Retirement Roth Conversions Part 2 [Video]

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / March 29, 2021In our first video on pre-retirement Roth Conversions , we talked about what Roth Conversions are and why you might want to do them. Saving taxes is a big driver of the strategy. You strategically “fill up” lower tax brackets in order to avoid seeing Required Minimum Distributions drive you into higher tax brackets while in retirement. In Part 2 of our series on Roth Conversions, we’re taking a deeper look on how to plan for this strategy years before your retirement.

Who Can Benefit Most From Roth Conversion Strategy?

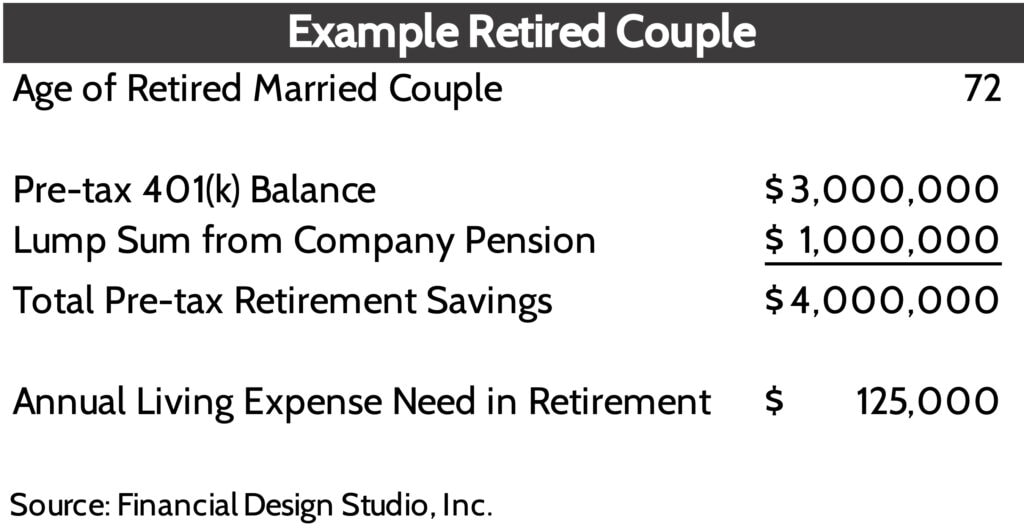

Roth conversions aren’t for everyone, so the question is, “Who’s this best suited for?” The short answer is anyone who has most of their retirement wealth in Traditional pre-tax 401(k)s or IRAs. Many high-earning company executives we work with are in this exact situation.

Large, publicly traded companies tend to have good benefits. These benefits range from having generous 401(k) matching programs, deferred compensation, or even a pension. Programs like this are designed to help executives save on taxes today.

The problem with having all of your retirement savings in pre-tax savings vehicles is that Uncle Sam is going to want his cut at some point. You got a tax benefit when you put money in. Uncle Sam wants his taxes on the way out. The way Uncle Sam does that is through Required Minimum Distributions, or RMDs, for short.

RMDs force you to take money out of pre-tax retirement savings vehicles starting at Age 72. But Roth IRAs aren’t subject to RMDs because the after-tax money you put in was already taxed!

Example of How Roth Conversions Can Save You Taxes

Here’s an example of the problems someone might face. For simplicity’s sake, we don’t assume any other income like Social Security.

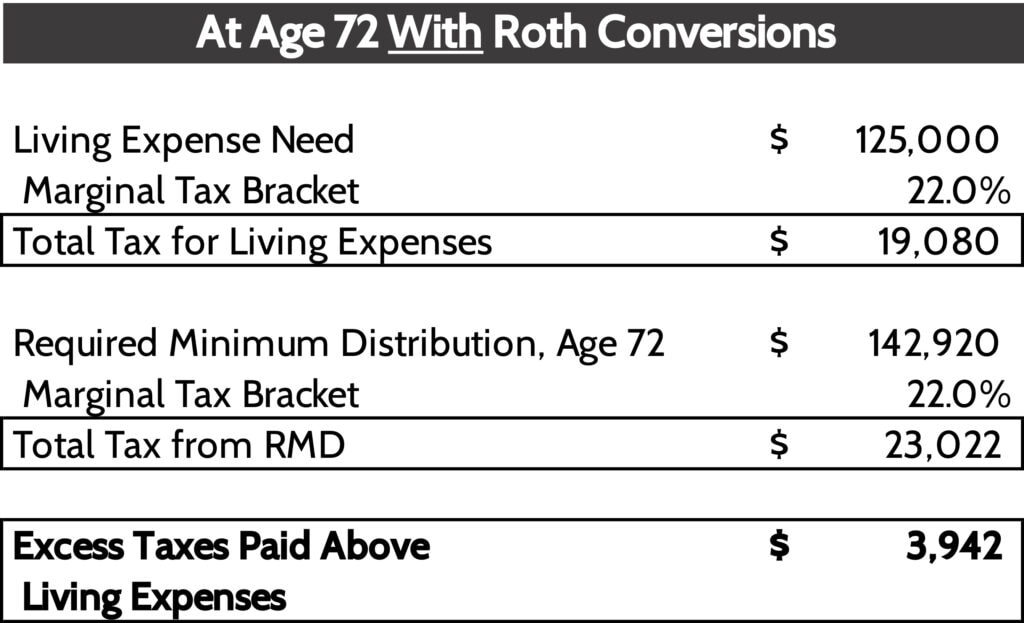

To satisfy their living expense needs, it’s natural to think you can simply take $125,000 out of one account and call it a day. If they did that, this couple would land in the 22% marginal tax bracket in 2020.

But that’s not how it works when you hit Age 72. RMDs kick in and force you to take money out of your pre-tax accounts, no matter if you need the money for spending or not.

Starting at Age 72, this couple must take 3.9% of their pre-tax account values out for their RMD. This withdrawal is counted as ordinary income, which is taxed at income tax rates.

In our example, this couple quickly finds out that they’re being forced out more than what they actually need to live on! This creates an unnecessary tax burden on them, as seen here.

RMDs force this couple to take out $31,000 more than what they need to live on and pay almost $7,000 in extra taxes.

This dynamic gets worse each year beyond Age 72, since the IRS forces more out of your pre-tax accounts the older you get. So what can be done about it?

Fill Low Tax Brackets With Roth Conversions

If you’re going to be retiring in the next 10+ years and have a hefty pre-tax retirement savings balance, now would be a good time to think about creating “income gap” years. This is a fancy way of saying “early retirement,” which is that period from when you retire to when you receive Social Security and RMDs.

Many executives like the idea of retiring early. Some like Age 60. Others Age 62. The key issue that needs to be solved is having money set aside to live on before you start taking Social Security and withdrawing funds out of your retirement accounts.

The gap between when you retire (early) and when you’re receiving Social Security and withdrawing funds out of your retirement accounts is the ideal time to do Roth Conversions. For example:

A married couple who retires at the end of Age 62 and takes Social Security at Age 67 has four income gap years to work with. Instead of leaving their income at $0 for those four years we could strategically “fill” a low tax bracket. In this example, we’re topping off the 12% tax bracket with Roth Conversions from Age 63-67.

Let’s see what happens to the hypothetical client example above.

By “filling up” the 12% tax bracket in their income gap years with Roth Conversions, they’ve shifted nearly $340,000 from pre-tax retirement accounts to a Roth. Going back to what Age 72 would look like for them, they’d still have RMDs over their spending needs. But this amount would be $14,000 lower than if they hadn’t done Roth Conversions. Even better, they would save nearly $3,000 in income taxes.

Is a Roth Conversion Strategy Right for You?

The above example is highly simplistic. We assumed no appreciation/depreciation in the value of the investments over that time period. And Congress is always fiddling with tax rates and rules. Because of this, we reevaluate client Roth Conversions strategies every year we’re doing them to make sure we’re optimizing taxes.

Whether a Roth Conversion strategy is right for you depends on a lot of factors. But the point we want to get across here is that you have to plan early to do this. Waiting until the day before your retirement to look at this may be too late.

A typical timeline for something is like this:

If you’d like to know how Roth Conversions might (or might not) work for you, we’re here to help you. We don’t do cookie-cutter retirement plans because we know everyone’s situation is unique and deserves to be treated as such. Let’s work together!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Everything to Know About Health Savings Accounts

Health Savings Accounts have been around for 20 years but are often misunderstood and underutilized. HSAs are powerful savings tools to cover future medical expenses, such as long-term care, or to help fund healthcare for early retirees. We explain everything you need to know about health savings accounts: what they are, how contribute to them,...

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.