Patience In Diversification

by Financial Design Studio, Inc. / May 17, 2018Patience In Diversification

As you’re saving money over time a natural question will inevitably arise: How do I make my savings grow? It’s important to assess your risk tolerance in the process. This is a matter of understanding what you’re willing to invest in or not invest in to make your funds grow. As part of diversification you invest in different countries or economic sectors such that over time your funds grow. But in the process, there may be some investments that aren’t constant high-performing winners that are still important to own.

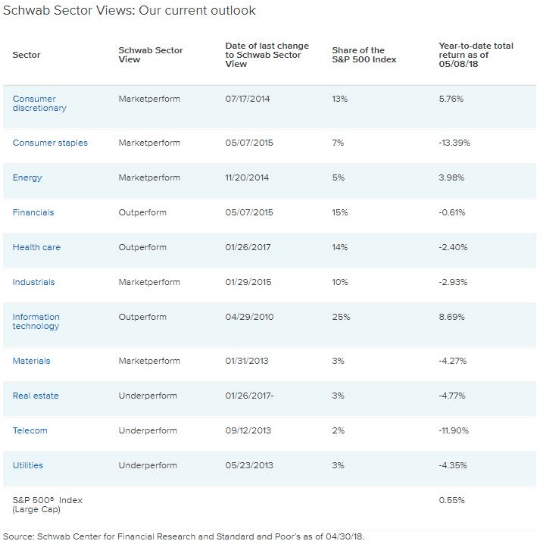

As you can see below in the year-to-date total returns of various economic sectors not every sector has performed like an investor would desire. We always want to be earning as much as possible on every investment. The problem with investing everything in fast-growing, high performing stocks is that if they’re all moving up so fast, they can equally move down as quickly. By balancing your portfolio so that you do have allocation to high growth holdings but also some positions that provide slow and steady growth over time you can weather volatility with more calm.

https://www.schwab.com/resource-center/insights/content/sector-views

Consider, that the market is forward looking and no one knows what tomorrow will bring. So if you diversify to include companies that actually perform when the world isn’t “in order” you protect against what can happen. Think of products you would use even if you couldn’t afford your cell phone. You would probably buy toilet paper, toothpaste, etc. These companies, while not fast-moving or high-performing make products that serve an important purpose to our lives. These companies are known as consumer staples. And as you can see from their performance this year many people would likely say they wouldn’t want to own those investments. However, negative performance isn’t always the story for every sector. As the economy cycles sectors move in and out of favor.

You’ll need to consider what type of companies to own so you are properly diversified, protecting your portfolios too. And diversification requires patience sometimes.

VIEW NEXT

Ready to take the next step?

Schedule a quick call with our financial advisors.