Is the 60/40 Portfolio Dead?

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / February 17, 2022

With both stocks and bonds stumbling out of the gate in 2022, there’s a lot of talk about whether the classic 60/40 investment portfolio is dead. The “60/40” as we like to call it, is the bedrock investment mix of many retirees. So it’s important to provide our thoughts about whether we’ve entered a unique investing world that warrants tossing aside a strategy that’s worked for a long time. Is the 60/40 portfolio dead, or is this just a temporary bump in the road?

What is a 60/40 Portfolio?

Before we go too far, let’s make sure we’re clear on what a “60/40” portfolio is. For most people, their investment portfolio comprises some mix of stocks and bonds, depending on their risk tolerance. The more risk tolerance, the more exposure that investor can have to stocks. If they’re conservative, or have an upcoming financial need, they’ll want to remain conservative with their investments, favoring bonds.

For a long time, the standard guidance for someone close to or in retirement is to have an investment mix of 60% Stocks and 40% Bonds. This balances two competing needs. The first need is a liquidity need, as the investor is relying on their retirement savings to fund living expenses. That’s where the Bond allocation comes into play. It’s relatively safe and you can count on it when you need it.

The other need for retirees is that their savings keep up with the pace of inflation. Inflation is a ‘tax’ on the purchasing power of your dollars. Over the last 100 years, inflation has averaged 3.0%. Meaning, over the course of 10 years, your dollars will be worth ⅓ less. Investing in growth assets such as stocks helps your savings keep up with inflation.

A 60/40 portfolio can be as simple or complex as the investor wants. The simplest 60/40 would be a total stock market index fund paired with a total bond market index fund. More complex portfolios will include other asset classes within the Stocks and Bonds categories, such as international stocks and high-yield bonds.

How Has a 60/40 Portfolio Done Historically?

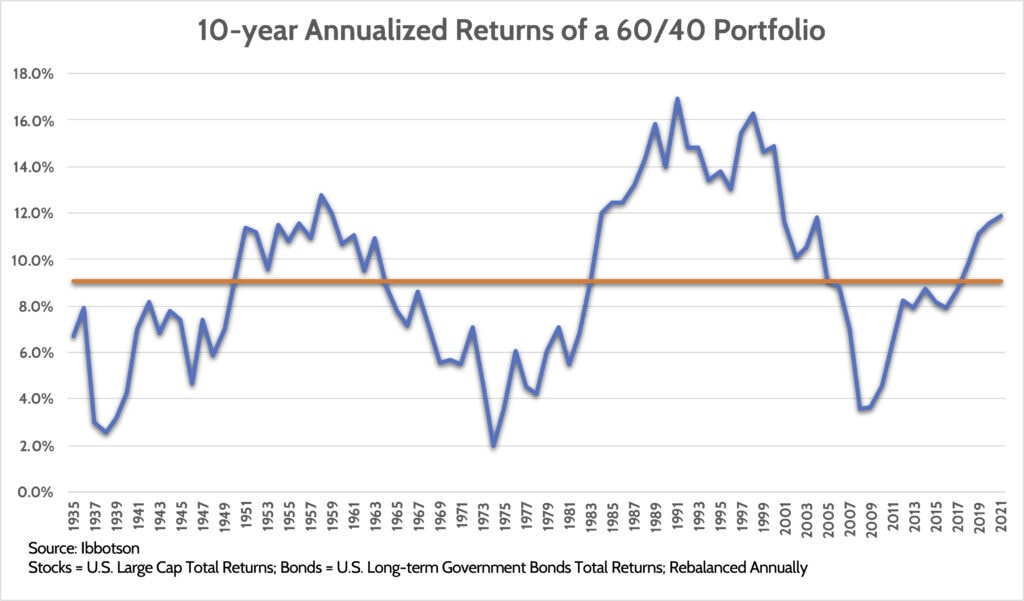

We can piece together the historical performance of a simple 60/40 portfolio using data available to us. This portfolio is very simple: 60% of it is in U.S. Large Cap stocks, with the remaining 40% invested in long-term U.S. government bonds.

The chart below looks at a rolling average of 10-year returns going back to the Great Depression. We looked at this on a rolling 10-year basis to help smooth out the yearly ups and downs. For example, during the last 10 years ending in 2021, the average annual return of a 60/40 portfolio was a gain of +11.9% per year.

The long-term average return for this simple 60/40 portfolio is +9.1%/year. But you can see that it’s rarely up that amount in any given year. Notable cycles have been:

- The 1930s and early 40s were marked by the Great Depression

- Post-WWII 1950s were great for investors and was when Warren Buffett got his start

- 1970s, which saw inflation ravage the country, hurting returns for both stocks and bonds

- A tech boom and collapsing interest rates in the 1990s made that decade the best in the history of the 60/40

Each of these cycles lasted 10-20 years. The average returns over the last 10 years have been above-normal, but not to the extent we saw in the 1990s.

60/40 Performance in 2022

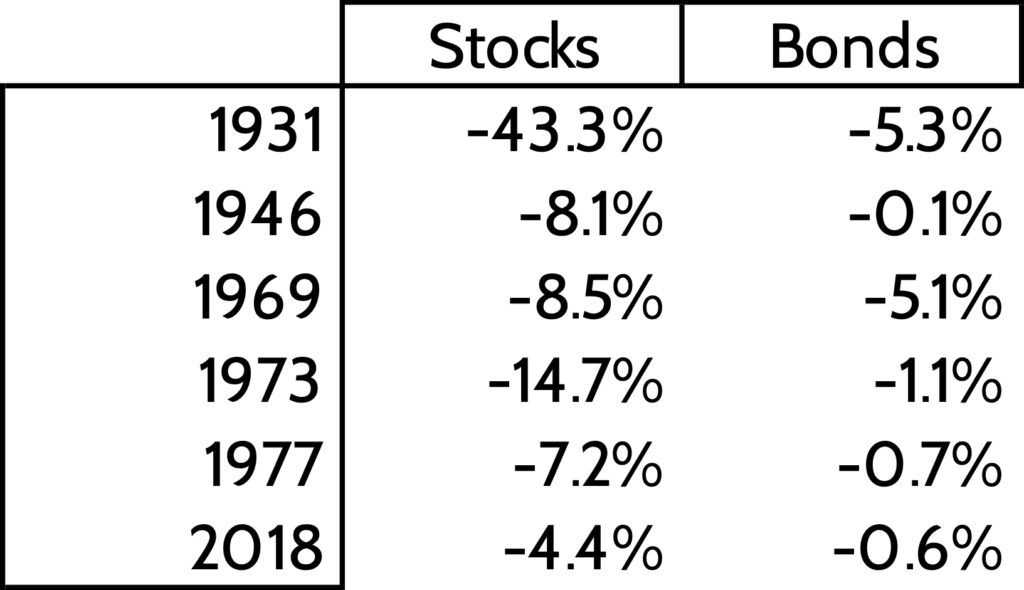

Through the end of January 2022, the 60/40 portfolio shown above is -4.0%. Negative returns aren’t all that unusual for a 60/40 portfolio. Going back 96 years, we find 20 of those years where the 60/40 portfolio generated a negative full-year return.

What’s unusual about 2022 is that both stocks and bonds are down. In those same 96 years of historical data, we find only six years where both stocks and bonds generated negative returns.

The most recent episode of stocks and bonds being down the same year was 2018. Aggressive interest rate hikes by the Federal Reserve marred returns that year.

However, the period I find most interesting is the 9-year period from 1969 to 1977, where there were three years of both stocks and bonds being down. That period was marked by persistently high inflation.

We’re currently experiencing the highest inflation we’ve seen in 40 years. High inflation hurts the value of bonds and can hurt the value of overvalued stocks, particularly growth stocks. Are we going to experience another decade like the 1970s? That depends on the future path of inflation. As we’ve been warning over the last year, we’re entering an investment regime much different from what we’ve seen in the last 40 years. But that doesn’t mean the 60/40 is dead.

If the 60/40 is Dead, What’s the Alternative?

In recent months, the media and many advisors have been confidently declaring the death of the 60/40. It makes for an interesting conversation point, but what’s the alternative? Two of the main alternatives to the 60/40 these folks cite are reviewed here.

Alternative #1: Own more stocks. The argument goes, if interest rates are at historical lows, they can no longer be counted on to generate returns for investors. As I get into more below, there’s some truth to this. But is owning more stocks the answer?

At FDS, we’d have a very hard time telling a retiree they should shift more of their savings into stocks. 70% Stocks and 30% Bonds, or even 80% Stocks and 20% Bonds? To me, that’s terrible – and dangerous – advice.

Anyone over the age of 40 has seen what stocks did in the early 2000s and late 2000s. A retiree relying on their savings to fund everyday spending would’ve experienced terrible outcomes having 70% or 80% of their investments in stocks during that period. So we don’t see “own more stocks” as the answer.

Alternative #2: Own “Alternative” Assets. Another solution offered to the “60/40 problem” is to take some portion of both stocks and bonds and invest in alternative asset classes. This may include real estate funds, hedge funds, or private equity funds.

The chief argument for owning these kinds of assets is that they’re uncorrelated with stocks and bonds. So if stocks and bonds are doing poorly, these assets would do better.

I don’t have enough room here to list all the reasons this is a bad idea, but I’ll talk about three.

First is liquidity. If you own a non-traded real estate investment trust (“Non-traded REIT”) or an investment in private equity, you’re locked in. You can’t pull your money out whenever you need it. Worse, the history of these types of investments is that investors get “gated” at the worst possible moment. Anyone who tried to pull their money out of these types of investments in 2008 or even March 2020 was told, “Sorry sir, but we can’t do that.” Dangerous.

Second is the idea that they’re “uncorrelated” with other asset classes. Meaning, their prices don’t move in the same direction as overall markets. Well, it’s easy to keep your price stable when you’re not actually marking the value of the underlying investments to current market prices! Too many alternative assets hide behind stale, unrealistic valuations that don’t reflect the real value of the investment.

Third, the fees in these funds are very high. “Alternative” investments are a favorite for commission-driven advisors. High fees pay high commissions to the one who sells them to an investor.

Can Bonds Still Make Money for a 60/40 Investor?

One argument of why the 60/40 is “dead” is that interest rates are at historical lows, putting bonds at a sustained disadvantage. There’s no argument on our part that low interest rates are a headwind to bonds. All we have to do is look at where 10-year government bond yields are today compared to history.

Does that mean it’s going to be impossible to make money in bonds in the future? I don’t think so. Looking again at the last 96 years of data, we find 26 years (27%) instances where long-term U.S. government bonds generated negative returns for investors. But if we look at intermediate-term U.S. government bonds, we only find 11 years with negative returns.

Shortening “duration” is a key strategy we’ve used to protect our client’s bond portfolios. We implemented this strategy a year ago when rates were even lower than what they are today. We also diversify into other bonds that pay higher yields, such as high quality corporate bonds, high-yield bonds, and inflation-protected securities.

Our view is that while low rates are a headwind to bonds, it doesn’t mean we can’t work around that. Diversification and opportunistic portfolio changes can mitigate some of the sting of low interest rates as they normalize to higher levels. And it’s better – and safer – for retirees to wait out interest rate normalization versus taking on more risk or sinking their money into terrible “alternative” assets.

60/40 Portfolio: Headwinds Ahead but It’s Not Dead!

Historically low interest rates and high stock valuations are no doubt a headwind for investors going forward. We are aware of these challenges, which is why we spend so much time constructing client portfolios to be as well-diversified and non-correlated as we can get them to be.

If we go through a higher inflation period similar to the 1970s, then investors need to reset their expectations for near-term investment returns. Will your financial plan survive a lower return period? We always stress-test our client’s plans for different scenarios, including a sustained period of lower returns and higher inflation.

It’s my experience that trying to avoid reality by diving into every fancy investment product that promises to solve whatever problem investors face ends in tears. If there was a simple place to “hide” then everyone – including us – would do it. We will not sacrifice our policy of investing client money in a well-diversified portfolio of low-fee, liquid investments.

This is also a reminder that if you’re coming up on retirement and haven’t had a portfolio checkup recently (or ever), then now is the time to get that done. Make sure you know what you own and whether your portfolio will withstand a higher inflation environment.

Ready to take the next step?

Schedule a quick call with our financial advisors.