Day Trading versus Long Term Investing

by Rob Stoll, CFP®, CFA Financial Advisor & Chief Financial Officer / February 11, 2021

As a parent, I’ve always been a big fan of reading Aesop Fables to our kids as part of their bedtime routine. Stories have a way of teaching kids valuable lifelong lessons. They allow kids to imagine themselves as an active part of the story, learning lessons in real-time as if they’re one of the major characters. One of my favorite fables is The Hare & The Tortoise. Recent events with the company Gamestop – which saw its stock rise to dizzying heights before descending just as quickly – reminded me of this time-tested story and brought up an interesting question: “Is it better to invest as The Hare or The Tortoise?” Or better, “Is it better to be a Day Trader or a Long Term Investor?”

Gamestop: A Battle Between Long and Short Investors

Before hopping into the moral of the story, we need to set the stage about what happened with Gamestop stock. In Wall Street parlance, it was a classic battle between “longs” and “shorts.”

Almost everyone reading this newsletter is a “long” investor. In plain English that means you buy a stock today expecting the stock price to rise. And if it does, you sell it and make a profit on the difference between the purchase price and the sales price.

“Short” investors want the exact opposite; they’re hoping the stock price goes DOWN. They go out and sell a stock today and then hope to buy it back at a lower price in the future. Their profit is the price difference between where they sold the stock and where they buy it back.

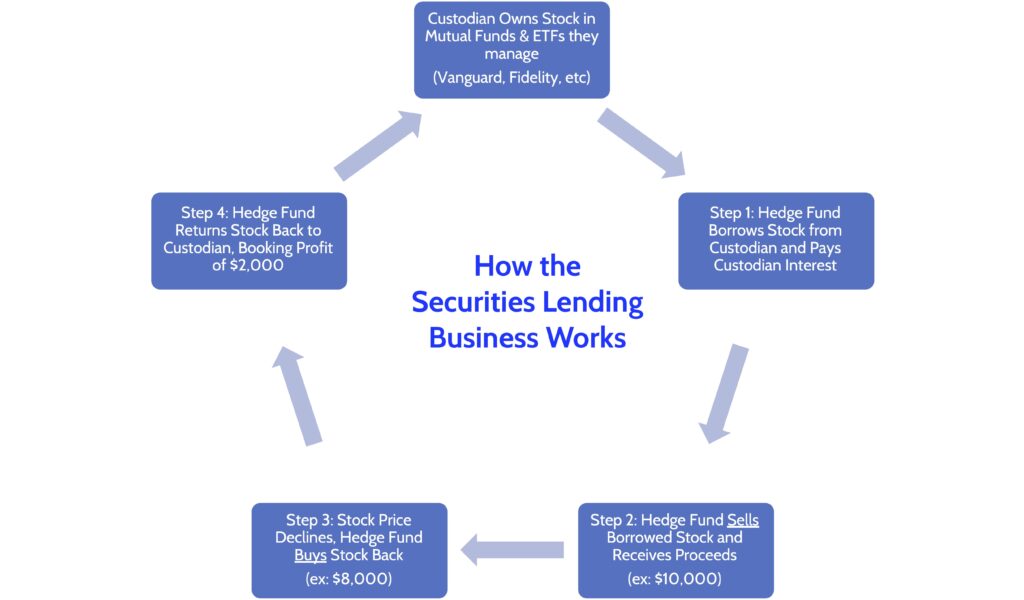

You might think, “How can a short investor sell a stock they don’t already own?” The answer lies in a business many large brokers and custodians have called “Securities Lending.”

If you’ve ever wondered how Vanguard, Fidelity, and others can make money despite charging extremely low fees on their funds, their Securities Lending business is one answer. Since they own a lot of stocks as part of their mutual funds and exchange-traded funds, they have a lot of stock to “lend” to hedge funds looking to short stocks.

It’s an interesting dynamic, isn’t it? These brokers sell you – the retail investor – funds that are “long” stocks for almost no cost. Then they turn around and make a lot of money lending stock to investors who are betting on the same stocks going down. Gotta love Wall Street!

With that background, let’s look at what happened to Gamestop.

What happened to Gamestop?

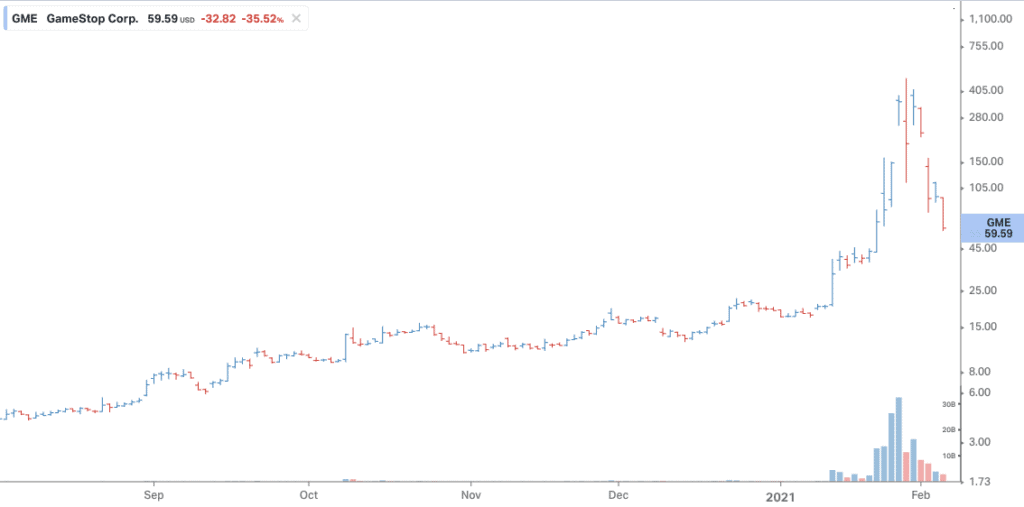

The stock price of Gamestop recently rose from $20 at the start of 2021 to a high of $483 on January 28. This is one of the most notable episodes of a “short squeeze” we’ve ever seen in the market.

Gamestop has been in trouble for quite some time, as more games are sold as a direct download to a gamer’s Xbox or PlayStation. Effectively, they’re the Blockbuster Video of the gaming market. As people stream more, the need for physical discs evaporates. Gamestop has seen sales plunge. Quarterly sales have been declining -25-30% over the last year. As a result, they’re closing stores at a rapid pace.

Short investors have been betting that the company will go bankrupt and the stock will go to $0. These investors have been so aggressive in shorting the stock that by January there were more shares “sold short” than the number of share the company had outstanding!

A group of investors online saw this dynamic and created a strategy: If they drive the stock price higher, then all these hedge funds that are short the stock will be forced to buy it back in order to stem losses. The more they’re forced to buy Gamestop stock, the higher the stock will go.

This is exactly how it played out, as seen in this chart below.

As these investors pushed the stock higher in early January, it forced hedge funds to “cover” their shorts by buying the stock back. Given the huge number of shares that were sold short, this created a buying frenzy as higher stock prices led to more short covering which led to higher stock prices. Hedge funds got trapped.

Day Trader “Hare” Investors Pile In

Individual investors watched as Gamestop’s stock price went up like crazy. Stories popped up on the internet about people making hundreds of thousands of dollars on the move. The bait was set on the hook.

As we all know, the lure of a quick buck is very hard to resist. During my lifetime, I’ve piled into dot-com stocks, stock options, commodities futures, and have even gambled on football games to get rich quick. “Man, if these corn futures go to $X, I’m gonna be able to cover the rent on my apartment for a year!”

Just like the lottery, however, very few people are actually hitting jackpot investing this way. Too often – and this was the case with my own misadventures – these get-rich-quick experiments end in ruin. Markets have a way of turning against you at the exact moment you try getting in on the action, as is happening right now with Gamestop, whose stock is dropping back to earth.

Being a “Hare” investor can be exhilarating, but can create long-term damage. The risk for “Hare” investors is that after getting burned in the market a few times, many conclude that investing is too hard so they quit completely. This is exactly what happened with many savers after the Tech Bubble burst in 2000. The problem with quitting the markets is that it’s very hard to achieve long-term financial goals like retirement or sending kids to college if your savings are stuffed in a mattress. So while the actual cost of losing money in hot stocks like this may be manageable, the psychological cost of avoiding markets all together can create lost long-term opportunities.

Investing as a Long Term Investor “Tortoise”

If you burnt yourself on the stove as a kid, you probably didn’t quit using it forever. You just learned how to use it more safely. Similarly, a positive result from “Hare” investing is learning the hard lesson but looking for a better way to invest: “Tortoise” investing, as I like to call it.

Tortoise Investing is basically this:

- Determine your investment allocation between stocks & bonds depending on how much risk you’re able to take.

- Create a well-diversified portfolio of various asset classes in each of those buckets, stocks and bonds.

- Have a disciplined process to rebalance your portfolio when it moves away from your investment allocation target.

- Lather, Rinse, & Repeat as necessary.

It’s a simple way to invest in theory, but putting it into practice takes time and attention. Specifically, the third point – rebalancing – is a very important piece to a Tortoise Investing strategy. The example below will help show this.

COVID Created Rebalancing Opportunities

The COVID experience of 2020 was a perfect environment to put this philosophy to the test. While we can’t show actual client results in this newsletter, we can create a hypothetical simulation using very simple assumptions:

- Client Target Investment Allocation is 70% Stocks, 30% Bonds

- Stocks are represented by the Vanguard Total Stock Market Index Fund

- Bonds are represented by the iShares U.S. Aggregate Bond Fund

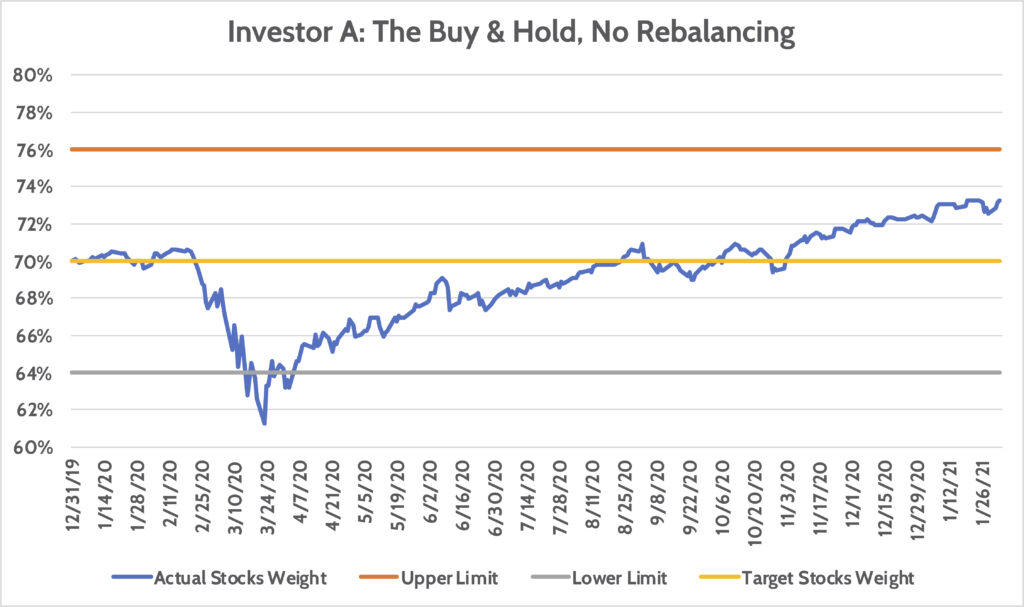

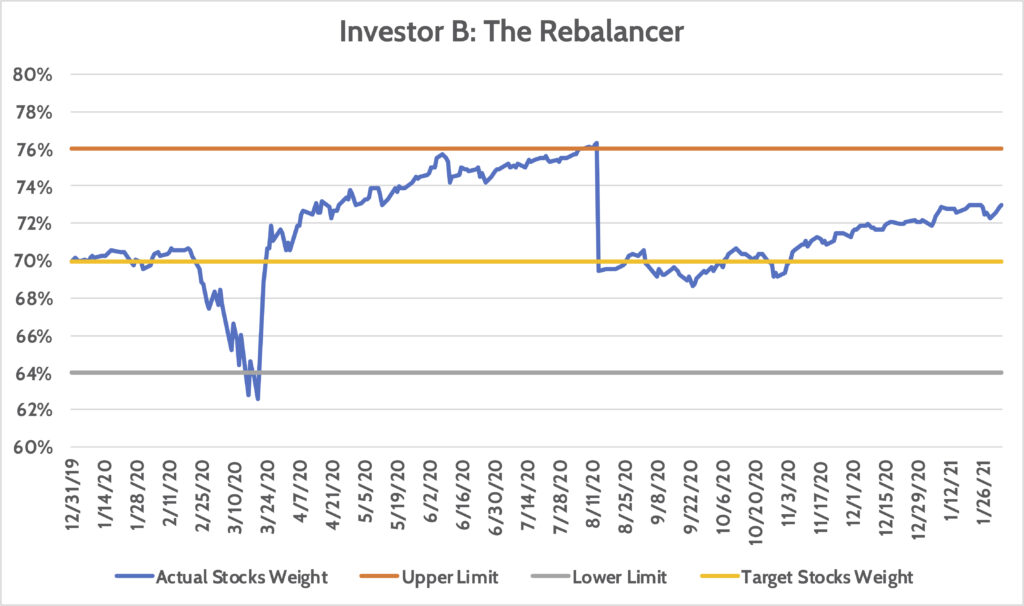

If we assume the client started on December 31, 2019, we can plot how their investments would’ve tracked through January 2021. Investor A is a traditional Buy & Hold investor, meaning that once they buy something, they don’t make any changes. Investor B is a theoretical client of FDS and has her portfolio rebalanced when Stocks stray too far away from her target of 70% Stocks.

The charts below show how each investor’s allocation towards stocks would’ve changed throughout that time period, starting at 70% each.

Investor A stuck with what they owned on the first day of 2020 and changed nothing despite the market volatility. At the lowest point of the stock market, their weight in Stocks would’ve fallen all the way to 61%, which is a long way from their target Stocks allocation of 70%.

Meanwhile, Investor B had a very similar start as Investor A. But when the market cratered in March, she found her Stocks allocation breach the lower limit of tolerance at 64%. At this point, her portfolio was rebalanced back to 70% stocks by selling Bonds and buying Stocks.

As stocks rebounded strongly for the rest of 2020, Investor B found herself overweight stocks to where they breached the upper limit of her tolerance in August. So stocks were sold and invested back into bonds to bring her Stocks back to 70% of her total portfolio.

Interestingly, both Investor A and Investor B ended the period with the same weight in stocks: 73%. But the path to get there was different.

Can Rebalancing Your Portfolio Help Your Investment Returns?

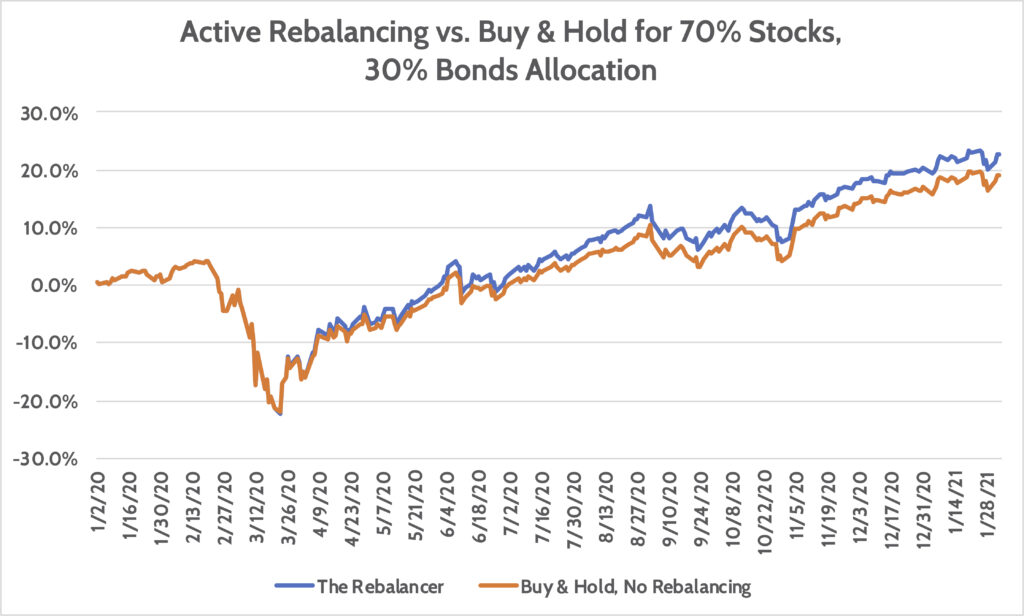

The critical question is whether The Rebalancer was any better off vs. the Buy & Hold. Based on what happened in 2020 and early 2021, using the examples above, we can say YES.

By January 2021, Investor B “The Rebalancer” saw her portfolio perform well, increasing +22.8%. Investor A – Ms. Buy & Hold – also had a solid performance rising +19.2%.

While both did well, Investor B clearly got value from having a disciplined rebalancing strategy. She outperformed Investor A by +3.6%. The reason is very simple: she was buying stocks when they were beaten down in March, while trimming them in the Summer as they rebounded strongly.

The trick to making this all work, however, is that you have to be nimble. That buying opportunity in March opened and closed in a short 1-week period. If you weren’t ready to rebalance, you could’ve missed your shot.

This is where a trusted financial advisor can create significant value for you. At FDS, we’re looking at each client’s portfolio allocation on an almost daily basis. So we’re ready to react to whatever opportunities the market is giving us.

On top of this, we can often execute strategies to realize tax opportunities for clients. We can execute Roth Conversion strategies at market lows when the tax bill to do so might be much lower. Or improve the asset mix of a client, moving tax-inefficient funds to tax-efficient accounts.

Again, all of this is hypothetical and there’s no guarantee of any performance improvement from rebalancing. But this is a prime example of how we at FDS helped clients in 2020.

The Day Trader versus Long Term Investor

We’ve seen what “Hare” investing looks like vs. “Tortoise” investing. Admittedly, Tortoise investing doesn’t have the same pizzazz or excitement that Hare investing does. But it works if you stick with it and keep your eye on the end-game: reaching your financial goals, whether that’s being able to send your kid to a good college or having the resources in retirement to take long vacations.

“The race is not always to the swift.” The Hare & The Tortoise

2020 taught us the importance of having a disciplined investment process. It also taught us the value of having an ongoing financial planning relationship, where opportunities to execute financial strategies can pop up when you least expect them. Having someone at your side before that opportunity arises helps you take advantage of it quickly. So if you’ve asked, “is having a trusted advisor really worth it?” the answer can be YES if you’re working with Financial Design Studio!

Ready to take the next step?

Schedule a quick call with our financial advisors.