Consider The Economic Cycle

by Financial Design Studio, Inc. / November 30, 2017Consider The Economic Cycle

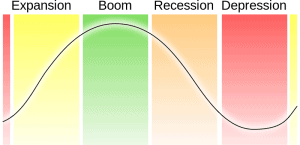

Deciding how to invest a portfolio starts with where we believe we are in the economic market cycle. Many well respected analysts believe the market potentially has another year to run and keep moving higher with a potential late 2018 or 2019 pullback where we could see a recession. So believing we are in the later stages of a bull market or expansion of the economic cycle should you be making changes to your investments?

Historic Economic Cycles

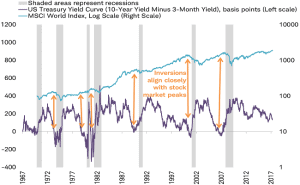

Many people are trying to time the final day of the boom or peak, but this is a great reminder to stay diversified for the longer term. History has proven that economic cycles come and go. Here is a chart showing historical economic cycles and the length they lasted (in grey).

Many people are trying to time the final day of the boom or peak, but this is a great reminder to stay diversified for the longer term. History has proven that economic cycles come and go. Here is a chart showing historical economic cycles and the length they lasted (in grey).

Depending on your time horizon to reaching certain goals you may need to update your risk tolerance and make changes in your portfolio. For example, if you will be retiring in the next few years you may not be as comfortable riding through another recession with no portfolio changes, like you were when you were younger.

What Is Your Risk Tolerance?

If you are younger with many years to invest before needing to use the funds you are saving for retirement then you may be able to stick through more economic cycles. Changing your portfolio due to a higher risk tolerance and time for the market to perform may not be as important.

More important than knowing where we may be in an economic cycle is understanding where you stand with your goals. You have to understand where you want to be and what goals you are reaching toward before you can set a plan to get there.

What This Means To You

Regardless of the economic cycle we are in continue saving toward your goals. The growth of what you’re saving will be important when the time comes to realize your dreams. If we can be helpful in designing your plan please reach out to get started!

VIEW NEXT

Photo Source: https://commons.wikimedia.org/wiki/File:Economic_cycle.svg https://www.schwab.com/resource-center/insights/content/are-bonds-signaling-a-major-stock-market-peak

Ready to take the next step?

Schedule a quick call with our financial advisors.