More Retirement Changes Coming With SECURE Act 2.0

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / May 27, 2021

Despite earning a reputation as a “do nothing” Congress, they’ve actually passed a lot of bills in recent years affecting taxes and retirement. It started with the Tax Cuts and Jobs Act of 2017. Then the SECURE Act of 2019. The CARES Act of 2020. And now they’re at it again. While the current bill making its way through Congress doesn’t make as dramatic of moves as the SECURE Act did, there are definitely more retirement changes coming with SECURE Act 2.0.

Why Is Congress Working on SECURE Act 2.0?

The current bill being pushed is focused only on retirement issues. It clocks in at just 146 pages vs. other recent bills that pushed over 1,000 pages, easily!

Why is Congress taking another swing at retirement? The official reason is that SECURE Act 2.0 “corrects” some changes that were made with the original SECURE Act of 2019. But we know Congress doesn’t move until they’re given a reason to, and both the original SECURE Act and Version 2.0 are being pushed hard by the life insurance lobby, which is a large donor to Congressional campaigns.

Regardless of who’s pushing these bills, some of the proposed changes will affect both savers and retirees alike. So let’s look at the key provisions.

Required Minimum Distribution Age to Increase Again, to Age 75

Required Minimum Distribution (RMDs) rules exist so that Uncle Sam can get a cut on money you earned. With Traditional IRAs and 401(k), pre-tax money is contributed, meaning you avoid having to pay taxes on earnings you’d normally have to pay taxes on in a given year. RMDs force money to come out of these pre-tax accounts, and you pay ordinary taxes on these withdrawals.

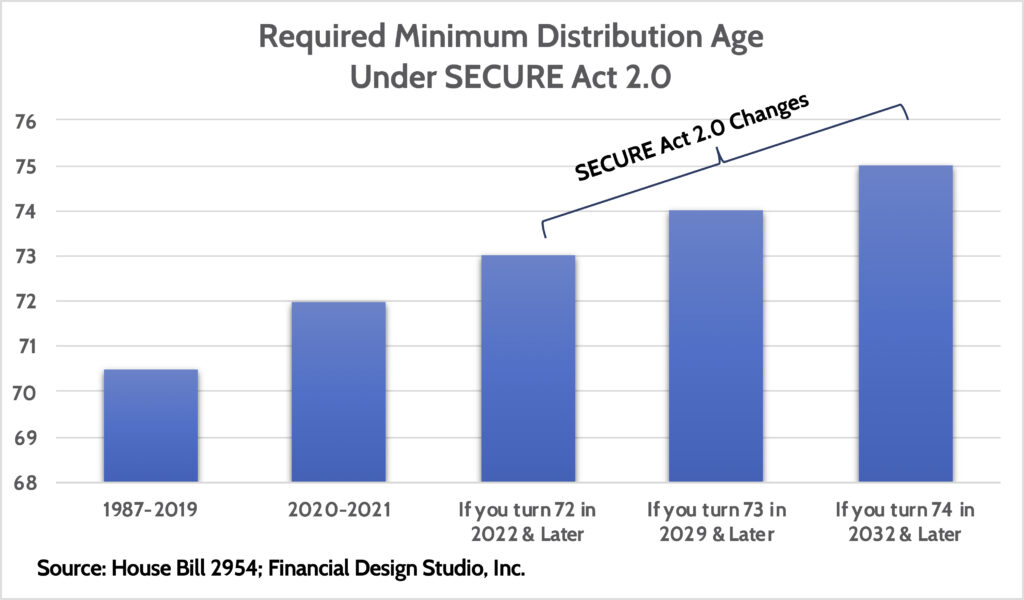

From 1987 to 2019, the age at which you had to take RMDs was stuck at 70-1/2 years. The SECURE Act of 2019 raised this to Age 72 starting in 2020. Now, SECURE Act 2.0 would raise the RMD age to 75. But in the infinite wisdom of Congress, it wouldn’t raise the age all at once!

Increases in the RMD age are a big deal because they give retirees more time to do Roth Conversions. We’ve talked before about what Roth conversions are and how they can save you taxes in retirement. By raising the RMD age again, they’d give retirees a longer window where they can do Roth Conversions. This proposal would be the most impactful financial planning change of SECURE Act 2.0.

Catch-up Contributions to Finally “Catch-up” with Inflation!

Catch-up contributions were first established by the 2001 Bush tax cut bill. The idea behind introducing catch-up contributions was helping savers get “caught up” with retirement savings if they were behind. Originally, IRA catch-up contributions were set at $500 for those Age 50 and over but increased to $1,000 in 2006.

Unlike IRA and 401(k) contributions, whose limits increase with inflation each year, IRA catch-up contribution amounts are not. For instance, in 2006 a 50-year-old saver could put away $4,000 in an IRA and another $1,000 as a catch-up contribution. By 2021, that same saver could put way up to $6,000 in an IRA, but the catch-up contribution remained stuck at $1,000.

SECURE Act 2.0 would change this by tying catch-up contributions to inflation. That’s the good news. The “bad” news – or at least the confusing news – is that Congress wants to create yet another catch-up contribution tier.

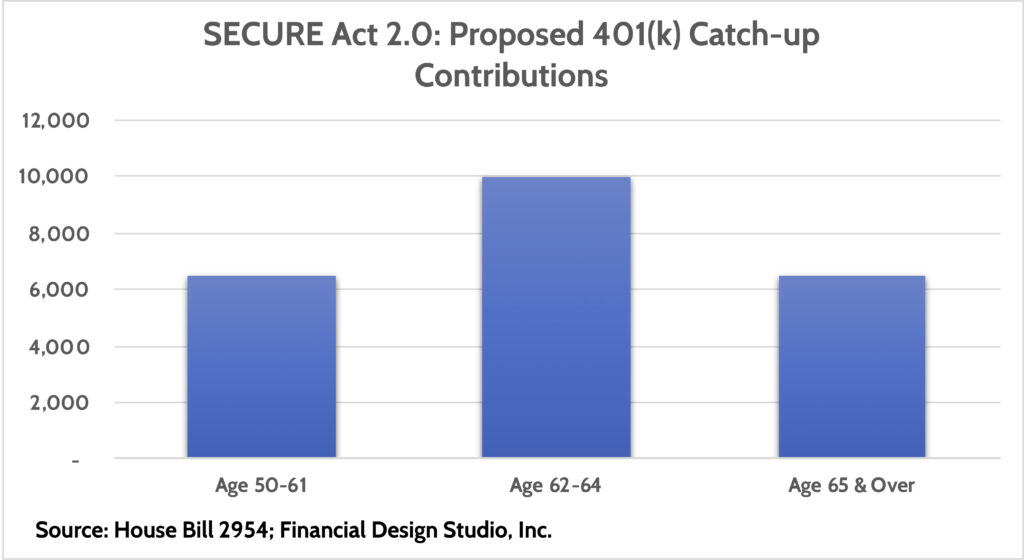

To best see this let’s look at the catch-up contribution for 401(k) savers. Currently (2021) the 401(k) contribution limit is $19,500 while savers Age 50 & over can put away another $6,500 for a total of $26,000. SECURE Act 2.0 would create a new catch-up “tier” for savers age 62-64, increasing the catch-up amount to $10,000. Oddly enough, once that saver turned Age 65 their catch-up contribution would drop back to $6,500.

Why would Congress allow 62-64-year-olds to contribute more but not someone Age 65? Who knows? This may be a provision that’s “fixed” before they complete the law. But the good news with this proposed change is that families that started for saving for retirement later in their careers could put more money away.

How the SECURE Act 2.0 Helps the Charitably Inclined

Retirees with large retirement savings balances often face the prospect of having “too much” money. They either face RMDs well beyond their annual spending needs or have way more saved up than they could ever hope (or want) to spend or pass down to their heirs.

Qualified Charitable Distributions (QCDs) are a great tool for these retirees to do some good with their excess savings. How do QCDs work?

If you’re at least 70-1/2 you can take a distribution of up to $100,000 from your IRA and donate it directly to charity. A QCD distribution satisfies part of your annual RMD but doesn’t result in income tax as QCD money is immediately donated. QCDs are a great tool for any retiree who gives regularly as they kill two birds with one stone: satisfy annual giving desires AND save on income taxes.

The problem with QCDs is that they’ve suffered the same problem as IRA catch-up contributions: contribution limits don’t increase with inflation. That would finally change under SECURE Act 2.0!

More Retirement Changes Coming With SECURE Act 2.0!

Like many Congressional bills, there are many other provisions and details that we haven’t gone into here. Our goal with this week’s post was to highlight the key changes that would affect savers the most.

The experience of the last 4 years has highlighted why working with a financial advisor on an ongoing basis makes so much sense. Tax law changes, retirement rule changes, and even episodic events like COVID-19 create planning opportunities on the fly.

At Financial Design Studio we have the combined know-how to navigate these changes and quickly implement the best strategy for clients. Our tax expertise is a key part of what sets FDS apart.

Ongoing financial planning means your financial plan is getting updated in real-time. Life changes, rules change, and tax laws change all the time. We proactively work with clients to update them on what’s going on and what it means for their unique financial situation. Essentially, we answer the question, “What does this mean for us?” before you even have to ask the question!

Reach out by clicking the yellow “Contact Us” button below and find out how we can help you!

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Target Date Funds Explained! [Video]

In this video, target date funds are explained, we share the pros and cons of using this strategy, and how age based funds work.

Why We Invest In Stocks, Bonds, and Cash [Video]

In this video we break down why our investment management focuses on asset allocations of stocks, bonds, and cash.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.