Retirement Changes in SECURE Act 2.0

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / January 18, 2023

A new law passed by Congress and signed into law by President Biden on December 29, 2022 makes further changes to the nation’s retirement savings system. This is the third such major revision to retirement rules since 2017 and our previous article. What do you need to know about the retirement changes in SECURE Act 2.0? We break it down, below.

SECURE Act 2.0 Changes for 2023

Required Minimum Distribution Age Change

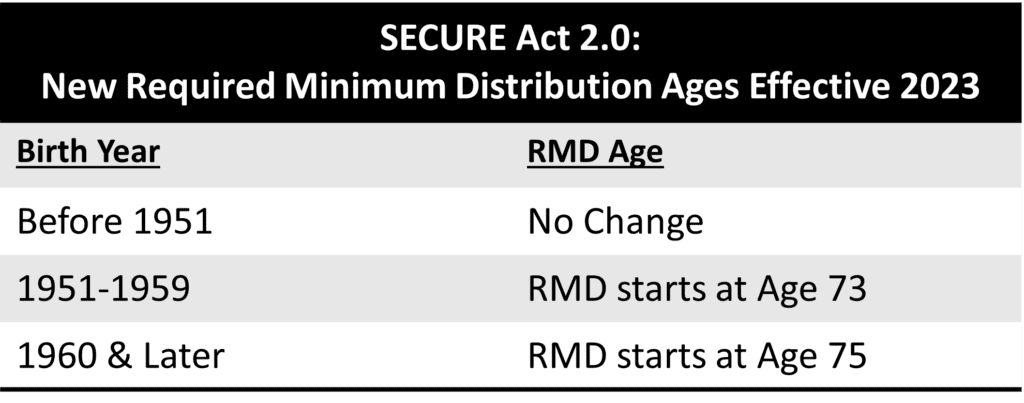

The biggest change in the SECURE Act 2.0 is to push out the starting age for when retirees have to take Required Minimum Distributions (“RMDs”) from their pre-tax retirement accounts. In 2019, the original SECURE Act raised the starting age from RMDs from Age 70-½ to Age 72. The SECURE Act 2.0 pushes these ages out further, but in a more complicated way.

The “lottery winner,” if you will, is for people born in 1951. Under the old rules, they would’ve had to start RMDs in 2023 after turning Age 72. Now, they don’t have to take RMDs until 2024!

For everyone else who hadn’t already turned 72 in 2022, the RMD age gets pushed back to Ages 73 or 75. There are some practical benefits for retirees from this change.

1) Roth Conversions: By pushing back the RMD age, retirees now have a larger window of opportunity to perform tax-saving Roth Conversions.

2) Tax Planning: Since retirees don’t have to take money out of IRAs and 401(k)s until Ages 73 or 75, they can better control how much they withdraw (and pay taxes on) until those ages.

3) Investment Growth Potential: The longer money stays in tax-deferred accounts, the more growth potential the retiree can earn.

Roth SEP-IRAs and Roth SIMPLE IRAs are Allowed

Small business owners often use SEP-IRAs and SIMPLE IRAs as an easy way to save for retirement. Prior to SECURE Act 2.0, these two accounts could only be “traditional.” Meaning, participants could only contribute money on a pre-tax basis, not on a post-tax, Roth, basis. The SECURE Act 2.0 finally allows Roth versions of these types of accounts to be opened, starting in 2023.

Lower Tax Penalty for Missing RMD

Under previous law, if a retiree failed to take their RMD at the required age, the IRS assessed them a tax penalty of 50%. Yes, 50%!! SECURE Act 2.0 lowers this tax penalty to 25%.

SECURE Act 2.0 Changes for 2024

There are many changes that will become effective in 2024. Some of them are extremely specific to certain types of people, so we will not cover all of them. But the major ones to think about are described below.

IRA Catch-up Contributions Linked to Inflation

Each year in October, the IRS publishes updated maximum IRA, 401(k), and catch-up contribution amounts for the following year. They have typically updated these in $500 increments, although some thresholds go years without rising.

In 2023, the catch-up contribution that an individual Age 50 or over can make to their IRA is $1,000. This $1,000 limit hasn’t changed since 2006.

Starting in 2024, the IRA catch-up contribution limit will increase with inflation in $100 increments.

RMDs from Roth 401(k) Plans Eliminated

One of the key benefits of Roth IRAs over Traditional IRAs is that IRS Required Minimum Distribution rules don’t apply to Roth IRAs. Oddly enough, for Roth 401(k) plans, RMDs are required. Meaning, a retiree would have to roll their Roth 401(k) to a Roth IRA in order to avoid having RMDs taken.

The SECURE Act 2.0 eliminates RMDs for Roth 401(k)s, streamlining a rule that had confused many.

Leftover Money in a 529 College Savings Plan Can Be Transferred to a Roth IRA

One of the more interesting provisions in SECURE Act 2.0 is to allow people to transfer leftover money in a 529 college savings plan to a Roth IRA. There are rules and limitations, of course. But for many parents who are concerned about over-funding a 529, this offers one way to get money out tax-free.

- Named beneficiary on the 529 and the Roth IRA must be the same. It’s easy to change the beneficiary of a 529. A parent can even name themselves after their kids are already through school.

- 529 plan must have been open for at least 15 years.

- Named beneficiary must have earned income.

- The maximum lifetime 529-to-Roth IRA balance transfer is $35,000.

- They limit your yearly transfers to the annual contribution limit for Roth IRAs.

How might this work in practice? Say a parent set up a 529 for their child 15 years ago. The child has gone through college and because he or she received scholarships and other help, there is $50,000 left over in the 529.

Normally, the parent would have one of two choices: name a new beneficiary (themselves or a grandchild), shifting those savings to them, or take the money out and pay income taxes on the investment gains and a 10% tax penalty.

Starting in 2024, this parent could make yearly transfers from the 529 to their Roth IRA until they reach the lifetime maximum of $35,000. With the $15,000 left over, they could choose one of the two paths mentioned above.

It’s early days with this new law, but over time there may be some interesting financial planning opportunities from “over-funding” 529 plans.

SECURE Act 2.0 Change for 2025 & 2026

Higher Catch-up 401(k) Contributions For Ages 60-63

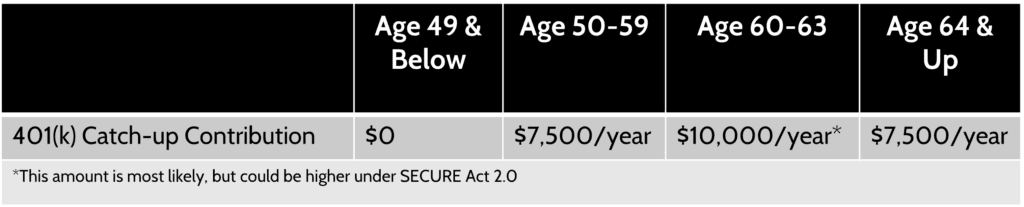

A rather confusing, albeit beneficial, change to catch-up contributions is made with SECURE Act 2.0. For 2023, nothing changes; the extra catch-up contribution someone Age 50 or older can put into their 401(k) is $7,500.

But starting in 2024, the SECURE Act 2.0 will allow higher catch-up contributions, but only for those aged 60 through 63. This is weird, so here’s a graphic for how it will work:

Why Congress allowed higher catch-up contributions for people ages 60 to 63 – but not for those age 64 or more – is beyond the scope of this blog!

401(k) Catch-up Contributions for Highly Compensated Employees Must Go To Roth 401(k)

Congress passed a sneaky new way to increase taxes on workers Age 50 and over that are Highly Compensated Employees (“HCEs”). They define an HCE as someone making $145,000/year or more.

As it stands in 2023, an HCE Age 50 & over can put an extra $7,500 catch-up contribution into their 401(k). Since the employees are highly compensated, these catch-up contributions are made on a pre-tax basis to help reduce their tax bills this year.

However, starting in 2026, these same HCEs can only put their catch-up contributions into their employer’s Roth 401(k) option. While getting money into a Roth is normally good, it would mean they would pay higher taxes in the current year. Worse, if your employer doesn’t offer a Roth 401(k) option, you will not be able to make a catch-up contribution!

Summary of Retirement Changes in SECURE Act 2.0

The changes noted above will get phased in over the next several years. The change in RMD age is obviously the most significant and immediate impact on retirees. But the net effect of other changes is to help people get more money into their retirement accounts during their working years.

Why is saving money for retirement important? For most people, Social Security will only cover one-third to upwards of two-thirds of annual living expense needs in retirement. The higher your annual spending, the lower percentage that Social Security will cover.

The gap between your retirement living expenses and what Social Security covers is your retirement saving need. This savings need is “filled up” by making regular contributions to retirement savings accounts and then investing those monies for the long term.

For many higher income earners, in particular, identifying your potential retirement savings need is critical, and best done early in your career. Younger, high-income earners don’t think they’re at the life stage of needing comprehensive financial planning. But that’s not the case. The sooner you engage with a financial advisor to plan out your future, the better. Let Financial Design Studio help you with all your planning needs, from retirement savings to college planning.

Ready to take the next step?

Schedule a quick call with our financial advisors.