Mortgage Rates at All Time Low – But for How Long?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / November 12, 2020

One of the major surprises during 2020 has been the resiliency of the housing market. Despite the pandemic and the surge in unemployment that came with it, the housing market is as hot as it has been since 2005-2006. As we’ll see, all-time low mortgage rates are a key driver of this trend.

Why Is Housing So Strong?

There are a couple of drivers of the strong housing market. First, the pandemic has created new demand for housing as more people work from home. What used to be a decent-sized place to live has suddenly felt cramped with kids not in school and parents working from their home office.

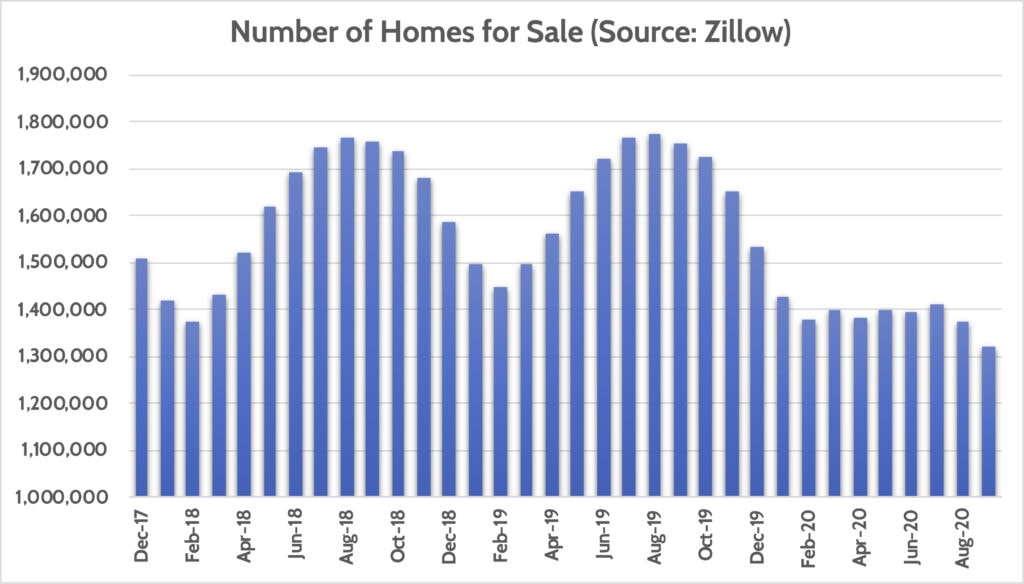

Secondly, the inventory of homes for sale is low. Home building was slow to come back after the housing crisis 12 years ago, despite the rebound in household formation as Millennials started to have families.

The third reason – and by far the most important, in our view – is the steep drop in mortgage rates over the last 12 months. In fact, they’ve have never been lower according to 50+ years of data from the Federal Reserve.

Lower mortgage rates make it much easier for people to afford homes. So the trade-off between renting and buying starts to favor buying when rates are this low.

What Drives Mortgage Rates Up and Down?

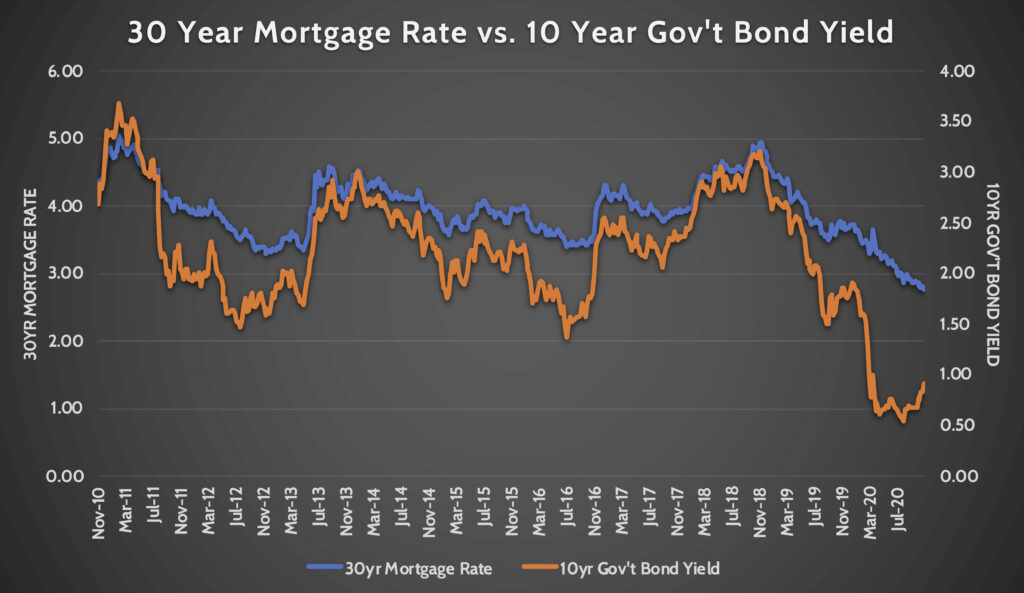

If mortgage rates are the key driver of the hot housing market, then it’s worth paying attention to what drives those rates up and down. While there are a few factors involved, the most important variable is U.S. Government Bond Yields. We like to look at 10-year Government Bond Yields as the key rate to watch.

As you can see, there’s a pretty clear correlation between moves in government bond yields and mortgage rates. Uncertainty related to the coronavirus pandemic sent bond yields tumbling in February and March of this year.

If you look very closely, you might notice that there’s a lag in terms of when mortgage rates move relative to the government bond yield. Focus on late 2012 and mid-2016. During those two periods, the government bond yield started to creep higher yet mortgage rates held steady or continued to drop. It was only when the government bond yield started to move sharply higher that mortgage rates followed.

Has the Election Affected Mortgage Rates?

One of the themes we’ve seen since last week’s election is increasing belief that higher government spending is coming. The need for a second round of economic stimulus related to the virus is becoming more urgent with the recent surge in cases. And the chances of more stimulus next year in the form of infrastructure spending is also high.

When the government spends more, they need to issue more debt to pay for it. In normal times, private investors and other countries are the ones who buy the debt. When the U.S. government is issuing more of it, investors will demand a higher interest rate as supply starts to overwhelm demand.

In the last week, we’ve seen the 10-year government bond yield increase by 0.15% to just over 0.90%. Even at this level, government bond yields are near historic lows. But it’s the change in direction that’s interesting.

So far, mortgage rates haven’t followed higher government bond yields. In fact, it’s possible they won’t move much in the next few weeks. But if this increase in government bond yields keeps going, it’s only a matter of time until the cost of financing a home purchase starts to move higher as well. And if that happens, the housing market may cool off a bit.

Impact to Your Home Purchase or Sale

Moves in mortgage rates mean different things to different people. For people looking to sell their home, it’s better to get ahead of any increase in mortgage rates. More buyers qualify to buy your home when rates are low, and if there are more buyers, you’re likely to get a better price on selling your home.

For home buyers, higher mortgage rates can hurt your ability to afford a more expensive home. But as we noted in another blog post recently (“It’s a Sellers Market!”) the drop in mortgage rates has also led to an increase in home prices.

Of course, you can always rent your home! But if you’re in the market for a home, our message is to pay close attention to what’s going on with government bond yields before buying or selling. Moves in those yields will lead any increase or decrease in mortgage rates. The recent move higher in these rates post-election bears close watching for what that means for the mortgage market.

Ready to take the next step?

Schedule a quick call with our financial advisors.

Recommended Reading

Preparing to Transition to Retirement [Video]

In this video, Stephanie Geisler, LPC, discusses how to work through emotions of financial choices of making the transition to retirement.

Impactful Giving: Tax Strategies and Vetting Charities [Video]

We all want to make a difference with impactful giving. In this video, find out how to evaluate charities and employ tax-efficient strategies.

Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer

Rob has over 20 years of experience in the financial services industry. Prior to joining Financial Design Studio in Deer Park, he spent nearly 20 years as an investment analyst serving large institutional clients, such as pension funds and endowments. He had also started his own financial planning firm in Barrington which was eventually merged into FDS.