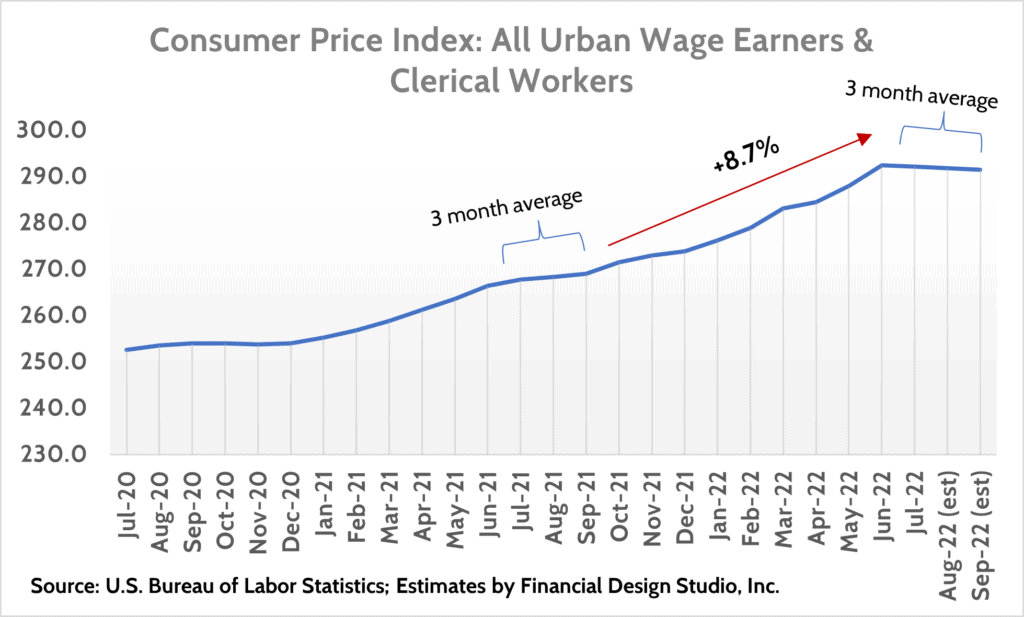

To determine the annual increase, the SSA looks at a special Consumer Price Index calculated by the U.S. Bureau of Labor Statistics. Economists often refer to this index as the “CPI-W.” They take a three-month average of the index readings for July, August, and September and compare it to the average of the same three months a year ago.

Since we’re currently in August, now is a great time to estimate how big the Social Security Cost of Living increase will be for 2022. Inflation is at an inflection point in late summer as gas prices have fallen. July 2022 represented the first month-on-month decrease in inflation since the early days of the pandemic.

We extrapolate July’s small drop to August and September. We then compare the July-September average in 2022 against what the average was for those same three months in 2021. The result?

We expect the Social Security Cost of Living increase in 2022 to be +8.7%. There’s a chance the ultimate result could be lower than that as gas prices have fallen more significantly of late. But either way, we expect Social Security cost of living to increase by a lot in 2022.

How Does the Estimated 2021 Cost of Living Change Compare to History?

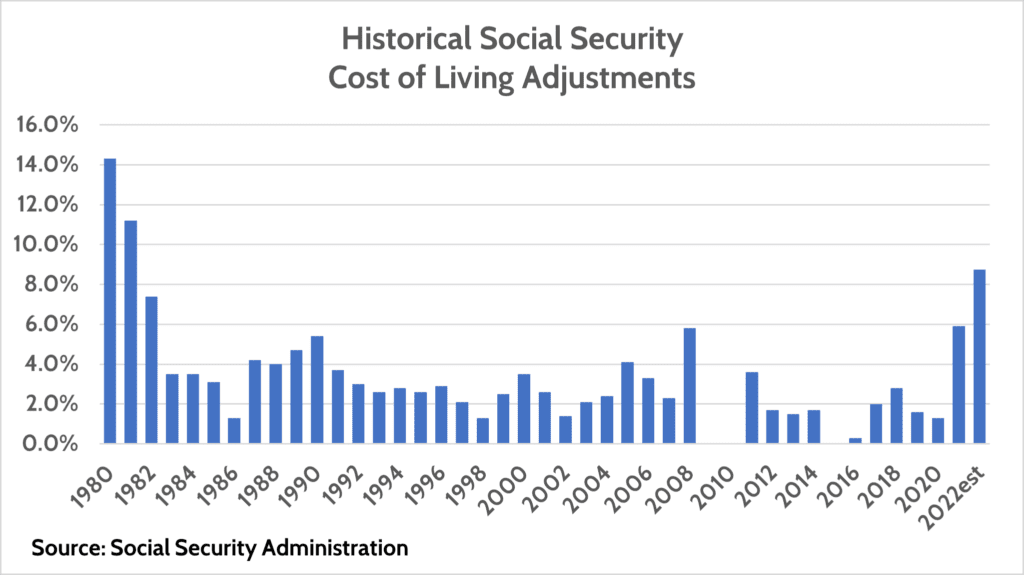

The +8.7% estimate is a huge increase compared to what beneficiaries have seen in recent years, other than last year. You’ll have to go all the way back to 1980 and 1981 to find years where the cost-of-living increase was higher than what it’s going to be in 2022.

Looking back at the last 40 years, including our estimate for 2022, the average annual increase in Social Security cost of living is +2.8%. That’s very close to other long-term measures of inflation, which show a +2.9% increase over the last 100 years.

What Does Surging Inflation Mean for the Social Security System?

The first Baby Boomers first started turning 62 years old in 2008. Age 62 is the first year someone can start taking Social Security, and statistics show many people do just that.

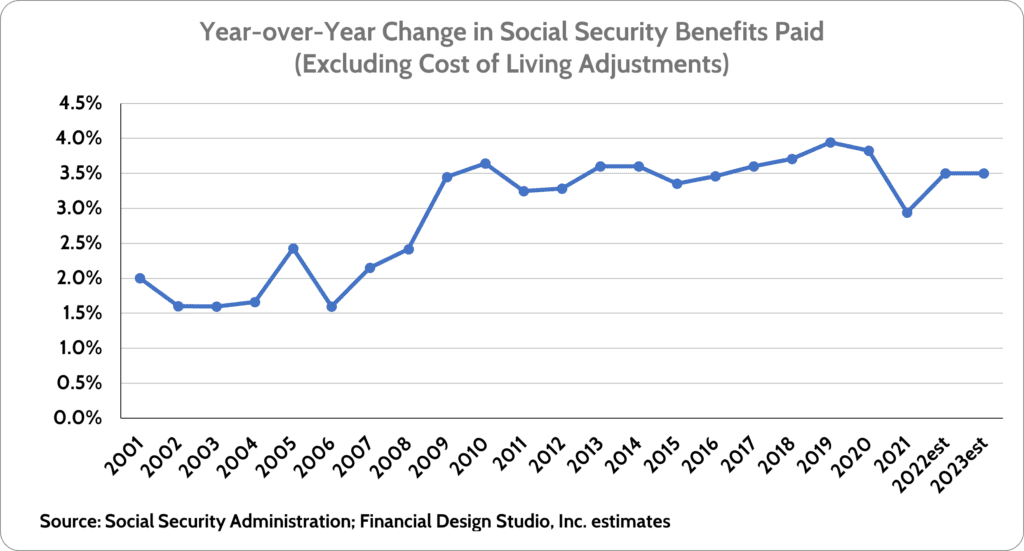

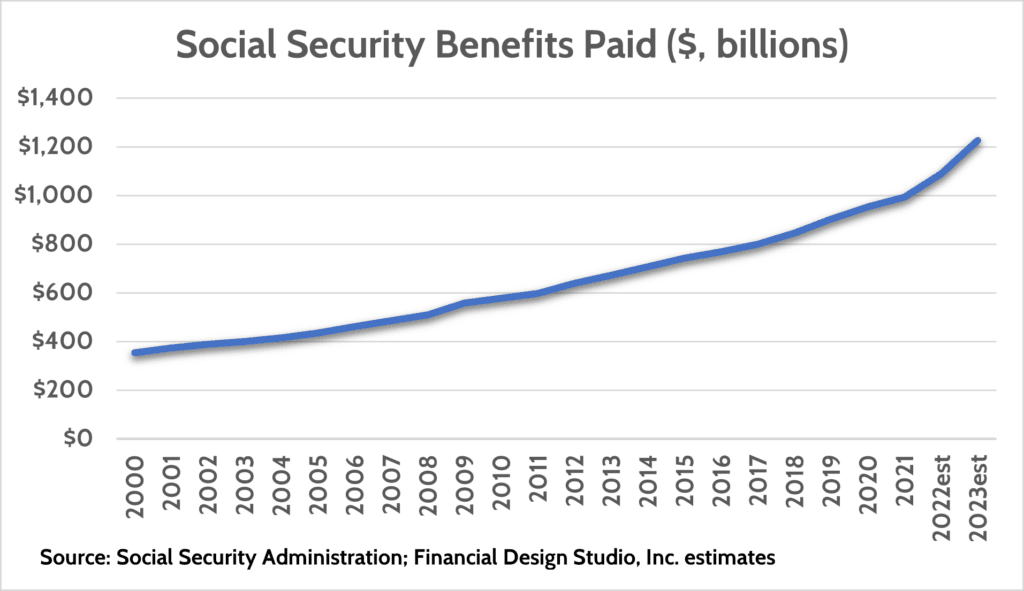

Since Boomers started retiring, we’ve seen an increase in the number of people getting Social Security. The step-up in pace of benefits being paid is unmistakable after 2008.

High inflation the last two years means a real increase in dollars paid out by Social Security. If we assume the same pace of increases in the number of people taking Social Security (+3.5%, above chart) and add in inflation, we can see a massive increase in the cost of Social Security for the government.

The increase in the number of people receiving Social Security plus the impact of cost-of-living increases means that actual Social Security benefits will cost the government $232 billion more than they paid out in 2021. This of course raises the question, “Can I count on Social Security in Retirement?”

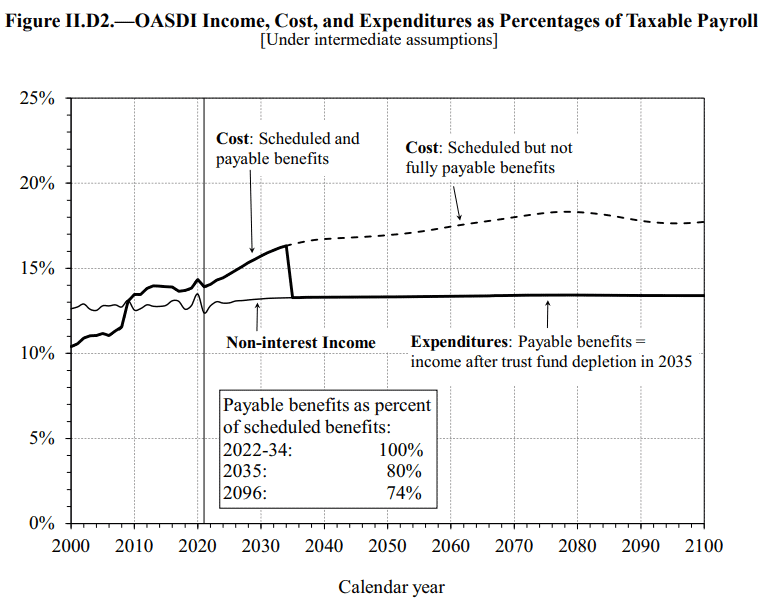

The 2022 version of the Social Security Trustee report estimates that the Social Security Trust fund will “run out” of money in 2035. The linked article above goes into more detail about what that means. But basically, it means that if Congress does nothing, then Social Security beneficiaries will get 20% less than what they “should” get.

We Expect Congress to Act (Eventually) to Shore Up Social Security

Looking back at the above chart of annual cost-of-living increases since 1980 you can see that inflation significantly increased Social Security benefits in 1980-1982. It’s no coincidence that the last major overhaul of Social Security came in 1983, as Ronald Reagan and a solidly Democratic Congress worked together to extend the life of Social Security.

The steep increase in the cost of Social Security benefits we expect for 2022 and 2023 is likely to put more pressure on Congress to act. It seems foolish to believe Congress can work together in this political climate, but history shows that they will when they’re forced to.

What would that look like? It might mean higher payroll taxes. Or it might mean that Congress raises the wage limit for paying Social Security taxes. Neither can we rule out increases to the Full Retirement Age, as they were in 1983.

Whatever the solution is, we expect there will be one. We simply don’t subscribe to the Social Security doom and gloom crowd that thinks benefits will get cut.

Inflation Wreaking Havoc on Retirees

Inflation is a good news/bad news situation for retirees. The bad news is the increase in cost of living. The good news is that they have a guaranteed annuity stream that’s indexed to inflation.

The situation with Social Security cost-of-living increases is yet another example of how inflation is wreaking havoc on the American economy. It’s our view that some short-term relief from inflation is coming. But that relief is likely to prove temporary unless we invest in energy production.

If you’re nearing retirement or are in retirement already, now is the time you want to be working with a financial advisor to navigate this environment. The “buy and hold” days of 2010-2020 are over. You need to be vigilant about updating your retirement plan regularly. And you need someone in your corner that keeps a constant watch over your investments.

That’s what we do at Financial Design Studio. If you’re interested in learning more, go ahead and hit the “Get Started” button below.

Ready to take the next step?

Schedule a quick call with our financial advisors.